Blog > The Benefits of Embedded Payments and Processing Payments in Sage

The Benefits of Embedded Payments and Processing Payments in Sage

Sage is a renowned provider of accounting software and services tailored for small to medium-sized businesses. It seamlessly integrates various accounting products and solutions to streamline financial operations, support informed business decisions, and offer insightful real-time transaction information.

Businesses can also incorporate embedded payments for more efficient and integrated transaction processing in Sage.

What are embedded payments?

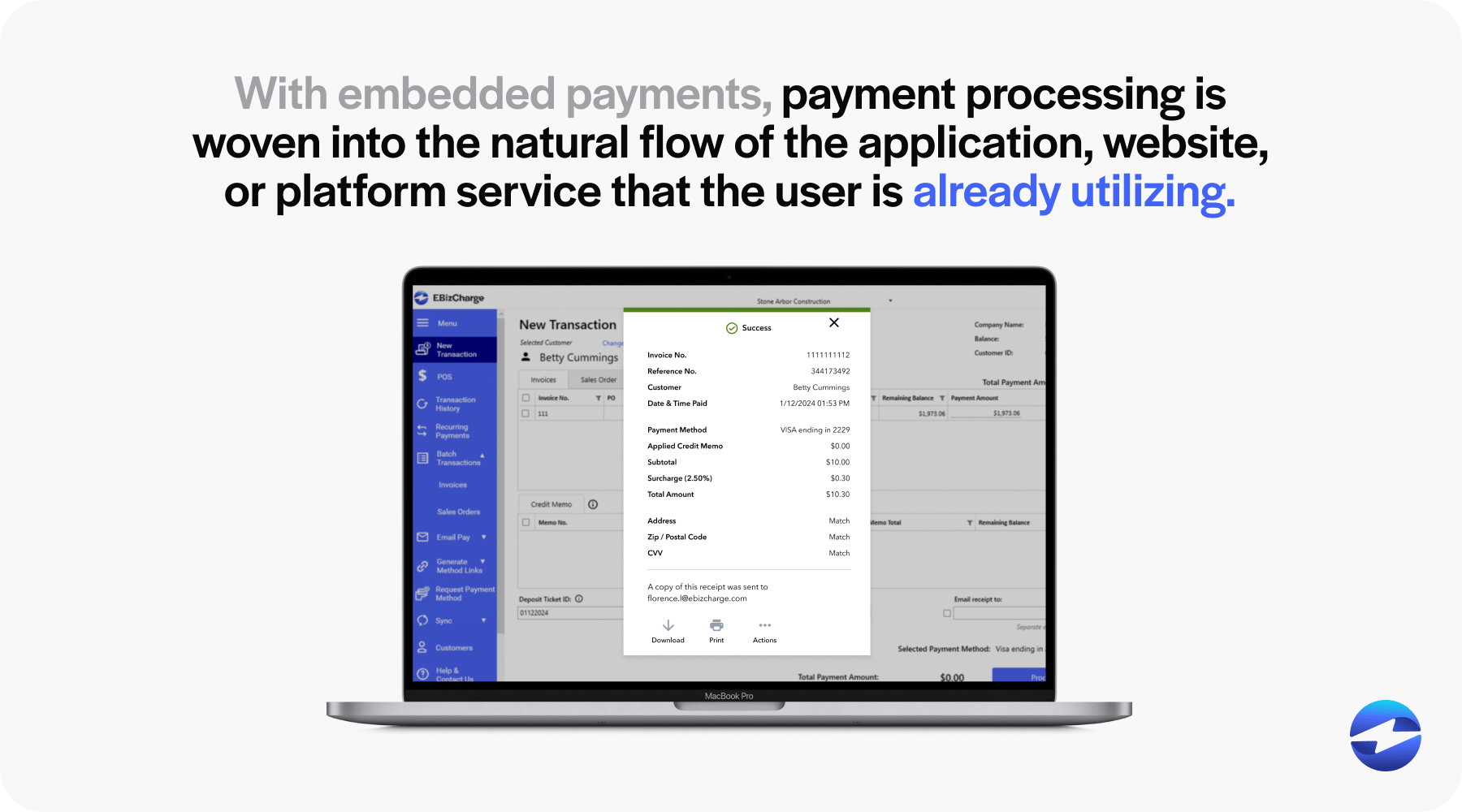

Embedded payments are a type of financial transaction that enables payments directly within the interface of another software or service.

More specifically, embedded payments allow users to conduct monetary transactions without having to navigate away to separate payment portals or systems. Instead, payment processing is woven into the natural flow of the application, website, or platform service that the user is already utilizing.

The overall goal of embedded payments is to create a seamless, efficient, and more user-friendly experience.

How to use embedded payments in Sage

Embedding payments in your Sage payment processing software is a game-changer for business operations and the efficiency of your payment process.

