Blog > Epicor Payment Exchange (EPX) vs. Third-Party Payment Solutions

Epicor Payment Exchange (EPX) vs. Third-Party Payment Solutions

Payment processing is one of those things most Epicor users don’t think much about until it starts slowing everything else down. A payment doesn’t apply cleanly. Accounts Receivable (AR) spends time fixing records. Reporting feels slightly off, and no one quite trusts the numbers.

If you work in Epicor ERP, especially in a manufacturing environment, this probably sounds familiar. Many teams start with Epicor Payment Exchange because it’s there, it’s native, and it feels like the simplest path forward. And in the early days, it often is.

But as businesses grow, payment volume increases, and customers expect easier ways to pay, questions arise. Is EPX still enough? Are fees adding up? Is manual work creeping back in?

This article is written for finance, AR, operations, and IT teams who live in Epicor every day. It’ll walk through how Epicor EPX works, where it tends to fall short, and why many manufacturers eventually explore third-party options that offer more flexibility and control.

How Epicor Payment Exchange (EPX) Works

Epicor Payment Exchange, or Epicor EPX, is Epicor’s built-in option for taking payments. It lives directly within Epicor, so teams can accept credit card payments without jumping between systems or managing external tools.

In a typical EPX setup, a customer submits a payment through the Epicor payment gateway. That payment is approved by the underlying payment processor and then written back into Epicor screens, making it easy to follow and manage.

For straightforward Epicor payment processing, this setup does what it’s meant to do. Payments apply to invoices, balances update, and reporting stays in one place. That’s why many teams use EPX for standard credit card payments tied directly to invoices or sales orders.

