Blog > How to Fight a Chargeback and Win

How to Fight a Chargeback and Win

Fighting a chargeback from customers can be incredibly infuriating for companies and can result in a loss of overall revenue and a poor reputation. To know how to win a chargeback dispute, you need to, first, understand the process of chargebacks and how they work. This requires researching the chargeback’s research code and collecting compelling evidence that will allow you to win your chargeback dispute. All winning chargeback cases also require a persuasive rebuttal letter providing an overview of all your evidence. While this may seem like a lot of information, this article will simplify and highlight how your company can fight a chargeback and win.

What is a chargeback?

A chargeback is a payment amount that is returned to a customer’s credit or debit card after they dispute a specific transaction. Many times a chargeback occurs from the result of a product return, but often, customers will attempt to receive their money back from a transaction where the product wasn’t returned. This unethical chargeback from customers results in businesses losing revenue and ruining the trust between the company and its customers.

Generally, in the cases of fraudulent customer chargebacks, financial institutions are helpful and will look into the case. With that said, the steps your company needs to take in order to win a chargeback case are critical. The next section will discuss the importance of avoiding the top mistakes made by merchants when fighting a chargeback.

Top 4 mistakes merchants make when fighting a chargeback

Fighting chargebacks are complicated and expensive, so understanding the common mistakes merchants make while fighting chargebacks is a critical step in winning the case. Here are the top 4 mistakes merchants make when fighting a chargeback:

1. Not fighting or knowing about a chargeback

Having a lack of awareness about customer chargebacks throughout your company is a huge mistake and should be brought to the attention of the accountants who manage your company’s finances.

While you shouldn’t fight every single chargeback against your company, it’s worse to do absolutely nothing about them. Doing nothing about a chargeback means that your company is guaranteed to lose the profit for that particular chargeback. Understanding the chargebacks throughout your finances will allow you to track which chargebacks are worth fighting and which are not.

2. Not maintaining a high level of customer service

With a high level of customer service and good communication, businesses can clearly communicate with their customers to solve any problems customers have with a purchase. If the issue is solved there, there may be no need for a chargeback to occur in the first place.

Merchants with a lack of customer service skills will often run into chargebacks that could’ve been avoided if there was a higher level of communication within the transaction. Customers are quicker to conduct a chargeback when there is nobody to contact about an issue the customer has.

To avoid this issue, merchants should clearly highlight their customer service contact information on their website along with having many methods of communication for customers. Additionally, a well-documented refund policy can help set expectations and reduce disputes.

3. Fully understanding chargeback reason codes

The reason code identifies the type of chargeback, the reason the chargeback has been requested by the customer, and defines the necessary steps needed for the merchant if they wish to dispute the customer’s claim. Understanding the reason codes associated with the particular chargeback claim is crucial to preparing an effective chargeback case against the customer.

Failing to understand the reason codes will result in a failed dispute by the merchant and will result in a lost profit for your company.

4. Wasting effort on certain chargebacks

Similar to not fighting or knowing about a chargeback, not understanding the complexities of chargebacks and putting too much effort into difficult chargeback cases will result in a waste of time and resources. It’s better to save time and allocate your resources to grow your company. Make sure to take a step back and evaluate if a chargeback is worth fighting.

5 tips on how to win a chargeback

Because of the complexity of chargebacks, it’s crucial to have the knowledge to be able to win a chargeback dispute. The following 5 tips on how to win a chargeback dispute will get you ready to fight a chargeback successfully.

1. Understand the process

Understanding chargebacks and the different stages chargebacks travel through is critical for winning a chargeback case. There are essentially five stages of a chargeback dispute:

- Cardholder: First, the cardholder sends the chargeback dispute through their bank.

- Cardholder’s Bank (Issuer): The bank then will contact the card brand associated with the dispute.

- Card Brand: The card brand then sends off the chargeback dispute to the merchant’s bank account.

- Merchant’s Bank (Acquirer): The merchant’s bank receives the chargeback dispute and then informs the merchant.

- Merchant: The merchant gets the notification from the merchant’s bank and decides how to respond to the chargeback. Once the merchant makes the decision on whether to fight the chargeback dispute, the information will be sent back to the cardholder in the reverse order.

