Blog > What is a Merchant Account and Does Your Business Need One?

What is a Merchant Account and Does Your Business Need One?

Mastering the financial aspects of operating a business is paramount to achieving success. A fundamental element that every business leader should be well-versed in is the merchant account — a critical service that facilitates electronic payments.

As digital payments continue to grow in popularity, a frictionless payment processing system is vital.

What is a merchant account?

A merchant account is a business bank account that allows companies to accept payments, such as debit and credit card transactions, electronic funds transfers (EFTs), and Automated Clearing House (ACH) payments.

Merchant accounts act as intermediaries between businesses and payment networks, facilitating the secure transfer of funds from customers to your account.

Merchant account providers (MSPs) often offer tailored solutions based on the type of business and online transaction volume.

Merchant accounts provide much value for businesses trying to accept payments, but how do they work?

How do merchant accounts work?

When a customer makes a payment, the transaction is routed through a payment gateway to the merchant account.

The merchant account provider processes the payment by communicating with the customer’s bank to approve or decline the transaction. Once approved, funds are deposited into the merchant’s account after deducting interchange fees and additional merchant account fees. The approval process can vary based on the business type and creditworthiness.

Merchants should also have a good grasp of how payments are authorized within these accounts.

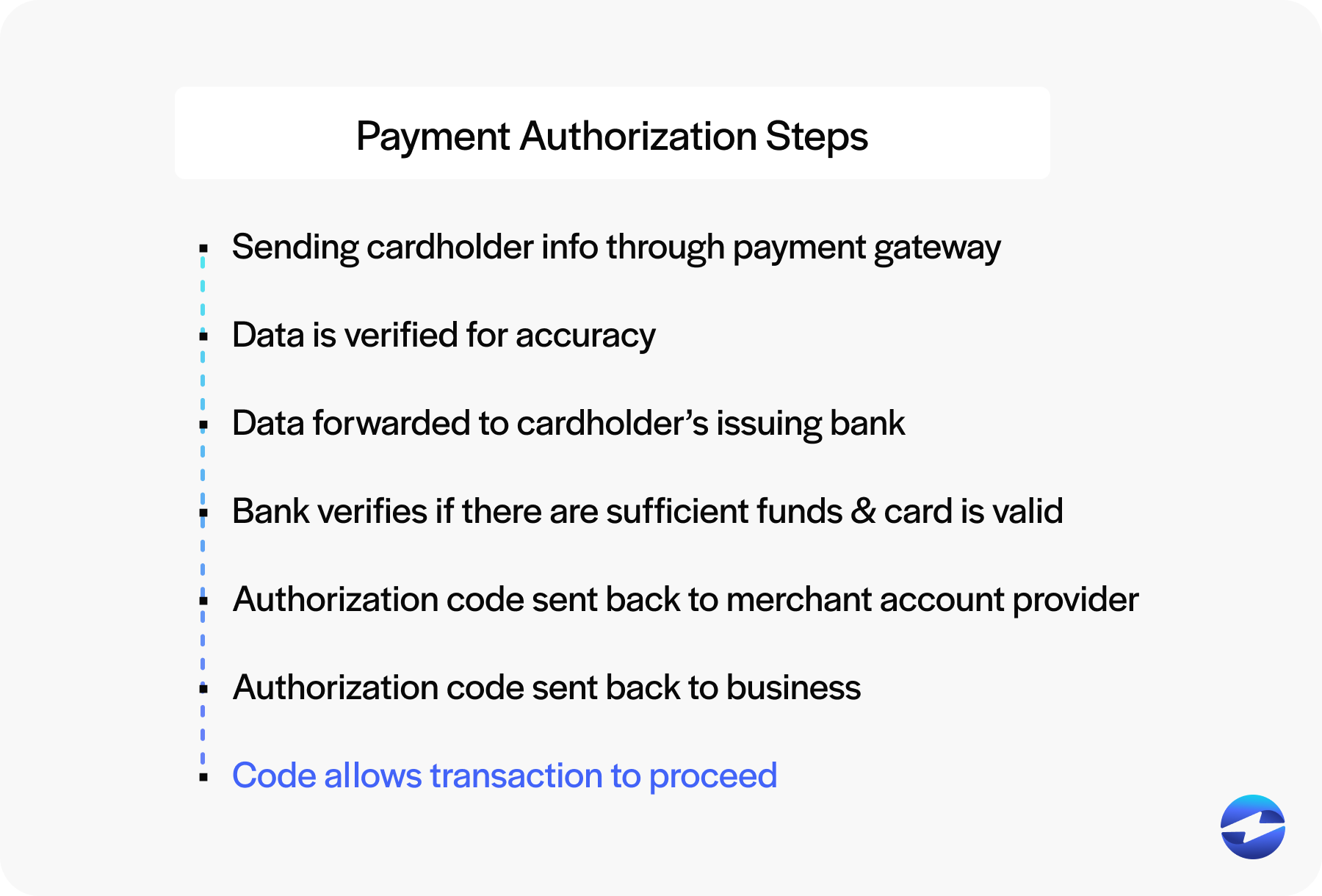

The process of payment authorization

Payment authorization involves several steps, beginning with sending the cardholder’s information through the payment gateway. This data is verified for accuracy and then forwarded to the cardholder’s issuing bank. The bank then verifies if there are sufficient funds and confirms the card’s validity.

