Blog > 18 Commonly Used Invoice Payment Terms

18 Commonly Used Invoice Payment Terms

Clarity in payment terms is essential for fostering strong relationships and ensuring timely payments. By understanding what invoice terms entail, businesses can streamline operations and minimize disputes.

This article will explore 18 commonly used invoice payment terms to guide businesses in their financial dealings.

What are invoice payment terms?

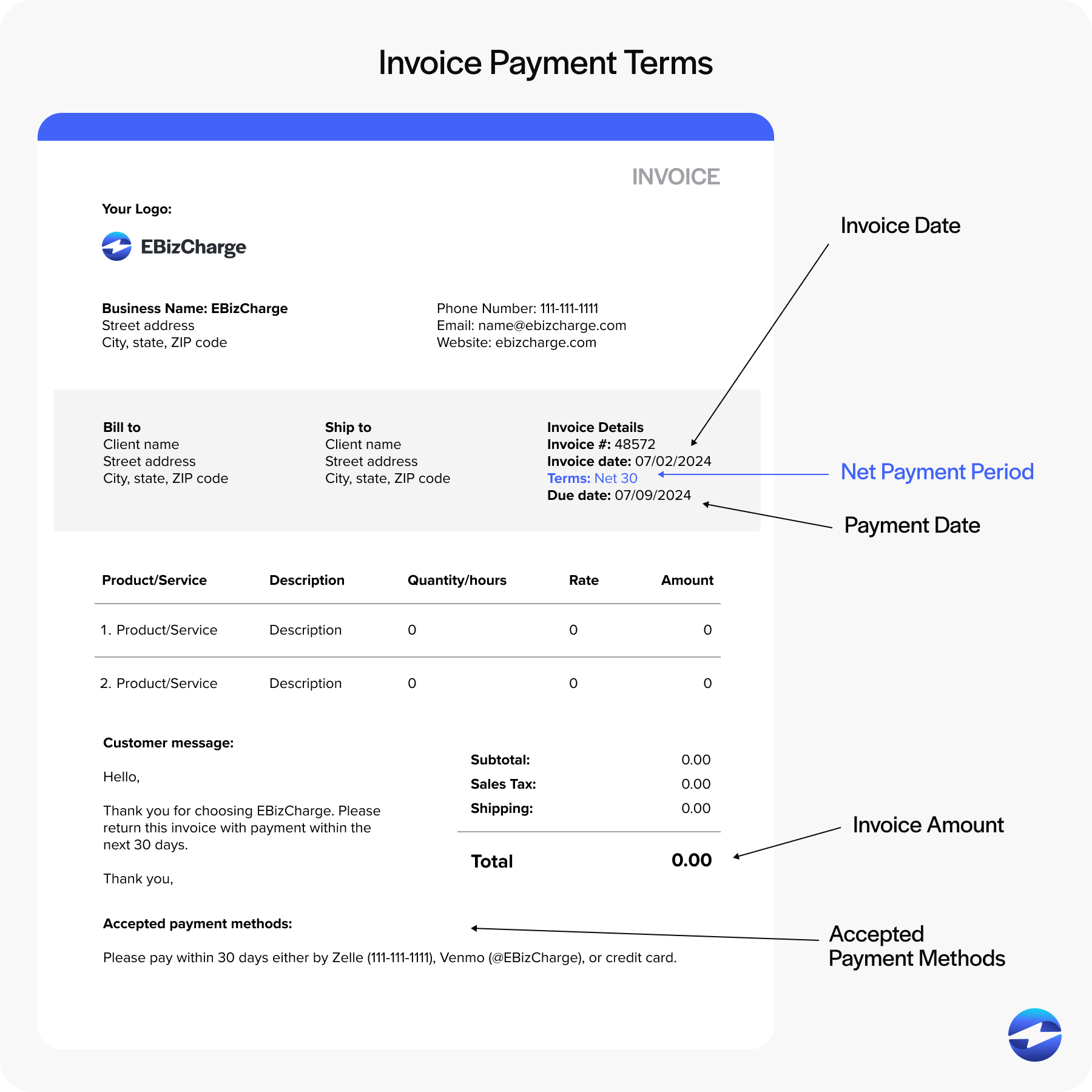

Invoice payment terms are crucial in defining the financial agreement between a seller and a buyer, providing clear expectations regarding when and how payments should be made.

These terms are typically included on invoices to minimize misunderstandings and disputes while ensuring a smooth transaction process.

Invoice payment terms outline key details such as the payment due date, acceptable payment methods, any applicable discounts for early payments, and penalties for late payments.

By specifying these terms, businesses can maintain cash flow consistency, forecast revenues more accurately, and foster a professional relationship with their clients.

How are invoice payment terms used?

Uses cases for invoice payment terms can vary, as these terms depend on the industry, client relationship, and transaction size.

For instance, in large-scale business-to-business (B2B) transactions, extended payment terms such as 60 or 90 days may be negotiated to accommodate the buyer’s cash flow cycles.

Additionally, modern invoicing tools and digital platforms enable businesses to automate reminders and integrate payment options, making adherence to payment terms simpler and more efficient.

There are many different payment terms that can be found on an invoice. The following section will outline some of the most common payment terms.

