Blog > How Much Do Credit Card Companies Charge Merchants?

How Much Do Credit Card Companies Charge Merchants?

Navigating the complexities of credit card processing fees is a significant challenge for merchants in today’s digital economy.

With the surge in cashless transactions, it’s essential for merchants to understand these fees to maintain profitability and deliver an efficient customer experience.

What are credit card processing fees?

Credit card processing fees are fees merchants must pay to accept credit card payments from their customers.

The fees associated with credit card processing typically consist of various costs, including transaction fees, interchange fees, and service provider fees, which can significantly impact a business’s bottom line.

Understanding these fees is essential for merchants to optimize payment processing strategies and manage costs effectively.

Merchants should evaluate credit card merchant fees to ensure this spend is worth the benefits of using payment processing services to accept credit cards.

Breakdown of credit card processing fees

Credit card processing fees are charged to merchants for each credit card transaction processed.

Merchants typically encounter three primary types of fees: interchange fees paid to the card issuers, assessment fees paid to credit card networks, and various payment processor fees that cover the services provided by merchant services providers. These combined costs are calculated as a percentage of each transaction plus, in some cases, additional fixed fees.

Here’s a breakdown to help you better understand the average fee ranges:

| Fee Type | Average Fee Range |

|---|---|

| Interchange Fees | 1.1% – 2.9% per transaction |

| Assessment Fees | 0.13% – 0.15% per transaction |

| Payment Processor Fees | Varies by provider |

| Additional Fees | Varies by provider and transaction type |

The fees outlined in this table encompass the standard costs. Still, merchants should be aware of other potential charges that may apply.

Assessment fees

Assessment fees are relatively small but consistent fees charged by credit card networks like Visa, MasterCard, American Express, and Discover. These fees support the network’s operational costs, including maintaining the credit card system’s infrastructure and ensuring secure and efficient payment transactions.

Assessment fees are a fixed percentage of each transaction and remain relatively stable compared to other fees. Merchants will find these fees listed as a separate line item on their monthly processing statements.