An authorization code is sent back through the payment network to the merchant account provider and then to the business upon approval. This code allows the transaction to proceed, ensuring funds will later be transferred to the business’s bank account. The entire process supports efficient electronic payments to maintain operational fluidity.

With these protocols in mind, your business can better understand the importance of merchant accounts.

Why are merchant accounts important for your business?

Without a merchant account, your company won’t be able to accept credit, debit, and electronic/ACH payments from its customers.

Merchant accounts support various payment methods, catering to customer preferences and enhancing their shopping experience. They’re particularly crucial for online businesses that rely on electronic payments to facilitate transactions. Businesses can open a merchant account in a few key steps to gain access to comprehensive financial statements and reporting tools, helping them better manage transaction volume and payment processing.

With a dedicated merchant account, businesses can access comprehensive financial statements and reporting tools, helping them better manage their transaction volume and payment processing.

These accounts can also provide more transparency for merchants to understand fee structures, including transaction and termination fees, to better control operational costs.

Now that you know what merchant accounts entail and their importance, you can look to the following section for steps to apply for this account.

How to apply for a merchant account?

Since establishing a merchant account is vital to accepting payments, knowing the steps involved in applying for this account is essential.

By understanding the key considerations and requirements, businesses can navigate the application process more effectively, increasing their approval chances and ensuring a seamless payment experience.

