Blog > How To Integrate a Payment Gateway into Salesforce

How To Integrate a Payment Gateway into Salesforce

Payment gateways have become a vital strategy for modern businesses looking to streamline their financial operations and deliver a seamless customer experience.

Popular customer relationship management (CRM) platforms like Salesforce continue to streamline these operations with robust sales, marketing, and service tools, making the ability to process payments directly within this system the cherry on top.

This article will explore how to successfully integrate a payment gateway into Salesforce, from choosing a provider and installing the integration to testing the setup and going live.

What is Salesforce?

Salesforce is a cloud-based CRM designed to help businesses manage their sales, marketing, customer service, and other critical operations. It provides a centralized hub for storing and accessing customer data, tracking interactions, managing leads, automating workflows, and analyzing performance metrics.

Salesforce is highly customizable, allowing companies to adapt workflows to match their unique processes. Its strong integration capabilities enable seamless connectivity with other software applications, making it a versatile solution for complex infrastructures.

Many businesses choose Salesforce for its scalable cloud solutions that can adapt to support growth.

Alongside its CRM capabilities, merchants can integrate a payment gateway into Salesforce to effortlessly accept and process payments inside this system.

8 benefits of integrating a payment gateway into Salesforce

Integrating a payment gateway into Salesforce can yield several advantages for merchants looking to enhance their financial operations and overall user experience.

Here are eight top benefits of syncing a payment gateway into your Salesforce system:

- Streamlined quote-to-cash: A Salesforce payment gateway allows you to manage the entire quote-to-cash cycle within one platform. From generating quotes and creating invoices to collecting payments and updating records, every step is handled with ease to reduce manual entry, eliminate delays, and minimize the risk of errors for faster deal closures and better operational efficiency.

- Improved cash flow: A Salesforce-integrated payment system accelerates payment collections thanks to features like automated billing, instant payment processing, and recurring payment capabilities that can significantly reduce days sales outstanding (DSO), improve cash flow, accelerate revenue recognition, and enhance financial predictability.

- Real-time payment visibility: With real-time transaction tracking, your team can immediately see the status of payments – whether pending, completed, or failed – without leaving Salesforce. This visibility allows for faster follow-ups, accurate forecasting, and timely resolution of payment issues. Sales and finance teams stay aligned, and customers benefit from quicker responses.

- Enhanced user experience: Customers expect fast, easy, and secure payment options. Integrating payments into Salesforce offers convenient features like one-click payments, branded payment portals, and flexible billing terms. These capabilities create a smoother, more professional experience that builds trust and encourages prompt payments.

- Centralized financial and customer data: An integrated payment gateway can store payment data alongside customer records in Salesforce. This centralization enables a 360-degree view of each customer, combining CRM data with financial history. Teams can make more informed decisions, personalize service, and reduce data silos across departments.

- Automated workflows and notifications: With Salesforce’s automation tools, you can trigger actions based on payment activity. For example, automatically sending payment receipts, updating invoice statuses, or notifying team members of overdue payments. These automations reduce manual workload, enhance consistency, and ensure nothing falls through the cracks.

- Simplified reporting and insights: Syncing payment data into Salesforce can come with built-in dashboards and reports to monitor key metrics like total revenue, outstanding balances, and payment trends. These insights help merchants make smarter business decisions and spot potential issues or opportunities early.

- Increased security and compliance: Reputable Salesforce payment integrations are designed with strong security protocols and compliance with Payment Card Industry Data Security Standards (PCI DSS). Features like tokenization, encrypted data transmission, and role-based access controls ensure that sensitive payment information is protected and your business meets industry regulations.

Now that you know the benefits of integrating a payment gateway into Salesforce, it’s time to learn how to set it up.

