Blog > What is Omnichannel Payment Processing?

What is Omnichannel Payment Processing?

In today’s interconnected world of commerce, businesses are redefining how they handle transactions through the revolutionary concept of omnichannel payments. Omnichannel payment gateways provide a seamless payment experience, allowing customers to navigate through online, in-store, and mobile channels effortlessly. Omnichannel payments seamlessly integrate various payment methods to offer customers consistent convenience and service. Omnichannel payment solutions utilize multiple payment solutions, all of which are integrated into a single comprehensive payment software. Multi-channel payment integration is not just an upgrade; it’s an evolution that brings cohesion to modern commerce. Financial transactions as omnichannel payments blend convenience, consistency, and customer satisfaction seamlessly.

What is omnichannel payment processing?

Put simply, omnichannel payment processing is an extensive solution intended to simplify your company’s accounting while making it easy for your customers to pay for your products or services. Omnichannel payment solutions utilize multiple payment solutions, all of which are integrated into a single comprehensive payment software. When performed correctly, omnichannel payments provide a personalized, intuitive experience for your customers and allow your business to get paid on time in a simplified manner. Having multi-channel payments online and in person is essential for creating a simplistic payment environment for your customers while attracting new customers to your company.

What is Omnichannel ecommerce?

Omnichannel ecommerce is a way of selling products or services online that provides a seamless experience for customers across various platforms and devices. It ensures a consistent and integrated shopping journey, whether customers are using a website, mobile app, social media, or physical stores. The number of digital online buyers is expected to increase by 17 million from 2022 to 2025. Therefore, setting up an omnichannel e-commerce system that ensures your customers get a positive user experience across various digital devices and platforms, regardless of the technology or platform chosen, is crucial.

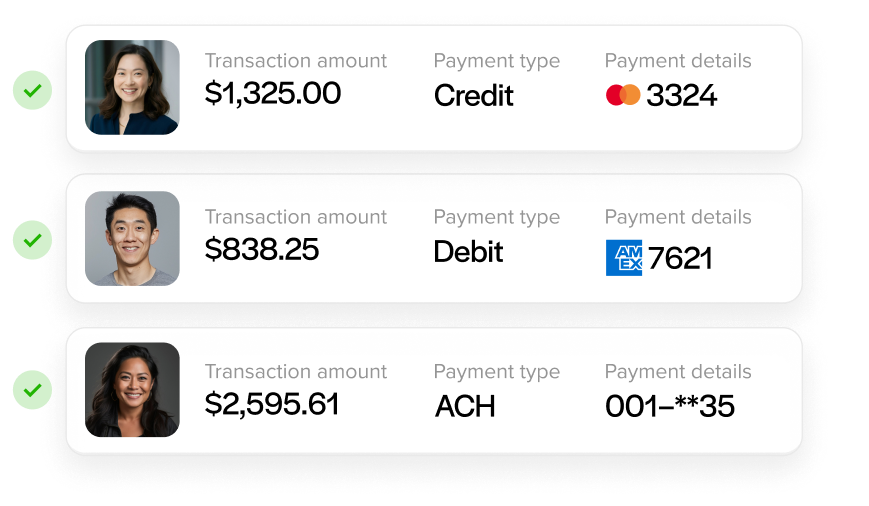

There are many ways to accept credit and debit card payments online and in person. It’s important to keep in mind all the channels you can receive payments in.

Different channels of omnichannel payment processing

When your customers are ready to pay, businesses that utilize a merchant that uses omnichannel payment processing will offer many ways of getting paid. There are many types of channels associated with omnichannel payment processing. Here is a list of some of the popular channels:

Credit and debit card payments

Enable customers to make secure and convenient transactions using their credit or debit cards, both in-store and online.

Manual bank transfers

Facilitate payments through traditional manual bank transfers, allowing customers to transfer funds from their bank accounts directly.

Direct debit payments

Streamline recurring payments by setting up direct debits, offering a hassle-free and automated method for regular transactions.

