Blog > What Is Remittance Advice? Definition, Examples, and Tips to Enhance for Your Company

What Is Remittance Advice? Definition, Examples, and Tips to Enhance for Your Company

Looking for a Remittance Advice Template? Download our free template today.

Remittance advice is a tool used to clearly communicate payments between customers and businesses. This simple, yet essential document can decode transactions and play a role in streamlining accounts receivable (AR) operations.

What is remittance advice?

Remittance advice refers to a document a customer sends to a business to indicate that an invoice has been paid. This notification can come in various forms, such as a letter, an email, or a slip attached to a check.

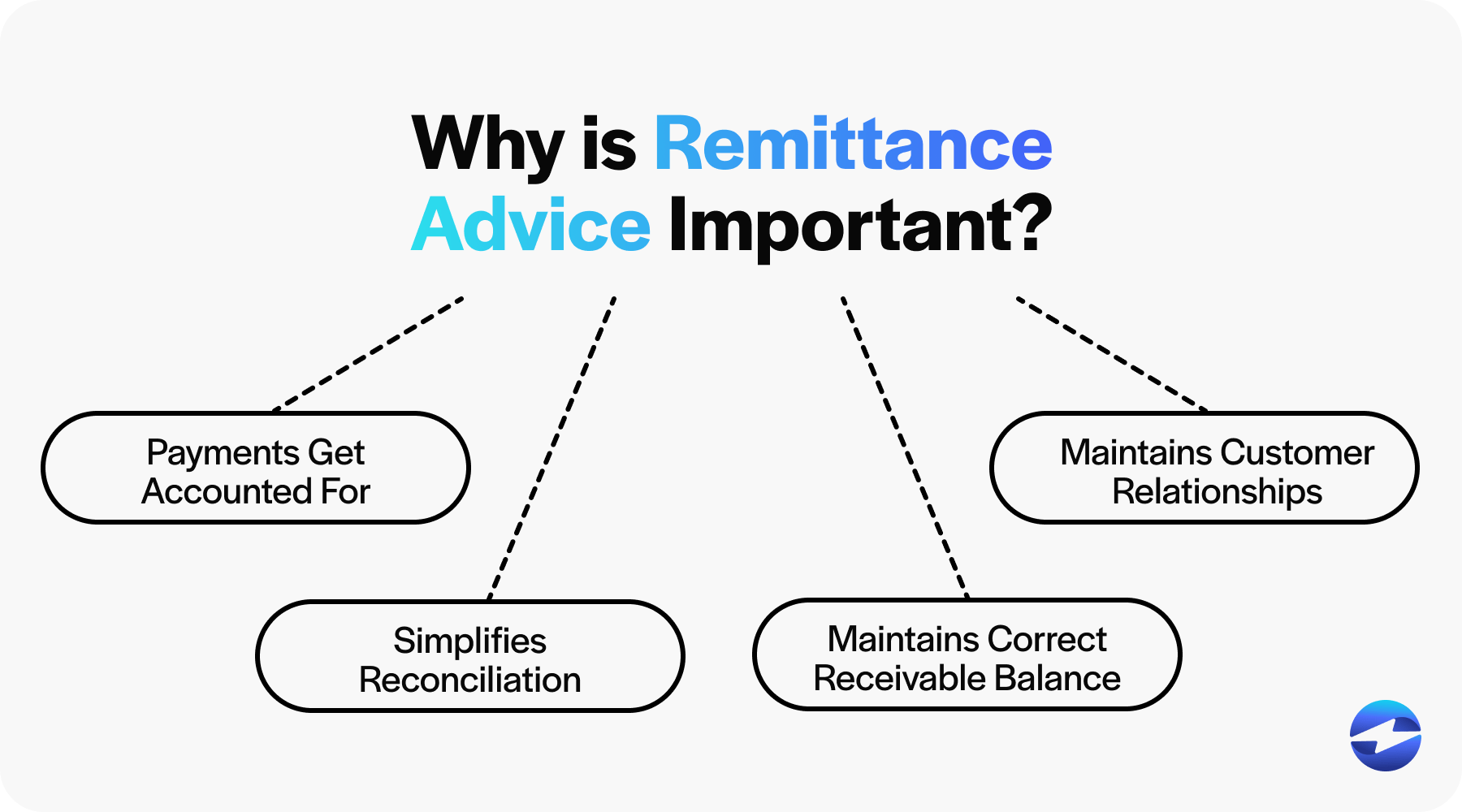

Why is remittance advice important?

