Blog > What You Need To Know About Credit Cards on File Payments

What You Need To Know About Credit Cards on File Payments

As businesses grow, keeping up with customer payments becomes increasingly tricky. With growth comes a more extensive list of priorities, including greater demand, inventory management, and the rise of new competitors.

With more responsibility comes less time for business owners to keep track of overdue customer payments. Fortunately, Credit Cards on File offers an accommodating solution for company owners.

This article explores what Cards on File are, how they work, their advantages, and the regulations and best practices for storing and using credit card information.

What are Credit Cards on File?

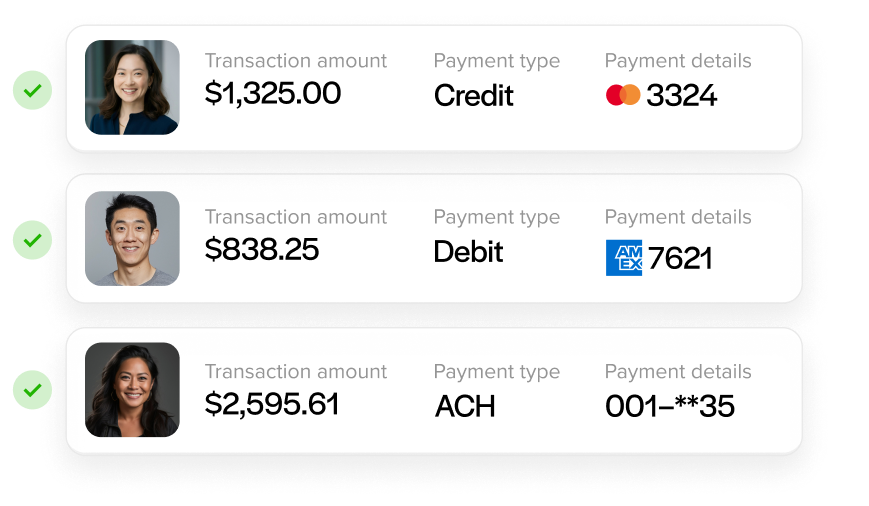

Credit Cards on File (CoF) are a payment method that allows customers to save their credit card information with merchants. This means customers don’t have to enter their credit card details every time they purchase a product or service, ensuring a more convenient and efficient checkout process.

With CoF, customers can add their credit card information to their accounts during checkout or by accessing their account settings on the merchant’s website. Adding a credit card is a simple process that usually involves entering the card number, expiration date, and credit card security code.

While it’s evident what credit cards on file are, the advantages of adopting CoF into your business model can lead to many positives for your business. The next section will discuss the main advantages of incorporating credit cards on file in your business.

Advantages of incorporating Credit Cards on File in your business

Cards on File has become a popular payment method for customers and merchants by allowing customers to securely store their credit card information with a trusted merchant.

CoF provides many advantages that streamline the checkout process and improve payment efficiency for merchants and customers. For customers, it means they don’t have to worry about remembering their credit card information or entering it every time they make a purchase. For merchants, it can increase the likelihood of repeat business, as customers are more likely to make purchases if the checkout process is quick and easy.