On top of understanding the process of a chargeback dispute, it is crucial to make your response, as a merchant, easy to review and clear for the issuer to determine the result of the dispute. This includes:

- Sending the response in the proper file type (.pdf, .doc, etc.).

- Use the required submission method that the issuer desires (email, fax, etc.).

- Include all of the compelling evidence and documentation.

- Adhere to your acquirer’s submission preferences.

- Make it easy for all included parties to read your rebuttal letter and identify the most compelling arguments against the dispute.

2. Respond on time

If you are able to fight the chargeback, you will receive a chargeback notice that includes a response deadline. If you fail to respond on time, you will lose the chargeback dispute along with any revenue associated with that case.

Always check the expiration date of your chargeback disputes to make sure to gather all of the required evidence and information to win the chargeback.

3. Research the reason code

Every chargeback comes with a unique reason code. The reason code explains why the chargeback dispute occurred in the first place. It helps you determine which type of evidence you’ll need to include in your rebuttal letter and chargeback response.

Be sure to understand the reason code attached to your chargeback to react appropriately to the dispute.

4. Collect compelling evidence

Possibly the most important tip on winning a chargeback dispute as a merchant, you need to have compelling evidence to convince the cardholder’s bank to reconsider the case. Your evidence needs to prove you:

- Processed the initial transaction properly.

- Confirmed the identity of the customer.

- Described the products or services accurately.

- Delivered the item as promised at the time of the purchase.

Because every chargeback dispute is unique, you can’t treat every case the same and use the same pieces of evidence for all disputes and expect the same result. Choose the information that is most compelling for the particular case you are working on and not just a generalized approach.