Remittance advice is critical in financial management for any AR team. Its importance is grounded in several crucial functions: it ensures that payments are accounted for correctly, simplifies the reconciliation process, and helps maintain a precise and updated receivable balance in the company’s ledger.

By providing a detailed record of each transaction, remittance advice helps prevent errors and discrepancies, aids in tracking outstanding payments, and enhances overall cash flow. It does this by providing timely and accurate information on payments received, enabling efficient cash allocation and better financial planning.

Remittance advice aids in ensuring that the customer’s payment is attributed to the correct invoice, thereby maintaining the integrity of the business’s financial reports, such as its balance sheet.

With prompt and accurate processing of remittance information, businesses can maintain good customer relationships by avoiding unnecessary follow-ups on settled accounts.

What information does remittance advice contain?

A typical piece of remittance advice includes several critical pieces of information for the recipient to identify and process the payment accurately.

Remittance advice documents generally consist of the following;

- The name and contact details of the payer

- The remittance advice date

- Payment amount and currency

- Payment method (e.g., check, wire transfer, credit card)

- Invoice number(s) and date(s) that the payment corresponds to

- Customer account number or reference

- Any additional notes or messages regarding the payment

These details are imperative as they help AR teams update accounting records and manage receivable processes.

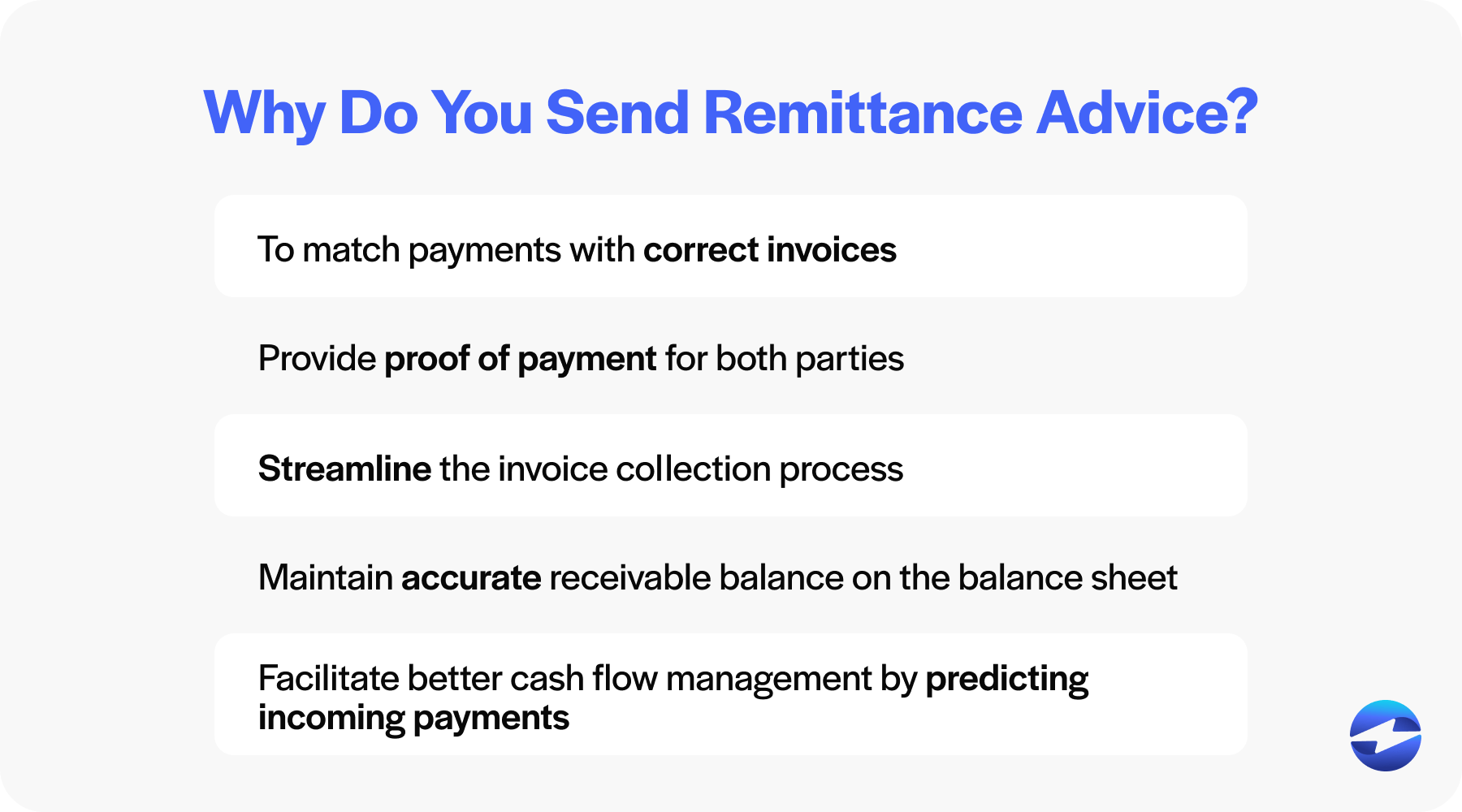

Why do you send remittance advice?

Remittance advice is sent to notify the payee of the details of a payment, ensuring the accurate allocation of funds to the correct invoices and facilitating efficient account reconciliation.

Some common reasons businesses will send remittance advice include:

- To match payments with correct invoices

- Provide proof of payment for both parties

- Streamline the invoice collection process

- Maintain accurate receivable balance on the balance sheet

- Facilitate better cash flow management by predicting incoming payments

Whatever the reason for sending remittance advice, a common misconception is whether remittance advice is proof of payment.

