Blog > What is a Chargeback Fee?

What is a Chargeback Fee?

Business owners continue to face challenges on a daily basis, whether it be internal operations like human error and faulty machinery or external processes like payment collections.

In this article, you’ll learn about one of the most significant challenges for merchants that accept credit cards — chargeback fees.

What are chargeback fees?

If you’re relatively new to being a business owner, you may be wondering, what’s a chargeback fee?

A credit card chargeback fee occurs when a cardholder disputes a particular charge on his or her credit card statement to nullify the transaction. This means the customer is requesting the card-issuing bank to return the funds back to his or her bank account.

A chargeback fee is issued by a bank for each chargeback dispute. When a chargeback is set into motion, the customer’s card issuing bank reimburses the cardholder for the transaction amount. When the card issuer/credit card provider reimburses the cardholder, they’re basically pulling the funds from their own pocket. The card issuer will then pull the transaction amount from the merchant’s account to recover the funds they’ve lost.

What is a chargeback item?

A chargeback item is a product or service that’s being disputed in a chargeback. For example, if a customer is charged twice for a candy bar when he or she only purchased one, a chargeback can be filed. In this situation, the candy bar would be referred to as the chargeback item.

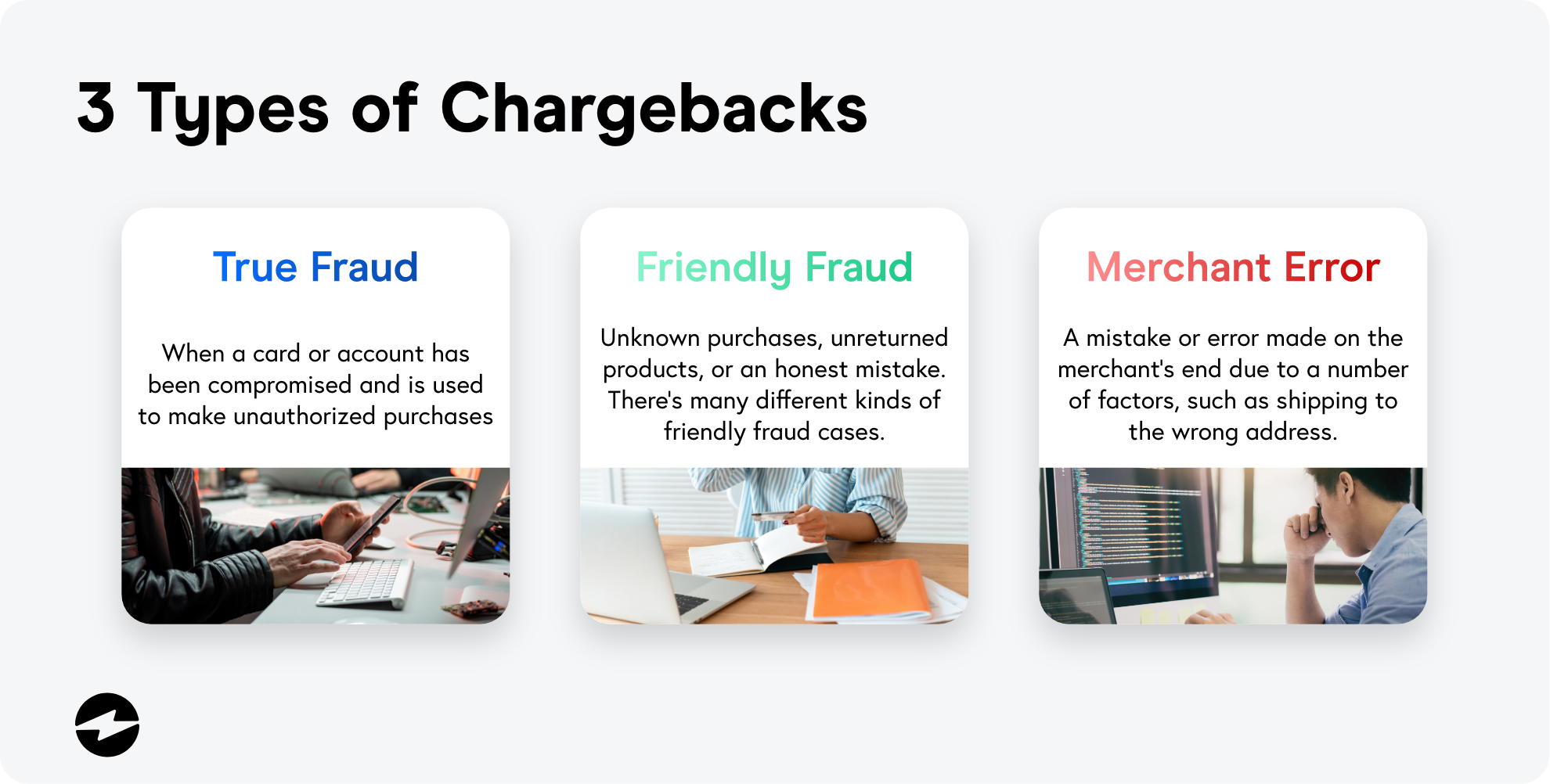

3 types of chargebacks

Chargebacks can be a hassle for merchants. Thankfully, your business can mitigate and avoid these unnecessary fees and disputes altogether by learning more about the different scenarios that cause chargebacks.

Here are three types of chargebacks your business should be aware of:

1. True fraud

A true fraud chargeback occurs when a cardholder’s card or account has been compromised and used by an unauthorized party to purchase products or services without the permission of the cardholder. This results in the cardholder filing a chargeback for unauthorized use of the card or account.

2. Friendly fraud

Friendly fraud chargebacks typically occur when cardholders claim they’re unaware of purchases made using their cards or they never received a product they paid for.

