Blog > Inventory Turnover Ratio Defined: Formula, Tips, & Examples

Inventory Turnover Ratio Defined: Formula, Tips, & Examples

Imagine your business could predict the perfect moment to restock every time. Mastering inventory turnover isn’t just about understanding numbers; it’s about timing and strategizing to ensure your business remains competitive and efficient. Inventory turnover is a critical measure that reveals how swiftly a company converts its stock into sales.

Knowing the nuts and bolts of this concept can transform your company’s approach to inventory management.

What is inventory turnover?

Inventory turnover is a critical financial measure which essentially shows how frequently a company sells and replaces its stock of goods during a certain period. Essentially, inventory turnover reflects how well a company aligns its inventory levels with its sales.

To calculate the inventory, companies need to use the inventory turnover ratio to understand their position in the industry.

What is the inventory turnover ratio?

The inventory turnover ratio is a specific formula used to calculate inventory turnover. By understanding this ratio, businesses gain insight into their sales performance, stock management, and customer demand trends. A healthy inventory turnover ratio indicates that a company is efficiently balancing inventory supply with consumer demand, mitigating holding costs and reducing the risk of dead stock or obsolete inventory.

How does the inventory turnover ratio work?

To calculate inventory turnover, one can use this straightforward inventory turnover formula: divide the cost of sales (also known as the cost of goods sold) by the average inventory for that time period. Here’s a simple breakdown:

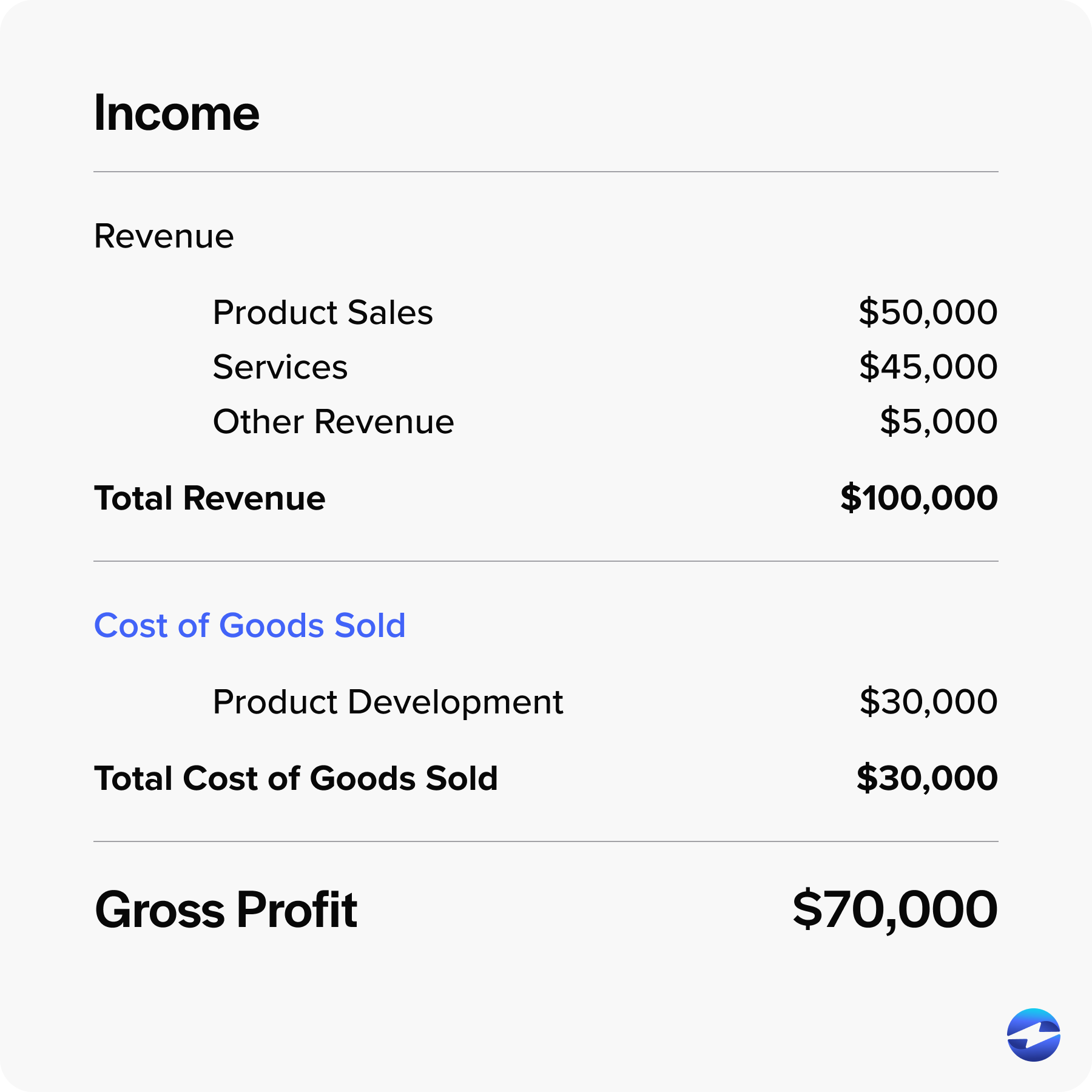

- Cost of Goods Sold (COGS): Found on the income statement, this number reflects the direct costs tied to the production of goods sold by a company. Understanding COGS is essential when assessing the health of a company’s inventory practices and its potential impact on profitability.