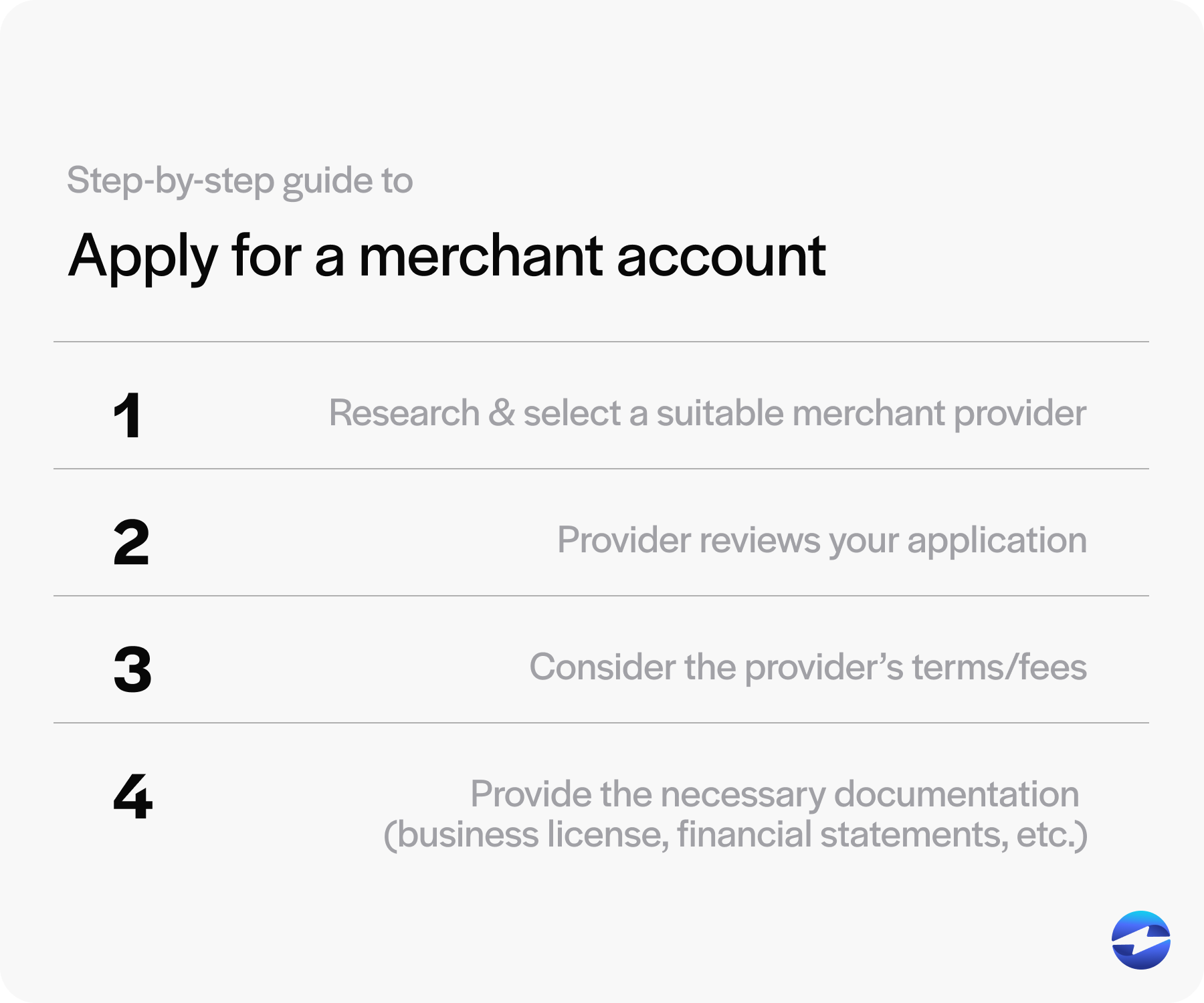

To apply for a merchant account:

- Begin by researching and selecting a suitable merchant account provider.

- The approval process involves submitting your application, after which the provider will review your business type and transaction history.

- Consider the provider’s terms and fees (such as interchange, transaction, and potential termination fees).

- Once you’ve decided, prepare the necessary documentation, which typically includes business licenses, financial statements, and details of your business checking account.

Payment service providers also require insight into your projected transaction volume and previous credit card payments.

A dedicated merchant service representative can guide you through this process to ensure all criteria are met, thus increasing the likelihood of approval.

There are several merchant account categories to choose from, so it’s essential to find the one that best meets your business needs.

4 types of merchant accounts

Choosing the right type of merchant account depends on various factors such as transaction volume, business type, and specific payment needs.

