Blog > What Is Zero-Cost Credit Card Processing and Is It Legal?

What Is Zero-Cost Credit Card Processing and Is It Legal?

Credit card processing fees have become a growing concern for many businesses, especially as margins tighten and consumer preferences lean heavily toward card payments. To offset these costs, more businesses are exploring zero-cost credit card processing—a model that shifts the burden of fees from the business to the customer.

But what does this model look like in practice? And more importantly, is it legal? In this guide, we’ll break down how zero-fee processing works, what merchants need to watch out for, and how to stay compliant while reducing out-of-pocket expenses.

What is zero-cost credit card processing?

Zero-cost credit card processing—also called no-cost credit card processing or no-fee merchant processing—means the business doesn’t pay the credit card processing fees. Instead, a surcharge is added at checkout, covering the fee and passing it on to the customer.

It’s similar to surcharging but with a key difference in how it’s marketed and framed. Surcharging typically refers to adding a fee that is specifically labeled as such, while zero-cost processing is often positioned as a built-in business model where customers cover transaction costs.

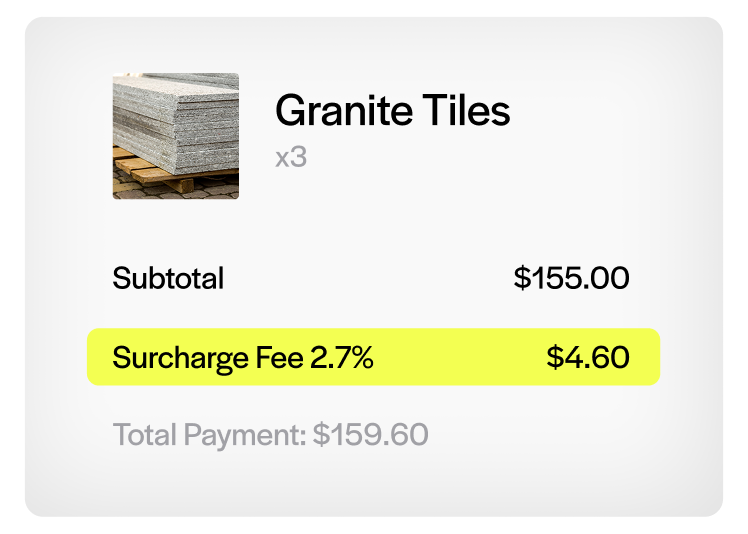

At checkout, this is usually implemented as a clear, line-item fee—often labeled as a card fee or service charge. Transparency is essential. Customers should see the fee before completing the transaction and have the option to switch to a non-credit payment if they want to avoid it.

How it works

To use a no-fee payment processing setup, merchants need a few key components working together:

- A payment processor that supports this model and offers tools specifically designed for compliance

- POS systems or online checkouts that can automatically detect the card type being used and apply the appropriate surcharge only to qualifying credit card transactions

- A mechanism for clearly disclosing the fee before the customer commits to the purchase, whether on screen, on paper, or via signage

Once these systems are in place, the surcharge is automatically calculated and applied at checkout. The customer pays the full transaction amount, including the fee, and the business receives the base sale amount, effectively eliminating payment processing costs from their side.

It’s worth noting that while many payment processing solutions now support no-cost credit card processing, not all do so in a compliant way. Businesses should be cautious about choosing a provider and ensure that the software they use follows current state regulations and card network rules. Proper implementation isn’t just about applying a fee—it’s about doing so correctly, transparently, and legally.

Legal considerations

From a federal standpoint, there’s no law in the U.S. that prohibits surcharging or zero-fee processing. That means merchants are generally allowed to pass credit card fees to customers—but the rules get more complicated at the state level.

Some states—like Connecticut and Massachusetts—either restrict or outright ban no-fee merchant processing models. In those jurisdictions, applying a surcharge may expose your business to penalties or legal challenges. Meanwhile, other states permit the practice, but only if businesses follow specific requirements around disclosure, labeling, and how the fee is applied.

In addition to state laws, you’ll also need to follow rules around how the credit card surcharge is calculated and presented. Most card networks cap the surcharge at your actual cost of credit card processing, usually no more than 3%. More importantly, customers must be notified clearly and in advance—meaning they should see the surcharge before completing the transaction, not as a surprise after the fact.