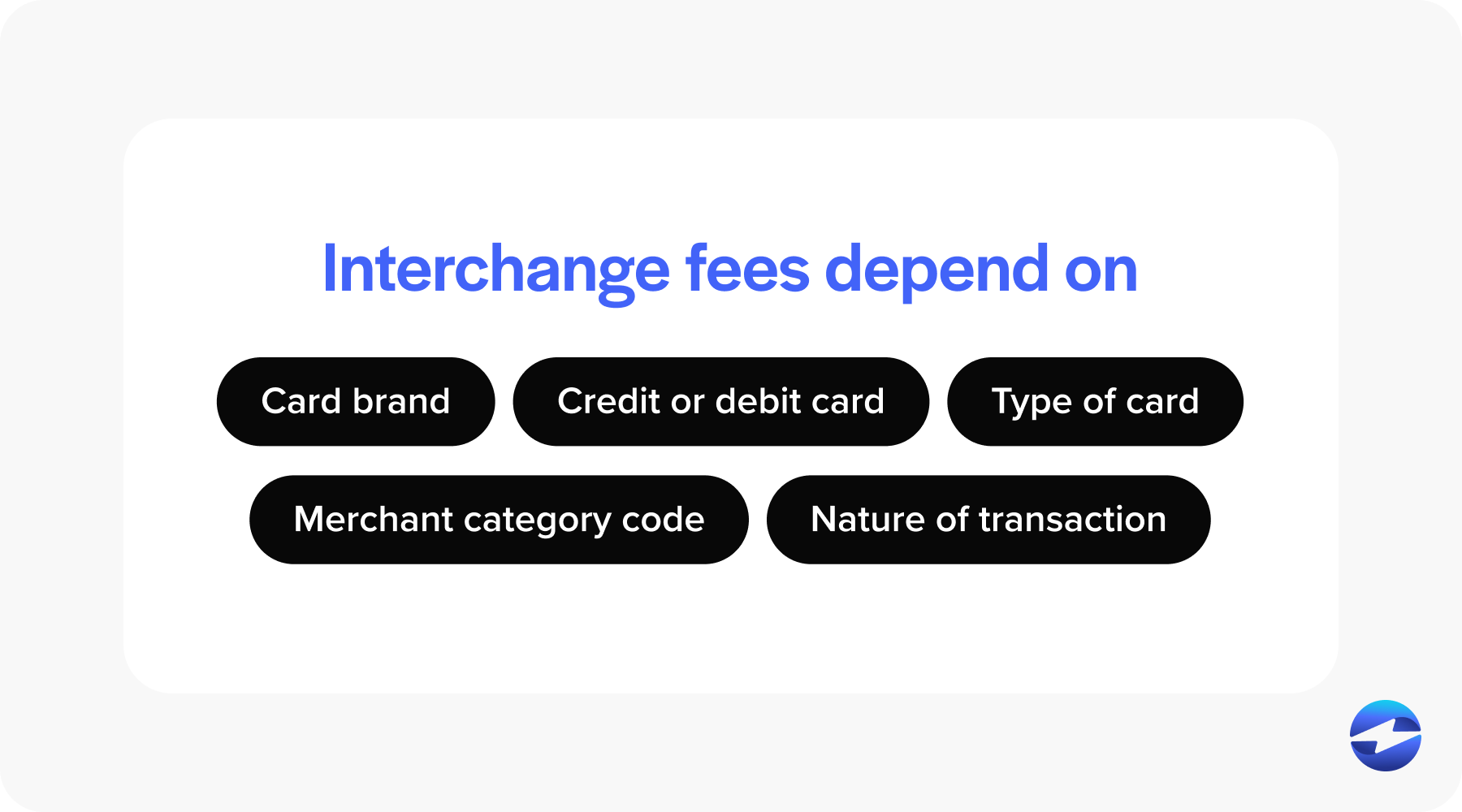

Interchange fees

Interchange fees make up the most significant portion of credit card transaction costs going to the card issuer — the bank or financial institution that issued the credit card to the consumer. These fees cover handling costs, fraud and bad debt costs, and the risk involved in approving the payment.

Interchange fees vary depending on numerous variables, such as the card brand, whether it’s credit or debit, the type of credit card (e.g., rewards, corporate), the merchant category code, and the nature of the transaction (e.g., card-present or card-not-present transactions). Each card issuer’s interchange rates are publicly available for reference.

Payment processor fees

Payment processor fees are determined by the merchant services providers that facilitate the transaction between merchants and customers. These fees vary depending on the payment processor and the merchant’s chosen service plan.

Processors may offer pricing models such as flat-rate, tiered pricing, or interchange-plus pricing, each with its own set of rates and fee structures. These fees may include a percentage of each transaction coupled with a fixed fee, monthly service fees, and equipment rental fees, among others.

Hidden and additional fees to watch out for

Aside from standard fees, merchants should be vigilant about hidden and additional fees that payment processors may charge, including termination fees, PCI compliance fees, chargeback fees, and monthly minimum fees. While some fees may be a one-time charge, others can recur monthly or annually.

Merchants should thoroughly review their merchant account agreement and ask for clarification on line-item charges they don’t understand. It’s also advisable to monitor monthly statements to keep track of any new or unexpected fees that arise.

3 factors that affect credit card fees for merchants

Credit card processing fees vary significantly and are influenced by many factors, sometimes making them appear complex and confusing to merchants. Understanding these factors is critical to anticipating credit card payment costs.

Credit card fees can vary depending on the specifics of the transaction or even the broader elements of a merchant’s business profile. Considerations such as the type of card used, the merchant’s industry and size, and the merchant’s processing history and risk profile all play notable roles in determining the ultimate fees charged for credit card transactions.

