Blog > The Benefits of Using a Payment Portal with Your Sage ERP Software

The Benefits of Using a Payment Portal with Your Sage ERP Software

Businesses are constantly seeking innovative ways to streamline their operations. One such innovation is the integration of payment portals with accounting software, a move that can significantly enhance operational efficiency.

One popular business system for managing various operations is Sage. When integrated with a payment portal, Sage users can transform their invoicing operations to focus on more growth and a better user experience.

This article will explore the advantages of leveraging a payment portal alongside your Sage ERP software.

What is Sage ERP software?

Sage ERP software is designed to help businesses manage various operations, such as finance, supply chain, manufacturing, services, and more.

With features like financial management for tracking income and expenses, inventory management for monitoring stock levels, and customer relationship management (CRM) for handling customer data and sales leads, Sage ERP provides a centralized software to oversee vital business functions.

Sage also includes project management tools for merchants to effectively plan and oversee projects, as well as human resources management for maintaining employee records and payroll.

Integrating a payment portal with Sage enables your company to upgrade this platform by enhancing operational efficiency.

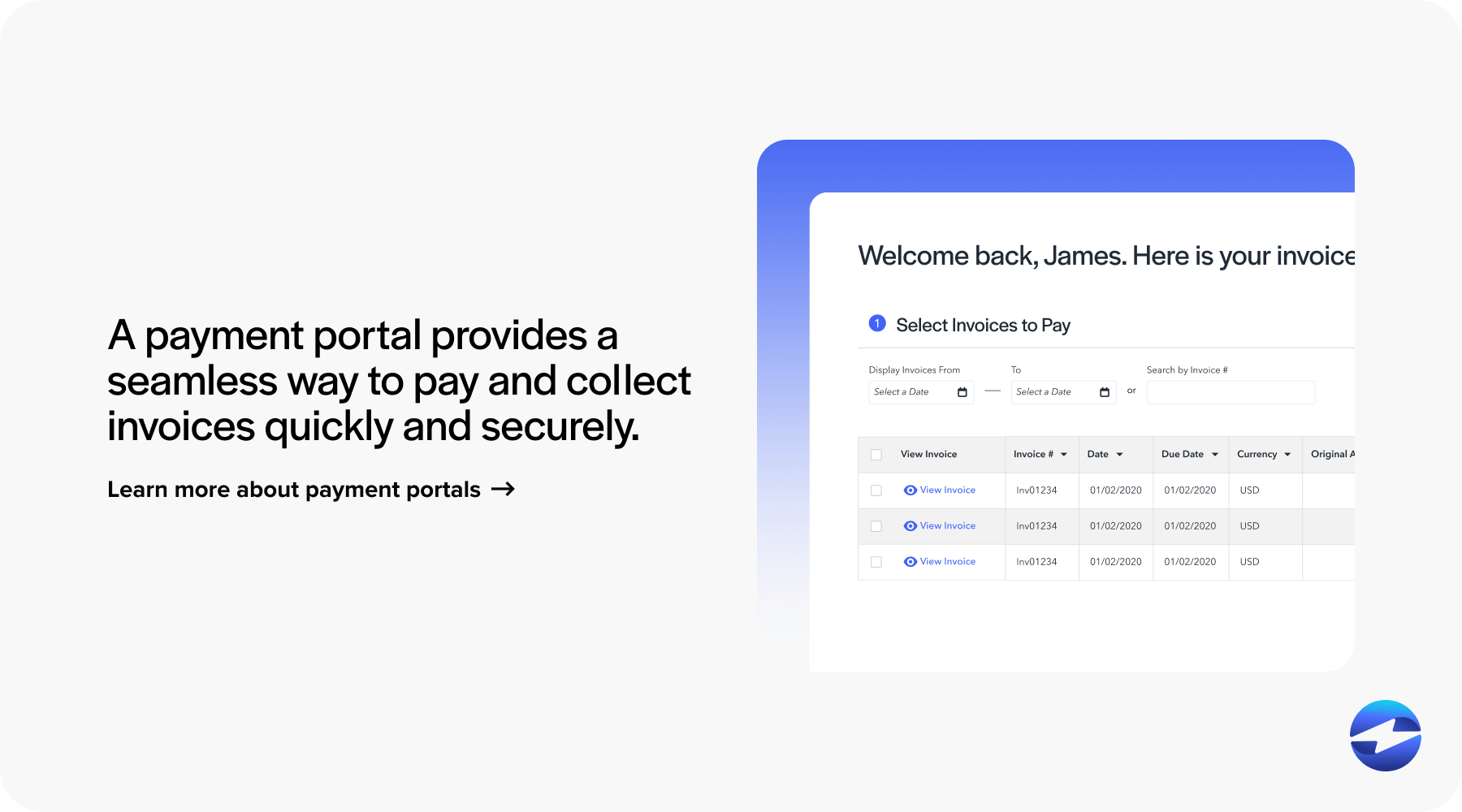

What is a payment portal?