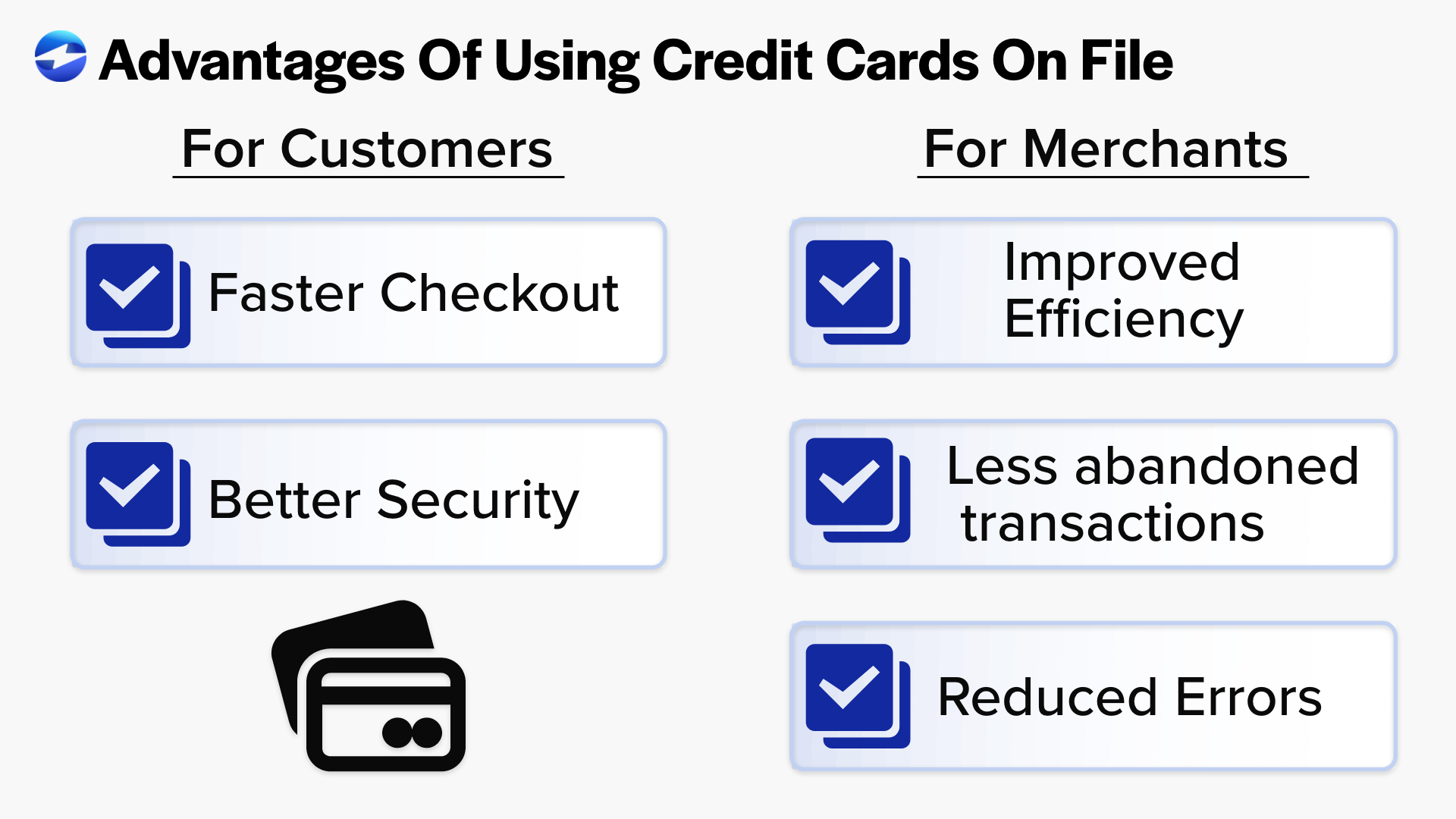

Benefits of CoF for customers

- Quick, hassle-free checkout: Customers can complete a transaction in a few clicks without entering their credit card information each time they purchase a product or service.

- Improved security: Customers can store their credit card data with a trusted merchant, which offers more protection than writing down card numbers or using a digital wallet.

Benefits of CoF for merchants

- Improved payment efficiency: With CoF, merchants can process payments faster and with less manual intervention, increasing efficiency and reducing transaction costs.

- Reduced cart abandonment: When customers’ cards are saved on file, this eliminates the need for manual entry which means they’re less likely to abandon their carts and more likely to complete these transactions.

- Reduced manual entry errors: Automating the payment process can help businesses reduce manual entry errors and the risk of chargebacks.

Despite these advantages, you may still wonder if offering CoF is necessary. This next section will explain the various cards on file features to help you determine if it fits your business.

5 Credit Card on File features to grow your business

As businesses grow, so does the need to optimize payment collections. Thankfully, debit and credit cards on file payments come with several features to encourage this growth:

- Resubmission: A resubmission occurs when retailers try to make a payment again after a customer’s credit card on file automatically fails. Typically, this failure is due to insufficient funds in the customer’s account. When retailers receive this notification, they can attempt a resubmission to make another effort at taking payment.

- Reauthorization: To ensure a customer’s card is working before a purchase is made, businesses with CoF can perform a reauthorization. If a customer has split their payment for an in-store purchase, with half due at the time of purchase and the other half due in two weeks, the retailer can reauthorize the credit card on file before billing the final amount.

- Recurring payments and subscriptions: Recurring payments, such as monthly subscriptions, are one of the main ways businesses use credit cards on file to eliminate manual card entry, save time, and reduce human error.

- One-click checkout: Credit cards on file are used for quick checkouts, where customers can complete transactions in a few clicks to reduce cart abandonment and improve the overall payment experience. With your card saved on file, many websites offer the one-click checkout feature, allowing you to have your order on its way with one click.

These debit and credit cards on file features can create a better approach to collecting customer payments and make for a more successful business overall.