- Average Inventory (AI) is calculated by adding the inventory at the beginning and end of the time period and dividing by two. Average Inventory (AI) represents the median stock a company has over a particular time period.

Understanding the inventory turnover ratio assists retailers in keeping the right amount of stock to meet customer demand without incurring excess holding costs or risking obsolete inventory.

How to Calculate the Inventory Turnover Ratio

To fully use the inventory turnover ratio, you must understand how it’s calculated and what the output suggests. The following sections will explain the variables involved in the inventory turnover ratio formula and provide an example of it.

Inventory turnover ratio formula and calculations

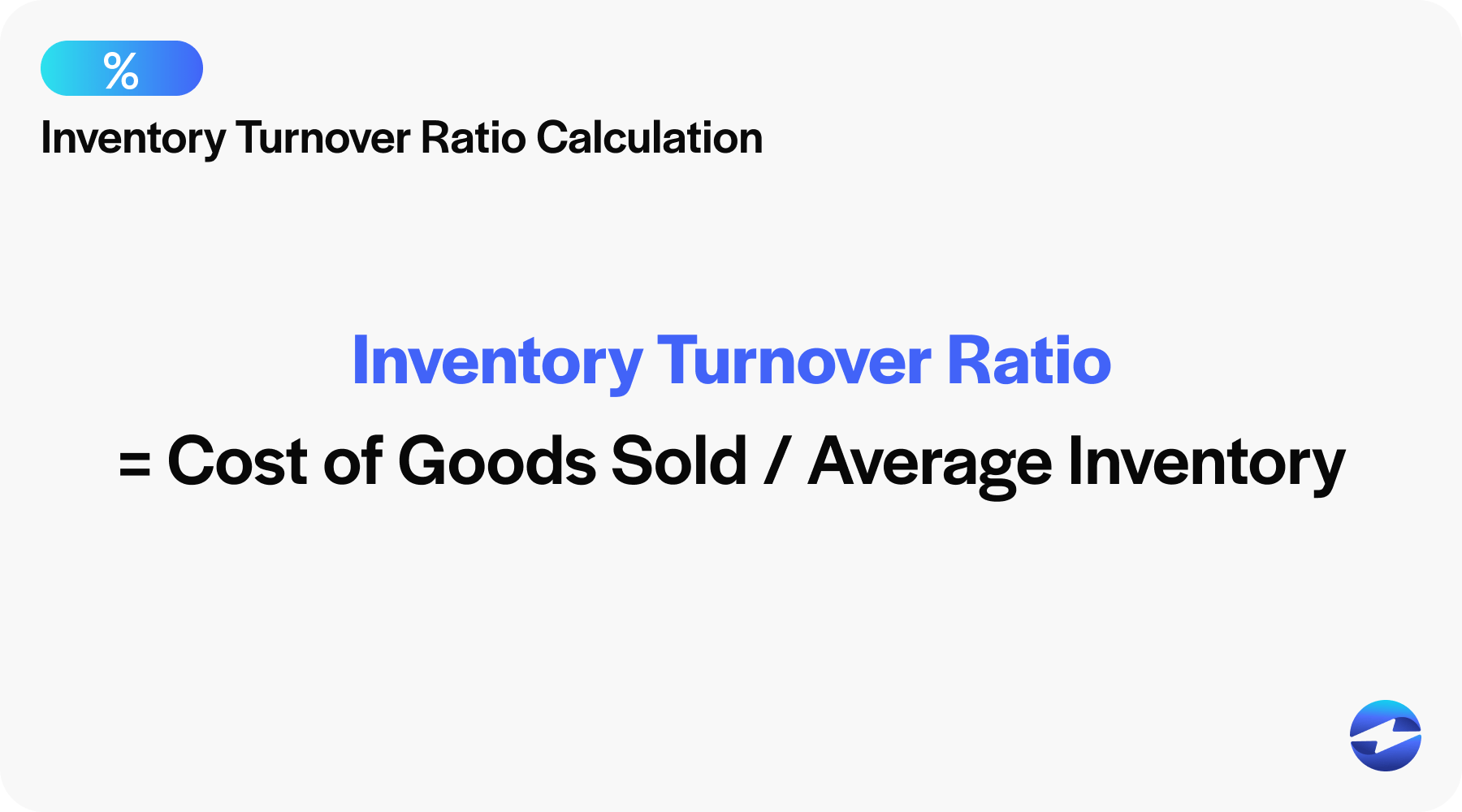

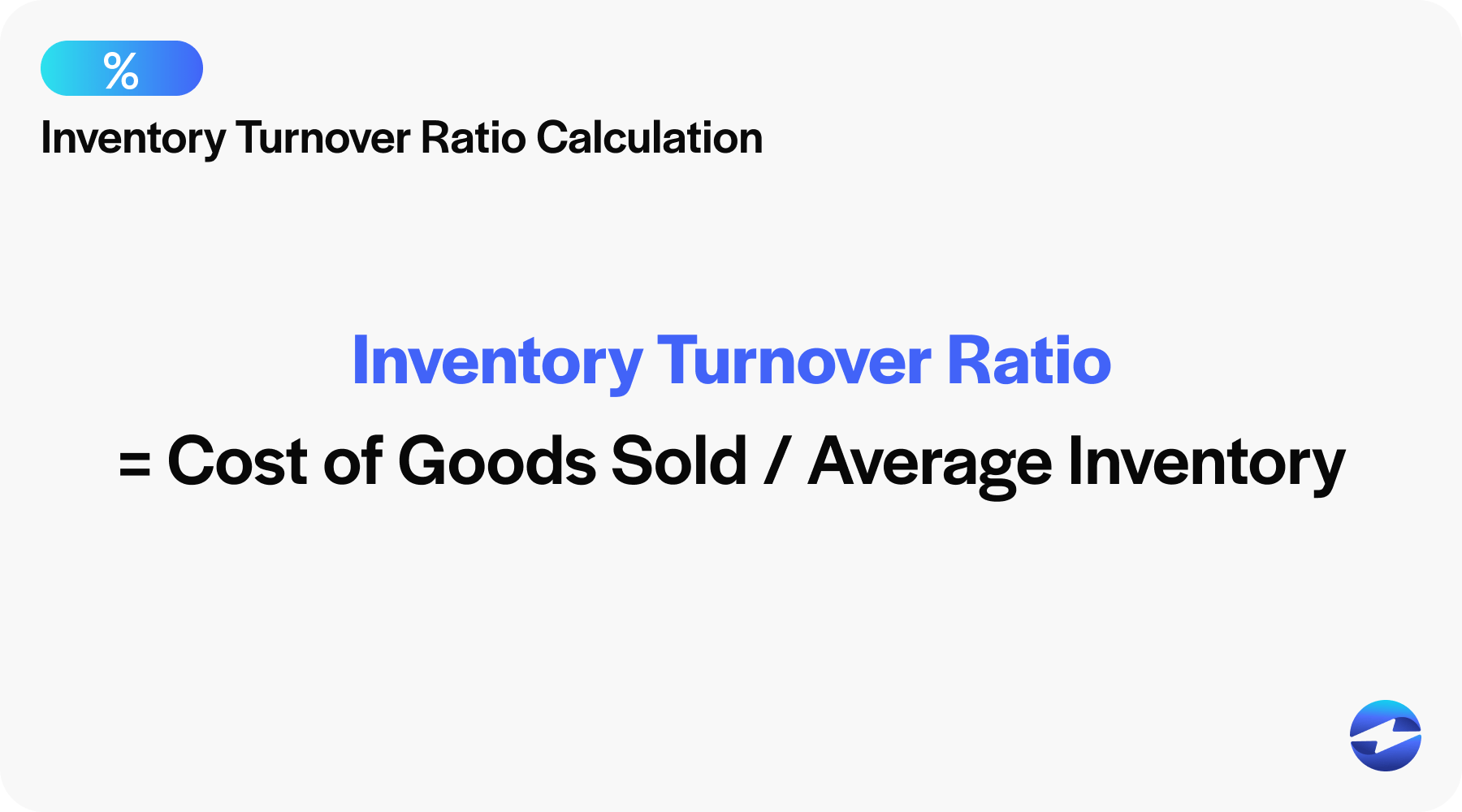

When delving into the details, the inventory ratio formula can be expressed as:

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

Below are the variables that make up the inventory turnover ratio.