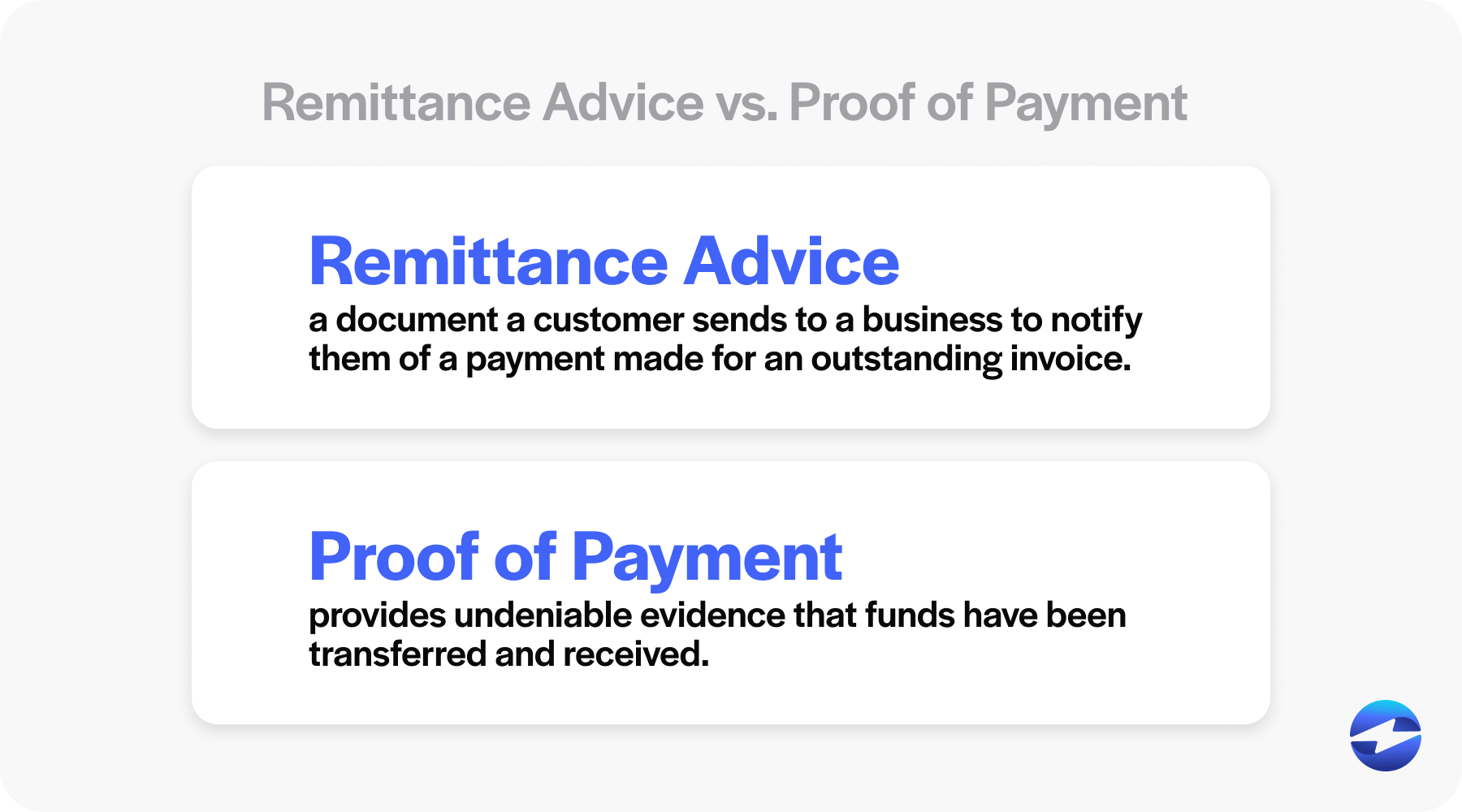

Is remittance advice proof of payment?

While remittance advice is often mistaken for proof of payment, they’re not the same.

Remittance advice is a document a customer sends to a business to notify them of a payment made for an outstanding invoice.

On the other hand, proof of payment is a document that confirms a payment was completed, such as a bank statement, a credit card receipt, or a transaction record from accounting software. Proof of payment provides undeniable evidence that funds have been transferred and received.

While remittance advice may accompany proof of payment, AR teams must understand that it doesn’t conclusively verify that funds have cleared or been deposited. Confirmation from a financial institution or a review of the company’s account balance is needed for proof of payment.

Therefore, remittance advice should be seen as an informative document rather than a conclusive verification of completed payment.

What are remittance slips, and how are they created?

Remittance slips outline essential invoice information, such as the payer’s details, the invoiced amount, the payment amount, and any remaining outstanding balance. They facilitate more straightforward accounting processes, allowing the AR team to match received payments with the correct invoices.

Remittance slips are created by the payer, typically using accounting or payment processing software, to detail the payment information, including the invoice numbers, amounts paid, and any deductions or adjustments.

Utilizing accounting software simplifies and streamlines the creation of remittance advice slips, ensuring that the data on each slip is accurate and corresponds with the respective invoiced transaction.

