Blog > Sage Intacct Integration Partners: What You Need to Know Before Choosing

Sage Intacct Integration Partners: What You Need to Know Before Choosing

For companies using Sage Intacct ERP, choosing the right integration partner can shape how efficient, secure, and scalable their financial operations become. Integrations are what make Sage powerful. They connect accounting, payments, reporting, and automation into one continuous ecosystem. However, with so many tools and providers in the Sage Intacct marketplace, finding the right fit takes some thoughtful consideration. This guide breaks down what to know before you commit—covering key features, pricing insights, and what separates a reliable partner from one that might overcomplicate your workflow.

Understanding Sage Intacct Integration Partners

A Sage Intacct integration partner is more than just a software add-on. These providers expand Sage’s functionality by helping different systems communicate—whether that’s syncing your payment gateway, automating reconciliation, or linking customer transactions to reporting dashboards. The goal is seamless data flow, where information updates in real time across your accounting, billing, and payments without extra manual input.

Through Sage integration, your financial ecosystem becomes more cohesive. Instead of juggling separate tools for credit card payments, ACH transactions, and reporting, an integrated setup keeps everything connected inside Sage Intacct. That means fewer data silos, cleaner records, and faster decisions.

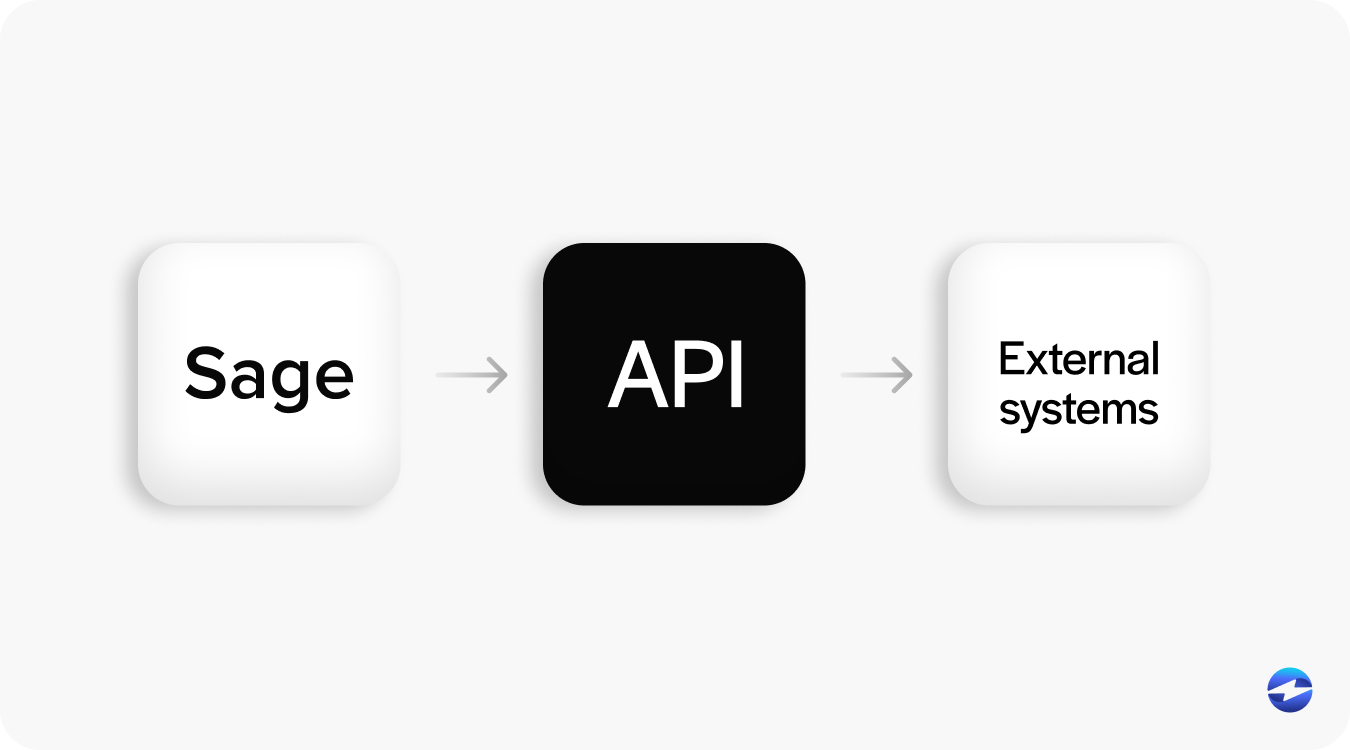

The technical backbone behind this process is the Sage API integration. Application programming interfaces (APIs) allow data to move securely between Sage and external systems. This ensures that invoices, payments, and general ledger entries are always in sync, even if multiple departments or applications are involved. For finance leaders and IT teams, reliable API integration means fewer sync errors and a more transparent view of company finances.