The type of card used

The fees charged for credit card transactions depend on the customer’s card type. Cards are generally categorized into various tiers by credit card networks, and each tier has its own set of interchange rates.

For example, a primary consumer debit card often incurs lower fees than a rewards or corporate credit card. Credit cards issued for international use or those with enhanced rewards and benefits can also attract higher interchange fees due to the greater value offered to cardholders. Differentiating between these can have a notable impact on the effective rate that merchants pay per transaction.

Merchant industry and size

Merchant services providers classify businesses with Merchant Category Codes (MCCs), which are four-digit numbers that card issuers use to identify purchases based on the type of merchant that provides the associated goods or services.

The industry a company operates in can affect the interchange fees, as different industries have different typical processing risks and average transaction sizes.

For instance, a retail store may incur lower fees compared to an online software vendor due to the differing risk of fraud and chargebacks.

Similarly, the size of your business and the volume of credit card transactions you process can influence merchant service providers to offer volume discounts or more favorable terms, lowering overall processing costs.

Merchant processing history and risk profile

A merchant’s processing history encompasses the volume of transactions, average ticket size, and the history of chargebacks or fraudulent transactions.

Established businesses with a consistent and robust processing history can negotiate better terms with payment processors. Conversely, companies that pose a higher risk due to numerous chargebacks, irregular transaction patterns, or operating in high-risk industries may face higher processing fees.

A strong processing history can signal to financial institutions that the merchant poses a lower risk, potentially leading to more favorable processing rates.

These variables are all critical considerations for merchants when navigating the complexities of credit card processing fees. It’s recommended that merchants review their processing activity regularly and consult with their merchant services provider to ensure they get the most cost-effective terms for their payment processing needs.

Now that you have a solid understanding of how a merchant’s processing history and risk profile influence fees, you can explore various strategies to reduce processing costs.

7 strategies to reduce credit card processing fees

Companies are often battling the never-ending cycle of paying off expenses and fees. However, there are ways they can avoid some of those costs.

Here are seven strategies to help your business reduce credit card processing fees:

- Look into surcharging options

- Implement payment optimization strategies

- Negotiate with payment processors

- Leverage technology and software solutions

- Monitor chargebacks

- Choose a suitable pricing model

- Avoid high-risk transactions

1. Look into surcharging options

Surcharging enables merchants to pass their credit card processing fees to customers who pay them by credit card while maintaining compliance with all the surcharging regulations.

Businesses can use surcharging options to charge a small fee (a percentage of the transaction or a fixed rate) to customers using credit card payments. While surcharging can offset or cover credit card processing fees altogether, merchants must comply with the rules set by credit card networks and local laws.

Disclosing the surcharge to customers before completing a transaction is essential, as it ensures transparency and maintains customer trust.

Reliable payment processors like EBizCharge provide surcharging options that eliminate these costs while keeping your business compliant with relevant regulations.

2. Implement payment optimization strategies

Optimization strategies may include selecting the most efficient and affordable transaction processing methods, minimizing costs while maintaining or improving service quality. This ensures that resources are utilized effectively, leading to cost savings and enhanced operational efficiency.

For example, entering additional information for each transaction, such as invoice numbers or order IDs, can lead to lower interchange fees for card-not-present (CNP) transactions.

Businesses should also ensure that their terminals and software are correctly installed to capture the highest level of data for each transaction, which can yield lower fees.

3. Negotiate with payment processors

Negotiation with payment processors can lead to reduced fees, especially for businesses with a high volume of credit card transactions or those with an excellent processing history.

By understanding your processing statement and fees, you can discuss rates and possibly receive custom pricing or reduced rates from your processor.

4. Leverage technology and software solutions

Businesses can leverage modern technology and software solutions to reduce their credit card fees.

For instance, integrating a payment gateway that optimizes interchange fees or software that automatically updates credit card information can lower costs.

Up-to-date terminals that accept EMV chip cards and contactless payments can also help merchants mitigate or avoid higher fees associated with manually keyed transactions.

