Blog > What Do You Need To Open a Business Bank Account?

What Do You Need To Open a Business Bank Account?

Starting a business typically requires making numerous financial decisions, such as choosing a suitable bank account to manage finances, separate personal and business expenses, and build credibility with clients and suppliers.

Understanding what you need to open a business bank account is essential for any entrepreneur aiming for success.

Thankfully, this article will explain what a business account entails, its importance, common mistakes to avoid, and how to successfully open this account.

What is a business bank account?

A business bank account is a bank account designed to manage the finances of a business separately from personal accounts.

A business bank account serves as a dedicated place to receive business income, make payments to vendors, manage payroll, and track all financial transactions related to the business. This separation of funds helps establish a clear boundary between personal and business finances, which is crucial for legal, tax, and organizational reasons.

Key features of a business bank account

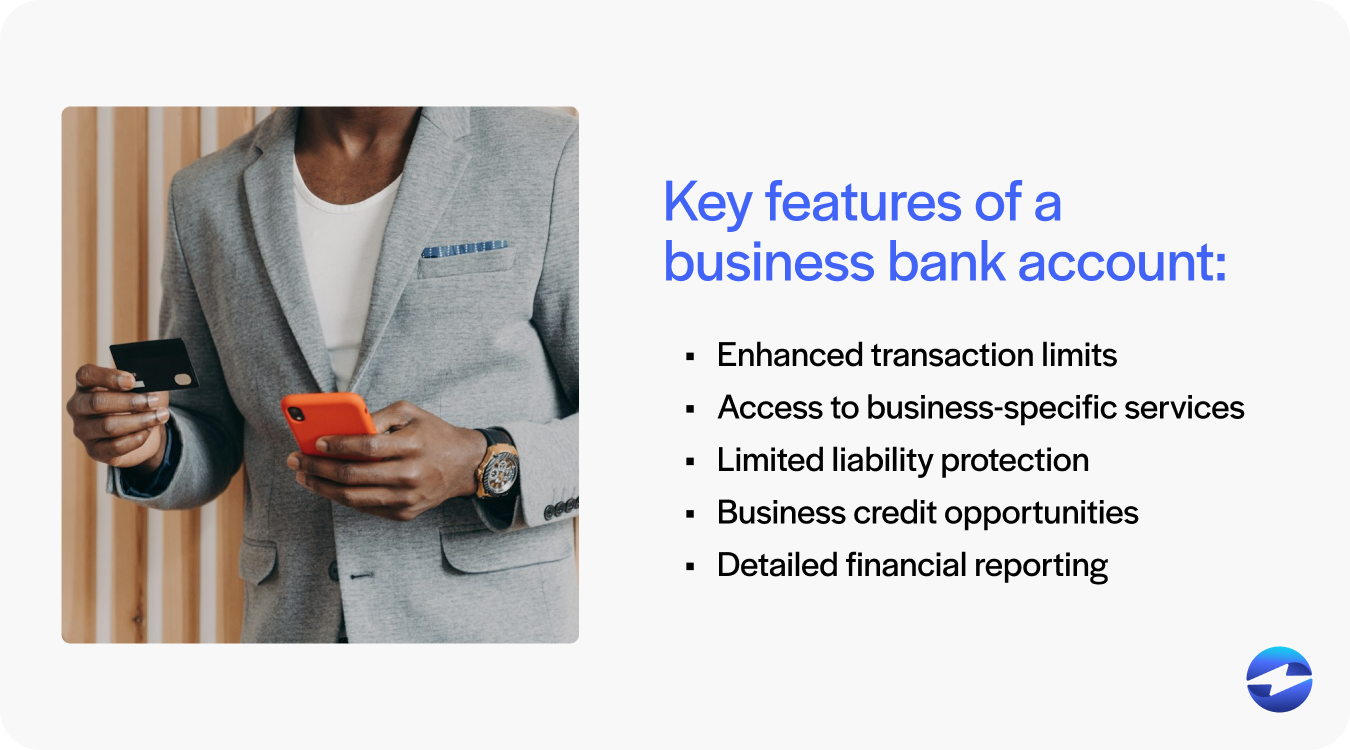

Business bank accounts come with features specifically tailored to meet business needs, often including:

- Enhanced transaction limits: Business accounts typically offer higher transaction limits than personal accounts to accommodate larger cash flow needs, including payroll, vendor payments, and recurring operational costs.

- Access to business-specific services: Many business accounts offer merchant services for processing credit card payments, invoicing tools, and integrations with accounting software. These additional services simplify financial management and make it easier to organize records.

