Blog > Wire Transfer vs Electronic Transfer

Wire Transfer vs Electronic Transfer

Wire transfers and electronic funds transfers have been staples of financial transactions for decades, but various electronic transfer methods have emerged with the innovation in banking technology.

Understanding wire transfers and electronic funds transfers, how they operate, and the security they offer is crucial to gaining a clearer picture of today’s financial landscape.

What is an electronic funds transfer (EFT)?

Electronic funds transfers (EFTs), or EFT payments, facilitate the transfer of money from one bank account directly to another without any physical currency exchange.

Unlike traditional methods that involve cash or paper checks, EFT uses computer-based systems to move funds between accounts securely. EFTs typically include digital payments such as direct deposits, ATM transactions, and credit and debit card payments.

EFTs are an integral part of payments and have many features that make them essential for businesses.

The importance of EFTs

EFTs are integral to modern transactions, as they offer convenience and efficiency for individuals and businesses to make domestic payments promptly and safely without the need for physical trips to financial institutions.

EFTs enable seamless direct payments for operations, including payroll, tax refunds, and recurring bills.

Adopting EFT can lead to swifter transactions, improved cash flow, and less cash handling which can be costly, time-consuming, and less secure. EFT payments can also reduce errors associated with traditional payments, streamlining accounting practices for businesses of all sizes.

How do EFTs work?

EFTs operate through a sophisticated electronic network, which allows financial institutions like banks and credit unions to communicate and transfer funds to each other.

When someone initiates an EFT, the payer’s bank sends a message to the recipient’s bank through a secure system with instructions to credit the account with the specified amount. This means transactions can happen without any manual handling of money.

The EFT payment process also includes authentication steps to secure these transfers, making them reliable for managing transactions.

Are EFTs safe?

EFTs are designed with multiple layers of security protocols to ensure funds are transferred safely. These protocols often include encryption, secure identification methods, and monitoring systems to detect and prevent unauthorized access.

Many financial institutions have established robust security measures to protect against fraud, such as two-factor authentication (2FA) and transaction alerts to account holders.

Although incidents can occur, the EFT framework is robust, and fraud is relatively low compared to other forms of payment. The key is vigilance by both the financial institution and the user to maintain the safety of every transaction.

Luckily, there is an abundance of different types of EFTs that are all safe to use.

What are the different types of EFTs?

When discussing EFTs, it’s important to understand the variety of transactions this term encompasses.

Here are eight common EFTs you may encounter:

- Direct deposits

- ATM transactions

- Credit and debit card transactions

- Online bill payments

- Mobile payments

- Bank-to-bank transfers

- Electronic checks or eChecks

- Remittance transfers

Each type of EFT serves a specific function, from streamlining commercial transactions to enhancing personal banking convenience.

For example, direct deposits allow employees to receive their salaries without physical checks, while mobile payments enable consumers to purchase or transfer funds with a few taps on their smartphones. Whereas international wire transfers and remittance transfers cater to the need for cross-border payments, which are often integral to business operations and personal finance.

Overall, EFTs cover a broad spectrum of financial activities, significantly modernizing how money moves in the economy.

What is an ACH transfer?

Automated Clearing House (ACH) transfers are a common form of EFT payment that facilitate the movement of funds between financial institutions in the U.S.

ACH transfers operate via the ACH network, managed by the National Automated Clearing House Association (NACHA), for merchants, banks, and individuals to initiate transactions.

ACH transfers are common for low- or mid-value payments that don’t require immediate settlement. They offer a cost-effective and convenient option for recurring payments, such as utility bills, mortgage installments, and subscription fees.

