Blog > 13 Best Practices for Accounts Receivable

13 Best Practices for Accounts Receivable

An efficient accounts receivable (AR) process is essential to maintaining any company’s financial health, as it represents the money customers owe for goods or services provided on credit.

Understanding your AR can be the difference between a flourishing cash flow and a stifling drought. This article will help set your business up for success by explaining AR, why it’s important, and best practices for optimizing your receivables.

What is accounts receivable (AR)?

Accounts receivable (AR) is a term for money owed to a company by its customers for goods or services that have been delivered or used but have yet to be paid for.

AR represents a line of credit extended by a company and is typically recorded on the balance sheet as a current asset, as it’s expected to be converted to cash within a short period. The balance in the AR account increases when sales are made on credit and decreases when customer payments are received.

Effective AR management is crucial for maintaining healthy cash flow and financial stability.

Why is the accounts receivable process important?

Effective AR operations are crucial for maintaining healthy cash flow within your business.

Timely and efficient AR collection ensures that companies have the necessary cash flow to meet their operational expenses, such as payroll, inventory purchases, and other overheads. Optimal AR processes can help prevent revenue shortages that may lead to borrowing and additional interest expenses.

Good receivable management can also protect businesses from bad debt losses by identifying overdue accounts and collecting outstanding payments. Eliminating or mitigating days sales outstanding (DSO) is essential for keeping the business running smoothly and financially sound.

Since it’s apparent how vital proper AR management is for financial stability, the following section provides best practices to help your company transform its receivables.

13 accounts receivable best practices

Adopting the best AR practices helps maintain consistent revenue, reducing the need for external financing and minimizing non-payment risk.

Here are 13 best practices companies can implement to optimize their AR:

1. Send invoices promptly

Generating and dispatching invoices immediately after goods or services are delivered increases the likelihood of early payments.

Delivery issues, such as late shipments or incomplete orders, can lead to payment delays as customers may withhold payment until the delivery is resolved. These delays can disrupt the timing of incoming payments, making it difficult to manage financial obligations and maintain operational efficiency.

Timely invoices highlight the importance of prompt payment, which is essential for maintaining a professional relationship.

2. Incentivize discounts for early payments

Incentivizing small discounts for customers that make early payments can accelerate your invoice collections.

For example, a company may offer a 2% discount on the invoice total if a payment is made within 10 days, instead of the standard 30-day payment term. This strategy, known as 2/10 net 30, encourages customers to pay early to reduce their invoice amount.

These discounts benefit both parties by enhancing cash flow and offering clients cost savings, motivating them to prioritize payments to capitalize on the opportunity.

3. Offer multiple payment options

Offering various payment methods will make it easier for customers to pay and reduce payment delays.

Credit cards, bank transfers, online payment platforms, and even no-fee credit card processing options can provide convenience, leading to quicker payment realization.

4. Regularly review past-due accounts

Identifying overdue accounts involves regularly reviewing payment records to pinpoint accounts that have missed their due dates, allowing for early detection of potential payment issues and enabling proactive measures to manage them effectively.

This enables timely intervention strategies, such as sending payment reminders or negotiating payment plans, to recover the outstanding receivables.

