Blog > What Are the Average Credit Card Processing Fees That Merchants Pay?

What Are the Average Credit Card Processing Fees That Merchants Pay?

Any merchant that accepts credit or debit card payments is required to pay credit card processing fees to their payment processor, credit card networks, and card issuers.

Despite these mandatory fees, merchants can take advantage of valuable insights and various resources to determine the average credit card processing fees and secure the lowest rates.

What are the average credit card processing fees?

Currently, average credit card processing fees for merchants can range anywhere from 1.3% to 3.5% for both swiped cards and keyed-in transactions.

While credit card processing fees vary depending on business size, card networks, processing volumes, and other factors, these fees typically stay within an average percentage range.

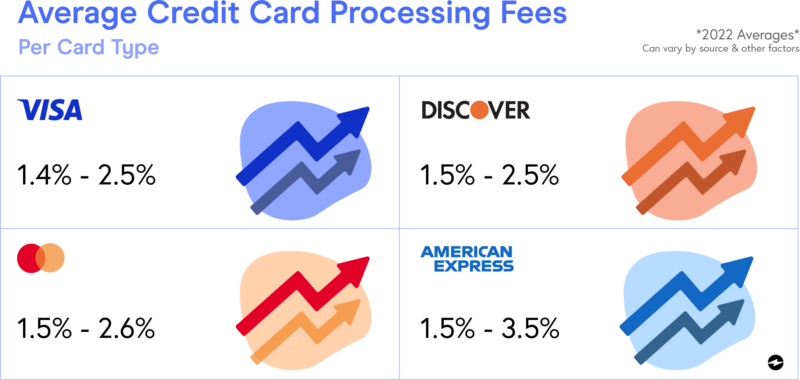

Here are broad estimates to expect in 2022 from the four major credit card networks for credit card processing fees:

- Visa fees: 1.4% – 2.5%

- Mastercard fees: 1.5% – 2.6%

- Discover fees: 1.5% – 2.5%

- American Express fees: 1.5% – 3.5%

In addition to these rates, card networks will also tack on flat fees ranging from $0.05 to $0.10 for each transaction.

Processing averages are helpful to reference for future decisions, however, it’s important to keep in mind that these ranges will differ by source and other variables.

Who determines average merchant processing fees?

Merchant processing fees are typically determined by three parties — card issuers (banks), credit card networks, and payment processors.

Card issuers, card networks, and payment processors play a significant role in determining merchant processing fees due to their active involvement in the credit card transaction process.

To understand how all three entities determine credit card processing fees, you must first understand the nature of each organization:

- Credit card networks: Credit card networks include Visa, Mastercard, Discover, American Express, and other card brands.

- Card issuers: Card issuers are banks or financial institutions that partner with card networks to issue credit cards to consumers.

- Payment processors: Payment processors act as mediators between merchants and their banks — and provide payment gateways — to complete credit or debit card transactions.

All parties determine the average merchant processing fees because they charge a credit card fee per transaction, which ultimately dictates how much a merchant will have to pay.

Types of merchant processing fees

Now that you understand how credit card processing fees are determined, it’s important to know how to differentiate between the fees associated with credit cards included within these costs.

Most merchant processing fees can be broken down into 4 main categories:

- Interchange fees

- Assessment fees

- Processing fees

- Transaction fees

Interchange fees

Interchange fees are the largest credit card processing rates merchants are expected to pay since they cover the risk involved with these transactions.

Interchange fees are determined by credit card networks and are paid to the issuing bank. Interchange rates consist of a percentage of the transaction plus a fixed transaction fee.

Interchange fees fluctuate depending on rates set by the major credit card networks (Visa, Mastercard, Discover, and American Express), as well as factors like the card used, payment amount, business type, how the transaction is processed, and more.

To give you a better idea of average interchange rates in 2022, click here to read the Visa USA Interchange Reimbursement Fees Report.

Assessment fees

Unlike interchange rates, credit card assessment fees are not determined per transaction but instead by a company’s monthly sales.

Credit card assessment fees are rates formulated and paid directly to credit card networks. Despite assessment fees being less expensive than interchange rates, these costs still vary by network and the card used for the payment, transaction volumes, and international transactions.

Assessment fees (along with interchange rates) are reviewed twice a year by card networks.

Payment processing fees

Compared to interchange and assessment fees which are paid to credit card networks and card issuers, processing fees are determined and paid to your payment processor or merchant services provider.

Payment processors determine merchant services charges which can include per-transaction fees, monthly service fees, or a flat cost for the credit card processing equipment.

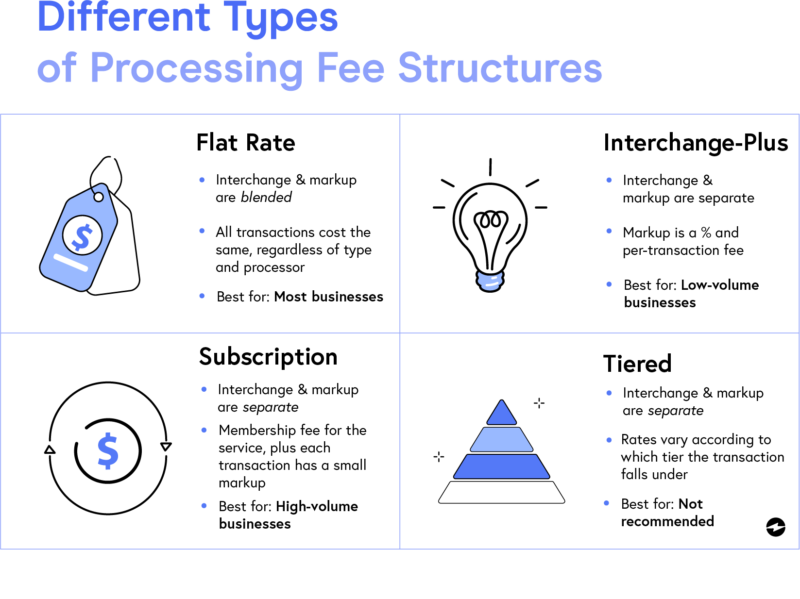

To simplify this, merchant services fees are broken down into 3 pricing models:

