Blog > 8 Tips to Improve Cost Control & Expense Control

8 Tips to Improve Cost Control & Expense Control

Without a well-organized financial management system, merchants may struggle to control their business costs and expenses properly.

Thankfully, there are cost control and expense control measures you can implement to avoid any financial concerns and maximize profitability.

What is cost control?

The first step in reducing or eliminating negative spending habits in your business is to apply proactive cost control efforts.

Cost control is the practice of estimating, identifying, and reducing expenses by applying a flexible budget that can adapt to any financial changes. Therefore, the objectives of cost control are to increase cash flow and revenue for your business.

Cost control techniques are typically broken down into 5 steps which include:

- Planning your budget

- Monitoring expenses

- Using change control systems

- Time management

- Tracking earned value

Implementing efficient cost control measures and systems can give your business access to valuable insights to make more informed financial decisions.

Cost control vs. cost management

Since the process of cost control and cost management work hand-in-hand, they’re often confused or interchanged but there are some key differentiators between the two.

Cost management typically involves the planning phases of budgeting — cost estimations, financing options, funding, and more. Whereas, cost control comes into play during the implementation phase of these budgets and incorporates management tactics to ensure costs don’t exceed budget limitations.

What is expense control?

In addition to cost control and cost management, expense control plays a crucial role in ensuring your business stays on track financially during each project.

Expense control focuses on making immediate spending adjustments, based on cost control analytics, to ensure budgets are maintained and projects stay on track.

Before you learn how to control expenses and successfully monitor them in your business, you should first understand the differences between direct and indirect expenses.

Direct vs. indirect expenses

As the name implies, the definition of direct expenses are costs that involve chargeable items or services directly related to a project which can consist of labor, manufacturing supplies and equipment, or other direct materials.

Indirect expenses are general business costs that can apply to your current project or other operations. Indirect expenses can include employee wages, rent, utilities, general office expenses, business-related materials, and other professional services.

Both indirect expenses and direct expenses should be factored into budgets, since they include fixed costs and variable costs that can have a great impact on your cost control.

8 tips to improve cost control and expense control

Now that you have a grasp on all the factors involved in controlling costs within your business, you can take the necessary steps to improve these efforts.

Here are 8 tips to help your business improve its costs and expenses…

- Create a cost-effective budget

- Monitor and measure expenses in real-time

- Identify KPIs

- Establish a contingency plan

- Use change control systems to document variations

- Implement an efficient data collection process

- Maintain clear communication across departments

- Automate the cost control process

1. Create a cost-effective budget

In any project, cost control can be achieved by incorporating a cost-effective budget that limits unnecessary spending and helps you stay within financial limitations.

Businesses should conduct a thorough analysis of real figures and data from past projects instead of only relying on rough estimates which can be highly beneficial when trying to control costs.

There’s also the option of implementing a zero-based budget which allows merchants to examine each expense to evaluate if it’s justified or unnecessary for the overall success of the project.

Regardless of how you put together a budget, it’s important to allocate extra resources for expansion opportunities, unexpected risks, variances that may occur, project delays, etc.

If you need savings on credit card processing costs, check out our video on the issue:

2. Monitor and measure expenses in real-time

After creating a cost-effective budget, merchants can actively control their costs to stay within the scope of each project by monitoring expenses and measuring real-time analytics.

Monitoring cost and measuring cost-related data in real-time allows you to take immediate action when noticing a cost variance.

