Blog > What Are ACH Prenotes and How Do They Work?

What Are ACH Prenotes and How Do They Work?

As electronic transactions garner popularity and evolving efficiency, understanding the nuances of systems like the Automated Clearing House (ACH) becomes more imperative than ever.

Among the various features included in ACH payments, ACH prenotes are valuable tools that provide an additional layer of security to keep your funds safe and secure.

This article will delve into the world of ACH prenotes and how they affect everyday transactions, answering common questions like what is a prenote and how long is a prenote period?

What is a prenote?

An ACH prenote (or prenotification) is a zero-dollar preliminary transaction verifying and validating bank account information before initiating an electronic fund transfer (EFT).

Prenotes are used for many financial transactions, including direct deposit and payroll, recurring payments, loan repayments, vendor payments, and insurance premiums.

While some account verifications require a micro-deposit to verify funds can be transferred appropriately, ACH prenotes use $0 deposits. So, no money is needed for a prenote, meaning verification can be accomplished without using any funds for the test transaction.

Prenotes and direct deposits are often used synonymously, although they differ in their purposes.

Prenote vs direct deposit

Despite prenotes and direct deposits both being electronic payment methods, they work in different ways.

A prenote validates bank information and tests bank detail accuracy, whereas direct deposits transfer money from one bank account to another on a recurring basis.

More specifically, direct deposits facilitate the transfer of funds to an employee’s account, eliminating the need for bank visits to cash a physical check. Prenotes are often used before the direct deposit transfer to validate that the employee’s bank account information is accurate.

Therefore, the main difference between a prenote vs direct deposit is that the prenote is meant to verify that the direct deposit will transfer without error.

Since prenotes can reduce transaction errors to ensure employees get their money on time without discrepancies, it’s essential to be well-versed in this process.

What is the prenote process?

Given the relevance of prenotes with direct deposits and other EFTs, businesses must thoroughly understand how prenote account verification works.

The prenote process is relatively straightforward and involves three simple steps:

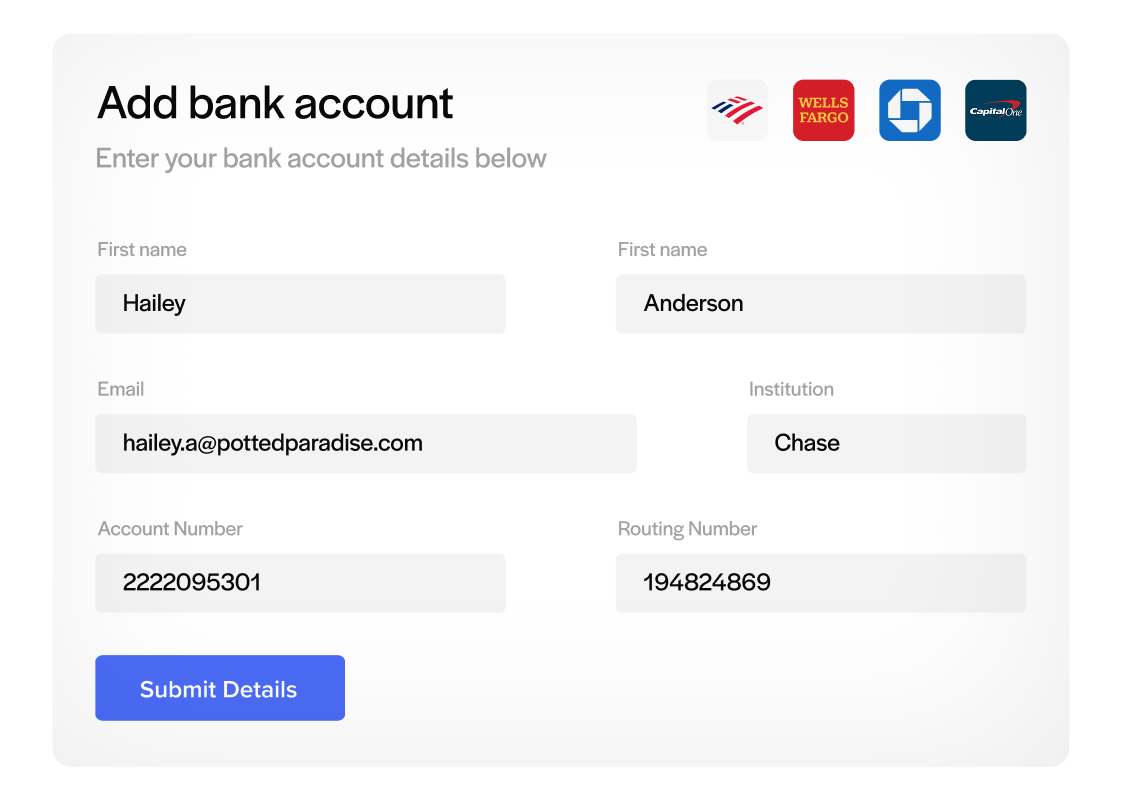

- Initiation: Before exchanging money between the sender and the recipient’s bank, a test transaction is sent along with the account information. This transaction can be a few cents or even $0. Once initiated, the transaction status is changed to pending.

- Prenote account verification: The transaction and account information are verified following the test deposit. Verifications include validating the account and routing number and identifying any errors that may have occurred during the transfer.

- Confirmation: Once verified, confirmation is sent to the initiating bank or financial institution, indicating the transaction is ready to be initiated.

An ACH return may be sent back to the initiating bank or institution if there’s an issue with the transaction. You may also receive a Notification of Change (NOC), which, along with the return, indicates the transaction failed.