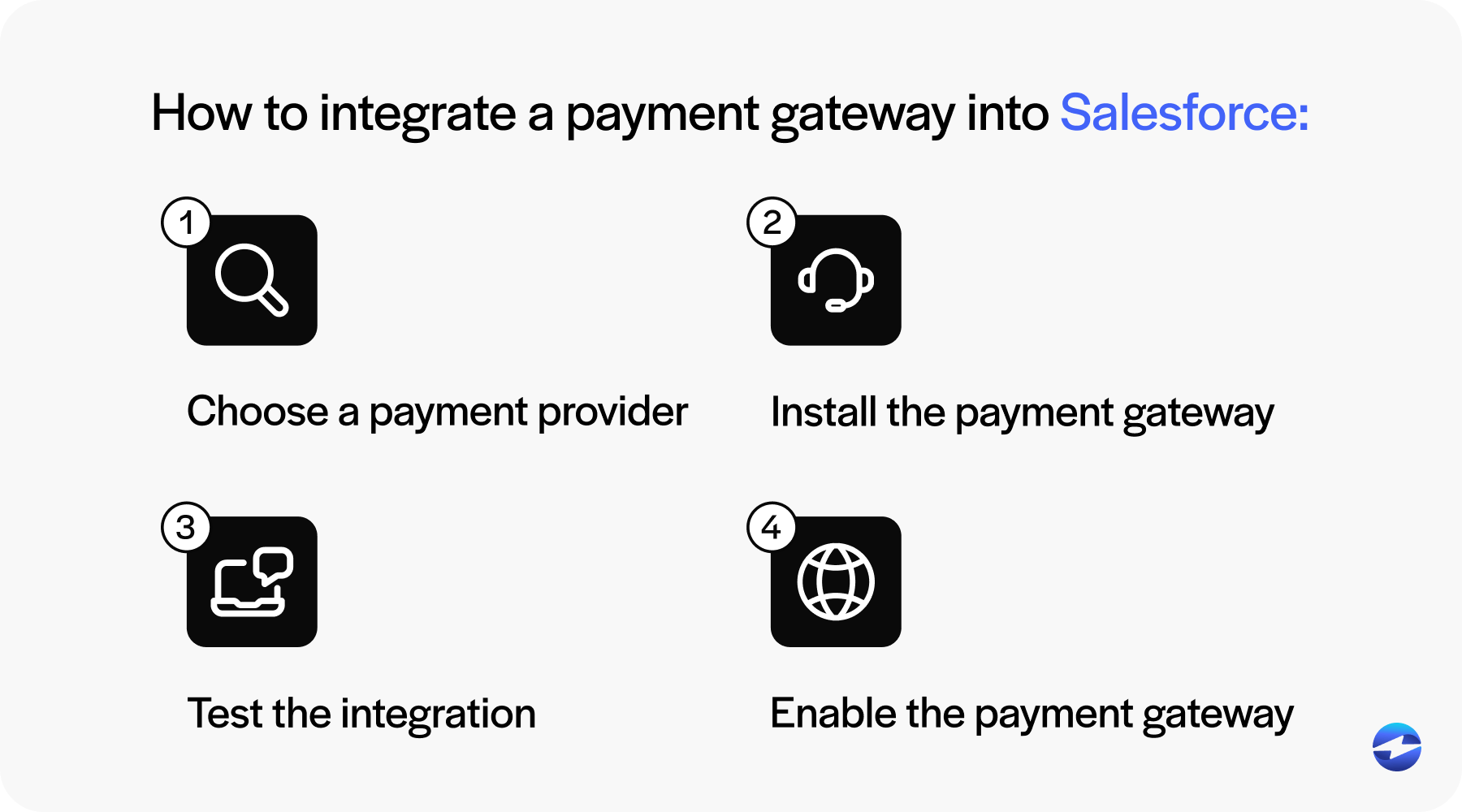

How to integrate a payment gateway into Salesforce

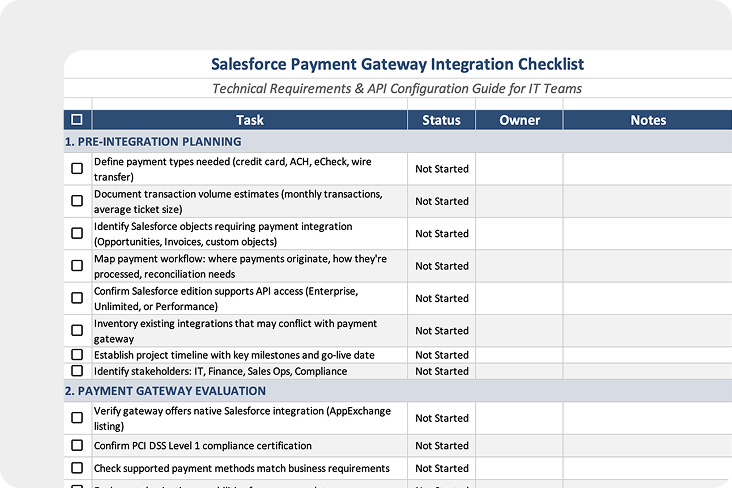

A successful Salesforce payment gateway integration requires thoughtful planning and evaluation.