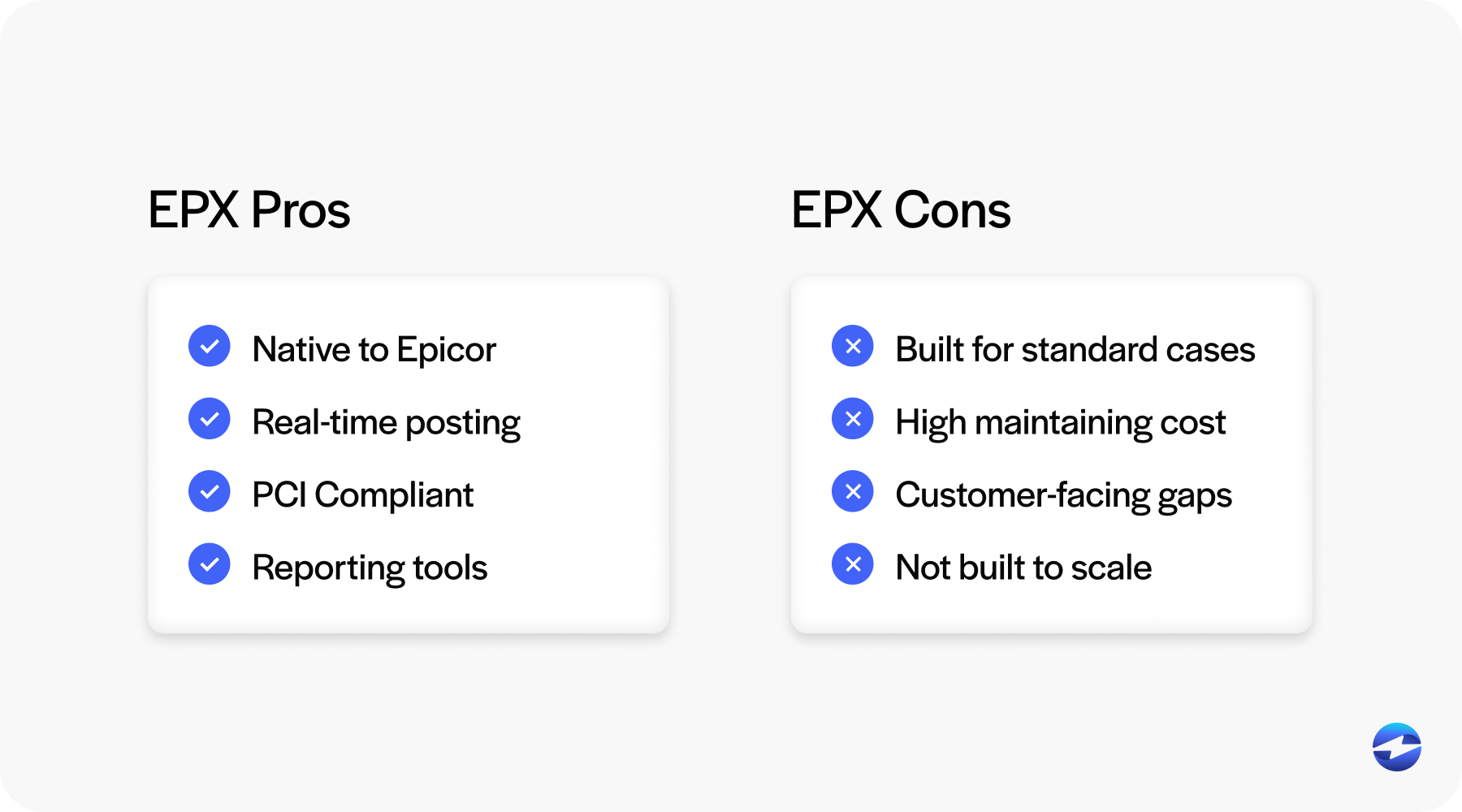

Strengths of Epicor Payment Exchange

There are reasons EPX is often the starting point.

For one, it’s native. EPX fits naturally into existing Epicor ERP workflows, so there’s less to configure and fewer systems to manage. Payments, invoices, and customer data all live in the same place, which keeps things simpler for teams getting up and running.

Setup is also relatively painless. For organizations with straightforward billing and lower transaction volume, Epicor credit card processing through EPX can cover day-to-day needs without much friction or special handling.

And then there’s familiarity. Teams already working in Epicor don’t have to change how they operate, and IT doesn’t need to support or monitor a separate integration right away. That comfort level is what makes EPX feel like the obvious first choice.

Limitations of Epicor Payment Exchange

Where EPX tends to show its limits is as businesses move beyond simple, predictable payment scenarios.

Automation is usually the first issue teams notice. Payment entry and cash application still need hands-on attention, especially when payments don’t line up perfectly with invoices. What starts as a small inconvenience can slowly turn into hours of manual work added back into Acounts Receivable (AR) each week.

Customer experience is another common friction point. Today’s customers expect to view invoices, choose how they pay, and complete payments online with minimal effort. EPX offers fewer options in this area, which can create extra back-and-forth for AR teams and frustration for customers.

As volume grows, reporting and visibility can also feel harder to manage. Payments post correctly, but pulling clear, actionable insight from the data often takes more effort than teams would like.

And then there’s cost. Epicor payment processing fees frequently come up as volume increases. With limited flexibility and transparency around pricing, manufacturers can find it difficult to predict and control payment costs over the long term.

Why Manufacturers Start Looking Beyond EPX

Most manufacturers don’t walk away from EPX all at once. It’s usually a gradual shift that happens as day-to-day realities start to change.

Transaction volume grows. Payment scenarios get more complicated. Deposits, partial payments, and mixed payment methods start showing up regularly instead of once in a while.

At the same time, expectations inside the business evolve. Finance teams push for faster closes and cleaner reporting. AR wants to spend less time fixing payment issues. Leadership wants a cleaner, more reliable picture of cash.

Customer expectations add even more pressure. Buyers want to pay online, when it’s convenient for them, without email threads or phone calls. When the system can’t easily support that, frustration builds on both sides.

Eventually, teams realize these challenges aren’t short-term growing pains. They’re signs that the current setup has real limits. That’s usually the point when third-party options start to make sense.

What Third-Party Payment Solutions Offer Epicor Users

Third-party payment solutions take a slightly different approach.

Rather than relying only on native tools, these platforms build deeper Epicor integration into the payment process. Payments still run through Epicor and apply to invoices there, but with more automation and flexibility layered on top.

In practice, that means payments flow through a secure Epicor payment gateway, are approved by a trusted payment processor, and sync back to Epicor cleanly and consistently. The core process is familiar – the difference is how much manual work is removed along the way.

Some third-party options depend heavily on external platforms and application programming interfaces (APIs). Others are built specifically for Epicor users, embedding payment tools directly into Epicor screens so teams can work the same way they always have, just with fewer steps and fewer exceptions.

Benefits of Third-Party Payment Solutions

The biggest advantage third-party tools offer is automation.

Automated payment entry reduces manual posting. Automated cash application ensures payments close invoices accurately the first time. These improvements directly impact AR efficiency and reporting accuracy.

Customer payment portals are another major benefit. Customers can view invoices, make payments, and manage payment methods without involving the AR team. This reduces back-and-forth while improving the overall experience.

Third-party solutions also tend to support a wider range of payment types, including ACH and Level 3 data for B2B transactions. For manufacturers, this flexibility matters.

As volume grows, these solutions scale more naturally. Instead of adding headcount to manage payments, teams rely on systems that handle complexity automatically.