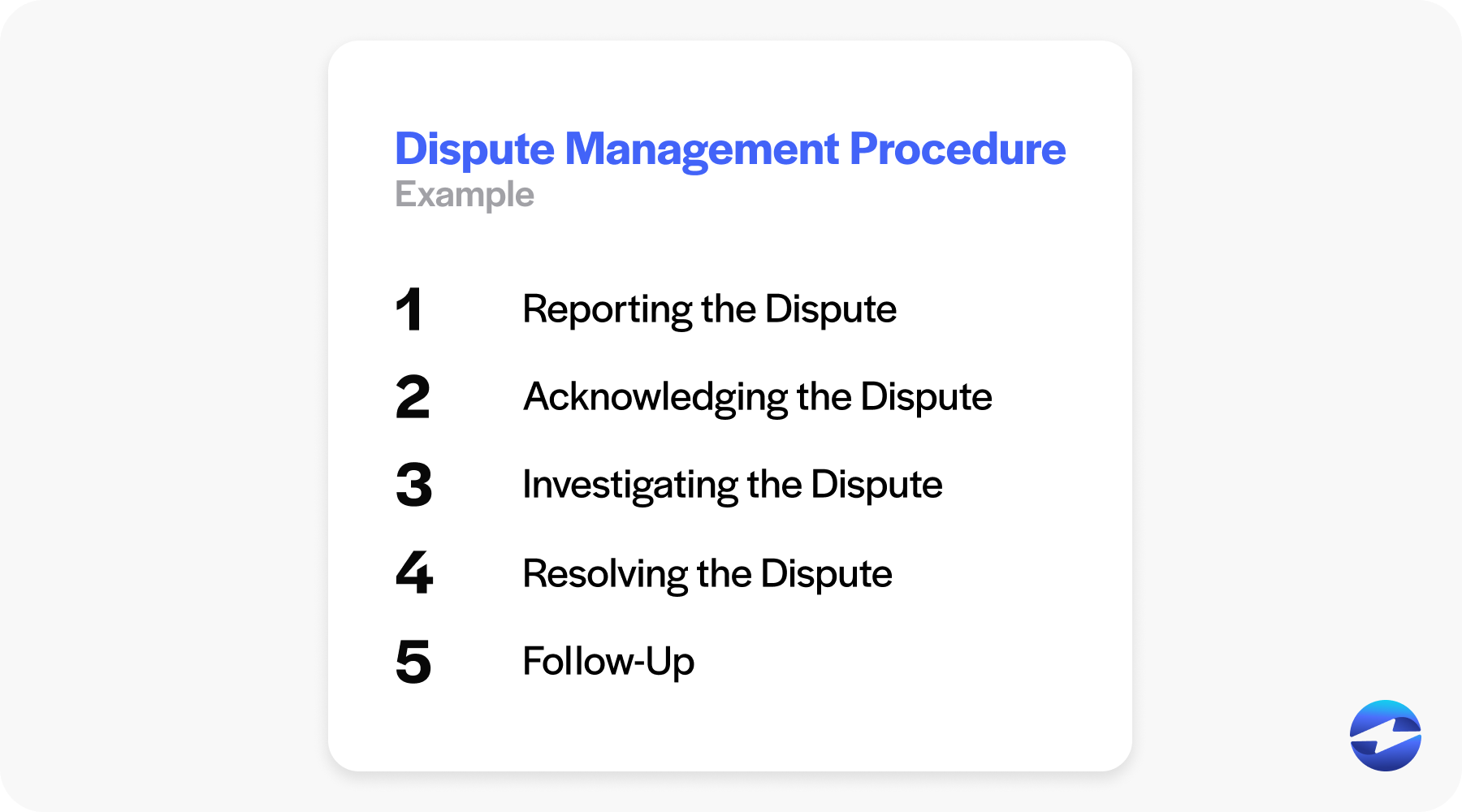

5. Establish an effective dispute management procedure

Establish clear dispute management protocols to ensure any AR discrepancies are handled quickly and effectively. This approach saves time and prevents disputes from escalating, which can further delay payment.

For example, a company can implement a dispute management procedure that includes the following steps:

- Step 1. Reporting the Dispute

- Step 2. Acknowledging the Dispute

- Step 3. Investigating the Dispute

- Step 4. Resolving the Dispute

- Step 5. Follow-Up

Any dispute can delay payment, so swift resolution is essential. Clear communication and a structured approach can resolve conflicts and maintain positive customer relationships, ensuring continued business and timely payments.

Businesses should follow up with customers to ensure a resolution has been reached and any outstanding payments are made promptly. This step helps maintain positive customer relations and decreases DSO.