From selecting the right provider to configuring the gateway and testing every detail, each step is vital in ensuring a secure and reliable setup.

1. Choose a payment gateway provider

The first step in integrating payments into Salesforce is selecting the right payment gateway provider for your business needs.

Consider providers that offer native Salesforce payment integrations or pre-built connectors, as these can save time and reduce the complexity of the setup process.

Look for key features such as compatibility with your Salesforce version, support for your preferred payment methods, PCI compliance, and robust security tools like tokenization and fraud protection.

It’s also important to evaluate the provider’s customer support, costs, API documentation, and scalability to ensure the solution will grow with your business.

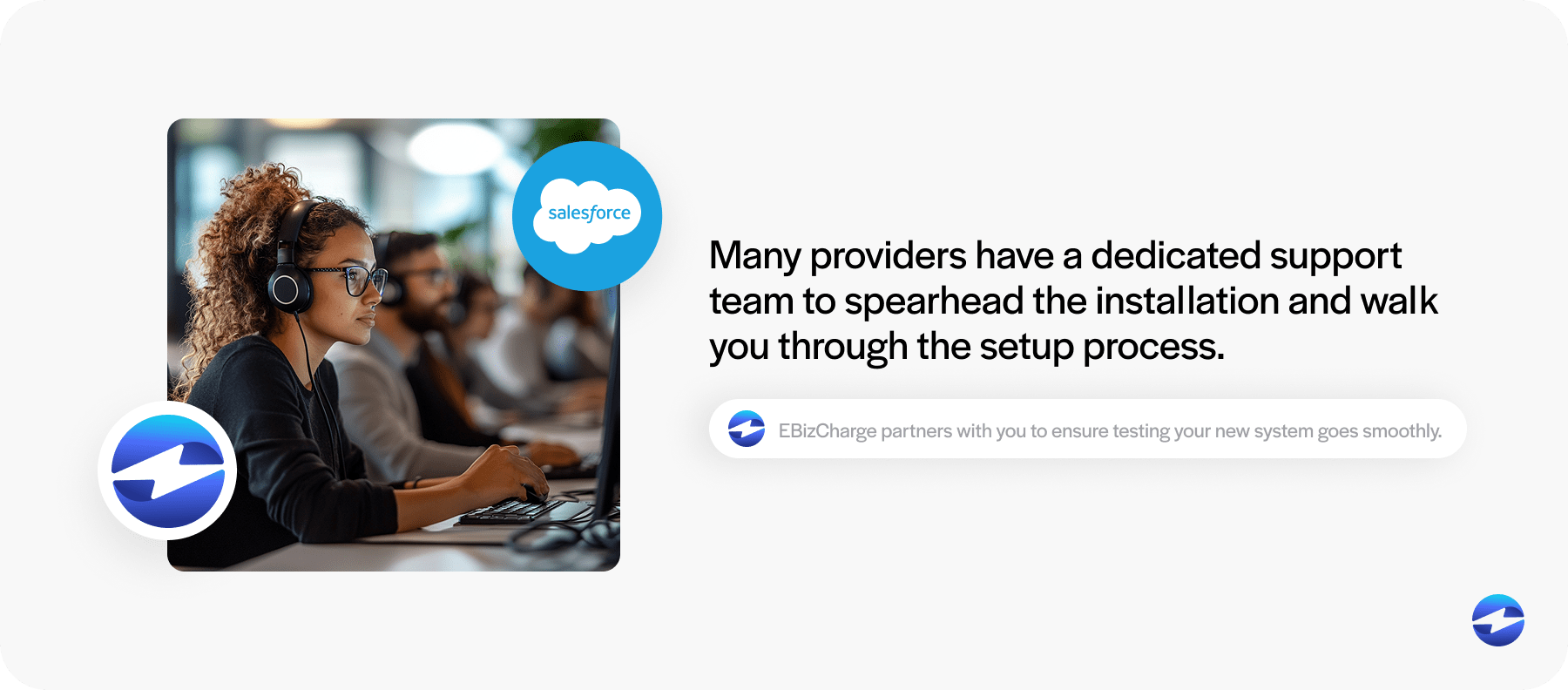

2. Install the payment gateway

Once you’ve selected a payment gateway provider, the next step is installing the payment gateway into your Salesforce environment. The provider should have a dedicated support team to spearhead the installation and walk you through the setup process.