- Limited liability protection: By separating personal and business funds, a business account helps ensure limited liability protection for limited liability companies (LLCs) and corporations. This separation is essential in maintaining the legal protections that keep personal assets safe in case of lawsuits or debts incurred by the business.

- Business credit opportunities: Many banks offer additional perks for business account holders, such as lines of credit, business credit cards, and access to small business loans. These financing options can help scale operations and mitigate cash flow gaps.

- Detailed financial reporting: Business bank accounts make tracking and analyzing cash flow, income, and expenses easier. Monthly and annual account statements provide a clear financial picture of the business, which is essential for budgeting, tax preparation, and strategic decision-making.

In addition to their various features, different types of business bank accounts are available.

Types of business bank accounts

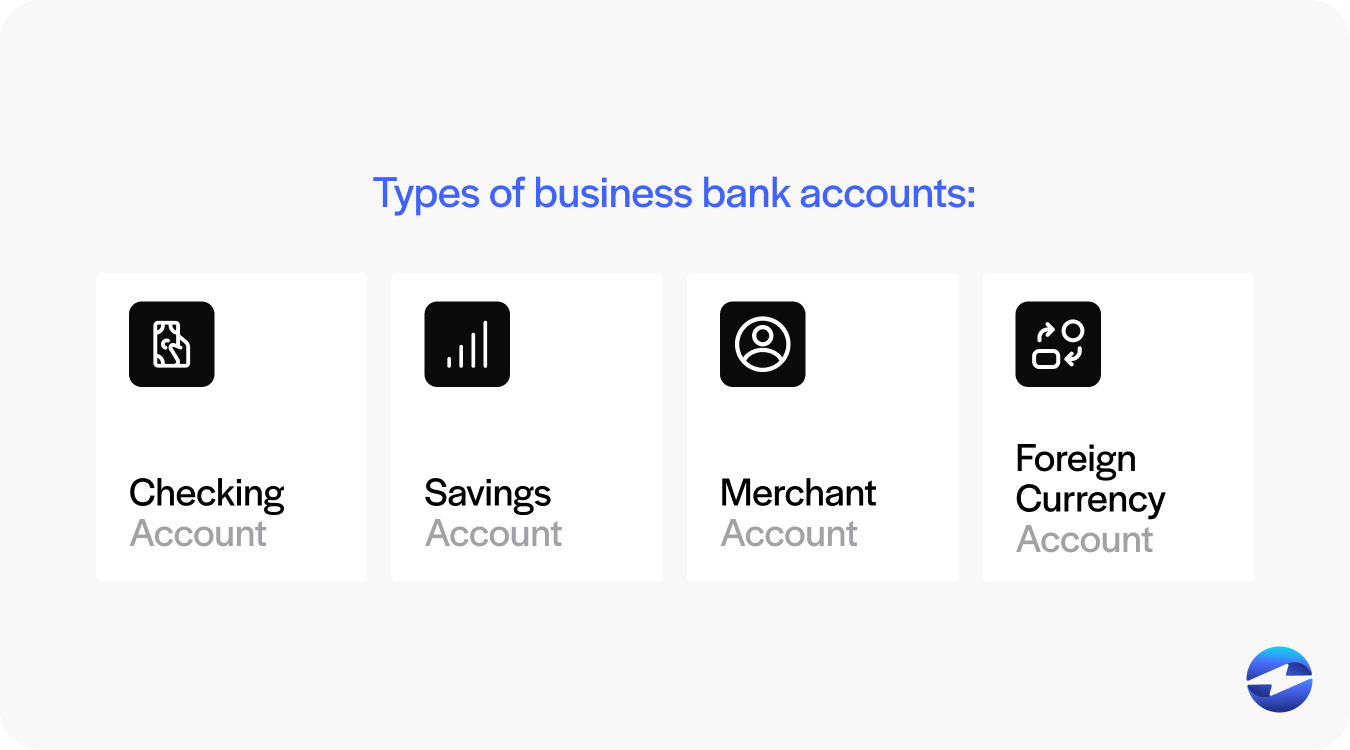

Different types of business bank accounts may be more suitable, depending on the size and nature of the business:

- Business checking account: Business checking accounts are commonly used for day-to-day transactions, providing easy access to funds for paying expenses, handling payroll, and managing operational costs. These accounts typically come with services like check writing, debit cards, and online banking.

- Business savings account: Business savings accounts help companies set aside funds for emergencies or planned expenses, earning interest on reserves while keeping them readily available. This account type is ideal for businesses wanting a buffer for unplanned costs or future investments.