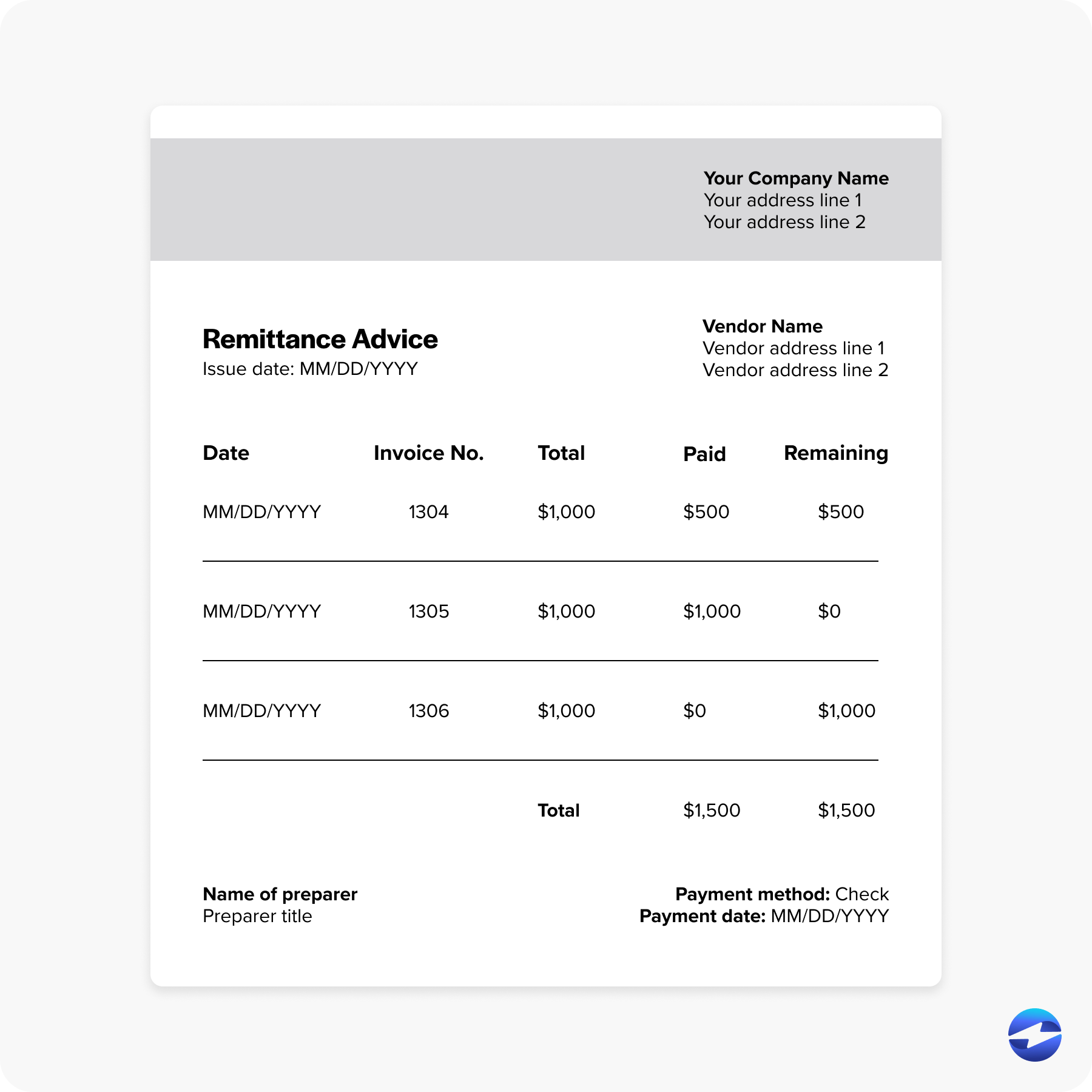

What does an example of remittance advice look like?

An example of remittance advice typically comes in the form of a letter, note, or email sent by a customer to a business.

Here’s an example of how a remittance advice slip may look:

This document helps the AR team match payments to outstanding invoices on the balance sheet.

Remittance advice can also be in digital formats via email, providing accessible and convenient confirmation of customer payments.