6. Train staff on AR best practices

Ensure that staff members are knowledgeable about receivable management policies and procedures. Routine training will keep your staff informed on best practices and new AR software and tools.

For instance, periodic training sessions can cover topics such as the latest accounting software features, changes in credit policies, and new regulatory requirements. These sessions can also provide practical tips on improving customer communication, handling overdue accounts, and leveraging data analytics to predict payment behaviors.

By investing in ongoing education, companies ensure that their AR team remains adept at managing receivables efficiently, reducing the risk of errors, and enhancing customer satisfaction.

7. Maintain accurate and up-to-date customer information

Accurate customer data is vital to effective AR processes. Regular customer contact and billing information updates can prevent delays caused by sending invoices or reminders to incorrect addresses.

Ensuring that all customer details are current and correct also facilitates smoother communication, reduces the likelihood of disputes, and enhances the efficiency of payment collection efforts.

8. Monitor AR processes

Monitoring your AR operations to identify inefficiencies and areas for improvement will help you optimize your invoicing strategy.

Routine evaluations provide a chance to assess the effectiveness of current policies and procedures, pinpoint bottlenecks, and implement changes that enhance your AR department’s overall performance. A good starting point is to monitor your accounts receivable ledger for patterns, delays, or discrepancies that may be impacting performance.

9. Simplify your AR workflows

Since complex procedures can slow down the receivable process, streamlining these workflows will reduce errors, accelerate the payment cycle, and positively affect cash flow.

Implementing automation tools for invoice generation and payment reminders, standardizing documentation, and integrating accounting software with customer relationship management (CRM) systems can significantly enhance efficiency.

Additionally, establishing clear policies for credit approval, payment terms, and follow-up procedures ensures consistency and minimizes delays in the AR process.

10. Use AR automation software

AR automation tools can send invoices, reminders, and receipts, cutting down on manual intervention. They also assist in tracking payments and flagging late invoices, heightening the efficiency of the receivable lifecycle.

Implement AR software to streamline invoicing, payment tracking, and follow-ups. This technology can automate routine tasks, reducing errors and freeing time to focus on analysis and strategic tasks.

Comprehensive payment processing solutions like EBizCharge seamlessly integrate with various accounting and ERP software to streamline AR processes by offering secure and efficient payment collection tools that reduce the time and effort required to manage receivables.

11. Perform credit checks

Conducting credit checks on new customers is essential as it helps assess their creditworthiness and ability to fulfill payment obligations.

By gathering information on their payment history and financial stability, businesses can establish appropriate credit limits and terms that align with the customer’s financial capacity. This due diligence reduces the risk of bad debt and strengthens financial planning and risk management strategies. It ensures a company enters business relationships with clients likely to honor their payment commitments, fostering long-term profitability and stability.

12. Follow up on overdue invoices

Consistently following up on late payments is critical. A structured approach that includes courtesy reminders, phone calls, and formal notices can nudge customers into settling their overdue accounts.

These efforts can also uncover underlying issues early, allowing for proactive resolution and strengthening customer trust over time.

13. Using KPIs to measure AR efficiency

Monitoring key performance indicators (KPIs) such as DSO, the percentage of current receivables, and the average days delinquent (ADD) provides insights into the health of the AR processes and guides informed decision-making.

DSO measures the average days it takes to collect payments, while the percentage of current receivables indicates the portion of invoices paid on time. ADD highlights the average delay in payment beyond the due date, helping to assess efficiency and identify areas for improvement within accounts receivable management strategies.

Incorporating these AR best practices into daily operations can strengthen a company’s financial base, ensure smooth cash flow, and contribute to its success.

Optimize your AR process with EBizCharge

Implementing these best practices can significantly enhance the efficiency and effectiveness of your AR management.

From establishing clear credit policies and conducting regular staff training to leveraging automation tools like EBizCharge, these strategies help ensure timely payments, reduce errors, and improve cash flow.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.