- Merchant account: Merchant accounts enable businesses to accept and process credit and debit cards and other electronic payments, allowing customers to pay through various methods. These accounts are essential for retailers, eCommerce platforms, and service providers wanting to offer secure, efficient payment options.

- Foreign currency account: Foreign currency accounts are ideal for companies that support international transactions, allowing them to hold multiple currencies. These accounts help businesses manage foreign exchange risks, reduce conversion fees, and streamline payments in overseas markets.

Now that you know what business accounts are and the various features and types of accounts they consist of, it’s also important to understand why they’re essential for your business.

Why do you need a business bank account?

Opening a business bank account is crucial for maintaining clear financial records and separating personal finances from business expenses, thus enabling more efficient income and expenditure tracking and financial management.

By establishing a dedicated business account, business owners can simplify tax reporting and ensure compliance with financial regulations, which can aid in improving their professionalism and credibility.

Various business bank accounts, such as merchant accounts, that will allow you to process credit card payments, manage transaction fees, and maintain a minimum balance, all are critical for seamless financial operations.

Business bank accounts also provide access to essential financial tools such as a business debit card and tailored banking services to properly manage daily transactions and produce valuable financial forecasts.

With this importance in mind, your company should look at the steps and necessary documentation in the following section to learn how to open a business account.

How do you open a business bank account?

Opening a business bank account is straightforward, but certain documents and information are necessary. By organizing these requirements in advance, you can streamline the application process and start managing your business finances efficiently.

