Blog > The Benefits of Processing Payments in Epicor

The Benefits of Processing Payments in Epicor

In the fast-paced world of modern commerce, efficient payment processing is essential for successful transactions.

Epicor, a global provider of industry-specific business software, carries an arsenal of tools and features to enhance productivity and profitability by integrating all facets of a business into one easy-to-use platform.

What is Epicor?

Epicor is a comprehensive enterprise resource planning (ERP) software designed to streamline and optimize various aspects of business operations. It provides modules for finance, manufacturing, supply chain management, human resources, customer relationship management (CRM), and more.

Epicor integrates data across departments, enabling businesses to improve efficiency, reduce costs, enhance productivity, and make informed decisions based on real-time insights.

With its customizable features and scalability, Epicor caters to businesses of all sizes and industries, helping them manage their operations effectively and drive growth.

Best practices for implementing Epicor payment processing

Adhering to standard best practices is crucial when implementing Epicor payment processing. These protocols can ensure your Epicor payment processing functionality is working properly, prioritizing performance, security, and reliability.

Here are some of the best practices your business can implement to process payments in Epicor successfully:

- Use a secure integration

- Adhere to compliance and security standards

- Optimize the user experience

- Implement robust reporting and analytics

- Run routine updates and maintenance

- Ensure transparent communication

Use a secure integration

Seamless and secure payment integrations are essential to effectively implementing Epicor payment processing. Businesses can look to trusted, top-rated payment processing solutions like EBizCharge for a reliable Epicor payment solution.

Payment integrations should use secure Application Programming Interfaces (APIs) with robust authentication and authorization mechanisms, such as OAuth and API keys, to control access and verify the identity of users and systems. Additionally, implementing data encryption for information both in transit and at rest is vital. This can be achieved by using SSL/TLS protocols for data in transit and employing strong encryption standards for data storage.

These practices contribute to compliance and security standards that are essential to a seamless Epicor credit card processing experience across all versions, from Epicor 9, Epicor 10, Epicor Kinetic, and Epicor ECC.

Optimize the user experience

Epicor payments should be intuitive and seamless for users. To achieve this, implement a user interface that’s easy to navigate, reducing the number of steps required to complete a transaction. Additionally, you should regularly gather user feedback and refine the payment system to meet evolving user needs, as an optimized user experience can lead to quicker payment cycles and increased customer satisfaction levels.