Mobile wallets

Embrace digital wallets, allowing customers to make quick, contactless payments using smartphones.

Email invoicing with links to a secure payment portal

Send secure invoices via email with direct links to payment portals, providing a convenient and secure way for customers to settle bills.

Recurring billing

Automate repetitive transactions with recurring billing, ensuring timely and predictable payments for subscription-based services.

Point of sale (POS) systems

Enhance in-store transactions with advanced POS systems, facilitating efficient and seamless payment processing at physical retail locations.

Text-to-pay

Allow customers to make payments through text messages, providing a quick and accessible option for completing transactions.

ACH payment processing

Utilize Automated Clearing House (ACH) for electronic fund transfers, enabling secure and cost-effective transactions, particularly for larger payments or payroll processing.

Merchant service providers like EBizCharge use a combination of omnichannel payment processing channels such as email pay, EMV payments, recurring billing, virtual terminals, and many others to allow businesses to easily get paid on time from their customers.

Benefits of omnichannel payment processing

Lowering DSO

The main benefits of omnichannel payment processing mostly revolve around businesses getting paid much quicker from their customers. This is crucial for businesses to reduce their Days Sales Outstanding (DSO) to lower the company’s accounts receivables (AR) and increase its overall cash flow. This increase to the company’s cash flow allows them to seek out other investment opportunities and establishes rapport with the organization’s customers.

Builds customer loyalty

Another benefit of omnichannel payment processing is that it provides an all-in-one payment solution, which makes it easy for customers to understand and pay businesses. Not only is this beneficial for the collection of payments, but it builds rapport and customer loyalty because of the simplicity that omnichannel payment processing provides.

Reduce management and maintenance time

Because of its intuitiveness, omnichannel payment processing also helps reduce management and maintenance time within the organization. Instead of managing and maintaining multiple channels for payment processing, omnichannel payment processing allows you to manage all of the channels in a single place. This creates a simplistic environment for organizing maintenance and allows your team to easily manage all of the different channels in one area.

Simplified accounts reconciliation

Since omnichannel payment processing combines multiple channels of accepting payments all in one convenient place, the accounting information will also be organized in one place rather than spread out over multiple channels. With this simplified accounts reconciliation process, your company will be able to reconcile your accounts quicker and with more accuracy.

Considerations of omnichannel payment processing

When implementing a cross-channel payment management system, the main area of consideration is the integration of data into the software your company uses. Since omnichannel payment processing uses many different channels of accepting payments, financial recording issues may occur because of the complexity of multiple channels. With this in consideration, it’s critical to select an omnichannel payment processor that’s fully integrated with the different aspects of your business, such as accounting, CRM, and eCommerce software. This organizes your financial data into one place, making it easier for your accountants to stay on top of the multiple channels of payment processing.

Omnichannel payments and security

Security is another major area of consideration when selecting an omnichannel payment platform. When choosing to work with an omnichannel payment processor, make sure that they are PCI compliant and follow the Data Security Stands (PCI DSS) set by the Payment Card Industry. Because omnichannel payment processing can be complicated, it’s important to choose a payment processor that has an excellent history of security.

Conclusion

Omnichannel payment processing may sound complicated, but it’s an excellent solution for companies that want to simplify their accounts reconciliation and provide an array of intuitive methods of accepting payments from their customers. There’s an excellent selection of merchant service providers, such as EBizCharge, that offer omnichannel payment processing with a high level of security to ensure safe and secure transactions for your customers.

This is why choosing a processor that integrates natively with your existing software matters. A QuickBooks payment gateway consolidates all your payment channels into one system that syncs directly to your accounting records, so every credit card, ACH, and email payment is reconciled automatically. For larger businesses, NetSuite payment processing brings that same unified experience into your ERP, giving finance teams a single view of every transaction across all channels. Both options solve the data integration challenge that makes omnichannel processing complex and help your team stay organized as payment volume grows.