Credit card on file policies and Security measures

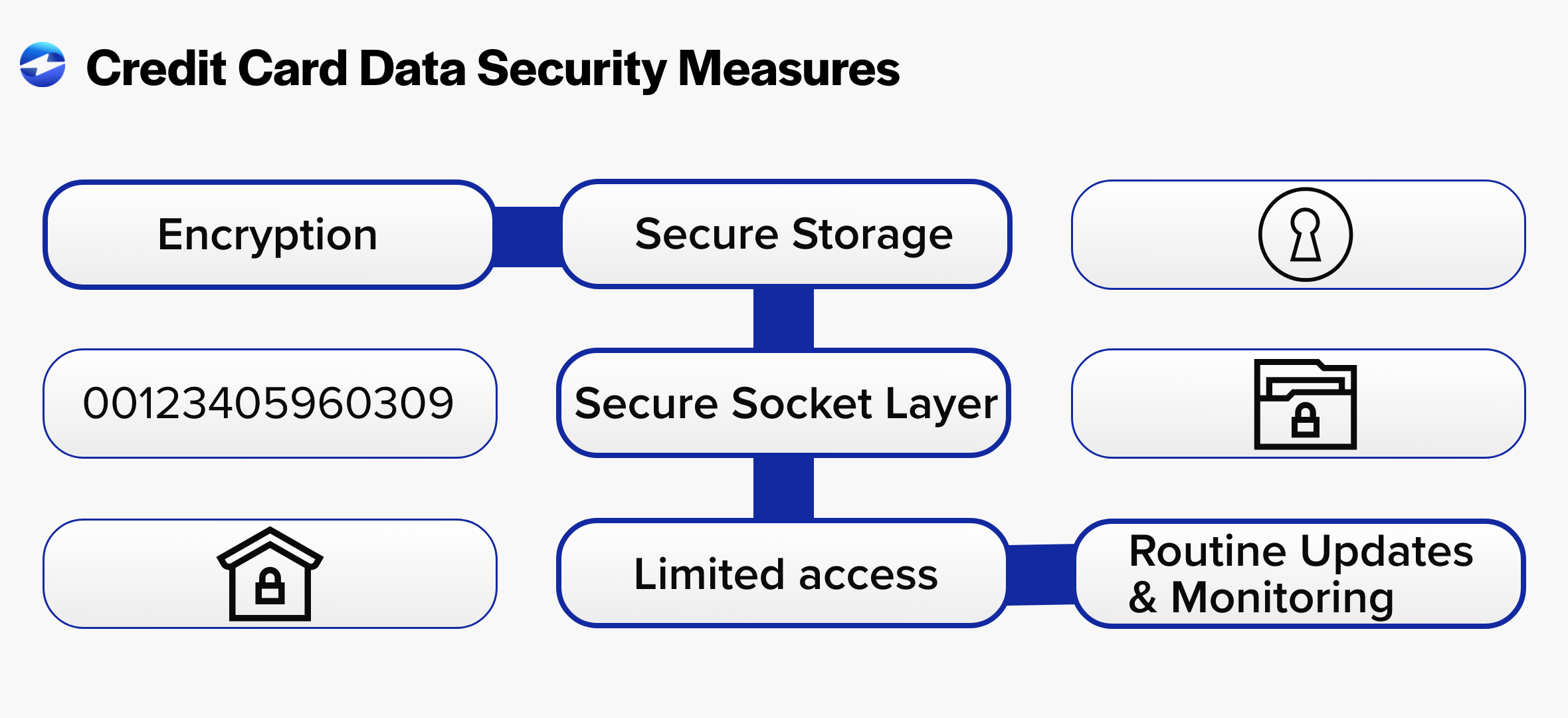

Merchants must abide by policies set, laws made, and regulations in place such as the Payment Card Industry Data Security Standard (PCI DSS) to ensure the highest level of protection when collecting, storing, and using credit card data.

These PCI guidelines ensure more customer data security and better protection for sensitive information — card numbers, security codes, etc.

Companies should also implement best practices and policies to properly store and manage credit card information to maintain customer trust and avoid legal penalties:

- Encryption: Encryption converts plain text or card data into a coded message to protect its confidentiality and integrity.

- Secure storage: Use a secure server, firewalls, antivirus software, and other security measures to protect card data storage systems.

- Secure Socket Layer: Secure Socket Layer (SSL) is a technology used to establish an encrypted and secure connection between a web server and a web browser, ensuring that data transmitted between the two remains private and integral.

- Limited access: Limit customer card file access to only those employees who need it to perform their duties.

- Routine updates & monitoring: Regularly update software and security measures to protect sensitive information and monitor these systems to detect and prevent unauthorized access to customer payment data.

- Retention Period: Companies should establish a retention period for storing credit card information and regularly review and purge outdated or unnecessary data to minimize risk.

Merchants are responsible for protecting their customers’ credit card information when it’s stored on file. This includes using secure servers and encryption methods to prevent unauthorized access and ensuring customer data isn’t shared or sold to third parties without consent.

By implementing these secure payment storage practices, businesses can protect customer data, comply with regulations, and avoid financial losses.

Optimize Card on File payments with EBizCharge

Credit Cards on File helps merchants provide a more streamlined approach to accepting and managing customer payments.

For an even more reliable and secure CoF solution, EBizCharge offers a PCI-compliant option that improves and accelerates payments, increases security, and provides a user-friendly experience for your customers.