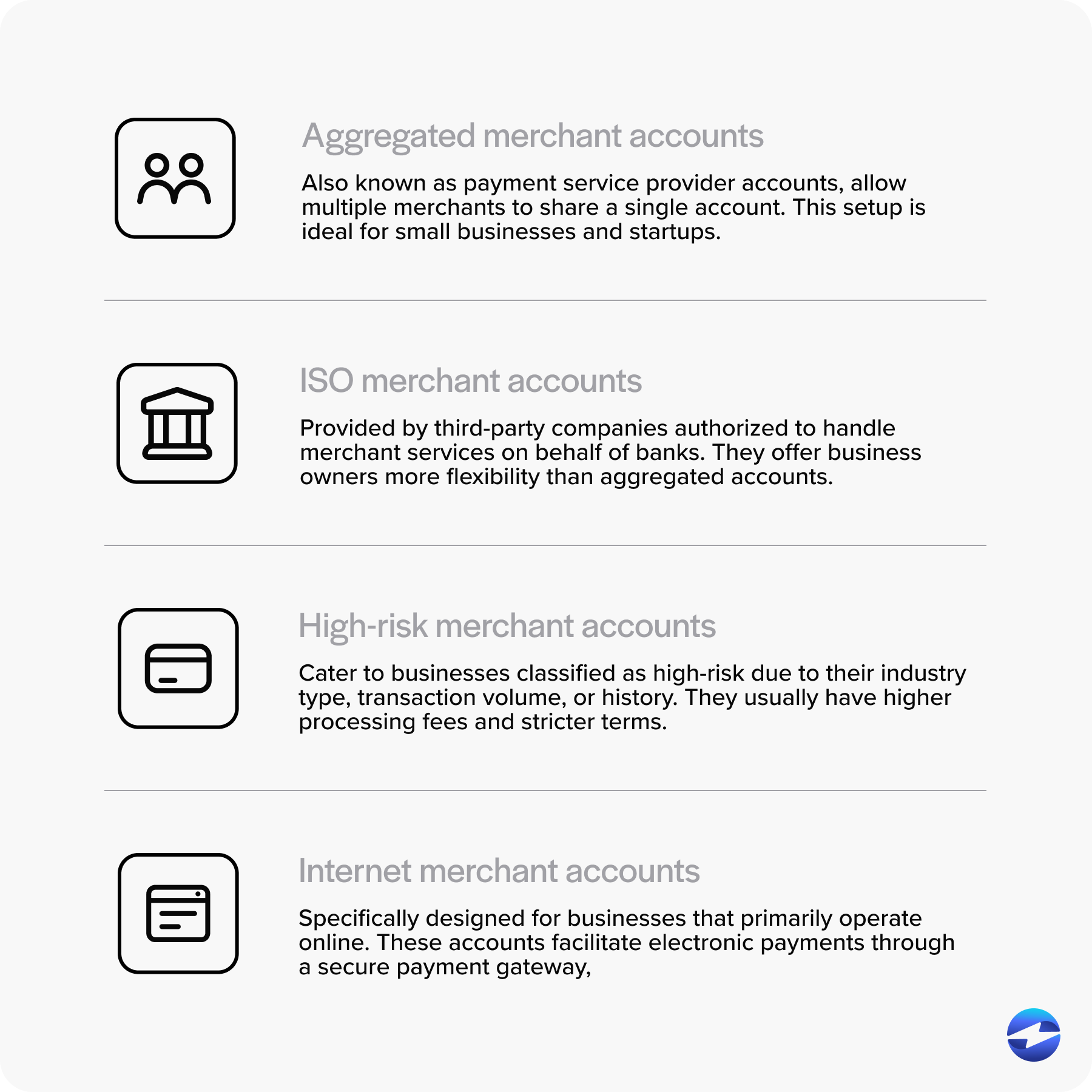

Businesses can choose from four merchant accounts: aggregated, independent sales organization (ISO), high-risk, and Internet merchant accounts.

Aggregated merchant accounts

Aggregated merchant accounts, or payment service provider accounts, allow multiple merchants to share a single account. This setup is ideal for small businesses and startups looking for a quick, cost-effective way to accept credit and debit card payments.

The approval process for aggregated merchant accounts is usually faster, and the fees are lower since they share the account with other users. However, transactions may face more scrutiny due to the shared nature of the account.

ISO merchant accounts

ISO merchant accounts are provided by third-party companies authorized to handle merchant services on behalf of banks. These accounts offer business owners more flexibility and personalized services than aggregated accounts.

Businesses using ISO accounts often benefit from tailored fee structures and dedicated merchant support. However, the approval process may take longer, and account fees can be higher.

High-risk merchant accounts

High-risk merchant accounts cater to businesses classified as high-risk due to their industry type, transaction volume, or history. Due to the increased risk, these accounts usually have higher processing fees and stricter terms.

Examples of commonly high-risk industries include online gambling, adult entertainment, and travel agencies.

High-risk businesses may also face termination fees if their accounts are closed prematurely. It’s important for these businesses to work with experienced MSPs who understand their unique needs to mitigate account closures and additional penalties.

Internet merchant accounts

Internet merchant accounts are specifically designed for businesses that primarily operate online. These accounts facilitate electronic payments through a secure payment gateway, allowing companies to accept credit and debit card payments via their websites.

With the rise of eCommerce, internet merchant accounts have become popular for online transactions. While they may involve interchange and transaction fees, these accounts are vital for online businesses looking to receive customer payments efficiently.

In addition to knowing these four types of merchant accounts, you should also understand how merchant services can differ.

Types of merchant services

Merchant services consist of various software and tools to facilitate smooth and secure business payment processing.

The primary types of merchant services include credit card and debit card processing, which involves safely handling card payments via payment gateways. Additionally, mobile payments allow businesses to accept payments via smartphones or tablets, offering flexibility for on-the-go transactions.