- Tiered pricing: Tiered pricing combines interchange fees set by card issuers into tiers that come with their own set of transaction fees — debit, qualified, mid-qualified, and non-qualified rates. Tiered pricing usually consists of higher processing costs and doesn’t offer any explanation or flexibility for its charges.

- Flat rate (blended) pricing: Flat fee pricing consists of a monthly per transaction rate for all card types, enabling merchants to receive upfront, transparent statements.

- Interchange plus pricing: Interchange-plus rates are determined by card issuers and based on the type of credit card. Like flat rate pricing, interchange-plus offers full transparency in regard to credit card processing fees and enables merchants to receive the lowest processing costs on corporate, commercial, business cards, and more.

In some cases, providers will offer membership- or subscription-based pricing where merchants pay a flat monthly or annual membership fee rather than a percentage of the transaction.

Transaction fees

Transaction fees are costs that are accrued every time a payment is processed. Along with markup fees, both interchange and assessment rates fall under transaction fees since they’re charged by transaction.

A typical transaction fee includes a percentage of a transaction and fixed per-item fees which enable your merchant services provider to cover the costs of processing credit cards, while also ensuring a credit card processing sales commission (profit).

Extra fees to expect from card issuers and networks

In addition to the standard merchant processing fees, merchants should be aware of any extra fees charged by card issuers and networks for their services.

These extra fees don’t vary, regardless of which payment processor you use, and include:

- Acquirer Processing Fee (APF): Acquirer processing fees are charged by Visa for all U.S. business credit card transactions.

- Kilobyte Access (KB) Fee: Kilobyte access fees are charged per transaction by Visa and Mastercard for each authorization submitted to card networks for settlement.

- Fixed Acquirer Network Fee (FANF): Fixed acquirer network fees are commonly charged by all card brands and are determined by if it’s a card-present or card-not-present transaction, the number of locations, and volume.

- Network Access and Brand Usage (NABU) Fee: Network access and brand usage fees are charged by Mastercard for all settled or refunded credit and debit card payments.

Additional factors that can determine your credit card processing rates

Now that you have better insight into the various fees your business can be charged to accept credit cards, the next step is determining which factors can influence these rates.

The biggest factors that determine your credit card processing rates include:

- Card-not-present (CNP) vs. card-present transactions: CNP transactions come with higher risks, and thus are more expensive than card-present transactions.

- Swiped cards vs. keyed-in card transactions: Card-present payments using a card reader typically involve lower credit card swipe fees than keyed-in transactions.

- Card brand: Cards that offer more rewards or are exclusive to businesses often come with higher credit processing fees.

Business type: Business-to-business (B2B) or business-to-government (B2G) companies usually have lower credit card processing costs since they’re more trustworthy. - Transaction history: Businesses with a history of inconsistent or unreliable transactions will likely incur higher merchant services costs.

- Charge amounts: Businesses with transactions involving larger amounts will often have more expensive processing fees. Whereas, businesses with a high volume of transactions involving smaller amounts can usually negotiate lower processing rates.

Keep in mind that credit card processing rates are often determined by the level of risk a transaction is associated with — the greater the risk, the greater the fees.

Fees merchants can avoid paying to their payment processor

While merchants won’t be able to dodge every credit card processing fee, there are quite a few charges they can avoid paying to their payment processor or merchant services provider.

The most avoidable fees are usually the ones that go toward payment processors’ operational expenses or to ensure they make a profit from their services.

The most common fees merchants can negotiate or avoid include:

- PCI Compliance fees

- Statement fees

- Account fees

- Monthly (subscription) fees

- Chargeback fees

- Service fees

- Batch fees

- Terminal or gateway fees

- Early termination fees

Merchants should also thoroughly evaluate their credit card processing statements to ensure they’re not missing any hidden fees.

Check out this article for more tips to get the cheapest credit card processing fees.

Businesses can easily calculate average credit card processing fees

Despite the many factors that affect processing rates, businesses can easily determine average credit card processing fees by conducting an internal analysis, as well as market research.

Merchants can begin to estimate potential credit card processing fees by reviewing which card types they accept, their transaction volumes, how they process payments, and more.

After internal analysis, merchants can then conduct market research and compare rates between payment processors to get a clearer idea of the credit card processing rates they’ll pay.

Find a reliable payment processor to secure the lowest credit card processing rates

Merchants will benefit the most from finding a reliable payment processor that’s trustworthy and provides competitive pricing.

The most cost-effective payment processors will be upfront and transparent about their pricing, provide advanced security and PCI compliant solutions, and offer complimentary features like in-house support.

Summary

- What are the average credit card processing fees?

- Who determines average merchant processing fees?

- Types of merchant processing fees

- Additional factors that can determine your credit card processing rates

- Fees merchants can avoid paying to their payment processor

- Businesses can easily calculate average credit card processing fees

- Find a reliable payment processor to secure the lowest credit card processing rates

Get a free cost-comparison of your current payment processing costs vs. EBizCharge

Get a free cost-comparison of your current payment processing costs vs. EBizCharge