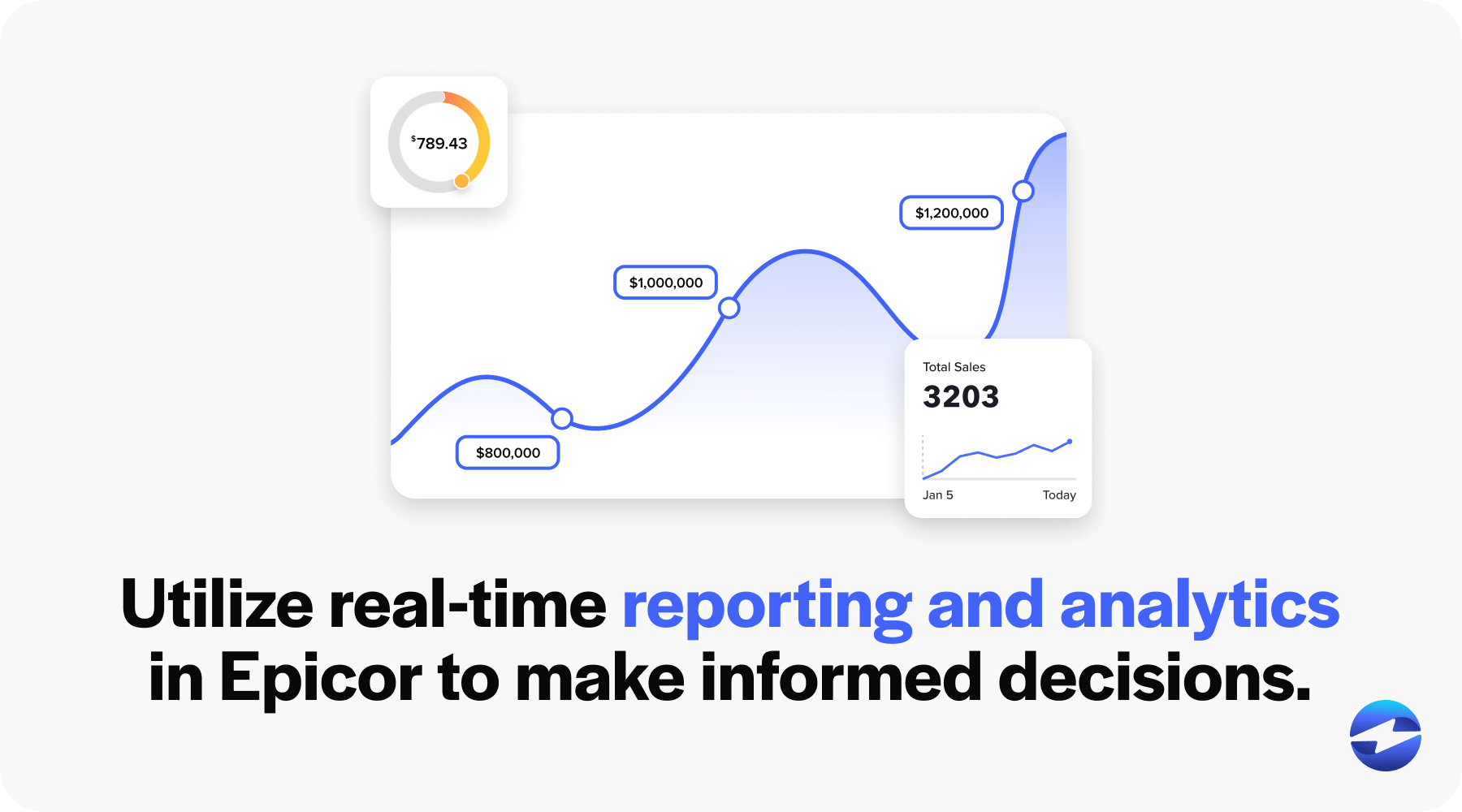

Implement robust reporting and analytics

Comprehensive reporting and analytics are crucial elements for informed decision-making. Therefore, it’s essential to work with a provider that offers real-time insights into payment processes, allowing tracking of key performance indicators (KPIs) such as payment card volume, processing times, and failure rates. You can also generate customizable reports tailored to different company roles and departments.

Analytics can be used to forecast trends, identify payment issues, and optimize the payment process. It’s essential to ensure that financial reports accurately reflect payment data for better financial planning and asset management. With robust reporting and analytics, businesses can make strategic decisions that positively impact the bottom line.

Run routine updates and maintenance

Staying informed is vital for maintaining an effective payment processing system. On top of your payment provider’s patches and updates, businesses should keep up with Epicor’s patches and updates to access new features and bug fixes. You can schedule system maintenance during off-peak hours to minimize disruptions and consistently back up data before performing updates or maintenance tasks.

Your company can also train its staff on these new payment processing features and updates to ensure smooth adoption. By keeping the system up-to-date, companies can avoid potential security threats and operational inefficiencies.

Ensure transparent communication

Clear and proactive communication is critical to successfully implementing and managing Epicor credit card processing. Businesses should communicate any changes and updates to all stakeholders, including customers, staff, and management.

Providing training and resources is essential to preparing users to work effectively with the new system. A good payment provider will give you proper training to manage the integrated system, ensuring they’re prepared to help customers with any problems that may arise. Additionally, offering a clear avenue for reporting issues or suggestions and providing timely responses helps address any concerns that may arise. It’s also crucial to collaborate with all departments to understand their needs and incorporate their feedback into the payment system.

A well-thought-out implementation strategy can facilitate streamlined operations, bolster security, improve customer satisfaction, and insightful data analysis.

Now that you’re familiar with some best practices of processing payments in Epicor, you should also look at the benefits of implementing it.

What are the benefits of processing payments in Epicor?

Businesses can pair a powerful payment solution with their Epicor systems to simplify financial transactions in a secure, efficient, and cost-effective manner.

Here are seven benefits of processing payments in Epicor:

- Real-time processing and reporting

- Automated cash application

- Enhanced security

- Cost savings

- Improved customer experience

- Scalability and flexibility

- Dedicated support and training

1. Real-time processing and reporting

With the right payment solution, Epicor users can enjoy real-time payment processing, ensuring that transactions are captured and reconciled immediately. This accelerates cash flow and provides up-to-the-minute financial data, which is crucial for timely decision-making.

Real-time reporting also empowers businesses with the insights needed to effectively manage finances. Fluid access to transaction records, monthly statements, and financial reports provide immediate visibility into financial health.

2. Automated cash application

Automated cash application enhances the overall efficiency and reliability of financial reports by quickly applying cash to the correct accounts, reducing delinquencies, and improving the accuracy of projections.

Companies can leverage the automated cash application features provided by their payment processors to drastically reduce the time it takes to close monthly statements, enabling a more dynamic and responsive financial management approach.

This functionality is particularly critical for larger enterprises with substantial volume under management, where manual cash application can become a significant logistical challenge.

Businesses can automate payments in Epicor to ensure they’re processed quickly and accurately, leading to better inventory, distribution management, and performance.