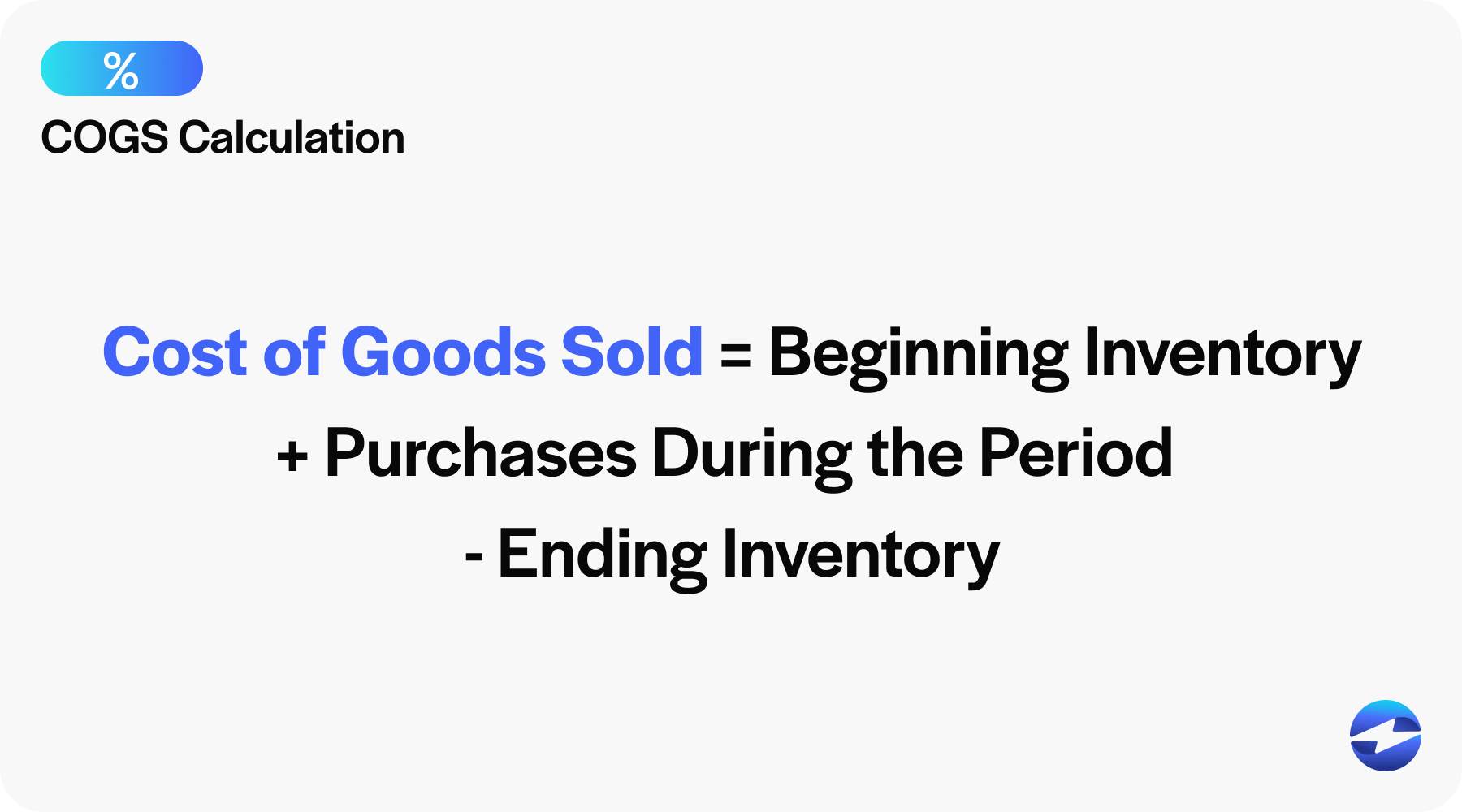

Cost of Goods Sold (COGS)

To start, we need to calculate COGS by taking the beginning inventory costs, adding any purchases made during the period, and subtracting the ending inventory. The formula is as follows:

COGS = Beginning Inventory + Purchases during the period – Ending Inventory

This calculation yields the total cost incurred for the goods sold during a specific time period.

Understanding COGS is essential when assessing the health of a company’s inventory practices and its potential impact on profitability.