Friendly fraud can also occur when cardholders claim they returned products and ask for a refund, even if they never actually returned the product. In these instances, cardholders will often file disputes directly with their credit card companies to avoid interacting with merchants.

Sometimes friendly fraud can be an honest mistake — customers sometimes input the wrong delivery address or make a purchase without fully understanding recurring billing terms. Regardless of the motive, this type of fraud can result in money loss and a damaged reputation if not addressed properly.

3. Merchant error

Unfortunately, there are also chargebacks that can result from a mistake or error on the merchant’s end.

Merchant error chargebacks can be due to a multitude of factors. Whether you accidentally charge a customer twice for an item or ship an item to the wrong address, merchants should be aware of these mistakes to avoid triggering a chargeback dispute and fee.

How do chargebacks work?

Now that we’ve explored the different scenarios that could trigger a chargeback, let’s break down how a chargeback actually works:

- The cardholder contacts his or her card issuer/credit card provider to request a chargeback on a particular transaction.

- The card-issuing bank pulls the transaction amount from the merchant’s account to credit the amount back to the cardholder’s bank account.

- The merchant’s payment processor sends an alert to notify the merchant of the chargeback.

- The merchant goes through their records to dispute or accept the chargeback.

If the merchant is unable to procure a sufficient amount of evidence to dispute the chargeback, then the funds will not be returned to the merchant’s account.

What’s the difference between a chargeback fee and a refund?

Chargebacks differ from refunds, also known as returned item chargeback fees, in the sense that refunds are issued directly by the merchant while chargeback fees are issued by the cardholder’s card issuer. In other words, the main difference between the two is who they’re issued by.

If a dispute is valid, the cardholder should request a refund directly from the merchant before going through the chargeback process. Refunds are preferred over chargebacks to decrease the merchant’s chargeback rate.