The payment gateway installation process typically begins by setting up a merchant account, which securely processes and transfers customer payments to your business bank account.

After your account is active, you’ll receive Application Programming Interface (API) credentials or authentication keys to connect your payment gateway to Salesforce. Most providers offer guided setup instruction or managed installation services to ensure proper configuration.

A well-configured installation will ensure transaction data successfully transfers between the payment gateway and your Salesforce system.

3. Test the integration

Before going live, testing the entire payment workflow in a Salesforce sandbox or staging environment is essential to verify your Salesforce payment gateway integration works correctly without impacting live data or customers.

It’s important to simulate various transactions during testing, including successful, failed, and refunded payments.

Businesses should run additional tests confirming that transaction statuses update in real-time, email notifications are triggered appropriately, and financial data syncs accurately with relevant Salesforce objects.

Lastly, testing custom workflows or automation rules that depend on payment triggers is also helpful.

Thorough testing helps identify and resolve issues early, ensuring a smooth and reliable experience once the system is live. Continuous assessments of your payment integrations are necessary to ensure they run to their fullest capacity.

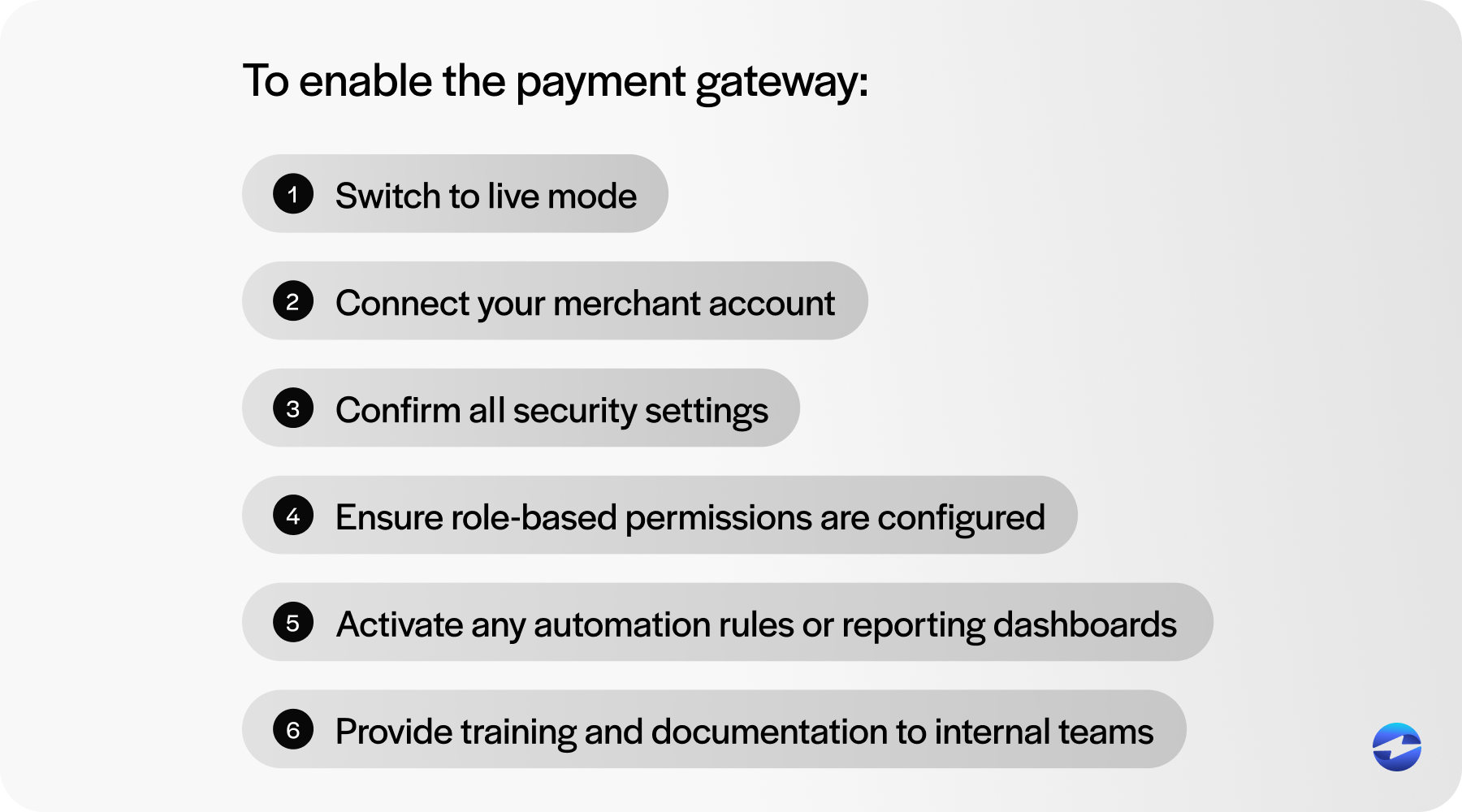

4. Enable the payment gateway

After successful testing, you can enable the payment gateway in your live Salesforce environment. This involves switching the system from test to live mode, connecting it to your production merchant account, and confirming all security settings are in place.

You’ll also want to ensure that role-based permissions are configured correctly so only authorized users can access or manage payment data. Then, activate any automation rules or reporting dashboards that support your billing, finance, or sales processes.

Finally, provide training and documentation to your internal teams so they know how to process payments, handle refunds, and use the reporting tools within Salesforce.

With everything in place, your integrated payment system will be ready to efficiently process transactions and improve your invoicing cycle.