3. Enhanced security

With a reliable payment processing solution that follows industry-standard protocols for Payment Card Industry Data Security Standards (PCI DSS) compliance, your business can ensure customer payment data is protected while processing payments in Epicor.

Tokenization and encryption replace sensitive information with unique identifiers, making the data virtually useless to unauthorized parties. Additionally, Epicor includes tools and measures aimed at fraud prevention, keeping malicious attempts at bay and protecting the integrity of every transaction.

4. Cost savings

Payment processing fees can be a significant expense for businesses that receive a large volume of credit card payments. Thankfully, syncing your Epicor system with the right automated payment processing solution can lower these costs.

With a cost-efficient payment processor, businesses can reduce transaction fees to manage costs more effectively without compromising service quality. This is especially important for supply chain management, distribution, and retail industries where margins can be tight.

5. Improved customer experience

Providing a seamless and secure payment experience enhances overall customer satisfaction. The right payment processing solution will provide Epicor users with flexible payment options and a streamlined checkout process, delivering swift and seamless transactions.

Flexible payment options cater to a broader customer base, addressing varied preferences and increasing the likelihood of repeat business due to the convenience offered.

6. Scalability and flexibility

As businesses grow, so do their payment processing needs. Epicor is designed with scalability in mind, enabling enterprises to adjust their payment processing requirements as their transaction volumes and complexity increase. This adaptability allows businesses to respond to changing business needs and different payment technologies.

Additionally, Epicor offers customization options, ensuring that businesses can tailor their payment systems to fit specific requirements. This means that as businesses expand into new markets or adjust their sales models, they can be confident that their payment system will adapt accordingly. Combined with a comprehensive payment solution, businesses can enjoy this scalability and flexibility to enhance their business operations.

7. Dedicated support and training

As with any new system, questions may arise regarding use and integration. On top of the payment provider’s support team, Epicor’s ERP provides users access to their own dedicated support team as well. This resource is invaluable for resolving any issues that arise quickly and efficiently. Furthermore, Epicor commits to empowering users with knowledge through comprehensive training, ensuring that staff can fully leverage the Epicor credit card processing tools available to them, minimizing downtime and optimizing the user experience.

Processing payments in Epicor provides numerous benefits for businesses. For a more streamlined experience, use comprehensive third-party payment providers like EBizCharge to enhance the Epicor system’s overall efficiency, security, and functionality.

Enhancing the Epicor experience with EBizCharge

Incorporating EBizCharge into your Epicor system can significantly enhance your overall payment processing experience for your business and its customers.

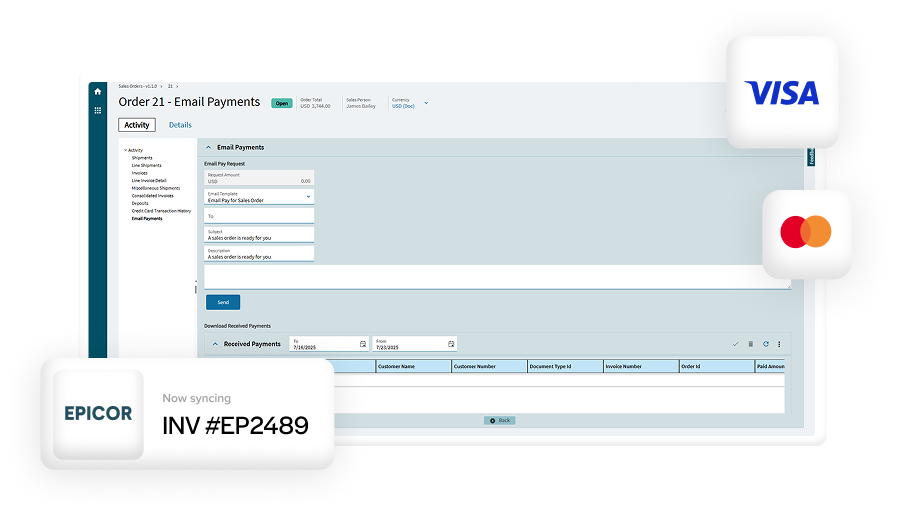

EBizCharge offers an all-in-one suite of robust payment collection tools and features to process payments in Epicor seamlessly. These features include online customer payment portals, automatic payment posting, secure email payment links, recurring billing, and more to offer a comprehensive solution that addresses the unique needs of various industries.

EBizCharge is a cost-efficient payment software that provides competitive transaction fees and reduced administrative costs. Additionally, EBizCharge’s scalable and flexible nature ensures that as businesses grow, their payment processing system can adapt to evolving needs and increasing transaction volumes.

This top-rated payment solution enhances the Epicor payment processing system by providing advanced payment processing capabilities, including streamlining automated workflows, real-time transaction reporting, and seamless customer payment experiences.