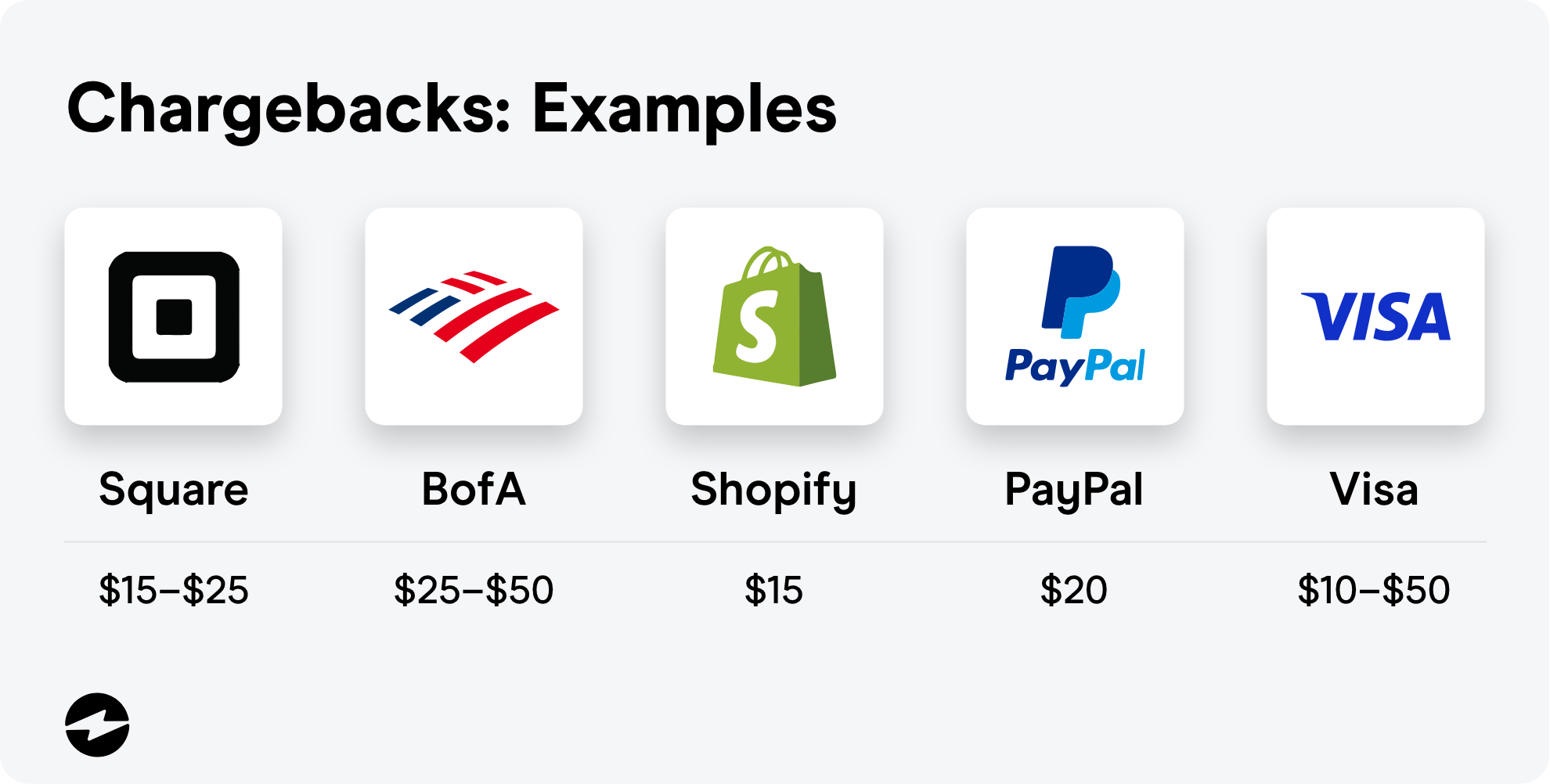

The average cost of a chargeback fee

Now that you know what chargebacks are and how they can result in fees, you’re probably thinking how much does a chargeback fee cost a merchant? In this section, you’ll learn about the various costs associated with chargeback fees.

Chargeback costs can vary depending on the situation, payment processor, card network, and other factors. Variables such as the acquiring bank and payment processor will usually play a role in determining the overall cost of the chargeback fee, along with credit card networks like Visa and Mastercard. Other variables such as the types of products and services being sold can also dictate costs. Generally speaking, a chargeback cost will range from $15 to $50 depending on the payment processor.