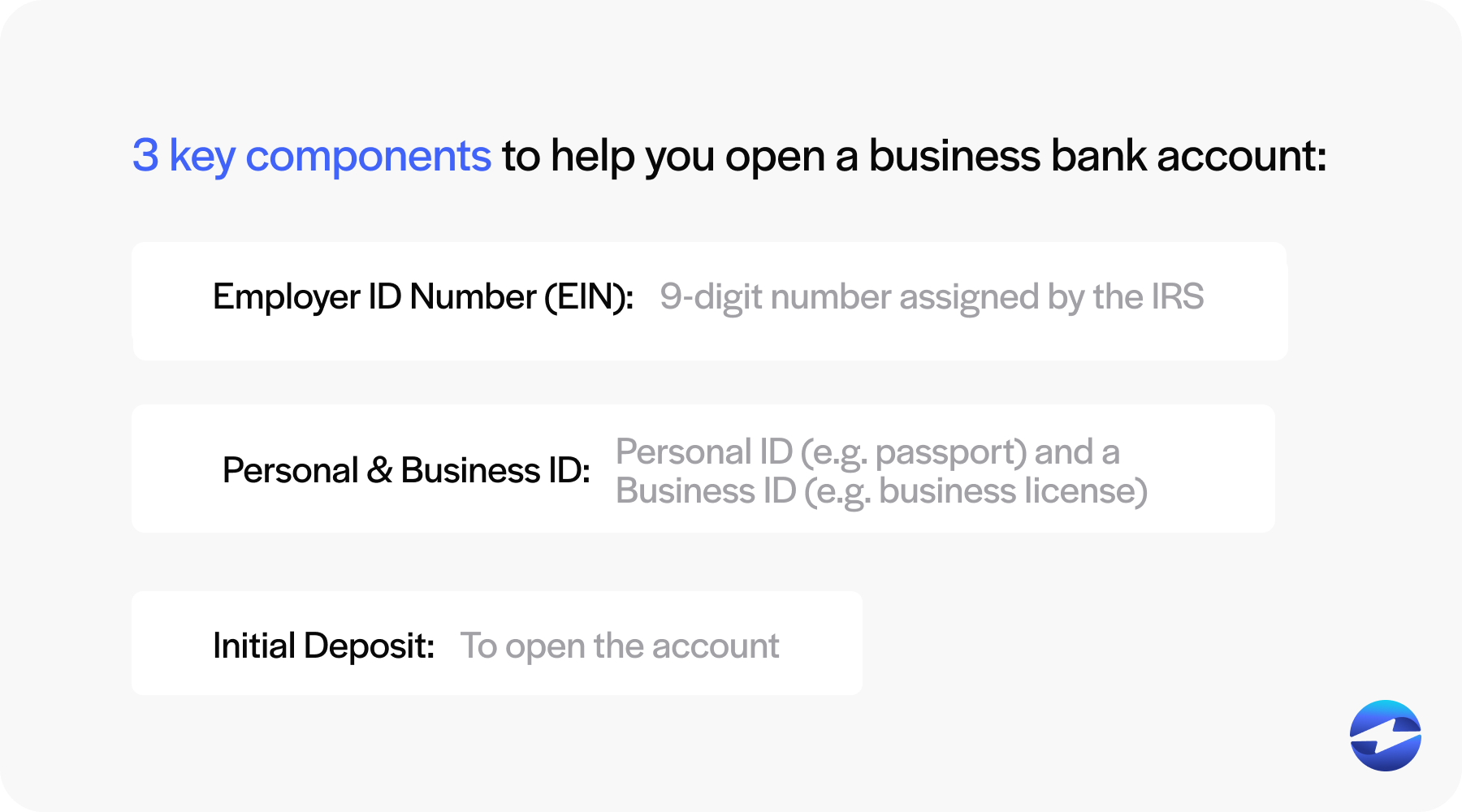

Three key components to help you open a business bank account include employee identification numbers (EINs), personal and business identification, and initial deposits.

1. EIN

An employer identification number (EIN) is typically required to open a business bank account, as this 9-digit number is assigned by the IRS and acts as a social security number for your business.

EINs are essential for tax reporting and help distinguish your business entity from personal financial activities. Most banks will request your EIN as part of the business documentation to establish an account.

2. Personal and business identification

Personal identification, such as a driver’s license or passport, and business identification, such as a business license, partnership agreement, or operating agreement, are standard requirements when opening a business account.

Personal and business identification documents verify your authority to open an account on behalf of the business and confirm your business type and structure.

3. Initial deposit

Most business accounts require an initial deposit to open the account, which can vary depending on the type of business bank account and the bank’s policies.

It’s important to inquire about this initial deposit requirement to ensure you meet the criteria from the outset. These deposits establish your account and can be a baseline for managing cash flow and transactions within your business account.

Once your business account is up and running, you can start processing customer payments, better manage your finances, and yield various benefits for your company.

4 benefits of business bank accounts

Business bank accounts offer numerous financial advantages for business owners by enabling them to track their revenue and accept incoming payments more efficiently.

Here are four benefits of business bank accounts:

- Improved financial management: Business bank accounts give companies a clear view of their financial health. With separate accounts, it’s easier to monitor cash flow, manage expenses, and prepare accurate financial reports, helping businesses stay organized and make informed financial decisions.

- Access to financial tools and services: Business bank accounts often come with additional tools, like business debit or credit cards, which streamline daily transactions and support online payments. Many accounts also offer payroll assistance, invoicing software, and merchant services, allowing businesses to easily accept payments and increase customer convenience.

- Enhanced loan eligibility: A dedicated business bank account with a solid transaction history can improve a company’s loan eligibility. Banks are more likely to approve loan applications for businesses that demonstrate a consistent and transparent financial track record, helping businesses access funds when needed for growth and expansion.

- Cost savings and professional advice: Business accounts often offer reduced transaction fees, tailored minimum balance requirements, and discounts on banking services designed specifically for businesses. In addition, account holders frequently have access to business banking experts who provide specialized advice and support, helping businesses optimize financial planning and gain a competitive edge.

Overall, business bank accounts improve financial management, offer essential tools, improve creditworthiness, and connect businesses with resources to support growth and operational efficiency.

Common mistakes to avoid

While opening a business bank account is crucial for business owners to effectively manage their finances, several common mistakes can complicate this process.

Not having the correct business documentation is a common mistake, so ensuring you have your business license, partnership or operating agreement, and business registration documents readily available is important. These are essential for verifying your business’s legitimacy and structure.

Another common mistake is using inconsistent personal identification information. Be sure to provide documents like your Social Security Number (SSN) and a consistent physical address for verification purposes. Failing to prepare these details accurately can cause delays in processing or even lead to rejection.

Failing to differentiate between your personal and business finances by using separate accounts can also lead to severe tax and liability issues. Always use business debit cards or credit cards for any business expenses.

Lastly, various bank requirements and costs can be expensive, so comparing transaction fees, minimum balance requirements, and available services such as merchant services is essential to finding the most cost-effective provider.

With a thorough understanding of these elements and careful planning, your business can select the best bank to handle its checking and savings accounts.

Transform your finances by opening a reliable business bank account

Opening a business bank account is essential for establishing a solid financial foundation and positioning your business for growth. By understanding the requirements and choosing the right account type, businesses can effectively separate personal and business finances, simplify tax reporting, and access valuable banking services tailored to their unique needs.

With a dedicated business account, your company can enhance its financial operations and capitalize on funding opportunities and expert banking support, helping to secure long-term success.