Templates | Rebuttal Letter

Chargeback Rebuttal Letter

Chargeback Rebuttal Letter

Looking for a chargeback response template?

Looking for a chargeback response template?

Download our free template today.

Dispute a Charge with Confidence – Get Your Rebuttal Letter Template Now!

Download a professional rebuttal letter sample to strengthen your case and protect your funds. This chargeback response template helps you dispute transactions effectively.

Learn more

Why do chargebacks happen in the first place?

Chargebacks can be frustrating, especially when they seem to come out of nowhere. To deal with them effectively, it is helpful to understand why they happen in the first place. Most of the time, chargebacks stem from miscommunication, unmet expectations, or fraud (intentional or not).

From the merchant’s side, chargebacks can pop up due to things like unclear return policies, delayed shipping, or unrecognized billing descriptors. Maybe a customer ordered something and it took longer than expected to arrive, or it showed up different from how it looked online. Maybe they didn’t recognize your company name on their credit card statement. These are simple things, but they can cause real headaches if they aren’t addressed clearly upfront.

Customers might file a chargeback because they feel they’ve been wronged, or think they’re protecting themselves. Sometimes it’s a genuine case of fraud where their card was used without their knowledge. Other times, it’s a misunderstanding or even what’s called “friendly fraud”—where the customer received the product or service but claims they didn’t, either by mistake or on purpose.

When a chargeback happens and you believe it’s unjustified, you have the right to dispute it. That’s where a rebuttal letter comes in.

What is a rebuttal letter, and how to write one.

A rebuttal letter is your chance to tell your side of the story. It’s not about sounding corporate or defensive—it’s about being clear, direct, and organized. Think of it as a short, factual summary of what happened, backed by evidence.

How to write a rebuttal letter

To write a rebuttal letter, start with a brief explanation of the situation and why you believe the chargeback is invalid. Then support your claim with whatever you have: order confirmations, tracking details, signed receipts, communication with the customer, or proof they used the product. Stick to the facts, and avoid emotional language. The goal is to help the person reviewing the case see things from your perspective. Keep it professional, but also human.

There are a few key things that make a strong rebuttal letter:

- A clear, concise summary of your argument

- Supporting documents and evidence, well-organized and labeled

- A logical timeline of events

- Consistent communication records

- Proof the product or service was delivered or used as expected

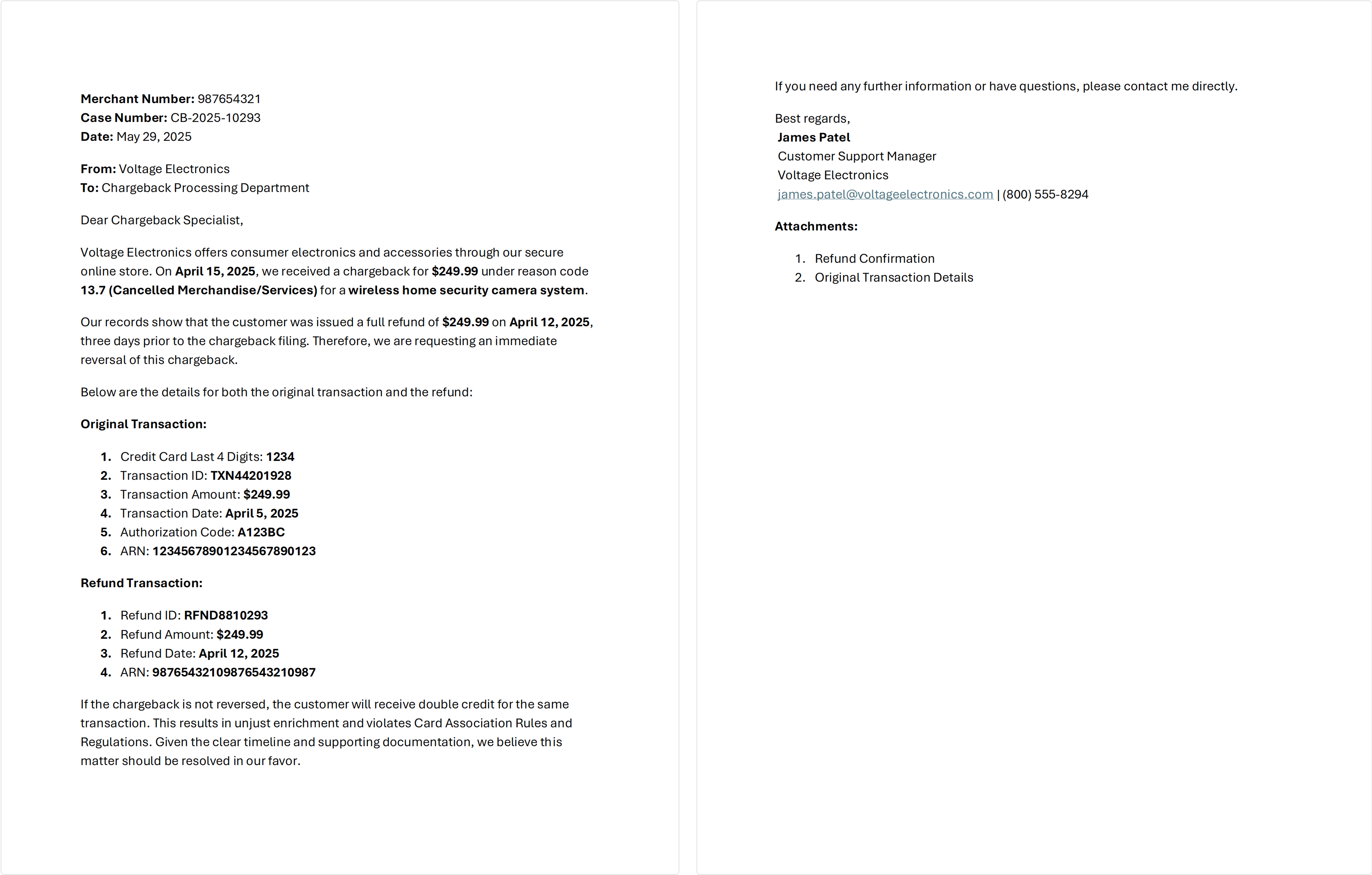

Here is a rebuttal letter example:

This dispute letter sample for a charge shows the kind of tone and detail that can help support your case. You can download our example above and customize it to fit your specific situation.

Chargeback dispute costs and financial impact

Here’s the part that’s easy to overlook: chargeback disputes cost time and money. Even if you win, there’s still the processing fee. If you lose, you’re not only out the money from the original sale—you also eat that fee, plus you might face higher chargeback rates that affect your standing with your payment processor. Too many chargebacks over time can even threaten your ability to accept cards at all.

These disputes can add up quickly, not just financially, but also in terms of stress and lost hours for small businesses. That’s why it’s worth putting processes in place to reduce chargebacks early on, like clear communication, strong documentation, and honest marketing.

If you’re reading this, you probably care about running a clean operation and protecting your revenue. You’re not alone—this is something every business deals with at some point. What matters is how you respond.