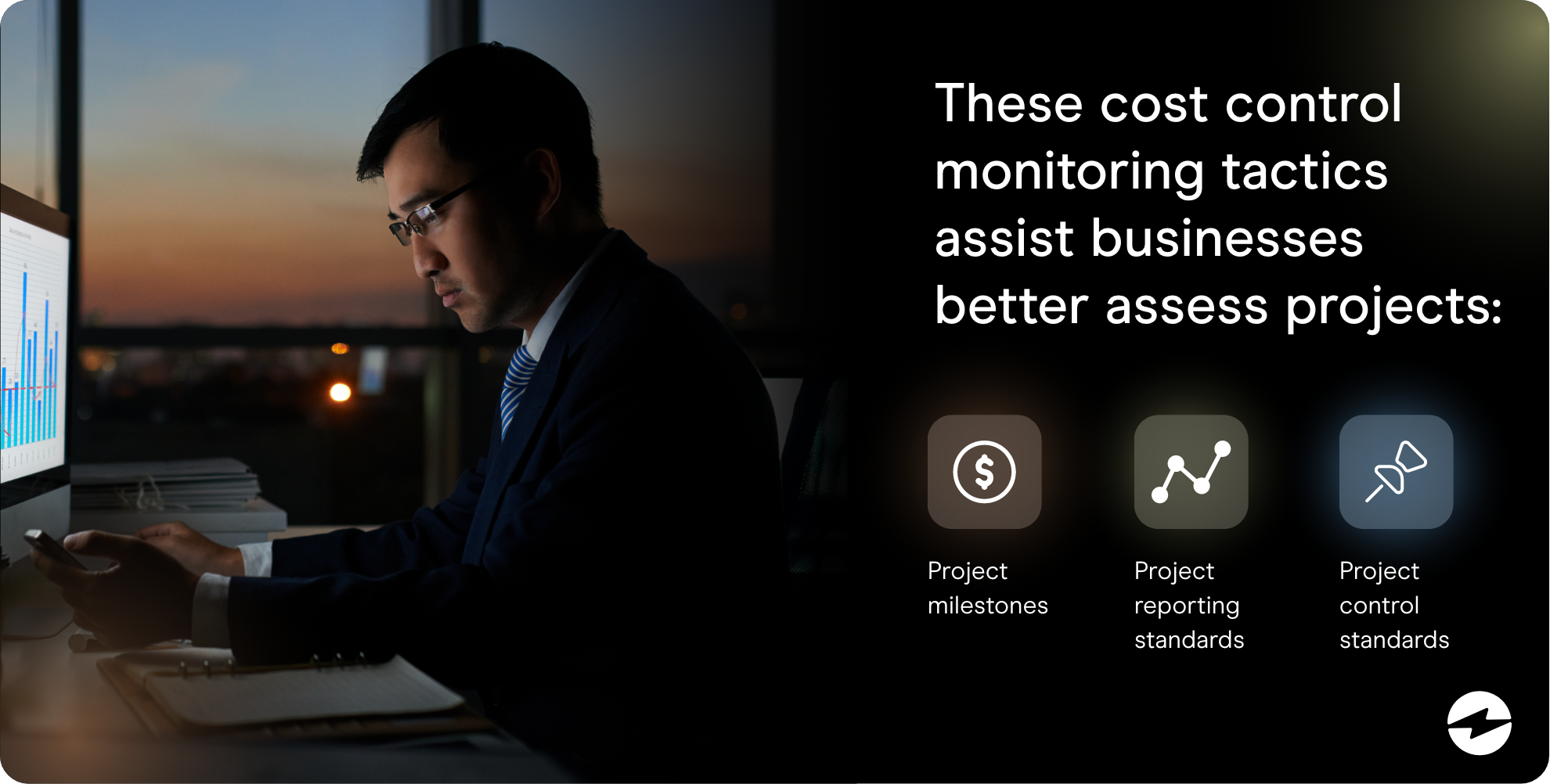

Businesses can monitor and control costs in real-time by setting project milestones, reporting standards, and controls standards:

- Project milestones: Milestones serve as checkpoints to help merchants monitor the progress of their projects more closely and measure the number of expenses they’ve tapped into for better decision-making as they move forward.

- Project reporting standards: Reporting standards help merchants maintain a more organized approach to reporting on budget baselines, current expenses, and pending budgets.

- Project controls standards: Controls standards give merchants better insights into project timelines and budgets to get a clearer picture of what stage the project is in, the number of expenses that have been disbursed, and realistic project forecasts.

These cost control monitoring and measurement tactics also assist businesses in pinpointing important performance metrics to better assess the progress of their projects.

3. Identify KPIs

Key performance indicators (KPIs) are predetermined metrics used to measure performance throughout a project to determine if milestones and goals are being met.

KPIs should be clearly defined when creating a budget and referenced regularly throughout projects. By identifying KPIs, merchants can determine if they’re hitting necessary benchmarks, properly controlling costs, and maximizing savings.

