Automated Clearing House Notification of Charge (ACH NOC) is a term used in the banking industry to refer to a notice informing a company or individual about a transaction returned or rejected by the receiving bank.

Simply put, an ACH Notification of Change is a notification sent to the account holder when an ACH transaction still needs to be completed.

What is ACH Notification of Charge (NOC)?

When someone initiates an ACH transaction, such as a bill payment or direct deposit, the funds are electronically transferred from one bank account to another. However, there are instances where the transaction can’t be completed due to insufficient funds, closed accounts, incorrect account information, and other various reasons.

When this happens, the bank sends an ACH NOC to notify the account holder of the failed transaction and provide information about the reason for the rejection.

Receiving an ACH NOC allows the account holder to be aware of the failed transaction and take necessary actions to rectify the issue. Account holders can review the notification details to identify the cause of the rejection and take steps to resolve the problem, such as making the necessary funds available or correcting the account information.

ACH NOC is a beneficial process for account holders that helps ensure more efficient banking operations. So, how do ACH NOCs work?

How do ACH Notifications of Change work?

ACH NOCs play a crucial role in the functioning of the ACH system. When there are changes in a customer’s bank account information, such as a new account number or a change in the account holder’s name, the financial institution sends a NOC to notify the originator of the ACH payment.

Upon receiving a notification of change, transaction originators must update their customer records to reflect the changes. This ensures that future ACH transactions are directed to the correct bank account and avoid unnecessary complications.

Receiving an NOC involves the financial institution or ACH operator identifying the change by referencing an ACH NOC code. These codes indicate the specific type of change being made, such as a change in account number, account holder name, or account status.

By using these codes, the recipient can quickly identify the nature of the change and update their records accordingly. Standard ACH NOC codes include:

- Code 01: Change in Receiving Depository Financial Institution (RDFI) Information

- Code 02: Change in Bank Account Number

- Code 03: Invalid Bank Account Number

- Code 04: Change in Account Holder Name

These NOC codes help businesses understand why ACH transactions weren’t completed.

How to manage transactions with ACH NOCs

An ACH NOC is a crucial tool for businesses to ensure the accuracy and efficiency of their electronic payments.

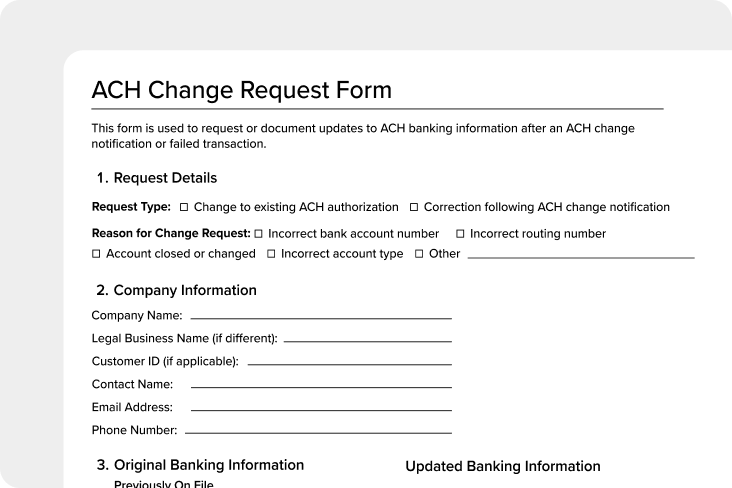

Businesses can promptly update banking information and resolve discrepancies to avoid unnecessary disruptions and potential fees. Using a standardized ACH authorization form when onboarding customers helps capture accurate bank details upfront, reducing the likelihood of NOCs down the line. In the case that you do need to update information, you can use an ACH change request form to submit corrections quickly and keep transactions running smoothly.

Businesses who learn the ins and outs of ACH NOC will find a much easier time managing their ACH transactions.

More articles you might like:

CONTENTS

From direct deposit to bill payments, the ACH network shapes the landscape of electronic fund transfers. ACH extends its influence across various areas to move funds between businesses, individuals, and financial institutions.

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19