That said, there are a few reasons why an ACH prenote may fail.

4 reasons why ACH prenotes can fail

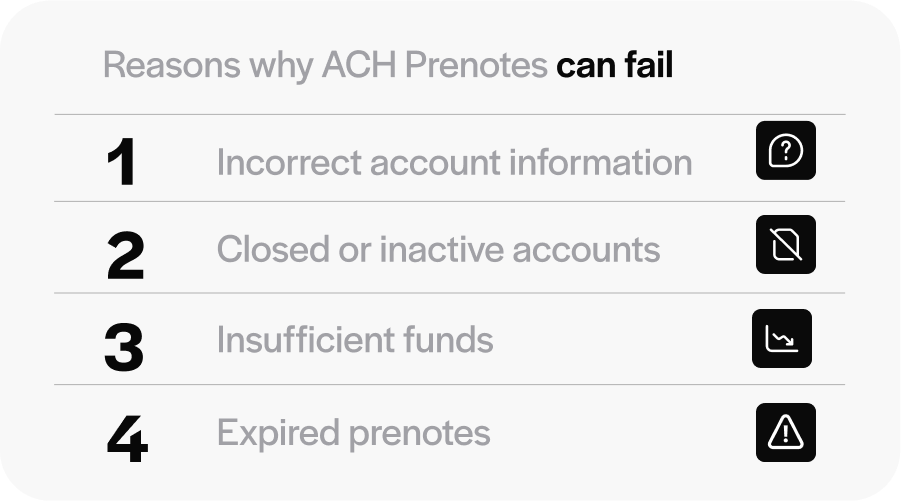

Prenotes can fail for various reasons, often related to discrepancies or issues with the account information.

Here are four reasons why an ACH prenote may not be successful:

- Incorrect account information: It’s not uncommon to input the wrong account number or routing number. If one or both of these numbers is incorrect, the prenote will fail as it will not pass verification.

- Closed or inactive account: A closed or inactive account can also cause a prenote to fail. It’s always important to check the status of the initiating and receiving accounts before using them to complete a transaction.

- Insufficient funds: Verifying sufficient funds in the initiator’s account before initiating the transaction is crucial. Since account balances constantly change, verifying the balance on the account right before the transaction is initiated is essential.

- Expired prenotes: In most cases, prenotes carry a time limit for validation. If too much time passes between the prenote and the actual transaction, the entire transaction may fail. This time frame varies depending on the financial institutions involved, so it’s important to check with your institution to find the time limit.

Since a prenote can fail for many reasons, verifying account details can help mitigate or deter discrepancies. By avoiding these discrepancies, you can enjoy the benefits of ACH prenotes.

The benefits of ACH prenotes

ACH prenotes can yield several benefits ranging from enhanced payment security to mitigated fraud risk for both financial institutions and customers.

ACH prenotes help financial institutions eliminate transaction errors, prevent ACH reversals, and reduce the need for manual payment data reviews. Customers can enhance security by verifying bank information before payments are made, preventing fraud, and the risk of unauthorized charges. ACH prenotes help improve cost efficiency and profitability.

Payment solutions like EBizCharge take this efficiency even further with eCheck and ACH processing that validates payment details upfront so ACH transactions go through the first time. With NetSuite payment processing and Sage payment integration, every successful transaction syncs directly to your accounting software — reducing errors, eliminating manual data entry, and keeping your books accurate.

While ACH prenotes come with many advantages, they also carry some limitations.

ACH prenote limitations to consider

Like most security protocols, ACH prenotes aren’t foolproof. Despite providing an additional layer of protection, prenotes still have the potential for error.

For example, there’s a small risk of a false positive or negative prenote, meaning some prenotes can pass verification without the proper account information or fail verification even with the correct account information. Although rare, these errors can create unnecessary complications, delays, and other issues. There is also no universal or standard procedure for verification across all banks, which can lead to complications and confusion in some cases.

However, the benefits of prenotes typically outweigh the drawbacks, as preventing fraud and reducing the risk of errors ultimately save all parties time and money.

Leverage ACH prenotes to secure your funds and optimize digital transactions

As a vital component within ACH payments, ACH prenotes emerge as an invaluable tool that can fortify your company’s security infrastructure to safeguard funds.

Understanding prenotes equips financial institutions and customers with the knowledge to navigate and leverage this critical element in electronic transactions.

Frequently Asked Questions

How long does a prenote take?

The prenote period is about three days, similar to the ACH transfer timeline. These time periods may vary depending on the bank’s cut-off time, leaving the answer to how long is a prenote period up to the individual banks.

For example, if you initiate a prenote on a Tuesday before the bank’s cut-off time, you can likely begin making payments on Friday if the prenote did not result in notification of change or ACH return.

However, if you initiate the prenote after the cut-off time, the period may extend to four days or more. Cut-off times can vary from bank to bank.

Can ACH prenotes be used for international transactions?

ACH prenotes are primarily used in the U.S. and its ACH network. While international ACH transactions are possible, prenotes are typically not adopted outside the U.S.

Can ACH prenotes be used for one-time transactions?

ACH prenotes are intended for ongoing transactions. That’s not to say prenotes can’t be used for this purpose, but they may not be the optimal solution.

For one-time transactions, other verification methods like instant bank verification may be more practical as they provide real-time confirmation of account details and enhanced accuracy.

Do ACH prenotes have transaction fees?

ACH prenotes typically don’t incur fees, but fees may be associated with other aspects of ACH transactions, such as the actual transfer.

Given the prominence of ACH transactions and prenotes, it’s important to understand how prenotes work as well as the function they serve.