5. Monitor chargebacks

Chargebacks can be costly due to the associated fees and penalties. By closely monitoring and managing chargebacks, merchants can avoid additional costs and look for gaps in their payment process to prevent future ones.

Businesses can actively monitor chargebacks by implementing robust fraud detection tools, explicit billing descriptors, straightforward refund policies, and excellent customer service.

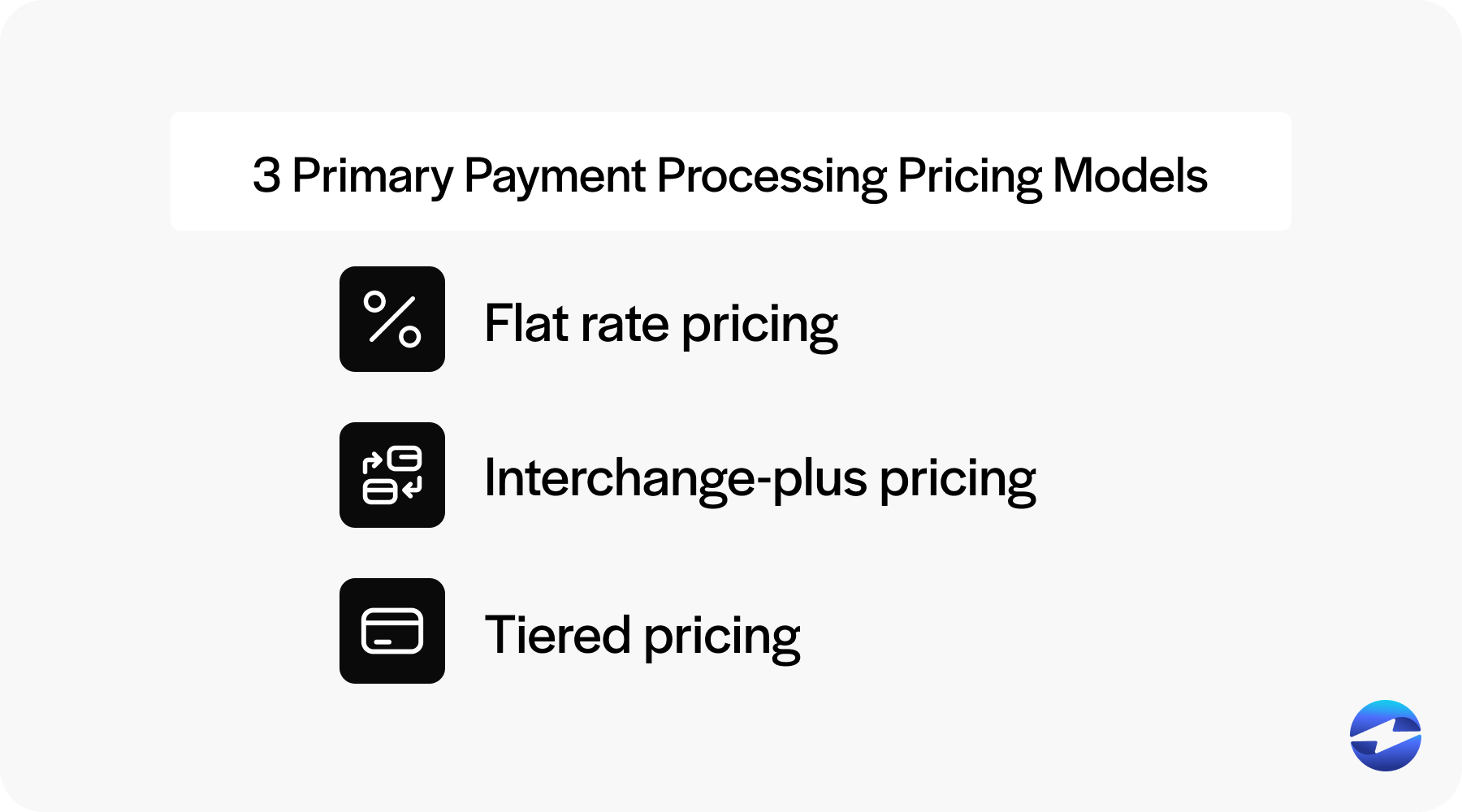

6. Choose a suitable pricing model

When choosing a pricing model for credit card processing, merchants must consider various factors to minimize credit card company charges.