Here are some of the most common KPIs:

- Operating cash flow/budgeted cash balances

- Product sales

- Materials

- Labor

- Sales expenses

- Costs of Goods (COGS)

- Inventory turnover

- General & administrative costs

Despite KPIs differing based on budgets and project goals, they universally work to hold teams accountable, improve financial performance, and may even generate valuable cost savings ideas for companies.

If KPIs indicate poor performance, your business should make the necessary adjustments to improve cash flow and cost control.

4. Establish a contingency plan

Establishing a contingency plan within your budget is another essential component of cost control, as it allows you to anticipate various risks and scenarios that can derail projects.

Contingency budgets typically include an extra reserve of funds and resources to be allocated in case of an unexpected event or emergency. Contingency plans also consist of protocols and actions to properly address these situations and mitigate any risks or damages involved.

Merchants can establish a well-rounded contingency plan by following these steps:

- Identify the risks your business is susceptible to

- Determine the probability of these risks occurring

- Prioritize risks by severity to focus on top concerns

- Create an action plan to prevent, address, and mitigate risks

- Create a contingency budget — reserve any necessary funds and resources

- Submit for approval (from internal and/or external stakeholders)

- Clearly communicate contingency plans to relevant departments

- Regularly review contingency plans and update them if necessary

If properly implemented, contingency plans offer a safety net for businesses to combat any project setback and to avoid exhausting important expenses that can hinder their cost control.

Anticipating changes will also help your business create effective contingency plans to offset challenges like fluctuating inflation rates, rising material costs, shortages, pandemics, and more.

5. Use change control systems to document variations

To control costs, it is essential to keep control on variations that can alter or derail your projects and budgets.

Using change control systems during projects helps businesses document variations and properly adjust to these changes.

Change control systems typically consist of five steps that work to actively manage changes or change requests made during projects:

- Initiation of change request: A change is requested during a project.

- Change request evaluation: The change request is reviewed and a decision to approve or deny the request is made.

- Change management strategy: A thorough strategy is formed to address and support this change during the project.

- Change implementation: The change is introduced (usually in phases) and the management strategy begins.

- Closure of change request: The change is reviewed and evaluated to determine if it was successful or not. The change initiator signs off and the process is closed for future reference.

If implemented successfully, change control systems can result in more adaptability, teamwork, productivity, and better control of costs.

6. Implement an efficient data collection process

With any project, an efficient data collection process is a valuable resource for merchants to reference to get a more realistic picture of their progress and spending habits.

Consistently collecting and analyzing data can assist merchants in controlling costs, as well as determining if any adjustments need to be made to keep projects on track.

Enforcing an efficient data collection process is essential to a project’s success but it’s useless if the information is inaccurate. Merchants can improve data accuracy by taking advantage of digital solutions that automate the collection process and support a variety of measurement methods.

Here’s a list of data software tools that may help your business compile data more efficiently to generate more innovative cost saving strategies.

7. Maintain clear communication across departments

Internal operations are essential when it comes to project management and properly controlling costs, therefore cross-communication between departments is a must.

To maintain a direct and clear line of communication, your business should implement company-wide communication strategies and protocols to keep projects and budgets in line.

Consistent communication plays an important role when addressing budget changes, sharing relevant analytics and data, and mitigating any project disruptions. This allows businesses to solidify their cost control during projects to ensure expenses are used accordingly.

8. Automate the cost control process

Automation is an invaluable digital tool when it comes to controlling costs and creating an efficient budget.

Businesses can take advantage of cost control automation to enhance their cost reducing strategies, expense management process, data collection, reporting, cost tracking, profitability control, and more.

Here are some of the most common automated software tools of cost control:

- Enterprise resource planning (ERP) systems: ERP systems enable businesses to manage and integrate various internal processes and operations using one platform. In addition to automating routine tasks and data collection, these applications connect different technologies — financial management, project management, inventory tracking, accounts receivable, accounts payable, customer databases, etc. — to promote more communication across departments.

- Accounting/ERP integrations: Accounting/ERP integrations allow businesses to import data involving costs and budgets into this software for more accurate reporting and variance analysis.