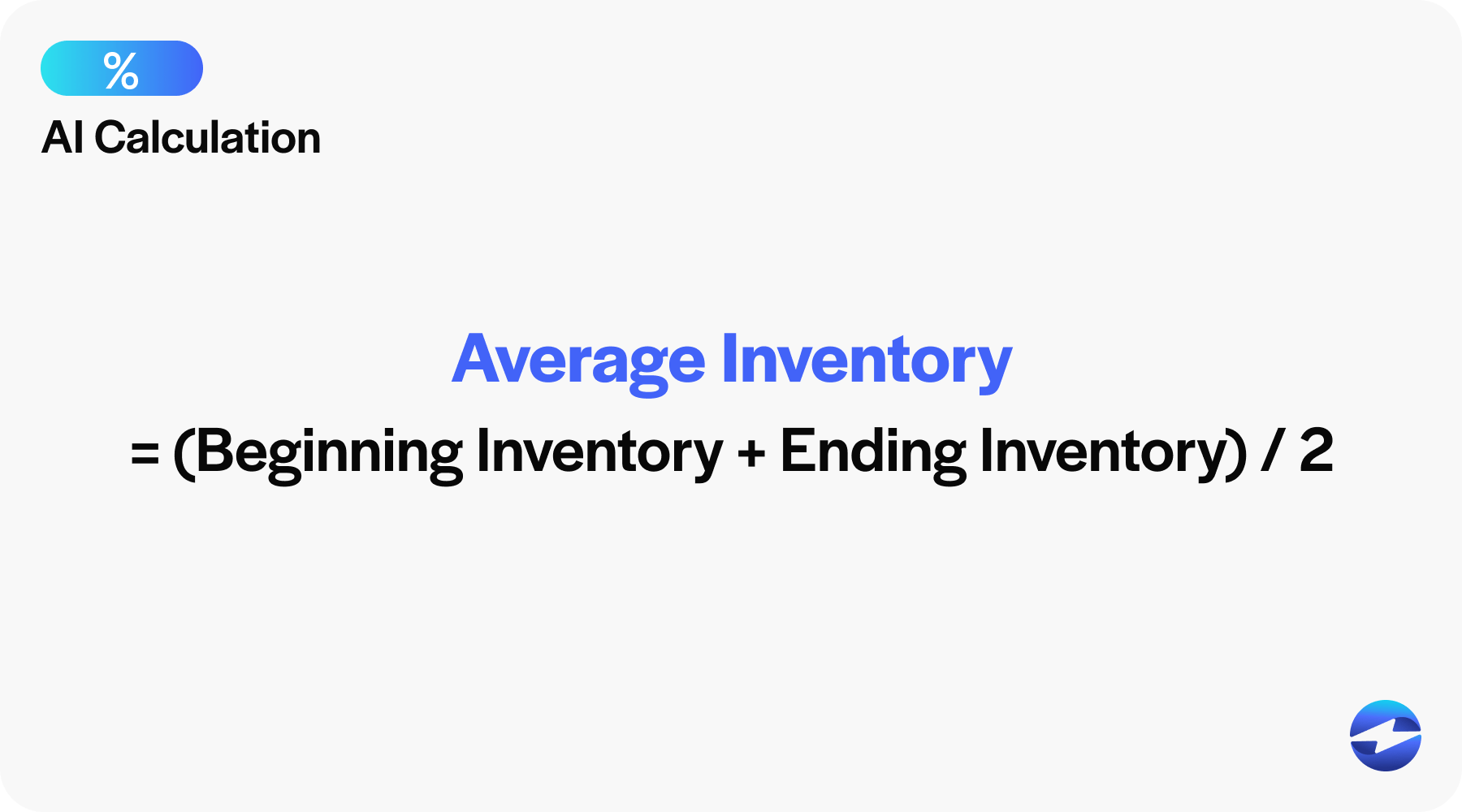

Average Inventory (AI)

Next, we need to calculate average inventory. To calculate average inventory, you add the inventory at the beginning and end of the time frame and divide by two. It’s elegantly simple:

AI = (Beginning Inventory + Ending Inventory) / 2

This figure is crucial for calculating inventory turnover, as it helps avoid skewed results from seasonal spikes or drops in inventory levels. The inventory turnover ratio then uses the AI to determine how efficiently a company sells through its stock within a given period.

The average inventory provides a more accurate base for the inventory turnover ratio, allowing businesses to measure the pace at which they are converting inventory into sales.

Inventory Turnover Ratio

This finally leads us to calculate inventory turnover. We can use the following formula:

Inventory Turnover Ratio = COGS / Average Inventory

Optimizing this ratio is crucial, as it affects holding costs and the company’s ability to meet customer demand without accumulating excess inventory or facing stock shortages.