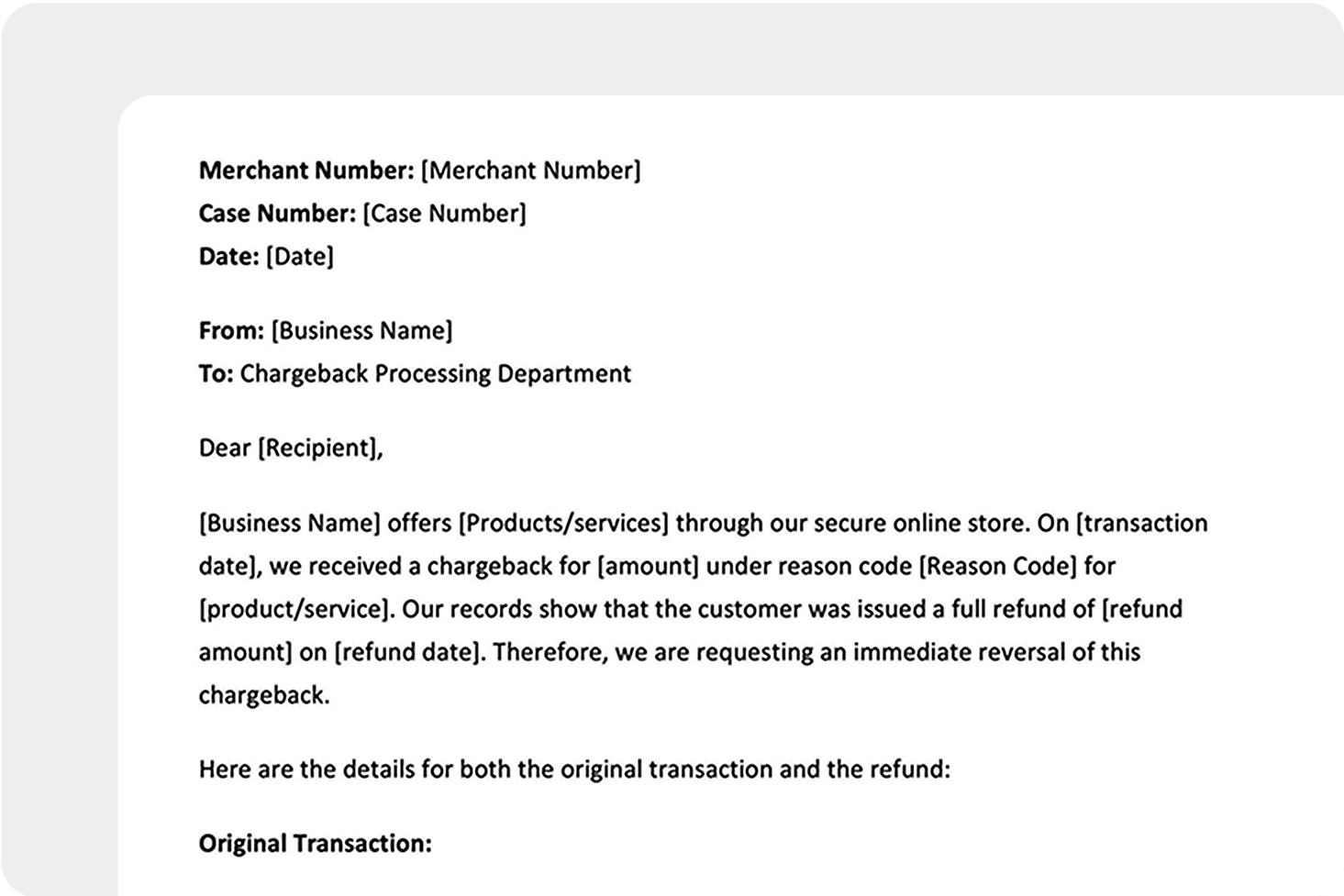

5. Craft a rebuttal letter

A rebuttal letter is an introduction to your chargeback response and provides a summary and overview of your compelling evidence. To win a chargeback, you need to have an effective rebuttal letter with your evidence neatly laid out.

Writing a rebuttal is an integral step in winning a chargeback case and should be carefully drafted in order to increase the chance of winning the dispute.

How to win a chargeback as a consumer

Sometimes, a merchant chargeback is justified. When consumers encounter unexpected charges, suspected fraud, or disappointing purchases, they may decide to take matters into their own hands by initiating chargebacks, seeking to reclaim their funds, and holding merchants accountable. Winning a chargeback as a consumer may seem daunting, but with the right approach and proper documentation, it is indeed possible. Here are step-by-step instructions on how to win a chargeback as a customer:

- Understand the reason for the chargeback: Review the reason your bank or credit card company provided for initiating the chargeback. This will help you gather relevant evidence to support your case.

- Gather evidence: Collect relevant information regarding your purchase, such as receipts, order confirmations, and product descriptions. This evidence will help support your claim and provide a basis for disputing the charge.

- Review your transaction history: Look closely at your credit card or bank statement and note the charge you wish to dispute. Look for any discrepancies or unauthorized transactions that may aid your case.

- Contact the merchant first: Before proceeding with a chargeback, attempt to resolve the issue directly with the merchant. Communicate your concerns and provide any necessary evidence or documentation. They may be willing to rectify the situation and offer a refund without needing a chargeback.

- Consult your bank or credit card company: If your attempts to resolve the dispute amicably fail, contact your bank or credit card company. Explain the situation and express your desire to initiate a chargeback. They will guide you through the process and provide the necessary paperwork to begin the dispute.

- Submit a chargeback request: Fill out the chargeback form provided by your bank or credit card company, including all relevant details, such as the transaction date, amount, and reasoning for the dispute. Attach any supporting documentation, ensuring everything is clear and concise.

- Monitor your statement: Keep a close eye on your credit card or bank statement to check for any updates or responses from the merchant. Your bank may require additional information from you or communicate the merchant’s response. Respond promptly with any requested documentation.

- Be patient and persistent: Chargeback disputes can take time to process, so exercise patience during this period. Stay vigilant and follow up regularly with your bank to ensure your case is moving forward.

Following these step-by-step instructions can significantly improve your chances of winning a chargeback as a consumer. Remember that proper documentation, effective communication, and honesty are critical to successfully disputing a merchant’s charge.

Fighting a chargeback and winning

As described, fighting a chargeback is a complicated process, but avoiding the mistakes and following the tips provided in this article will allow your company to save revenue on chargeback disputes.