Blog > The Ultimate Guide to NetSuite Payment Solutions

The Ultimate Guide to NetSuite Payment Solutions

Managing payments in NetSuite isn’t just about clicking “Apply Payment”—it’s about building a system that supports cash flow, reduces busy work, and gives you visibility across your business. Whether you’re part of a lean finance team, an overextended operations department, or the IT crew supporting both, choosing the right NetSuite payment solution makes a difference.

This guide will help you understand what matters when evaluating a NetSuite application for payment software, what to look for, and how to avoid the traps that can cost you time and money later.

Why Payment Solutions Matter in NetSuite

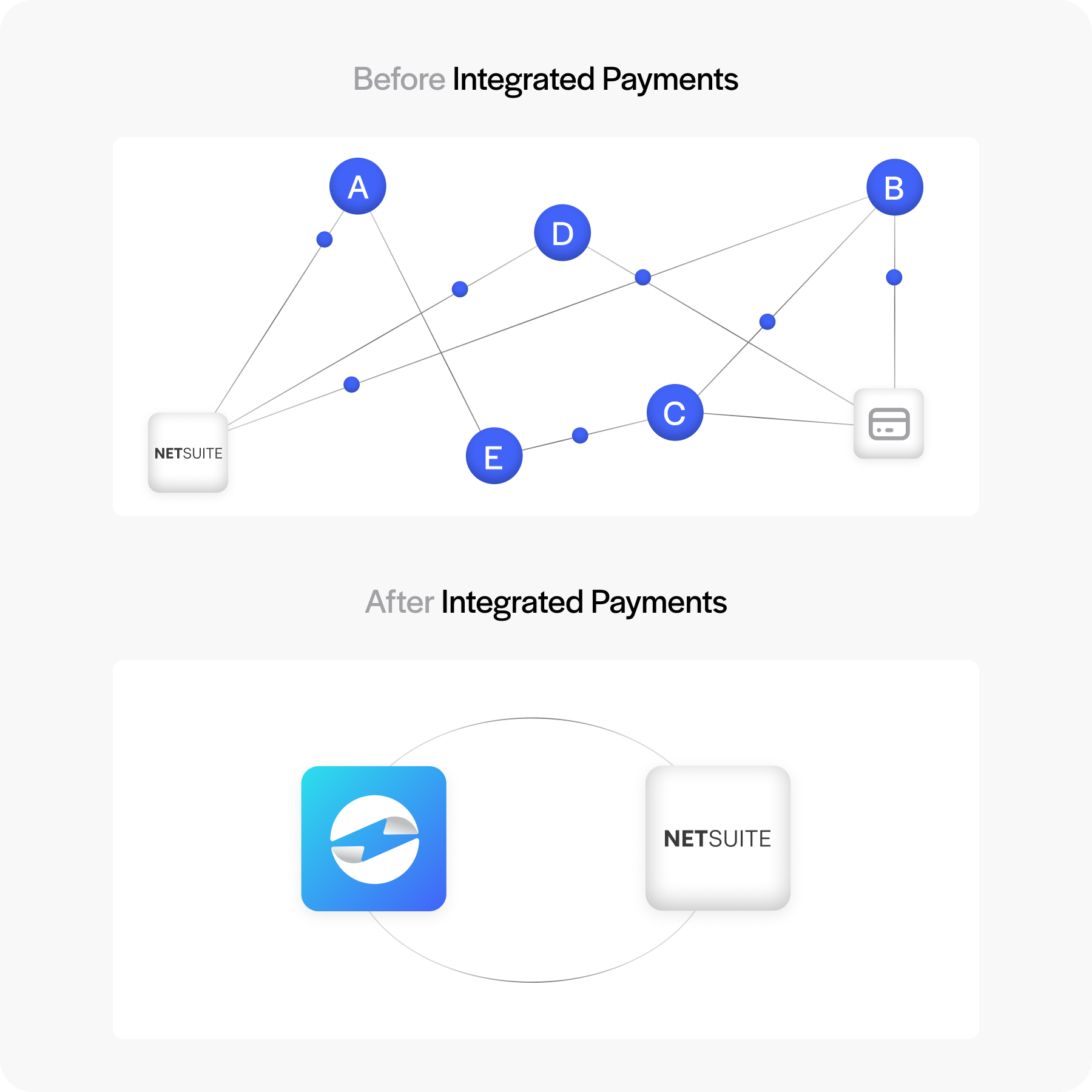

Payment processing lies at the heart of accounts receivable, revenue, and customer satisfaction. Yet many teams still use disconnected systems that create delays and inconsistencies. Manually posting payments, updating general ledger entries, and reconciling transactions across platforms isn’t just inefficient—it’s error-prone and costly.

A well-integrated payment management NetSuite integration brings everything under one roof. When your ERP and payment processor talk to each other in real-time, you save hours a week and reduce the risk of human error. The result? Better data, cleaner books, and fewer late payments.