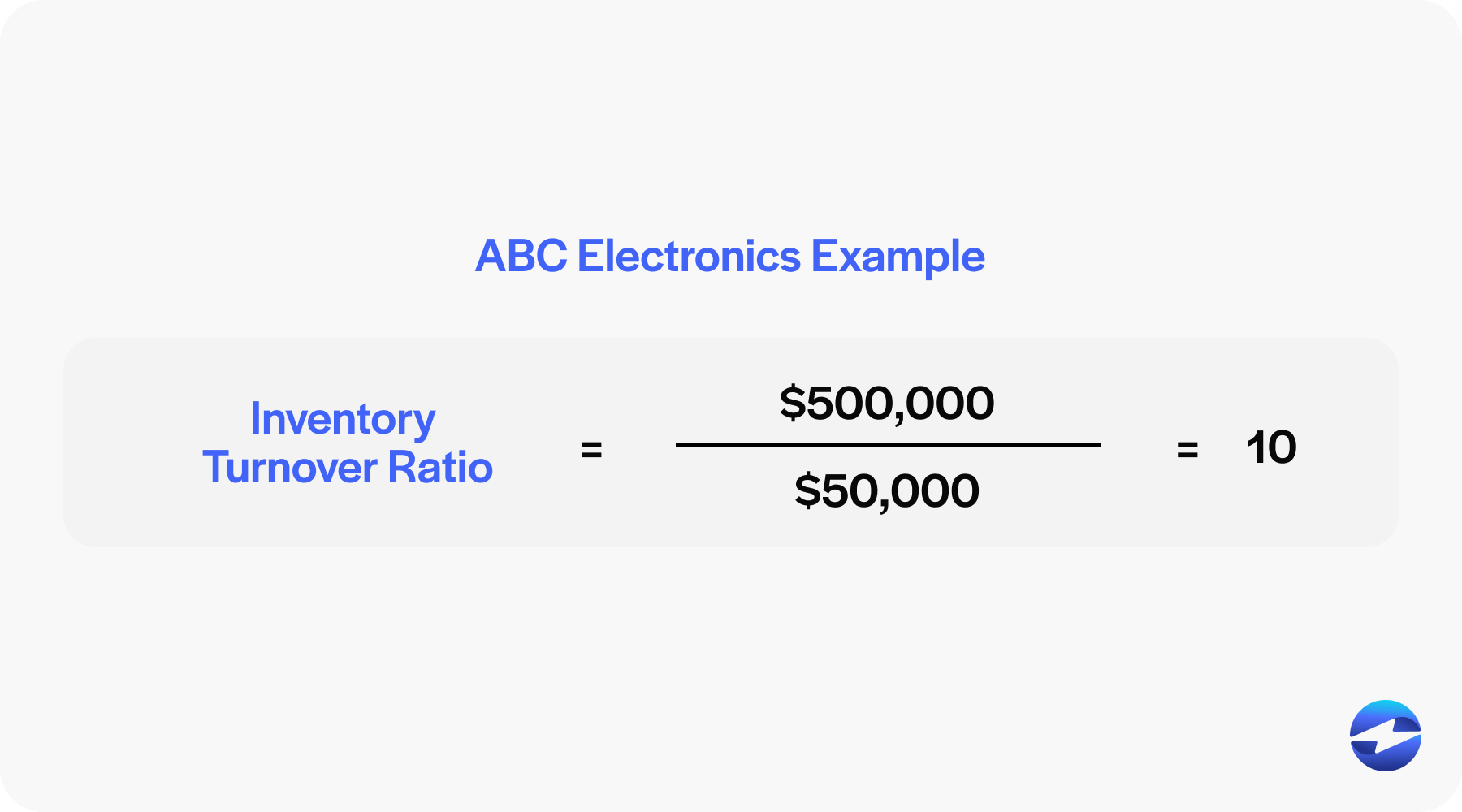

Inventory turnover ratio in practice

To put the concept into practice, let’s take the example of ABC Electronics, which specializes in selling high-end electronic goods. Suppose ABC Electronics reported a Cost of Goods Sold of $500,000 for the previous year, and their average inventory value during the same period was $50,000. Using the inventory turnover formula:

Inventory Turnover Ratio = COGS / Average Inventory

ABC’s inventory turnover ratio would be:

$500,000 / $50,000 = 10

This means ABC Electronics turned over its inventory 10 times over the past year. Managers at ABC Electronics can use this figure to assess their sales effectiveness and avoid unnecessary holding costs associated with unsold goods.

By monitoring this ratio regularly, businesses can strategize inventory restocks in alignment with customer demand, eliminating dead stock and reducing the chances of obsolete inventory.

What is a good inventory turnover ratio?

Determining a good inventory turnover ratio is contingent on several variables, including industry standards, market conditions, and company goals. While a higher turnover indicates brisk sales and a lower turnover suggests sluggish sales or overstocking, the ideal ratio balances the two extremes. It effectively aligns with customer demand to minimize holding costs without leading to stockouts. Generally, a ratio between 4 and 6 assures steady sales in inventory while avoiding the accumulation of obsolete inventory is considered advantageous.

How inventory turnover varies based on the industry

Inventory turnover ratios vary markedly across different sectors due to varying business models and product life cycles. For example, a grocery store with perishable items will naturally have a higher turnover compared to a furniture retailer that has longer-lasting products. Each industry has its benchmarks for what is a good inventory turnover ratio. High-volume, low-margin industries, like fast-moving consumer goods, typically exhibit higher turnover rates, while businesses dealing in luxury or specialized items may experience lower turnover, reflecting a longer sales channel and different pricing strategy.

How to fix a low inventory turnover ratio

To address a low inventory turnover, a multipronged approach is usually necessary. Here are some strategies:

- Optimize your pricing strategy to boost sales.

- Reinvigorate your marketing efforts to increase customer outreach.

- Examine and enhance your sales channel efficiency.

- Streamline inventory through better demand forecasting and inventory management software.

- Clear out dead stock with promotions or discounts.

- Diversify your product offering to mitigate dependency on weak-performing stock.

By systematically applying these methods, businesses can enhance their turnover rates, thus improving their overall financial health and operational efficiency.

How a higher inventory turnover ratio is a good thing

A higher inventory turnover ratio is often a positive sign for a business as it implies robust sales and effective inventory management. It can lead to stronger sales, reduced risk of obsolescence, and lower holding costs, promoting a healthier cash flow. Moreover, a well-maintained turnover rate can indicate that the sales of inventory are well-aligned with customer demand, reducing the likelihood of excess inventory or direct costs associated with unsold items. In essence, a commendable turnover rate reflects a fine-tuned balance between supply and demand dynamics, central to achieving operational success and financial stability.

Top 4 ways the inventory turnover ratio can be used

This inventory turnover ratio serves as a valuable indicator across various fronts of a company’s operations. Below are the top 4 ways the inventory turnover ratio can be used for your company.

Turnover trends

Monitoring the inventory turnover ratio can provide valuable insights into industry turnover trends for a business.

For example, if a business observes that its inventory turnover ratio is significantly higher than the industry average, it may indicate that the company is more agile in responding to market demand or has more efficient inventory management practices.

By identifying industries turnover trends, businesses can make more accurate decisions to adapt their overall strategy to adapt to the industry they’re in.

Strategic planning

The inventory turnover ratio plays a vital role in strategic planning for businesses. By providing insights into inventory management efficiency, it helps businesses make informed decisions regarding production, purchasing, and pricing strategies.

For example, the inventory turnover ratio can identify that a retail business that sells electronics more rapidly than before by seeing a higher ratio value. As a result, the company could change its strategy to plan its inventory purchases to align with the value the inventory turnover ratio is outputting.

By leveraging the insights provided by the inventory turnover ratio, the company effectively aligns its inventory management strategy with its business objectives, ultimately improving profitability and customer satisfaction.