Here are a few examples of chargeback fees by popular payment processing providers:

- Paypal’s chargeback fee: $20

- Square’s chargeback fee: $15 to $25

- Bank of America’s chargeback fee: $25 to $50

- Shopify’s chargeback fee: $15

- Stripe’s chargeback fee: $15

- Visa chargeback fees: $10 to $50

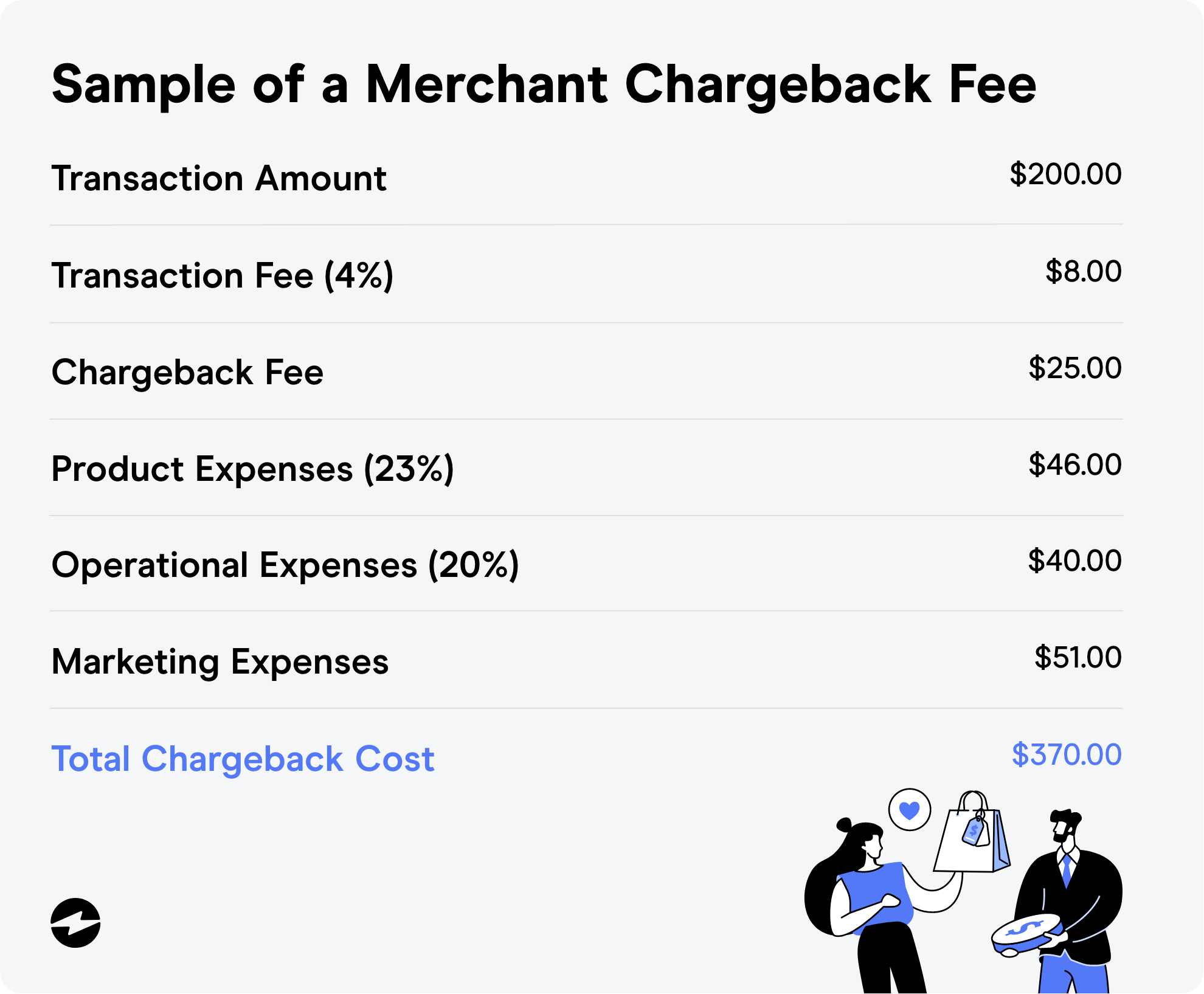

What does a chargeback fee consist of?

Chargeback fees may also consist of other charges to make up for the lost sale and other associated costs.

Here are a few fees that can be added when a chargeback is issued:

Transaction processing fee

This includes the wholesale cost of the transaction, along with the processor’s rate markup.