A payment portal facilitates electronic transactions between merchants and their customers, providing a seamless way to pay and collect invoices quickly and securely.

Your payment processor will provide the necessary payment portal software to authorize and transfer funds from customers’ accounts to your business’s account.

Businesses use billing portals to accept various payment methods, including credit cards, debit cards, and Automated Clearing House (ACH) or eChecks, for a flexible and convenient payment experience.

Payment portals are often integrated with accounting or ERP systems to ensure transactions are recorded accurately and synced directly into this software.

The following section will outline the main benefits of using this extensive tool within your Sage software.

7 benefits of using a payment portal with Sage ERP software

As consumer expectations evolve, leveraging an integrated payment portal becomes essential for maintaining financial stability and optimizing cash flow.

Here are seven benefits of using a payment portal with Sage ERP software:

- Enhanced payment processing efficiency

- Improved cash flow and financial visibility

- Secure and PCI-compliant transactions

- Better user experience and convenience

- Reduced errors and operational costs

- Seamless integration and scalability

- Advanced reporting and analytics to improve decision-making

1. Enhanced payment processing efficiency

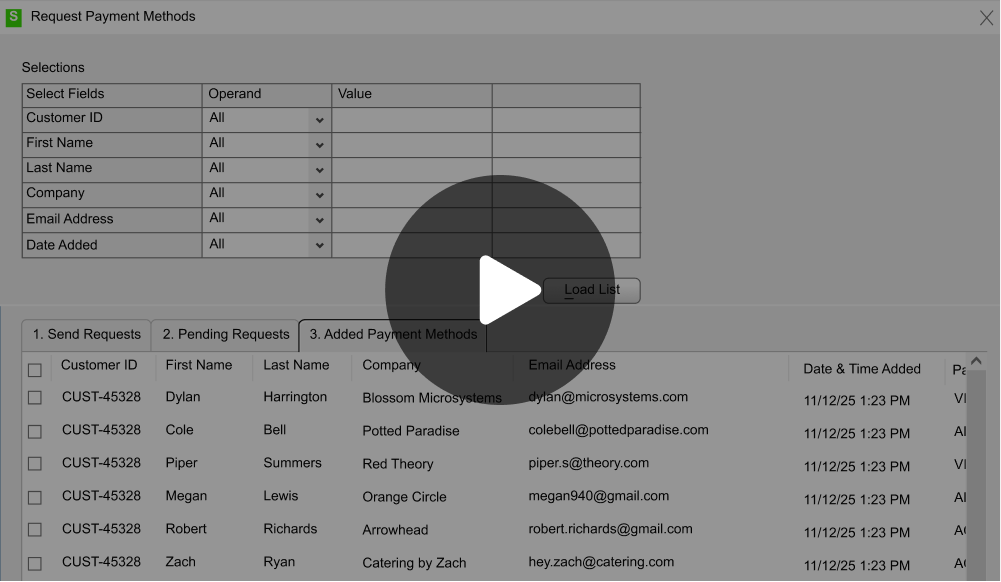

Integrating a payment portal into your Sage ERP streamlines payment workflows, eliminating the need for manual data entry.