80/20 rule

Commonly known as the Pareto Principle, the 80/20 rule implies that roughly 80% of consequences come from 20% of causes. In the context of inventory management, the inventory turnover ratio can pinpoint which items (the vital 20%) contribute to most sales (80%). Businesses can leverage this principle by focusing on products that have higher turnover rates, dedicating more resources and space to them, and reducing or eliminating slow-moving items. Utilizing inventory ratios in conjunction with the 80/20 rule assists companies in efficiently managing their stock, ensuring they capitalize on their most profitable items.

Operational efficiency

The inventory turnover ratio serves as a key metric for assessing operational efficiency within a business.

Consider a manufacturing company that produces furniture. By closely monitoring its inventory turnover ratio, the company notices a steady increase in the ratio over the past year. Due to these operational improvements, the company experiences reduced lead times in production and delivery. With inventory moving more quickly through the supply chain, they minimize storage costs and free up working capital that was previously tied up in inventory.

By leveraging the insights provided by the inventory turnover ratio, businesses can fine-tune their operational processes, improve cash flow management, and enhance overall efficiency in their operations.

Top 6 inventory turnover tips for business efficiency

Achieving a great inventory turnover ratio is crucial for maintaining a healthy, efficient, and profitable business. Understanding how to calculate inventory turnover is the starting point, but implementing strategies to optimize it is where the real work begins. Here are the top six tips designed to help businesses enhance their inventory turnover and, in turn, pave the way for operational success.

1. Streamline the supply chain

A well-organized supply chain is the backbone of high-performing inventory turnover. Streamlining your supply chain means it’s essential to synchronize production schedules, shipping logistics, and warehousing for minimum lag time. By doing so, you ensure that products move swiftly from production to customer without excessive dwelling time, which, in turn, can boost your inventory turnover ratio. Employing inventory management software can help maintain a real-time view of stock levels and assist in prompt replenishment, keeping the balance right between overstock and stockouts.

2. Adjust pricing strategy

A competitive and flexible pricing strategy can stimulate sales and amplify your stock turnover. Identifying the right price point, possibly through A/B testing or analyzing sales data, might encourage quicker purchases and, thus, an enhanced inventory ratio. Seasonal discounts and promotions are useful tactics to spur customer interest and liquidate excess inventory, which can improve the turnover rate. By tailoring your pricing strategy according to customer demand and market conditions, you can maintain a strong sales channel and prevent inventory from becoming obsolete.

3. Focus on your place in your industry

Understand your unique position within your industry to optimize your inventory turnover ratio. If your business specializes in niche products, for example, your turnover rates might naturally be lower compared to mass-market retailers. Assess what is a good inventory turnover ratio within the context of your market segment and strive for that benchmark. Observing competitors’ performance and inventory strategies can offer insights that refine your management approach, allowing you to adjust expectations and operational tactics accordingly.

4. Continuous forecasting improvement

Accurate demand forecasting is a linchpin in achieving good inventory turnover. Continuous improvement in forecasting means leveraging historical sales data, market trends, and even predictive analytics to fine-tune your stock levels in anticipation of customer needs. This could lead to quick turnover and reduced instances of dead stock. Implement regular reviews of your forecasting methods and adapt your strategies to stay aligned with changing market dynamics. The better you can predict product demand, the more efficiently you can manage your inventory.

5. Automate purchasing

Purchasing automation can substantially reduce the time and errors involved in replenishing inventory. Automated systems help maintain optimal inventory levels by generating purchase orders when the stock dips below a predetermined point. This ensures a consistent capacity to meet sales demand without overstocking, thereby improving the inventory turnover ratio. Automation can also provide better deals from suppliers by strategically timing purchases when prices are more favorable.

6. Solidify supplier relationships

Strong supplier relationships are vital for a responsive and flexible inventory system. By building good rapport and negotiating better terms with suppliers, you can enjoy shorter lead times, lower prices, or more favorable payment terms. This kind of collaboration not only improves your inventory turnover by making it easier to quickly adjust inventory levels as needed but also enhances your company’s ability to respond to unforeseen sales fluctuations. Effective communication with suppliers ensures that they are aligned with your inventory management goals and can support you in achieving optimal turnover rates.

Optimizing the inventory turnover ratio is an ongoing process that touches various aspects of your business, from the supply chain and pricing strategy to forecasting and purchasing. Monitoring this efficiency ratio and adopting these best practices will help keep inventory aligned with sales, reducing costs and driving profitability.