To stay compliant, it’s critical to understand both state-level legislation and card network standards. Merchants should regularly review the legal landscape and ensure their payment processing solution includes built-in compliance tools and up-to-date guidance.

Card network guidelines

Visa, Mastercard, American Express, and Discover all have detailed policies that govern surcharging and no-cost credit card processing. These rules are in place to protect consumers and ensure consistency across merchants that choose to pass processing fees on to their customers.

Here are a few highlights you need to be aware of:

- Fee caps: You generally can’t charge more than 3% as a surcharge, even if your credit card processing costs are higher. In some cases, card networks may limit you to the actual cost of acceptance.

- Brand parity: If you choose to apply a surcharge, it must be applied to all credit card brands equally. You can’t selectively charge a fee on only Visa or Mastercard while leaving others exempt.

- Advance notice: Most card networks require that merchants provide formal notice at least 30 days before beginning a no-fee merchant processing or surcharging program. This includes completing an online registration form and submitting specific details about your business.

These guidelines are not optional. They are part of your contractual obligations with your payment processor, and violating them could lead to penalties, card acceptance restrictions, or even the termination of your merchant account. Before implementing zero-cost credit card processing, make sure your payment processing solution helps you navigate and comply with these network rules.

Pros and cons for merchants

Before diving in, it’s important to weigh both the potential benefits and trade-offs of no-fee payment processing. For some merchants, the promise of lowering or even eliminating credit card processing costs without adjusting prices is an appealing prospect. Instead of embedding fees into your pricing, you’re putting the choice directly into your customers’ hands.

Here are a few of the main benefits:

- It reduces or eliminates the cost of credit card processing for your business.

- It allows you to maintain or improve profit margins without inflating your pricing.

- It gives customers a choice—pay the surcharge or switch to a non-credit method like debit, ACH, or cash.

Of course, it’s not without trade-offs:

- Some customers may push back against added fees, especially if they weren’t expecting them.

- If you don’t disclose fees clearly and early in the transaction, you risk non-compliance and reputational damage.

- Not all payment processing solutions are designed to handle surcharging properly, which can lead to technical or legal issues.

Beyond the technical setup, customer perception plays a major role in success. When implemented with care and communicated well, zero-cost credit card processing can be a sustainable way to reduce overhead. But when it’s poorly presented or confusing to the customer, it can backfire. Clarity and consistency—both in your systems and your messaging—are key.