18 common payment terms found on an invoice

By understanding standard payment terms, businesses can foster better communication, reduce payment delays, and create a foundation of trust and reliability with their clients.

Whether you’re a seasoned professional or new to managing invoices, familiarizing yourself with these terms is essential for streamlining operations and maintaining healthy cash flow.

Here are 18 of the most commonly used invoice payment terms:

- Net 7: Payment is due 7 days after the invoice date.

- Net 10: Payment is due 10 days after the invoice date.

- Net 15: Payment is due 15 days after the invoice date.

- Net 30: Grants buyers 30 days to pay the full amount.

- Net 60: Payment is due within 60 days of the invoice date.

- Net 90: Full payment is expected within 90 days of the invoice date.

- 2/10 Net 30: A 2% discount is offered if the payment is made within 10 days. If not, the full amount is due in 30 days.

- End of month (EOM): Specifies that payment is due by the end of the month when the invoice was issued.

- Cash account: Payments are expected in cash, rather than credit or checks, upon receipt of delivery of goods

- Cash before shipment: Requires payment before shipping the goods, reducing the seller’s risk of non-payment.

- Cash in advance: Like cash before shipment, cash in advance means the buyer must pay before any services or products are delivered.

- Cash next delivery: Payment is expected with the delivery of the next order, establishing a continuous cash flow.

- Cash with order: Requires the buyer to pay when placing the order.

- Contra payment: Involves offsetting receivables with payables from the same company, clearing amounts owed.

- Interest invoice: Refers to additional charges for late payments.

- Terms of sale: These are the overall conditions agreed upon for the transaction. They include everything from prices to delivery and payment terms.

- Recurring payments: Regular payments require regular, scheduled payments for ongoing services, like subscriptions or memberships.

- Partial payment: Allows the buyer to pay a part of the total due amount by the invoice’s due date.

Understanding these standard payment terms can significantly improve the invoicing process.

The importance of net terms management

Net terms management involves setting and monitoring payment timelines for invoices, which is critical to maintaining business transactions and financial stability.

Effective net terms management improves cash flow by providing businesses with precise and transparent payment schedules, ensuring they have sufficient cash on hand for daily operations. It also creates predictable revenue streams, enabling companies to anticipate payment timelines and plan finances accordingly.

Additionally, clear net terms help reduce late payments by outlining specific consequences, minimizing accounts receivable (AR) issues, and streamlining the invoicing process.

Beyond financial benefits, transparent payment terms strengthen client relationships by fostering trust since clients value clear guidelines and are more likely to honor their commitments when expectations are explicitly defined.

While knowing these terms is essential, it’s also important to thoroughly communicate them to your customers.

How to effectively communicate your payment terms

Understanding how to communicate payment terms is crucial since it can ensure that customers know when and how to pay, minimizing the risk of late payments and securing steady cash flow.

Your business can efficiently communicate these payment terms to customers by enforcing best practices, such as using simple and straightforward language, highlighting terms on invoices, providing detailed breakdowns of charges, and more.

Use simple and understandable language

Using simple and clear language is key to effective communication and enabling customers to make timely payments.

Avoiding jargon and complicated terminology when relaying invoice information and payment terms is essential. You should also ensure your verbiage is concise to avoid any confusion.

Highlight payment terms on an invoice

Highlighting payment terms on an invoice makes them stand out, so they’re hard for customers to miss.

Use bold or colored text to draw attention. Place the terms near the total amount or due date. This direct approach ensures that customers see and remember their payment obligations. It also prevents confusion during the invoicing process.

Provide a detailed breakdown of charges

In addition to transparent payment due dates, providing a detailed breakdown of charges will help customers understand what they’re paying for.

Include itemized lists with descriptions, quantities, and prices to make it easier for customers to verify charges and reduce disputes. Thorough cost breakdowns support on-time payments by eliminating the need for clarification.

Reinforce payment terms in advance

Reinforcing payment terms prior to sending an invoice is imperative. Repetitive reinforcement clarifies payment expectations and ensures customers are prepared to pay on time.

When you accept an order, remind customers of the payment schedule and options. This can be done through email or written agreements.

Use consistent formatting across invoices

Consistent formatting and templates across invoices can assist customers in quickly pinpointing important payment information.

Your business can deliver consistent formatting using the same design, font, and layout so that customers can easily find payment periods and terms for each invoice. This can also reduce errors and improve the overall payment process for both parties.

Send payment reminders

Sending reminders is a proactive way to ensure payments aren’t late, as gentle reminders a few days before the due date can prompt payments.

Merchants can use automated systems to send payment reminders via email or text messages. These reminders demonstrate professionalism and prevent unpaid invoices from becoming a problem.

With thorough communication of payment terms, your business can build trust with its clients, leading to seamless transactions.

Leverage invoice payment terms to generate more long-term revenue

Invoice payment terms are a cornerstone of effective financial management and professional communication. They empower sellers to assert their expectations while offering buyers a structured framework for fulfilling their obligations.

As businesses grow and evolve, continually refining and adapting payment terms to reflect industry standards, client needs, and economic conditions can strengthen financial health and build lasting client relationships.