The Role of Integration Partners in Payment Processing

In the world of Sage Intacct payment processing, integration partners are what make automation possible. These partners link your payment systems directly to your ERP, ensuring that transactions update automatically—no batch uploads or manual reconciliation needed.

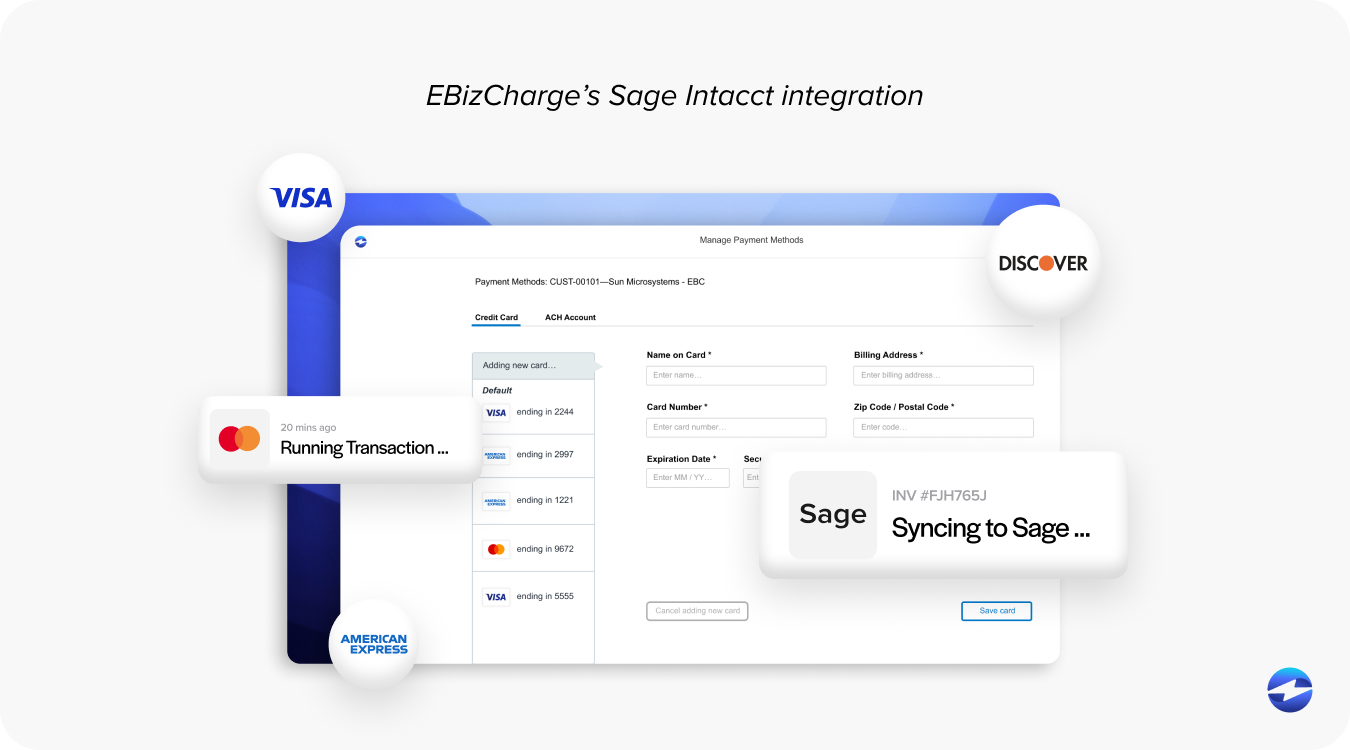

A strong integration partner also supports advanced workflows like recurring billing, tokenization, and refund management. This helps finance teams handle payments at scale while maintaining security and compliance. Many payment processing solutions available through the Sage Intacct marketplace also include built-in fraud detection, real-time reporting, and multi-currency support—features that become essential as companies expand globally.

Key Factors to Consider When Choosing a Sage Intacct Integration Partner

Finding the right integration partner isn’t about choosing the biggest name—it’s about finding one that fits how your business actually operates. Here’s what to look for:

- Compatibility: Ensure the integration supports your version of Sage Intacct and works smoothly with your existing payment processor or gateway.