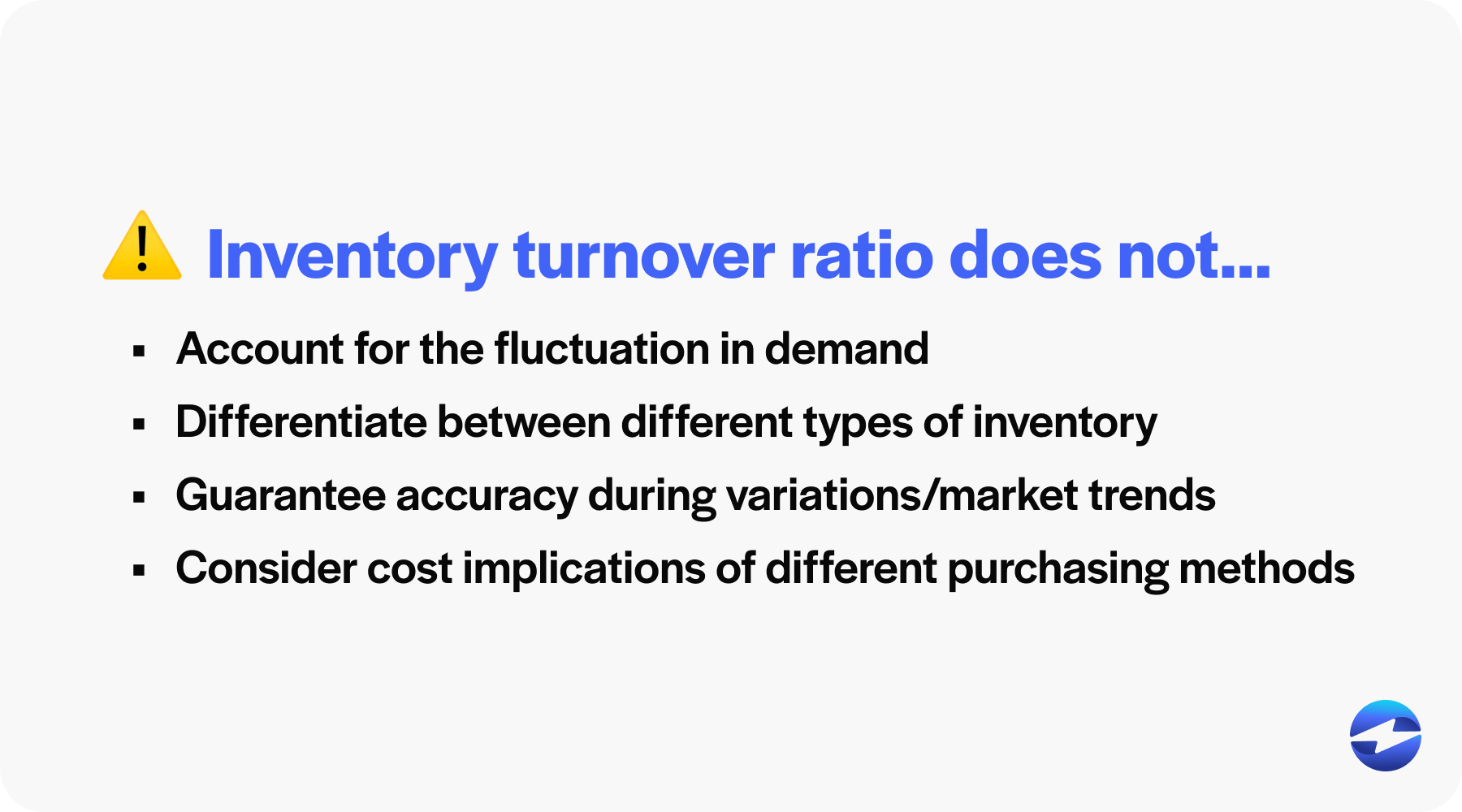

What Are the Limitations of Inventory Turnover?

While the inventory turnover ratio provides valuable insights into a company’s efficiency in managing and selling stock, it has its limitations. For one, it does not account for the fluctuation in demand; high turnover could mean strong sales or simply insufficient inventory, leading to potential lost sales. This ratio also fails to differentiate between different types of inventory, lumping together high-value items with low-value ones, which could skew the interpretation of turnover efficiency. Moreover, average inventory figures used in the calculation might not accurately reflect seasonal variations or market trends.

Inventory turnover does not consider the cost implications of different purchasing methods, such as bulk buying, which could artificially lower inventory levels and inflate the turnover ratio. It also overlooks the qualitative aspects of inventory, like the presence of obsolete or dead stock, that could signal poor inventory management despite a favorable turnover ratio.

Inventory turnover does not consider the cost implications of different purchasing methods, such as bulk buying, which could artificially lower inventory levels and inflate the turnover ratio. It also overlooks the qualitative aspects of inventory, like the presence of obsolete or dead stock, that could signal poor inventory management despite a favorable turnover ratio.

These issues suggest that while inventory turnover can be a useful gauge, it should be considered alongside other metrics and qualitative assessments for a comprehensive analysis of inventory efficiency.

Optimize inventory management with the inventory turnover ratio

Mastering the inventory turnover ratio is vital for businesses looking to optimize their inventory management and increase profit margins. This efficiency ratio shines a light on how well a company manages customer demand, reduces holding costs, and prevents obsolete inventory. Remember, calculating inventory turnover by using the inventory turnover formula provides insights into whether a company has strong or weak sales and if it struggles with excess inventory.

Stay proactive in your approach, and use the insights from your inventory turnover rates to make informed decisions that keep your business competitive and responsive to market changes. With careful analysis and strategic adjustments, a well-managed inventory turnover can lead to more than just reduced dead stock—it can significantly boost your company’s financial health and success.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.