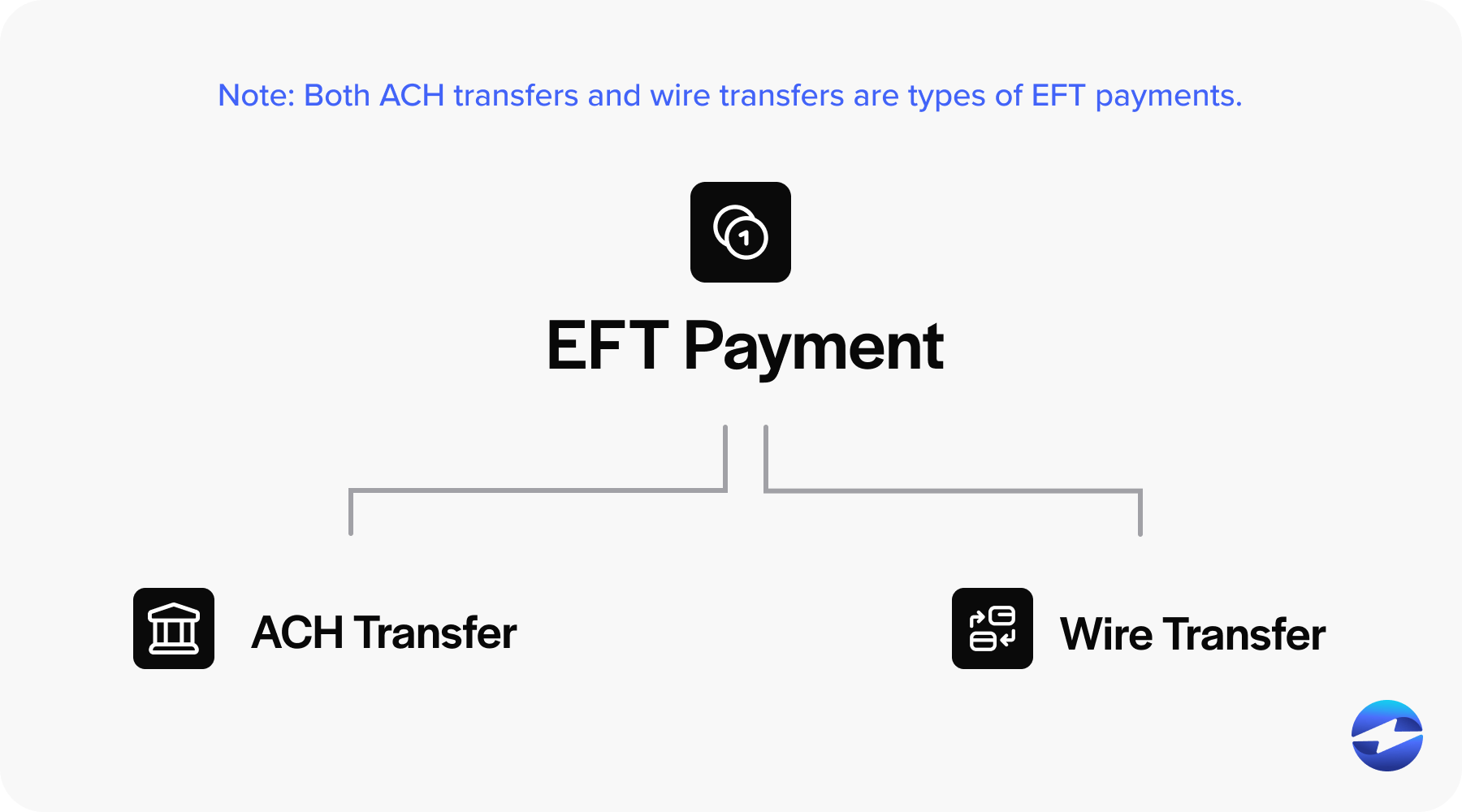

While wire transfers are similar to EFT methods like ACH transfers, which move funds between various parties, these transfers have a few differentiating features.

What is a wire transfer?

A wire transfer is an EFT method that moves money directly and securely from one financial institution to another.

Wire transfers are particularly useful for urgent or high-value transactions. The primary appeal is their speed and reliability, making them a preferred choice for international and domestic wires.

When comparing wire transfer vs electronic transfer, it’s critical to note that while all wire transfers are a form of EFT, not all EFTs are wire transfers.

The difference between wire transfer and electronic transfer mainly arises in their typical usage—wire transfers are often reserved for pressing or substantial transactions with higher wire transfer fees, while other forms of EFTs are more commonly used for routine transactions.

How do wire transfers work?

With the swift pace of modern finance, wire transfers simplify the transfer of funds by offering a streamlined process, ensuring efficient transactions.

To initiate a wire transfer, the sender must provide the recipient’s banking details, including the account and routing numbers, to their bank or a wire service provider. The sending institution then communicates with the recipient’s institution via a secure electronic network.