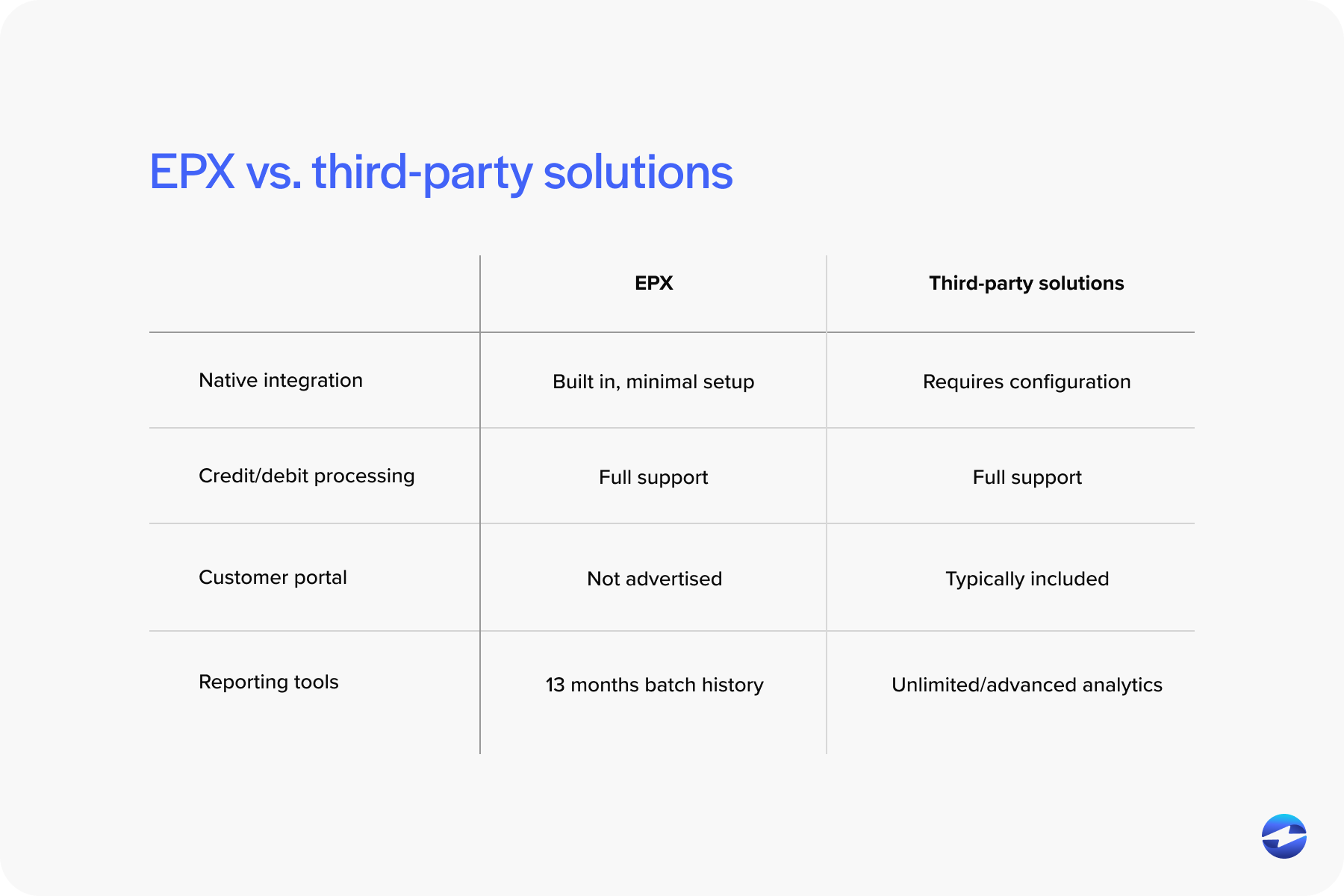

Epicor Payment Exchange vs. Third-Party Solutions: A Practical Comparison

At a high level, the difference comes down to simplicity versus scalability.

EPX offers a straightforward starting point for Epicor payment processing. Third-party tools focus on long-term efficiency, automation, and control.

Cost transparency is another key difference. While Epicor payment processing fees can become harder to manage over time, many third-party providers offer clearer pricing structures.

Ownership matters too. EPX tends to sit squarely within Epicor workflows. Third-party solutions often shift more control to finance and AR teams, reducing reliance on IT for daily operations.