This portal allows transactions to be processed instantly, reducing administrative tasks and ensuring payments are recorded automatically within Sage.

This approach also improves payment processing efficiency by automating payment management, enabling merchants to prioritize more time for growth initiatives.

2. Improved cash flow and financial visibility

Real-time payment processing in Sage ensures businesses receive funds faster, improving cash flow and financial stability.

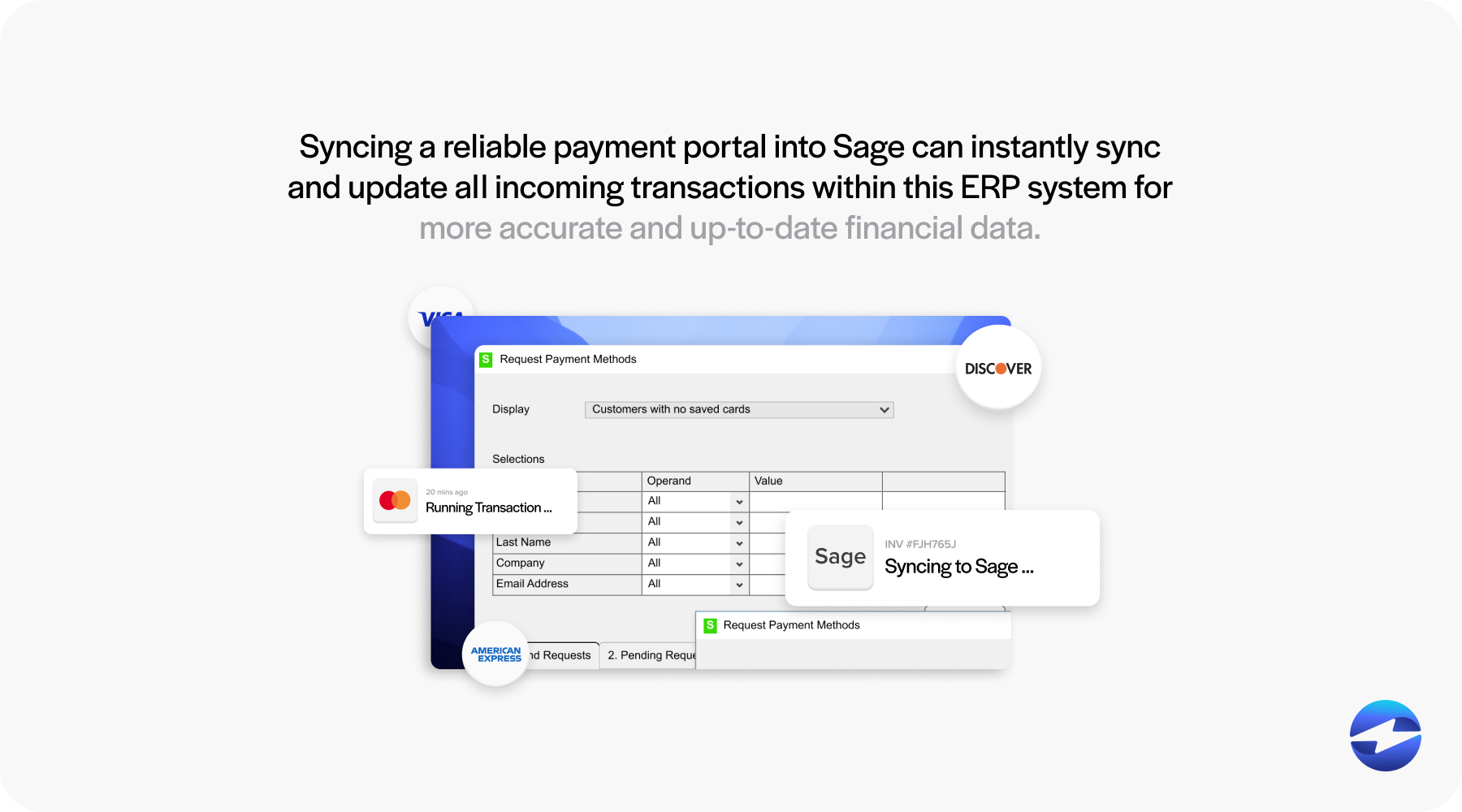

Syncing a reliable payment portal into Sage can instantly sync and update all incoming transactions within this ERP system for more accurate and up-to-date financial data. This enhanced visibility also allows for better financial planning and decision-making.