International wire transfers may involve intermediary banks and require additional information, such as SWIFT or IBAN codes, to facilitate cross-border payments effectively. These codes simplify the wire transfer’s ability to handle international and domestic payments, positioning it as a solid and reliable instrument for various financial needs.

How long does a wire transfer take?

The speed of wire transfers is one of their standout features. Domestic wire transfers can often be completed within a business day, while international wire transfers typically take a bit longer, generally between one to five business days.

Various factors can influence wire transfer processing times, including time zone differences, currency exchange necessities, and the policies of the involved financial institutions.

Business days are pivotal, as weekends and bank holidays can extend the timeline. Therefore, senders should check with their financial institution for time-sensitive transfers, as there may be cut-off times that affect how quickly a transfer can be initiated and processed.

Are wire transfers safe?

Wire transfers are a highly secure method for transferring funds, thanks to banks and credit unions applying robust encryption and security protocols to safeguard these transactions.

The direct and established connections between financial institutions further minimize risk, making wire transfer payments a reliable option for moving large sums of money, especially in a business setting.

However, it’s the sender’s responsibility to validate the accuracy of the recipient’s information before initiating the transfer, as funds sent to the wrong account can be challenging to retrieve.

Since wire transfer scams still exist, it’s essential to be vigilant when overseeing transfer requests. Senders should always verify the legitimacy of any request for a wire transfer, especially for international and remittance transfers, where the sender may not personally know the recipient.

With the proper precautions, wire transfers can remain largely uncompromised, instilling more confidence in them for critical payments and disbursements.

Comparing wire transfer and electronic transfer

Understanding the nuances between wire transfers and electronic transfers is vital for any business owner or individual navigating digital transactions.

Though closely related and often confusing for many, each type of transfer serves distinct purposes and operates under different sets of norms.

| Features | Wire Transfers | Electronic Funds Transfers (EFTs) |

|---|---|---|

| Common Uses | International payments, Large sums | Payroll, Bill Payments, ATM |

| Speed | Same-day (domestic), 1-5 days (international) | Varies, usually 1-3 business days |

| Fees | Typically higher | Often lower or non-existent |

| Transaction Type | Single, direct transfer | Can be single or recurring |

| Best Used For | Urgent transactions | Routine, non-urgent transactions |

Similarities of wire transfers & electronic transfers

Wire transfers and EFTs share several common attributes. Both methods move money without requiring physical cash to change hands.

Both wire transfers and EFTs can help maintain cash flow, facilitate timely payments to suppliers, and receive funds from clients.