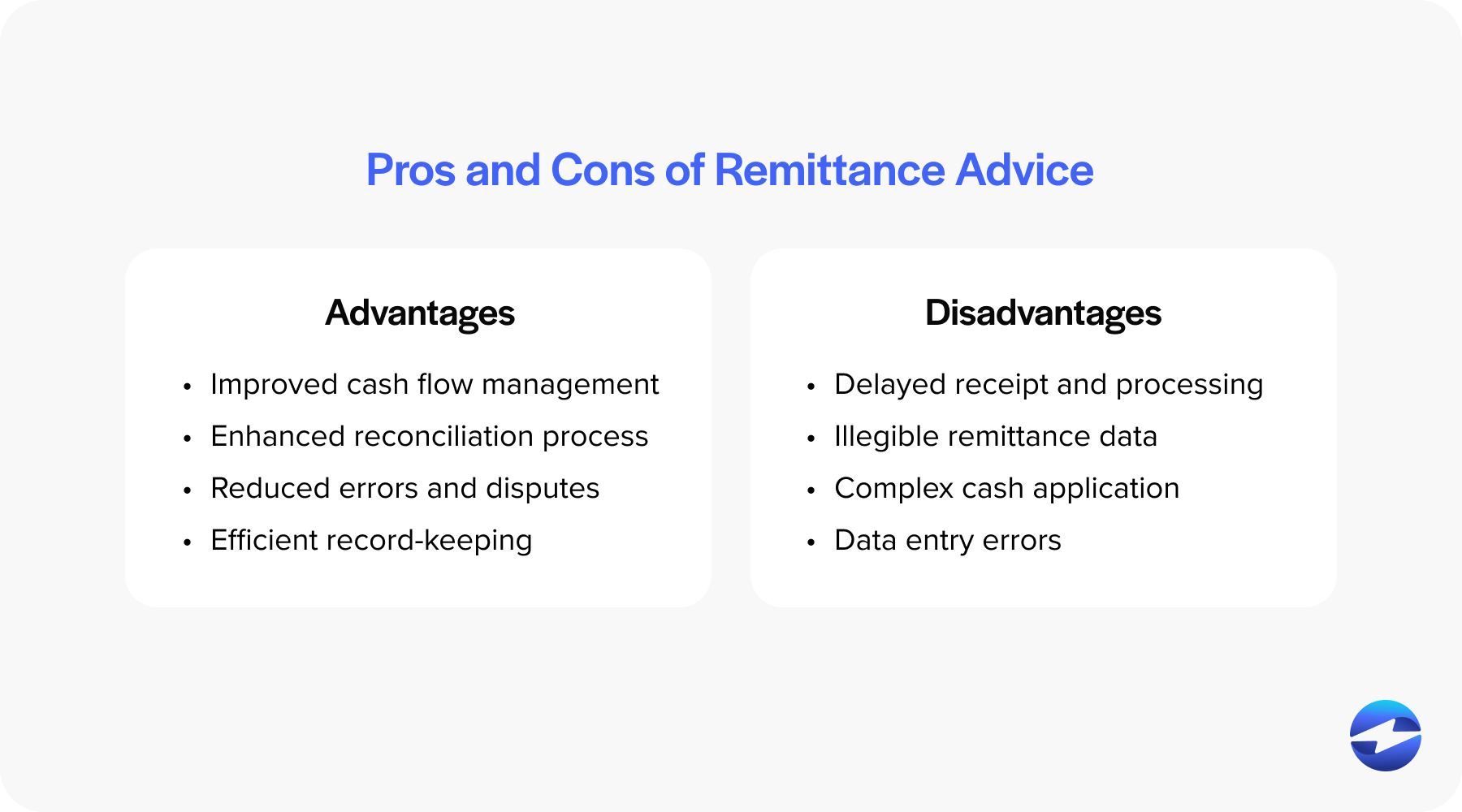

4 pros and cons of remittance advice

Remittance advice is pivotal in the transaction process, especially when businesses manage incoming payments.

Like any business tool, remittance advice has advantages and drawbacks.

Pros

Pros

- Improved cash flow management: Remittance advice enhances cash flow management by enabling businesses to gather payment information in a timely manner, enabling more efficient cash allocation and better financial planning.

- Enhanced reconciliation process: Remittance advice simplifies the reconciliation process by clearly detailing which invoices have been paid, reducing the time and effort required to match payments to outstanding invoices.

- Reduced errors and disputes: Remittance advice helps minimize errors and disputes by specifying payment details, ensuring that both parties clearly understand which invoices are being settled.

- Efficient record-keeping: Remittance advice contributes to efficient record-keeping by providing a clear paper trail of transactions, making it easier to maintain accurate financial records and comply with auditing requirements.

Cons

- Delayed receipt and processing: Delays in receiving and processing remittance advice can slow down the AR process, potentially impacting cash flow and financial planning.

- Illegible remittance data: Illegible or poorly formatted remittance advice can lead to confusion and errors, making it challenging to accurately apply payments to the correct accounts.

- Complex cash application: Handling complex or large volumes of remittance advice can complicate the cash application process, requiring additional resources and time to manage effectively.

- Data entry errors: Manual data entry of remittance advice increases the risk of errors, which can lead to misapplied payments and discrepancies in financial records.

Regardless of the drawbacks of remittance advice, these documents can effectively track payments, ensure that balance sheets accurately represent finances, and fortify the foundation for sound financial practices.

Transform your remittances with EBizCharge

As businesses move forward, managing remittance advice information and adopting adequate accounting software are vital steps to prevent overdue invoices and improve financial records.

Alongside remittance advice, businesses can further improve their payment collections by working with automated payment solutions like EBizCharge, which streamlines the invoicing process and cash application by directly integrating payments and their data into accounting software.

With its top-rated payment features and robust reporting abilities, EBizCharge transforms cash flow management, reduces manual entry errors, and gives businesses valuable transaction insights to enhance their financial operations.

Frequently Asked Questions

Frequently Asked Questions

Summary

- What is remittance advice?

- Why do you send remittance advice?

- Is remittance advice proof of payment?

- What are remittance slips, and how are they created?

- What does an example of remittance advice look like?

- 4 pros and cons of remittance advice

- Transform your remittances with EBizCharge

- Frequently Asked Questions