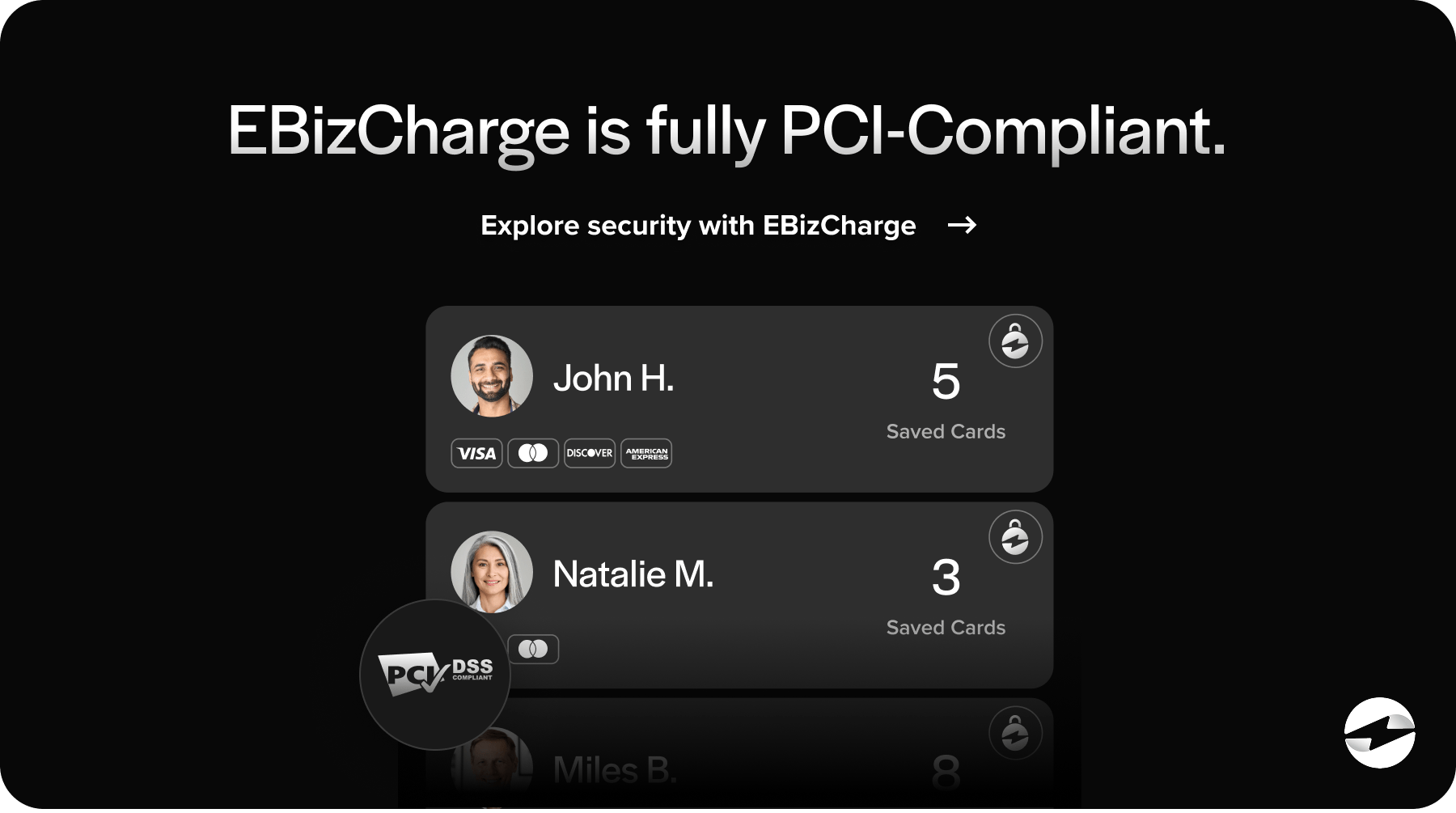

3. Secure and PCI-compliant transactions

With a trusted Sage payment portal, your business can ensure compliance with Payment Card Industry Data Security Standards (PCI DSS) by adhering to various security protocols and implementing the necessary measures to protect sensitive customer payment data.