Differences of wire transfers & electronic transfers

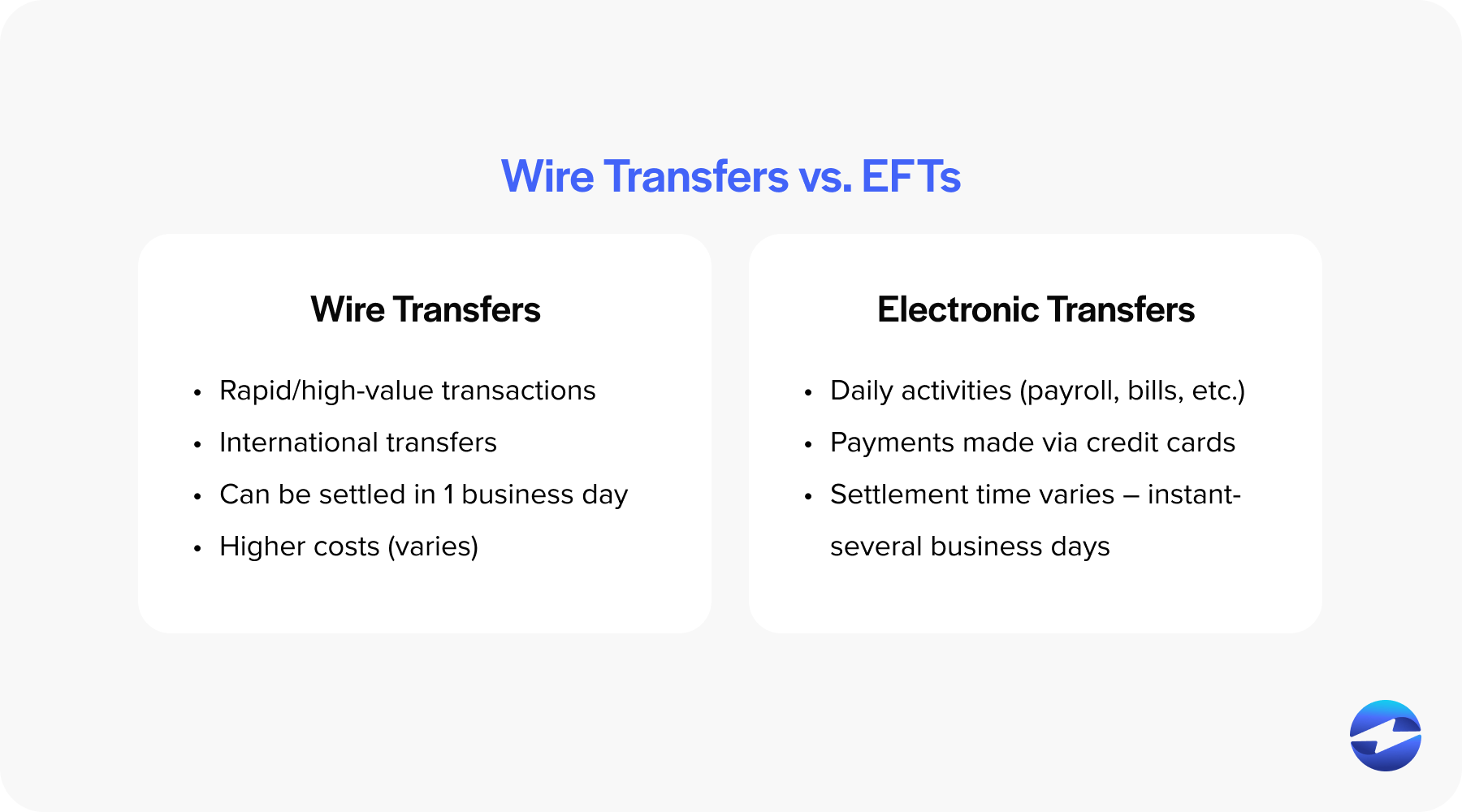

Despite their similarities, wire transfers and electronic transfers are not identical, so distinguishing them is important.

Wire transfers are designed mainly for rapid and high-value transactions and are ideal for international money transfers, often involving unique intermediary institutions and the assessment of wire transfer fees.

On the other hand, EFTs encompass a broader category of digital transactions, which include daily activities like direct deposit payroll, online bills, transfers between accounts in the same bank, or payments made via credit cards and credit card companies.

Transaction speed is another area where wire transfers often have the upper hand, especially for domestic payments, which can be settled within the same business day. Most other forms of EFT vary in speed. While some can be instantaneous, others may take several business days, specifically if crossing borders or relying on Automated Clearing Houses (ACH), which don’t operate on weekends or holidays.

Additionally, wire transfer fees generally accrue higher costs than standard electronic transfers, which can sometimes be free depending on the terms set by financial institutions.

Understanding these distinct features can empower business owners and individuals to select the most appropriate and cost-effective transfer method based on their needs.

Are EFTs better than wire transfers?

When comparing EFTs and wire transfers, determining the best option will likely depend on your specific needs as a business owner or consumer.

EFTs include many electronic payments, including direct payments like salary deposits, tax refunds, and ATM transactions. They’re generally more cost-effective, especially for domestic payments, because they often have lower fees than wire transfers.

Wire transfers are known for their speed and security regarding urgent or large-volume international transfers. They’re typically completed within a single business day and are a staple for international payments, thanks to their efficient processing through electronic networks.

For domestic transfers, credit unions and banks offer both options, with EFTs often being integrated into the banking system for seamless transfers across various accounts. Wire transfers may be justified for immediate transfer needs or cross-border payments despite their costs.

Overall, EFTs are typically better for routine, non-urgent domestic transfers due to their lower costs. Whereas wire transfers are typically the go-to for faster international or high-priority transactions.

Revolutionizing the global economy with EFTs and wire transfers

Whether it’s a routine payment or an urgent international transfer, electronic and wire transfers offer efficient solutions to meet the diverse needs of today’s global economy.

By understanding how EFTs and wire transfers work, your business can leverage these transfers to make informed decisions and better manage its financial activities and revenue.