When choosing a payment gateway provider, merchants should evaluate a few critical factors to ensure they select the most suitable option for their business infrastructure.

How to choose the best payment gateway for your Salesforce software

Choosing the right payment gateway for your Salesforce software is key to effortless payments for your business and its customers.

A reliable and powerful Salesforce payment gateway creates a seamless customer experience and simplifies payment processing. This ensures your business can efficiently handle transactions.

Consider the following features and benefits to ensure a perfect match.

Compatibility with Salesforce

Ensuring your payment gateway is fully compatible with Salesforce will solidify that all features can sync smoothly for efficient payment processing.

A gateway that integrates without issues with Salesforce software is pivotal in enhancing the overall user experience, reducing technical errors, and improving financial record accuracy.

When your payment system and Salesforce CRM are in harmony, workflow becomes more efficient. This compatibility helps track customer payment details and maintain proper billing records.

Supported payment methods

A reliable payment gateway that accepts multiple payment methods is vital for success, so finding a provider that supports credit cards, debit cards, Automated Clearing House (ACH)/eChecks, digital wallets, and more will be highly advantageous.

By offering varied payment options, this diversity will allow you to cater to different customer preferences to reach broader audiences and enhance customer experiences and satisfaction.

A processor that supports popular payment methods can streamline the payment process, ensuring more transaction efficiency and a seamless customer checkout experience.

Payment security standards

Since payment security is non-negotiable, your payment gateway provider should be PCI-compliant and offer advanced security features.

Merchants should look for gateways equipped with payment security features, including tokenization to protect cardholder data, data encryption for secure transmission, fraud detection tools, and role-based access controls for managing internal user permissions.

These protocols protect your company and its customers while helping you meet industry compliance standards.