- Security and Compliance: Choose Sage Intacct integration partners that are PCI-compliant and equipped with strong encryption standards.

- Scalability: Your transaction volume will grow over time. Pick a solution that can handle larger data loads without slowing down your workflows.

- Support and Implementation: Reliable onboarding and responsive technical support can make or break your experience. Ask about implementation timelines and whether the partner offers dedicated account support.

- Cost Transparency: Review transaction fees and integration costs carefully. The best partners help reduce costs through efficiency and features like interchange optimization.

Reducing Payment Processing Fees with the Right Integration

Not all payment integrations are built equally when it comes to cost savings. Some Sage Intacct payment processing systems still route transactions through third-party gateways, adding unnecessary fees. Others, however, use direct connections and optimization tools to lower those costs.

Top Sage Intacct integration partners—such as EBizCharge—reduce fees through interchange optimization. This process automatically classifies transactions into the lowest-cost categories available, lowering your effective processing rate without manual intervention. Over time, this can save companies thousands on fees annually.

A reliable Sage API integration can also reduce expenses by cutting out redundant systems. By managing payments, billing, and reconciliation from within Sage, businesses avoid paying for separate reporting or gateway platforms. Combined with automation, this creates a more cost-efficient and transparent workflow that grows alongside your operations.

Top Integration Partners to Explore

The Sage Intacct marketplace offers a range of verified payment processing solutions, each suited for different business needs. Here are a few that consistently perform well:

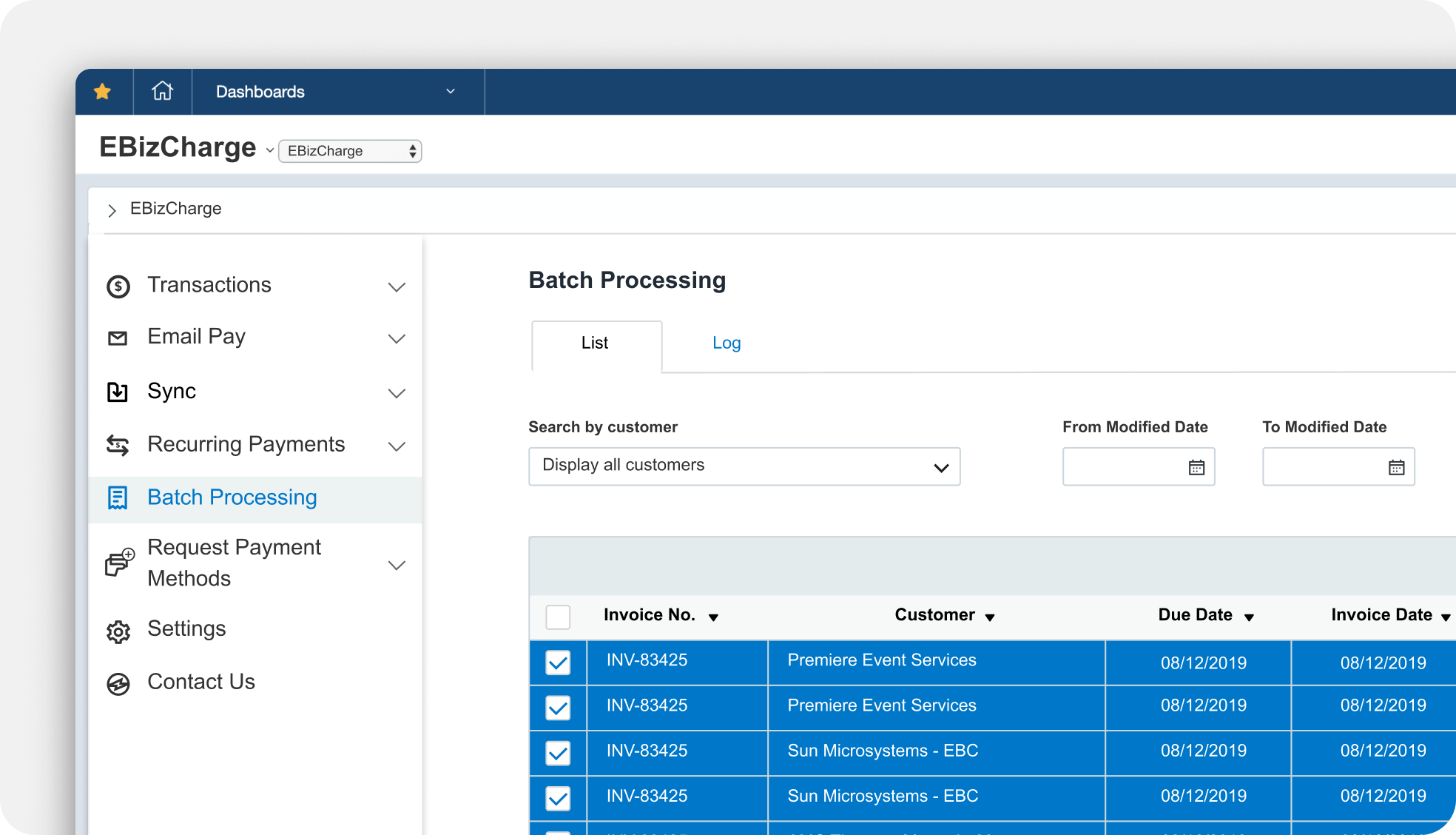

- EBizCharge: Known for its native Sage Intacct integration, EBizCharge processes payments directly inside Sage, posting results instantly to invoices and customer accounts. Its automation tools and cost-saving features—like interchange optimization—make it a top choice for growing businesses.

- Paya: A reliable partner for ACH and credit card processing. It’s simple to set up and fits well for organizations handling moderate transaction volumes.

- REPAY: Geared toward companies with higher payment complexity, offering strong API flexibility and customizable payment workflows.

Each of these integration partners offers slightly different advantages. The best fit depends on your team’s technical comfort, transaction mix, and reporting needs.

Evaluating Integration Performance and Long-Term Value

Once your integration is in place, ongoing evaluation is key. Watch for consistent performance, minimal downtime, and smooth syncing between systems. Most issues—like duplicate entries or failed reconciliations—can be prevented with proper API maintenance and regular software updates.

Regular audits of your payment activity can also reveal whether your payment processing solution is performing efficiently. If you notice rising transaction costs or slow reconciliation, it might be time to re-evaluate your setup or explore new Sage Intacct marketplace offerings.

A good integration partner should also keep up with Sage’s regular software updates. When Sage releases API or system improvements, your integration should evolve alongside it. This ensures your workflows stay efficient and secure long-term.

Why EBizCharge Is a Great Choice for Sage Intacct Users

Among all the Sage Intacct integration partners, EBizCharge consistently earns strong reviews for its combination of simplicity, transparency, and deep functionality. It’s built specifically for Sage users who want a system that feels native—not bolted on.

EBizCharge integrates directly into Sage Intacct ERP, allowing payments to post instantly to invoices, accounts, and projects. This removes the need for manual entry or delayed reconciliation. The setup is straightforward, and the company’s support team specializes in Sage integrations, making deployment smooth even for non-technical teams.

Cost savings are another key advantage. EBizCharge’s built-in interchange optimization automatically lowers processing fees, while PCI-compliant tokenization ensures sensitive payment data never enters your Sage environment. That means stronger security with less compliance scope to manage.

Unlike general-purpose payment gateways, EBizCharge is purpose-built for Sage. It combines automation, analytics, and secure processing into a single, cohesive workflow. For companies that process a high volume of credit card or ACH payments, it delivers meaningful long-term savings and operational clarity.

Choosing the Right Partner for Your Business

At the end of the day, the right Sage integration partner depends on your priorities—cost, control, support, or scalability. For finance and IT professionals, choosing the right system isn’t about flashy features; it’s about long-term reliability and measurable ROI.

When evaluating Sage Intacct integration partners, consider how well they understand your business model, how transparent their pricing is, and how easily their technology scales. Whether you explore solutions through the Sage Intacct marketplace or connect directly with providers, focus on those that align with your daily workflows and budget.

With its strong native connection, proven automation tools, and cost transparency, EBizCharge continues to stand out as one of the most practical and effective payment processing solutions available. It offers everything modern businesses need to simplify their Sage Intacct payment processing, reduce fees, and strengthen financial efficiency—without adding unnecessary complexity.

- Understanding Sage Intacct Integration Partners

- The Role of Integration Partners in Payment Processing

- Key Factors to Consider When Choosing a Sage Intacct Integration Partner

- Reducing Payment Processing Fees with the Right Integration

- Top Integration Partners to Explore

- Evaluating Integration Performance and Long-Term Value

- Why EBizCharge Is a Great Choice for Sage Intacct Users

- Choosing the Right Partner for Your Business