Your payment portal should provide standard payment security features like tokenization and encryption, fraud prevention tools, off-site data storage, 3D Secure, and more, all of which can safeguard payment data and reduce fraud risks and unauthorized access. This security is crucial for maintaining customer trust and avoiding financial liabilities.

4. Better user experience and convenience

Nowadays, consumers rely on quick and seamless payment options. Thankfully, Sage payment portals support this with numerous payment tools and supported methods.

Your Sage payment portal can provide an effortless user experience with convenient options for customers to pay invoices online, in person, over the phone, and on the go, as well as supported payment methods like credit and debit cards and ACH/eChecks.

Customers can also leverage payment collection tools like an online billing portal, secure email payment links, recurring billing, and many other options to accelerate this process.

Automated invoicing and online payment options reduce friction in the payment process, enhancing customer satisfaction and increasing the likelihood of on-time payments.

5. Reduced errors and operational costs

Since manual payment processing can lead to data entry mistakes, reconciliation errors, and increased administrative workload, working with a processor that automates these operations is essential.

By automating payment recording and reconciliation in your Sage software, merchants can reduce costly errors and minimize labor-intensive tasks. This not only saves time but also lowers operational expenses related to payment management.

6. Seamless integration and scalability

A payment portal compatible with Sage ERP will guarantee a more effortless integration with existing workflows, eliminating the need for separate payment processing systems.

Sage users have several options depending on which version of the software they run. A Sage payment integration connects payment processing directly to platforms like Sage 50, Sage 100, and Sage 300, ensuring transactions are recorded and reconciled without extra steps. For businesses on Sage Intacct, payment processing for Sage Intacct brings that same automation to a cloud-based ERP environment, giving finance teams real-time visibility into every payment. Both options scale alongside your business and keep your payment workflows tightly connected to your accounting data.

As businesses grow, your Sage payment integration can scale to accommodate higher transaction volumes and additional payment methods, making it a powerful solution that will adapt to your evolving needs.