Having a real-time, embedded NetSuite application for payment module improves cash flow by shortening the time between invoicing and settlement. It also makes life easier for customers by offering frictionless payment options.

Core Features of a NetSuite Payment Solution

Not all tools are created equal. A good NetSuite payment solution should work behind the scenes, automating key processes without forcing users to learn a new system from scratch.

Here are some features to look for:

- Ability to accept multiple payment types—credit cards, ACH, and digital wallets—directly in NetSuite.

- Built-in PCI compliance and tokenization for secure storage of payment credentials.

- Automation for invoice-based payments, especially in B2B environments.

- Customer payment portal with embedded links to pay without logging into a separate platform.

- Clean reconciliation tools that tie every payment to general ledger entries and transaction records.

A good NetSuite payment solution should integrate seamlessly and provide value to non-technical users. These core features are the foundation of smooth, scalable payment processing.

NetSuite Native vs. Integrated Solutions

NetSuite offers native tools, like SuitePayments, which are built for ease of use and quick activation. These native tools offer simplicity and basic functionality for processing payments within the system. However, they fall short when businesses require advanced features such as a robust customer portal, international payment capabilities, or deeper customization options for complex workflows.

Third-party payment gateway integrations offer more features and flexibility. These integrations can offer dynamic invoicing, advanced fraud detection, and customer data insights. They often have deeper connections with NetSuite supported payment gateways, so you can work with processors you already trust or prefer.

SuitePayments is a suitable solution for businesses with simple payment needs but may require custom workarounds for B2B workflows or recurring billing setups. Third-party NetSuite application for payment software solutions tend to support more complex requirements out of the box but may require more configuration during implementation.

Ultimately, your choice should reflect your company’s specific needs and technical capabilities. Whether you prioritize a fast, simple setup or a more advanced, flexible feature set, make sure your team has the resources and expertise to manage and maintain the system you choose.

How to Choose a Payment Provider

Choosing a payment processor for NetSuite is more than a pricing conversation. It’s about how well the tool fits your workflows and how much it can grow with you.

Here are a few questions to ask your provider:

- What are the total costs, including transaction fees, monthly charges, and support?

- How does the provider handle fraud protection and PCI compliance?

- Does it support the types of payments you accept (ACH, credit card, international)?

- Is real-time sync supported?

- How responsive is support when issues arise?

You should also consider if the provider supports your business model—B2B, B2C, recurring billing, or subscription models all have different needs.

Above all, look for a partner who understands payment management NetSuite requirements and can walk you through the trade-offs.

Implementation Factors

Implementing a NetSuite application for payment module isn’t as simple as flipping a switch. Even with the best tools, success ultimately depends on effective planning, clear communication, and stakeholder buy-in.

Consider:

- Time and resource requirements for implementation. Some solutions can be up and running in a week, while others may take several weeks or even months. Field mapping, transaction testing, and user role setup.

- Training across departments, especially AR and support, to ensure adoption.

Make sure your team knows how the new payment gateway works in NetSuite, what it automates, and what they’re still responsible for.