- Accounts receivable (AR) automation: AR automation takes accounting/ERP integrations a step further by automating payment collections, eliminating manual data entry, and decreasing late payments to improve budgeting and cost control efforts.

- Project management software: Project management software offers an all-in-one platform for teams to communicate different project tasks, deadlines, budgets, reporting/analytics, and more, to stay on task which helps them control costs better.

- Operations Management Software (OMS): OMS systems assist companies in importing and storing real-time data related to operational costs — labor, materials, machinery, etc. — for a more accurate look into allocated expenses and resources, cost estimates, project forecasts, and more.

- Business Intelligence (BI) solutions: BI solutions use real-time data collection software to import and review large amounts of data and generate reports regarding actual costs, performance projections, and cost forecasts. These solutions provide valuable insights for businesses, stakeholders, and investors to make more data-driven decisions.

All of these software systems and budgeting strategies can help your business improve its cost analysis and control and implement expense management best practices.

Now that you understand the importance of cost control methods, technology, and cost savings ideas, you can learn about commonly made mistakes involving business spending to avoid them in the future.

Common cost control and expense control mistakes to avoid

When it comes to controlling costs and expenses, there are many mistakes your business can unknowingly make.

Cost control and expense control mistakes can include anything from poor vendor relations to neglecting inventory and repair issues. Nonetheless, it’s important to be aware of these mistakes to avoid them altogether.

Failing to prioritize vendor relations

Failing to prioritize vendor relationships is one of the most common cost control and expense control mistakes your business can make.

Maintaining positive vendor relations can make all the difference when trying to decrease expenses and maintain your budget. One of the best ways to improve these relationships is to make early or on-time invoice payments to ensure there are no discrepancies. This will also be advantageous for your business to avoid late payments and fees associated with them.

A strong vendor relationship can help when negotiating contracts and may encourage vendors to give you advance notice of future price hikes going into effect to better prepare for them.

Not investing in technology

As previously mentioned, technology is one of the most valuable — if not the most valuable — tools when trying to better manage and control your costs.

Businesses that fail to invest in technology are doing themselves a disservice and wasting valuable time and expenses on time-consuming, manual operations that could be streamlined with a click of a button.

Incorporating new software and digital tools that focus on improving data collection, tracking expenses in real-time, managing resources, and creating more effective reports, will enable your team to make more informed decisions related to budgets and overall costs.

Overlooking indirect expenses

Indirect expenses can commonly be overlooked since they’re not always related to a specific project and are typically used for operational needs and overhead costs.

Despite some indirect expenses including fixed costs, they can also contain variable costs which are subject to change and increase periodically. Failing to track these expenses can lead your business to exceed its budget and derail your project.

Businesses that don’t factor indirect expenses into their budgets may also be forced to tap into emergency funds to cover these costs.

Neglecting to address inventory or repair issues

Neglecting to address inventory or repair issues in your infrastructure can greatly hinder cost control and expense control efforts.

Inventory and repair issues are bound to happen but with a proactive approach and proper management, your business can address these issues quickly and efficiently to avoid unnecessary costs.

It’s important to be realistic about each project — collect and review accurate data and sales projections — to ensure you order the right amount of inventory to avoid overspending or profit loss.

Your business should also stay on top of any repairs and replace any faulty or broken equipment to speed up production and reduce production costs.

Consequences of not implementing cost and expense control

Without the proper cost control and expense control in place, companies may be subject to more external threats and internal setbacks that can be devastating to their business.

Not implementing cost and expense control can lead to consequences such as overspending, exhausting resources, insufficient funds, increased fraud, loss of trust and credibility, and in the worst-case scenario, business closures.

Enhance your cost control and expense control with an all-in-one payment provider

Controlling costs and expenses can be a daunting task for many teams. Luckily, there are many types of cost control and expense control strategies and software systems that can be used to prepare your budget for any situation.

Alongside the cost control tips and digital solutions mentioned in this article, working with an all-in-one payment provider that offers robust security, effective payment collection tools, and integrated payments, will allow your business to maximize its growth and profitability.

Get a free cost-comparison of your current payment processing costs vs. EBizCharge

Get a free cost-comparison of your current payment processing costs vs. EBizCharge