7. Advanced reporting and analytics to improve decision-making

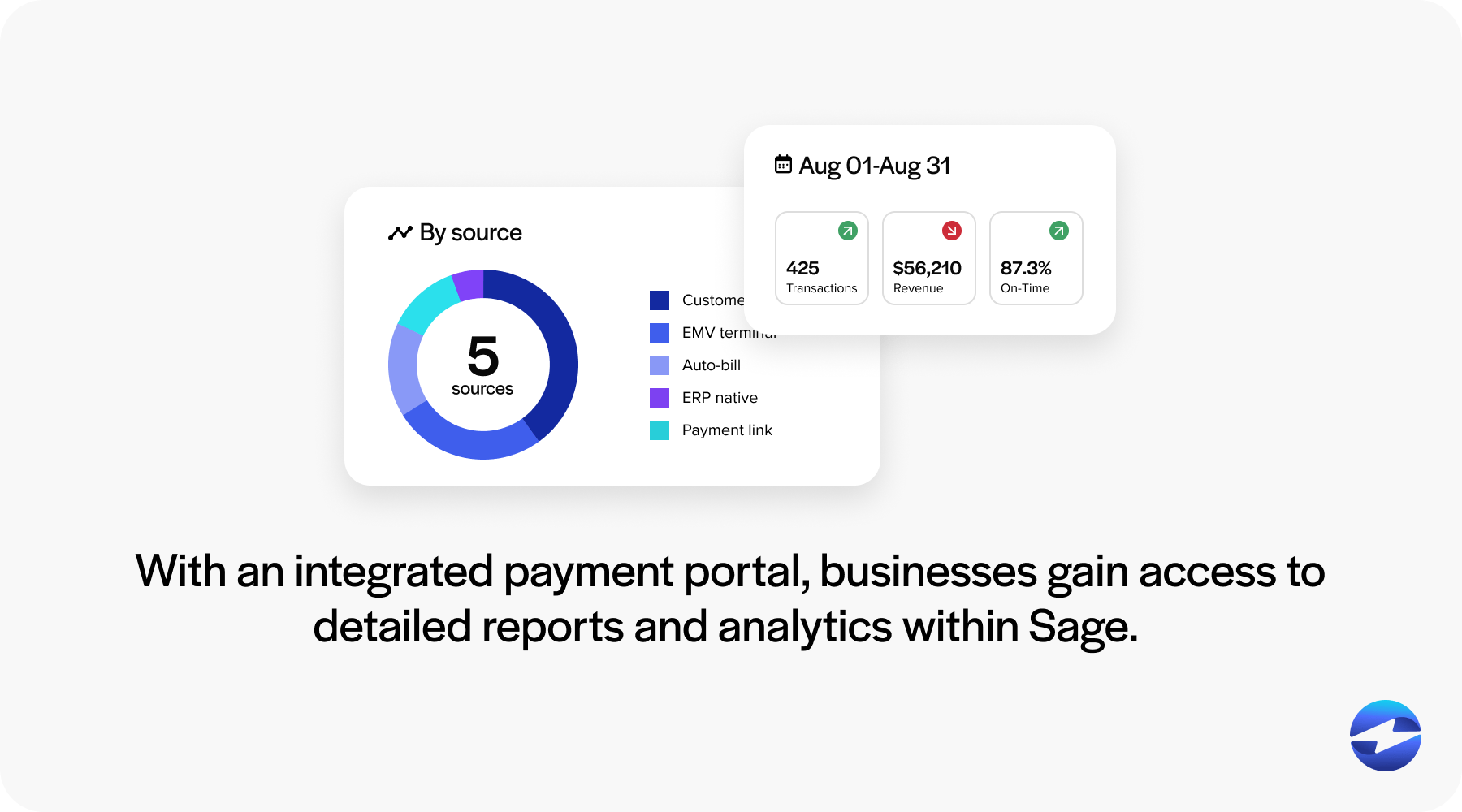

With an integrated payment portal, businesses gain access to detailed reports and analytics within Sage.

These portals can provide real-time insights into transaction history, payment trends, and outstanding invoices, allowing merchants to track performance, identify improvement opportunities, make informed decisions, and enhance financial management.

Thanks to these benefits and many others, a robust payment portal in Sage ERP software will optimize payment processing, enhance security, improve customer experience, and increase financial control for your company. This integration ultimately leads to greater efficiency, reduced costs, and a more streamlined payment workflow.

When selecting a payment processing solution for your Sage system, look for trusted solutions like EBizCharge.

EBizCharge: A powerful payment portal for Sage users

EBizCharge is a payment processing solution that provides a powerful payment portal that integrates seamlessly with Sage ERP software, simplifying payment operations and enhancing overall efficiency.

The EBizCharge for Sage integration consists of robust tools designed to streamline payment processing, reduce manual tasks, and improve financial management.

One of its standout features is real-time payment posting, which automatically updates payments in Sage without requiring manual entry, saving time and minimizing errors. The customer payment portal also provides a secure, self-service platform where customers can conveniently view and pay invoices online, improving the overall payment experience.

With customizable reporting, merchants gain access to detailed reports that help track payments and monitor cash flow, offering valuable financial insights.

EBizCharge is also fully PCI-compliant to ensure all transactions in Sage meet various industry security standards to protect sensitive payment data and reduce fraud.

By integrating EBizCharge with Sage, businesses benefit from faster payment processing, greater customer satisfaction, and more financial visibility.

Overall, EBizCharge transforms payment operations for merchants by automating invoices, enhancing security, and supporting long-term growth.