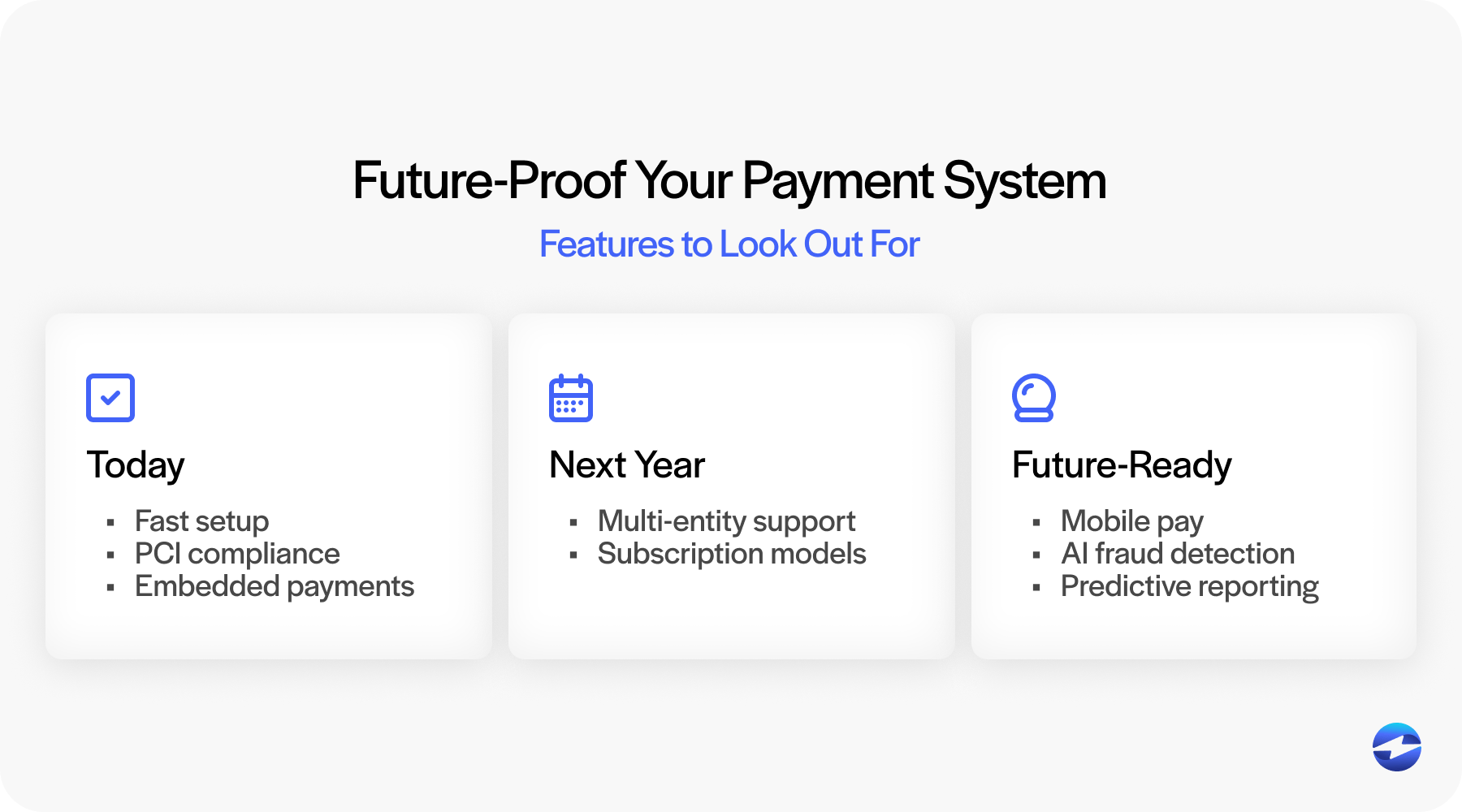

Future Proofing Your Payment Infrastructure

The solution you choose today should still serve you a year or two down the road. That’s why scalability matters—not just in terms of volume but in terms of adapting to new business requirements and maintaining long-term support.

- Can it support international payments, multi-entity setups, and complex billing cycles without needing constant reconfiguration?

- Does the vendor provide regular updates and responsive support as NetSuite evolves?

- Is their product roadmap aligned with your growth plans, such as support for new payment methods, enhanced reporting, or more automation?

When evaluating NetSuite supported payment gateways, don’t just assess current functionality—look at how they prepare for what’s next. A forward-thinking provider will not only respond to change but drive innovation. Choosing a NetSuite application for payment solution that stays ahead of the curve ensures your system keeps pace as your business grows and changes.

The EBizCharge Option

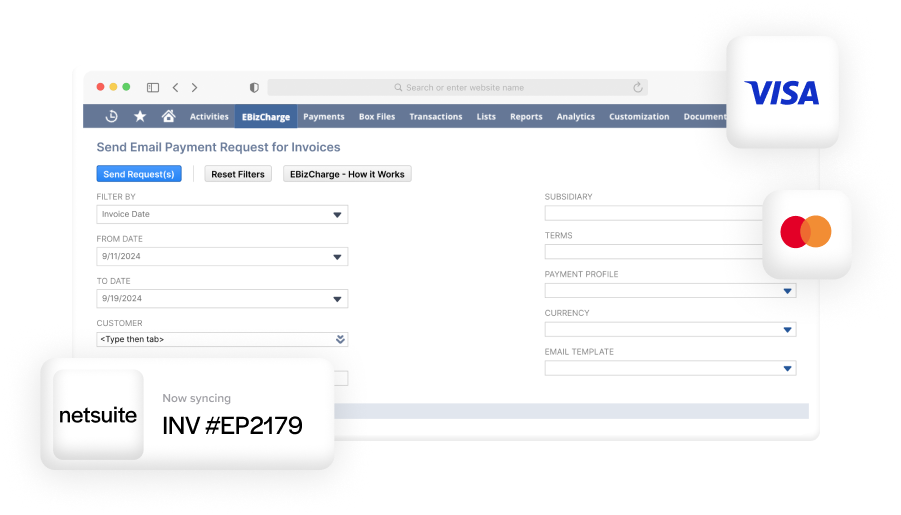

There’s no one-size-fits-all NetSuite payment solution. What matters is finding the tool that fits your workflows, simplifies your operations, and helps your team move faster with fewer mistakes. EBizCharge is a proven NetSuite payment solution with deep integration and a strong track record. Its embedded model allows users to process payments without ever leaving the NetSuite environment.

It supports email invoice links, saved payment methods, and multi-entity roll-ups—all designed to make life easier for AR and finance teams. Additionally, reconciliation is automatic, reducing manual entry and freeing up time.

As a NetSuite application for payment module, EBizCharge is flexible enough for companies with complex billing models and powerful enough to support long-term growth. It’s a good choice for those who want robust functionality without sacrificing usability.