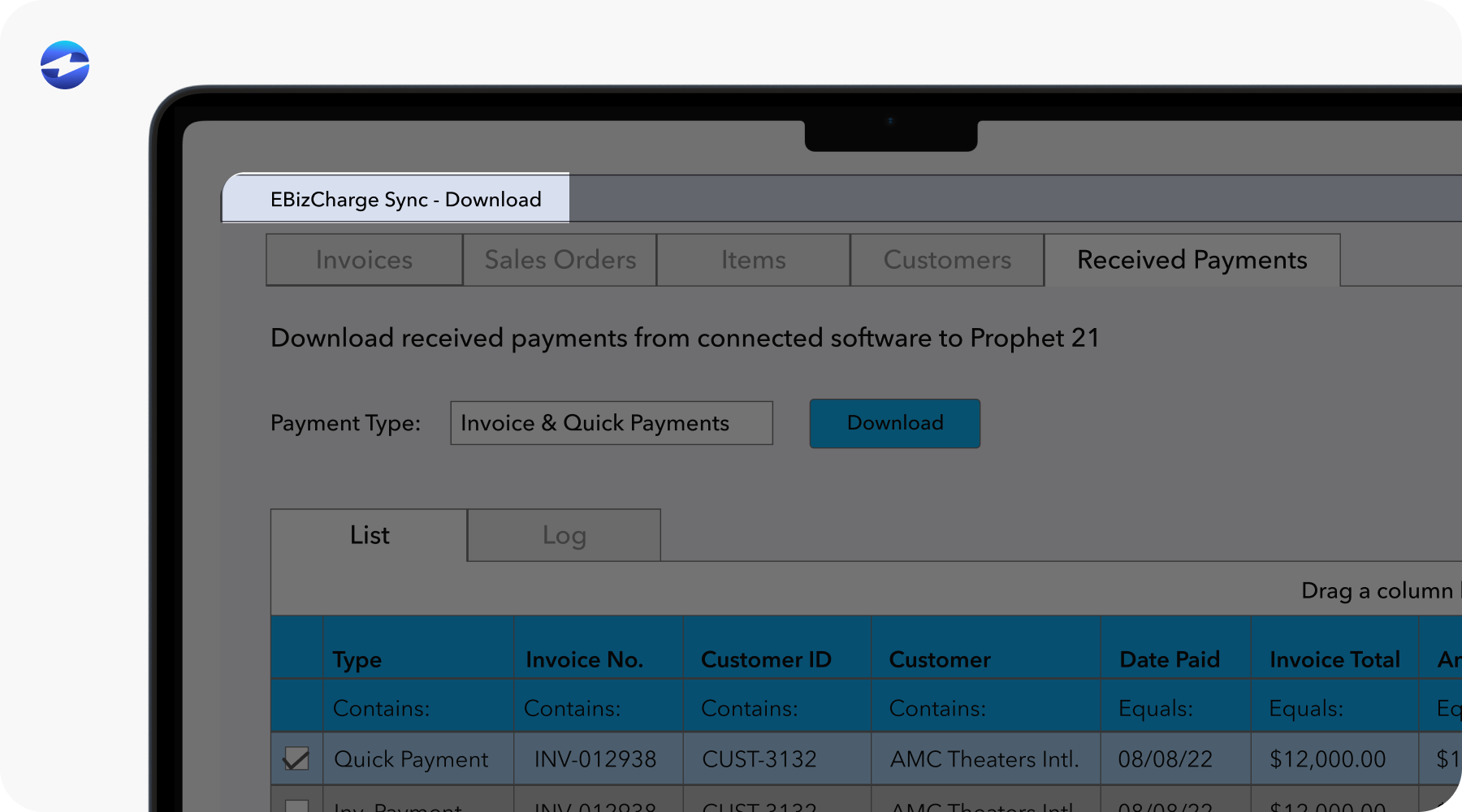

Why EBizCharge Is Often Chosen Over Epicor Payment Exchange

For many manufacturers, EBizCharge represents a middle ground between native simplicity and advanced capability.

EBizCharge is designed specifically for Epicor ERP, embedding payment tools directly into Epicor workflows. Payments move through a secure Epicor payment gateway, are handled by a reliable payment processor, and apply automatically to invoices without extra steps.

This approach reduces manual effort while keeping systems easy to manage. Credit card and ACH payments post cleanly. Customer portals simplify how buyers pay. Reporting stays accurate without constant cleanup.

When teams compare EBizCharge to Epicor EPX, the conversation often centers on automation, cost control, and long-term scalability.

Key Questions to Ask Before Choosing Between EPX and Third-Party Solutions

Before making a decision, it’s worth stepping back.

How much manual payment work does your team handle today? How often do payments require correction? Are Epicor payment processing fees predictable as volume grows?

It’s also important to consider ownership. Who manages payment issues when they arise? Finance, IT, or both?

Clear answers to these questions usually point toward the right payment processing solution.

Choosing The Right Approach for Your Business

Epicor Payment Exchange plays an important role for many Epicor users, especially early on. But as businesses grow, their limitations become harder to ignore.

Third-party payment solutions exist because manufacturers need more automation, better customer experiences, and greater control over costs and workflows.

Whether you stay with EPX or move to a third-party payment processing solution, the goal is the same: reliable, efficient Epicor payment processing that supports how your business actually runs.

Choosing the right approach now can save years of friction later—and help your team focus less on fixing payments and more on moving the business forward.