ECommerce services cater specifically to online businesses and include solutions for accepting electronic payments via online shopping carts. Whereas point-of-sale (POS) systems are ideal for brick-and-mortar stores, enabling swift in-person payments.

Lastly, businesses can leverage merchant services to provide recurring billing services and automate regular customer payments.

Each type of merchant service comes with its own fee structure that varies based on transaction volumes and business types.

With these options in mind, businesses can select the most suitable merchant account that meets their specific needs and yields the most benefits.

6 benefits of using a merchant account

Merchant accounts can yield several benefits for businesses, resulting in more streamlined financial transactions and payment options for your customers. These accounts can also assist in maintaining accurate financial statements, ensuring transparent tracking of all transactions.

Here are six top benefits of merchant accounts:

- Robust credit card processing functionality

- Enhanced customer convenience

- Increased sales

- Less stress when handling payments

- Faster access to funds

- Better transaction security

1. Robust credit card processing functionality

Accepting credit card payments can widen the reach of your business to a broader customer base.

Businesses benefit from payment gateways that securely handle electronic payments, providing a seamless checkout experience. This capability enables convenient transactions and boosts customer confidence in your site.

2. Enhanced customer convenience

Merchant accounts allow customers to pay using their preferred methods, such as credit cards, debit cards, or electronic/ACH payments.

This convenience can improve customer satisfaction and loyalty, as it removes barriers to completing purchases. For businesses, this means facilitating a smoother and faster sales process, benefiting both parties involved.

3. Increased sales

With a reliable merchant account, your business can deliver a seamless customer payment process to quickly capture sales. One of the significant advantages of having multiple payment methods is that they cater to diverse customer preferences.

Whether customers prefer credit cards, debit cards, electronic/ACH payments, or mobile wallets, providing a range of payment options enhances their experience and makes them more likely to make purchases and boost sales.

This flexibility can also increase sales for eCommerce businesses, as cart abandonment rates can be high due to limited payment choices or complicated checkout procedures.

4. Less stress when handling payments

Merchant accounts simplify the management of transactions by consolidating all payments into a single system. This setup reduces manual processes and minimizes the risk of errors in accounting.

By partnering with trustworthy MSPs, merchants can focus more on core operations and less on the intricacies of transaction management, resulting in more efficient operations and less stress when collecting customer payments.

5. Faster access to funds

Merchant accounts typically facilitate quicker deposit times than traditional processing methods, which can improve cash flow and help businesses manage their expenses more effectively.

Faster access to funds is especially valuable for small businesses that rely on steady cash flow to maintain inventory, pay employees, and cover other essential costs.

6. Better transaction security

Merchant accounts often come with advanced security features that protect the business and its customers.

Thanks to the built-in fraud detection and secure encryption technologies that many merchant account providers offer, businesses can secure sensitive customer payment data, reduce the risk of chargebacks and fraud, and boost customer trust.

Now that you know the benefits, you can determine if merchant services are right for your business.

Should I set up merchant services for my eCommerce business?

Setting up merchant services is crucial for an eCommerce business to process electronic payments through its website.

This setup enables your business to accept payments seamlessly and establishes a professional and trustworthy image, which is essential for gaining customer confidence in the digital marketplace.

With reliable merchant services that provide customers with secure, flexible payment options, your business can cater to diverse customer preferences and competitive digital market demands and enhance the user experience to encourage repeat purchases and customer loyalty.

Additionally, merchant services can support advanced payment solutions such as recurring billing and mobile payment integrations, which promote customer convenience and help businesses streamline operations.

For the most efficient merchant services, your company can look to a trustworthy account provider that gives you the tools to accept payments and grow your business.

Finding the best merchant account for your business

A merchant account is essential for companies planning to accommodate a high volume of credit and debit card payments, especially online transactions.

When it comes to reliable and cost-effective merchant services, EBizCharge stands out as a top-rated provider that will set you up on a merchant account and offer a comprehensive suite of payment processing solutions designed to streamline your business operations, reduce transaction fees, and enhance the customer experience.

With advanced security features, seamless integrations with major accounting and ERP systems, and robust reporting tools, EBizCharge helps businesses of all sizes manage their payments confidently and efficiently.

By working with EBizCharge, your business is choosing a partner committed to optimizing your payment processes and driving more revenue to yield long-lasting success.