The three primary payment processing pricing models include:

- Flat rate pricing: Flat rate pricing offers simplicity with a fixed percentage plus a small fee per transaction. This pricing is ideal for businesses with lower sales volumes.

- Interchange-plus pricing: Interchange-plus pricing divides fees into two components: interchange fees set by credit card networks for each transaction and the markup charged by the credit card processor. This pricing is transparent but can vary widely depending on the card type used and other transaction details.

- Tiered pricing: Tiered pricing batches transactions into tiers based on the credit card type and transaction method. Due to its variable nature, this pricing model can be less predictable.

To choose the right pricing model, merchants should assess their average credit card processing volume, the types of credit cards their customers use, whether the card is present during transactions, and their merchant category code. While each pricing structure has its benefits and drawbacks, merchants should choose the option that best suits their specific needs and business model.

7. Avoid high-risk transactions

High-risk transactions often incur higher fees from payment processors because they’re more vulnerable to fraud, disputes, and chargebacks.

High-risk transactions can include international cards, large purchases, or payments processed without a physical card present (e.g., online or over the phone).

By limiting these types of transactions, implementing strong security measures, and encouraging safer payment methods (chip-and-PIN or verified payment gateways), businesses can reduce the frequency of high-risk transactions and, in turn, lower their processing fees.

Legal considerations and compliance

Merchants must efficiently navigate legal considerations and compliance related to credit card processing to ensure they actively meet these requirements.

Merchants must adhere to the Payment Card Industry Data Security Standard (PCI DSS) to protect cardholder data. PCI compliance standards are mandatory for any entity that stores, processes, or transmits credit card data.

Other legal considerations include understanding the contractual agreements with credit card processors, which outline the fees, terms of service, and dispute resolution mechanisms. Merchants must also know the financial regulations relevant to their jurisdiction, as these may affect handling transactions and income reporting.

Privacy laws must also be taken seriously to ensure customer information is correctly used and protected.

Merchants can maintain compliance by engaging with reputable merchant services providers, implementing routine staff training in compliance standards, regularly updating systems and security measures, and staying informed on evolving credit card processing regulations and laws.

Failing to comply with applicable laws and regulations can result in hefty fines, legal action, and damage to a business’s reputation. Following these guidelines will enable merchants to avoid legal fees and maintain their reputation.

Lower your credit card processing costs with EBizCharge

Merchants can proactively understand the different credit card processing fees, negotiate with processors, select appropriate pricing models, and monitor hidden fees to manage and mitigate these costs. Working with a reliable payment processor can also help.

EBizCharge is a leading payment processing solution that offers comprehensive tools for businesses looking to optimize their credit card processing strategies and costs.

With EBizCharge, merchants can access advanced payment optimization features to capture detailed transaction data and transparent, customized pricing options that guarantee the lowest credit card processing costs for their businesses.

Companies can also take advantage of the zero-cost payment processing that EBizCharge provides to eliminate credit card processing fees by passing them to customers while ensuring compliance with all relevant regulations.

Lastly, EBizCharge offers over 100 seamless payment integrations into existing business systems like QuickBooks, NetSuite, Microsoft Dynamics, Salesforce, Sage, and more, making it the perfect option for companies looking to minimize fees while enhancing their overall payment efficiency.

Get a free cost-comparison of your current payment processing costs vs. EBizCharge

Get a free cost-comparison of your current payment processing costs vs. EBizCharge