Costs and fees

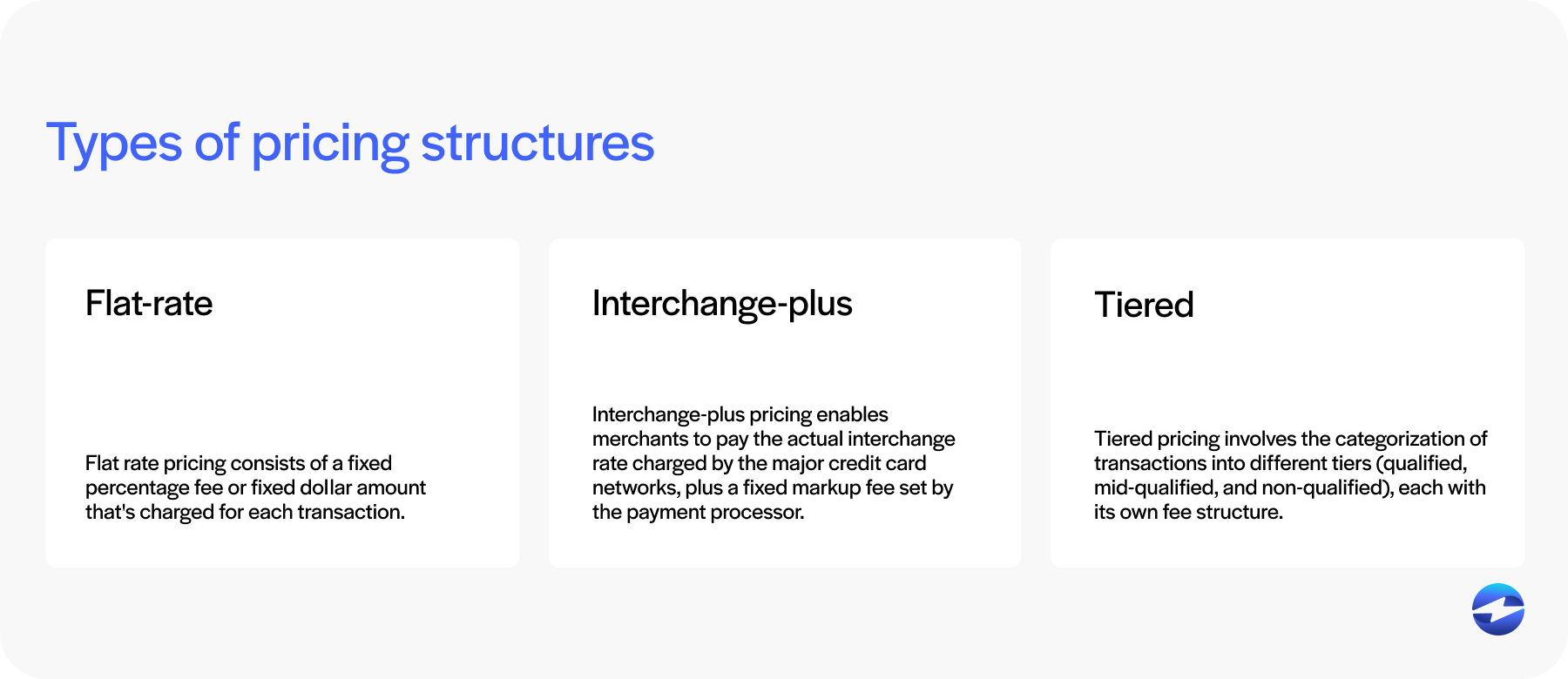

Understanding costs and fees is essential when choosing a Salesforce payment gateway, as different providers vary in pricing structures and costs, including setup and transaction fees and monthly charges.

There are several pricing structures that can suit different business needs, such as flat rate, interchange-plus, and tiered pricing.

Flat rate pricing offers predictable costs, making it ideal for small businesses. Interchange-plus pricing can benefit larger or high-volume businesses with lower, more transparent rates. Tiered pricing is common but less transparent. Choosing the right model can guarantee better cost efficiency and alignment with your payment infrastructure.

Merchants should also evaluate various fees to ensure they fit into their budget. High fees can erode profit margins, so choosing a cost-effective payment processing solution is crucial.

Your business can analyze the costs associated with the services offered to ensure they provide value to your financial operations.