Acquiring bank fee

The acquiring bank will seek to recover the chargeback processing fees, so it will add an additional fee to the merchant’s business. Despite average chargeback fees ranging from $20 to $50, merchants can be charged more if they’re considered a high-risk business.

Business operations expenses

In addition to the cost of the chargeback, your business will also be responsible for the chargeback transaction’s operational expenses. These expenses include shipping and inventory costs, employee labor costs, and fraud prevention software costs.

Merchant marketing costs

Companies invest heavily in their marketing and advertising campaigns to attract customers to their products and services. When a chargeback is issued for a particular item, the expenses used to fund the marketing and advertising costs for that item cannot be recovered which is why these additional charges may be added.

Higher chargeback ratio expenses

Chargeback fees work similarly to car insurance. If you get into multiple car accidents, your insurance can go up; if you get hit with numerous chargebacks, your chargeback fees can go up. If this trend continues and your chargeback ratio is 1% or higher, your acquiring bank will likely mark your business as a high chargeback ratio client and each chargeback will incur extra fees.

It’s important to actively track your chargeback ratio to ensure it stays within a normal range. If it gets too high, your acquiring bank could place your business in a chargeback ratio monitoring program which adds another service fee. In the worst-case scenario, your bank can terminate your merchant account or even blacklist your business which means you won’t be able to accept credit cards at all.

Sample of a merchant chargeback fee

To get a better understanding of how chargeback fees can add up, here’s an example of additional expenses that are added to the total cost of a chargeback:

Is it possible to dispute a chargeback fee?

As a merchant, disputing a chargeback fee is possible but it’s important to understand that chargeback disputes tend to favor the customer.

During the chargeback resolution process, you have a limited time to respond during each phase of the process. That being said, it’s important to know that the merchant is the last party to be notified of the chargeback.

Minimize your risk of a chargeback fee

Chargeback fees can be a nuisance to deal with. Luckily, there are steps merchants can take to minimize the number of chargebacks their business is hit with.

Here are a few steps you can take to minimize your risk of a chargeback fee:

Confirm your cardholder’s identity

Stolen credit cards are one of the most prominent reasons for a chargeback fee. Thankfully, verifying your customer’s identity is an easy way to eliminate this problem.

Merchants should always request a photo ID for all in-person purchases, as well as card verification codes to ensure they’re identifying each cardholder’s identity. After a sale is completed, merchants can also send an itemized receipt to customers for verification of the transaction.

Clarify your billing details

It’s recommended to use your business’s name on the billing statement to avoid any confusion. If a merchant uses a parent company’s name or a DBA (doing business as) on the billing statement, the cardholder may not recognize the transaction and file an unnecessary chargeback dispute.

Document all shipping and return policies

It’s important to be as transparent as possible when it comes to shipping policies and timelines. In terms of shipping timelines, you should never make promises you can’t keep. Doing so can come back to haunt you if shipped items arrive past their expected arrival dates.

Utilize chargeback management tools

You have seven days to respond to a chargeback from the date of the notice. Failing to respond within this time frame can result in a loss of revenue for the transaction that triggered the chargeback fee, meaning time is of the essence.

Decrease payment processing costs

Chargeback fees are an inevitable part of owning a business. Although you can’t fight every chargeback dispute, you can lower your overall credit card processing costs which will decrease the overall cost of the chargeback.

Managing chargebacks

Despite the multiple reasons why chargebacks can be initiated, there are valuable steps merchants can take to prevent them and minimize their chargeback ratio. If done in a timely manner, disputing a chargeback is definitely possible.

Partnering with a reliable payment processor like EBizCharge will help you better manage chargebacks and reduce the number of chargebacks your business incurs.

Frequently Asked Questions

Frequently Asked Questions

Summary

- What are chargeback fees?

- 3 types of chargebacks

- How do chargebacks work?

- What’s the difference between a chargeback fee and a refund?

- The average cost of a chargeback fee

- What does a chargeback fee consist of?

- Is it possible to dispute a chargeback fee?

- Minimize your risk of a chargeback fee

- Frequently Asked Questions

Get a free cost-comparison of your current payment processing costs vs. EBizCharge

Get a free cost-comparison of your current payment processing costs vs. EBizCharge