Best practices for compliance

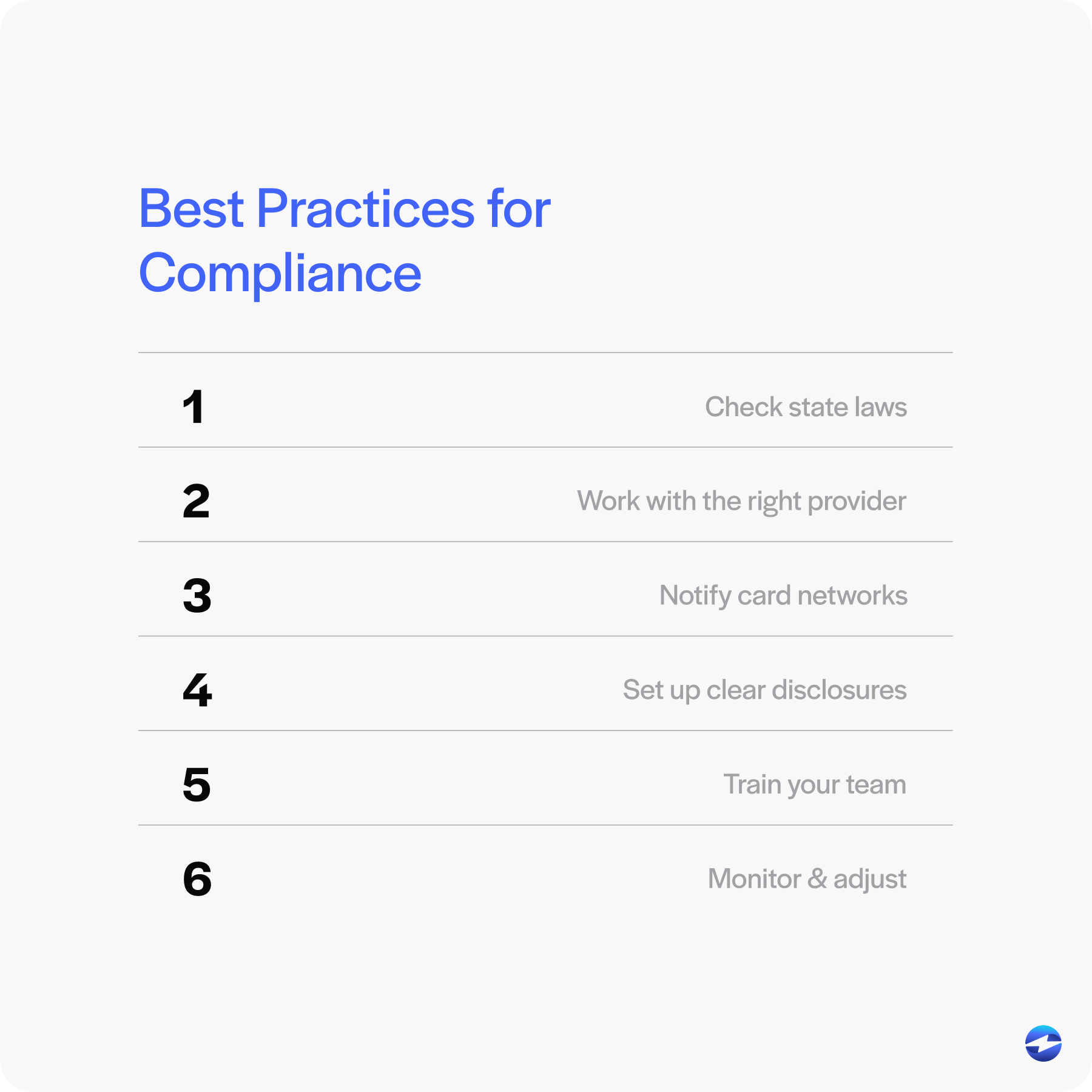

To avoid running into compliance issues or customer friction, you’ll want to make sure you’re covering all your bases from day one.

This section outlines a few practical steps that can help you implement no-cost credit card processing responsibly and effectively:

- Check state laws: Make sure no-cost credit card processing is legal where you operate. Some states have restrictions or specific disclosure requirements.

- Work with the right provider: Choose a payment processor that knows the rules and offers tools that support compliant surcharging out of the box.

- Notify card networks: Don’t skip this step—it’s a required part of the process and helps ensure transparency with your payment partners.

- Set up clear disclosures: Customers should see the fee before completing their purchase, not as a surprise at the end.

- Train your team: Staff should know how to explain the fee clearly and respond to questions without sounding unsure or defensive.

- Monitor and adjust: Stay on top of updates to laws and card brand rules, and be prepared to refine your approach as needed.

By taking a thoughtful, informed approach, you’ll not only stay compliant—you’ll build trust with your customers while recovering processing costs more effectively.

Zero-cost processing made easy with EBizCharge

Zero-fees processing offers a way for merchants to stay competitive without eating into profits. When done right, it shifts the cost of payment processing to the customer in a transparent and compliant way. But setting up a compliant no-fee merchant processing system can be complex—especially when dealing with state laws, card network rules, and customer expectations.

That’s where EBizCharge comes in. EBizCharge helps simplify the transition to zero-cost credit card processing by offering built-in tools that automatically apply surcharges only to eligible transactions, calculate fees within card network limits, and generate compliant receipts. Whether you’re using a POS system in-store or running an online checkout, EBizCharge provides the flexibility and support you need to get it right.

Their platform helps merchants register with card networks, configure disclosures, and avoid the common compliance pitfalls that can put other businesses at risk. From staff training resources to ongoing updates on legal requirements, EBizCharge makes it easier to offer no-fee payment processing without the legal guesswork.

In the end, it’s not just about cutting costs—it’s about doing it in a way that’s smooth for your business and fair to your customers.