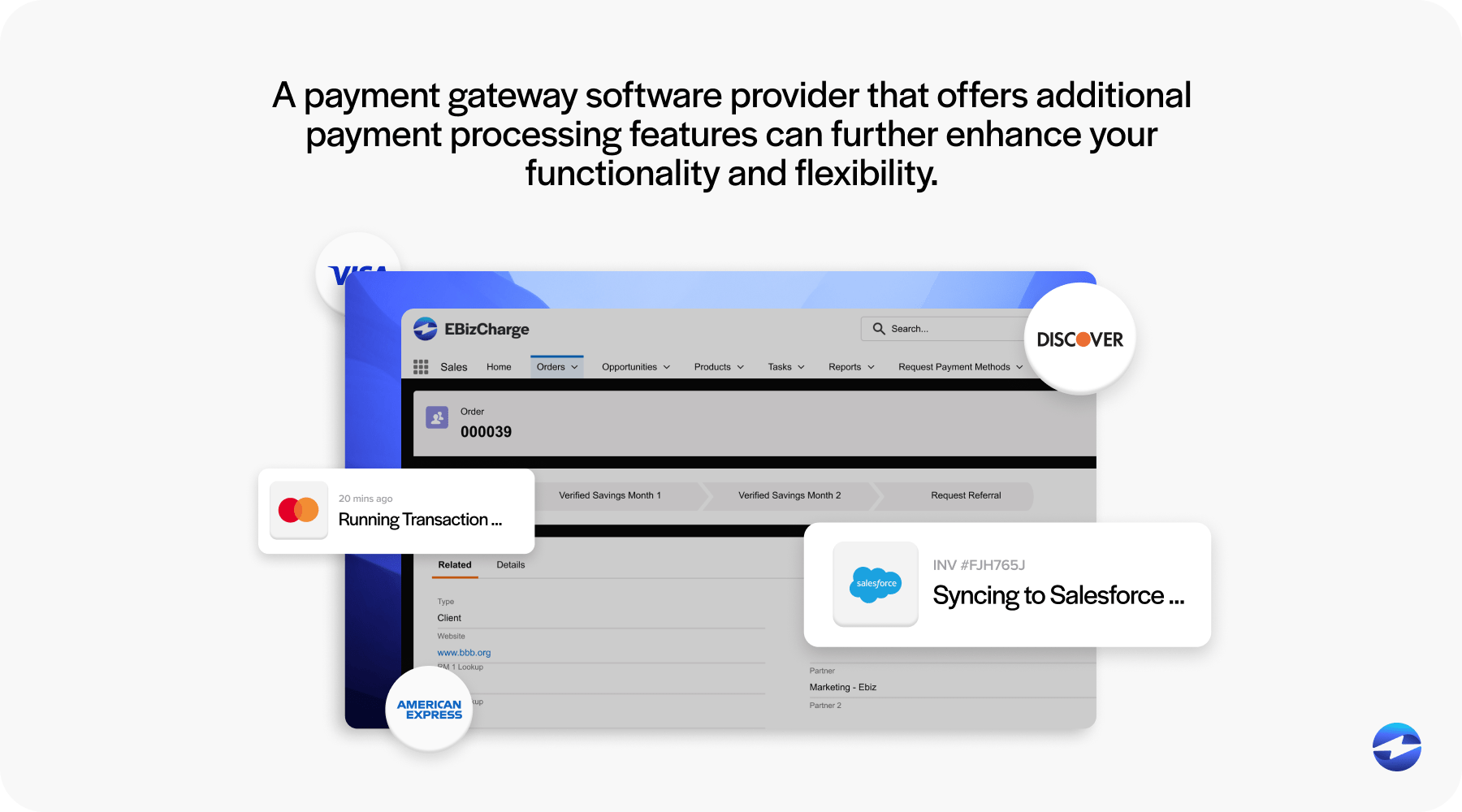

Additional payment processing features

A payment gateway software provider that offers additional payment processing features can further enhance your functionality and flexibility.

An integrated payment gateway with features like recurring billing, automated invoicing, and detailed payment status tracking can improve operations. Such features can enhance your management of payment processes and the user experience and streamline your billing operations in Salesforce.

Additional tools give customers more accessibility to conveniently make payments, like online payment portals, which can strengthen brand loyalty. Secure email payment links offer another layer of flexibility, enabling merchants to send encrypted links directly to customers for fast, secure payments without logging into a portal.

Overall, a feature-rich payment gateway adds value to your Salesforce account software, boosting overall system performance and user satisfaction.

Enhancing payments in Salesforce with EBizCharge

EBizCharge provides a powerful Salesforce integration that significantly enhances how merchants accept and process payments. Its comprehensive payment collection tools and features are designed to improve efficiency across the entire invoicing process.

EBizCharge users can easily manage multiple payment methods, including credit and debit cards and ACH transfers, all within the Salesforce environment. This integration simplifies customer payment options and streamlines transaction workflows for internal teams, creating a more cohesive and productive experience.

Businesses can leverage EBizCharge for Salesforce to tap into tools like automated workflows that help streamline repetitive tasks and real-time reporting that provides valuable insights into payment history and financial performance. Customizable payment interfaces further enhance the customer experience by offering branded, user-friendly payment portals.

Overall, EBizCharge integrates effortlessly into Salesforce, optimizing every step of the payment journey while boosting operational efficiency, visibility, and security.