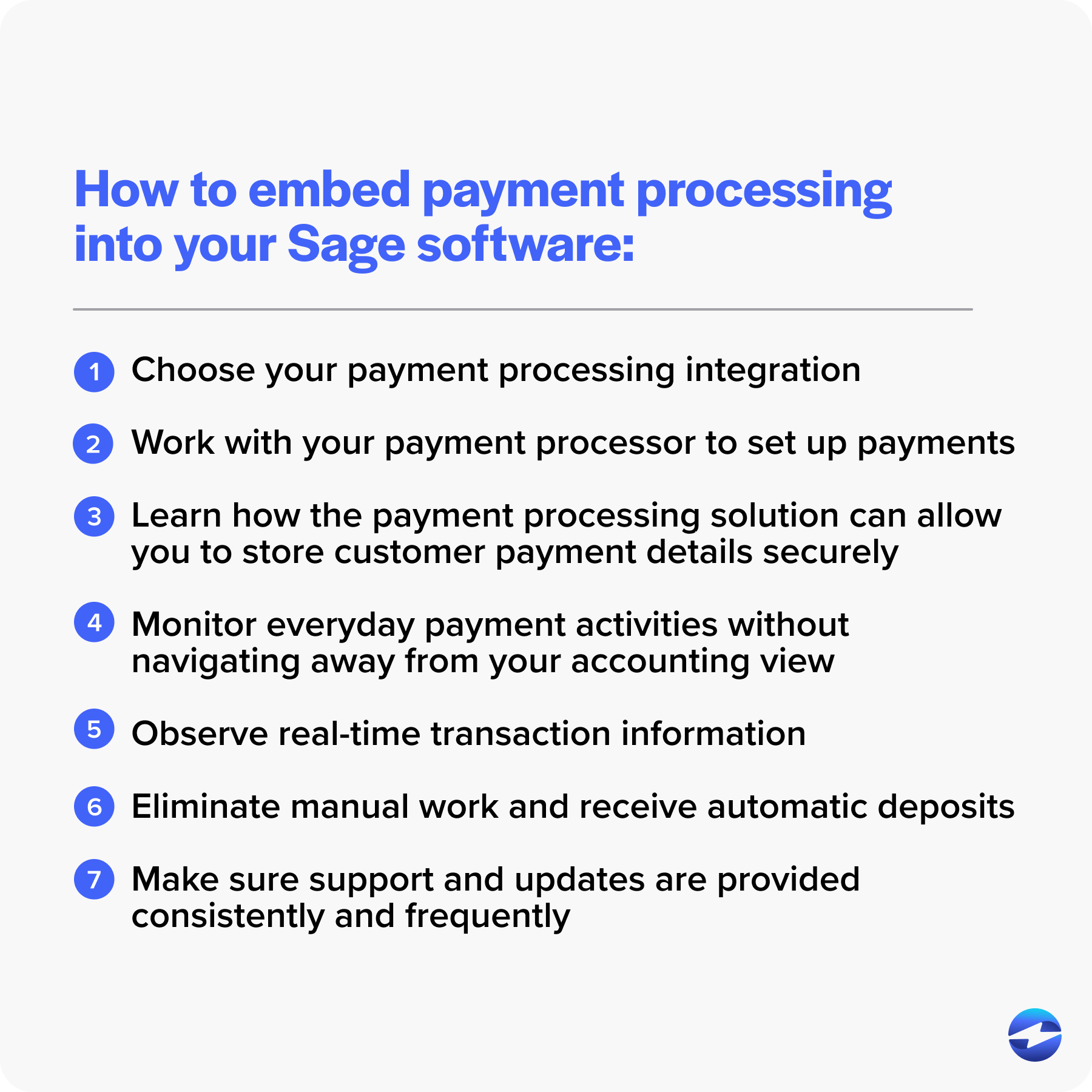

Here’s a step-by-step guide on how to integrate embedded payment processing directly into your Sage payment processing software:

- Choose your payment processing integration: Select a payment processor that integrates into Sage. Ensure this solution meets your business’s needs and accepts credit and debit cards and other major payment methods.

- Setup and configuration: After choosing a payment processing solution, you can work with the processor’s team to set up these payments. Their team should help you integrate their payment processing software with Sage, ensuring all the payment types and options you need are configured correctly.

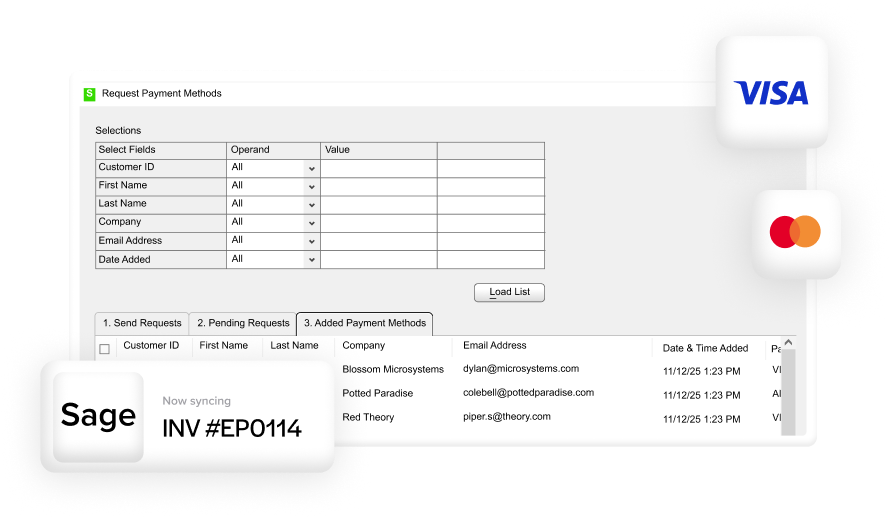

- Securely store customer data: The payment processing solution can allow you to store customer payment details securely within the system. This reduces the need to re-enter information and speeds up recurring transactions.

- Process payments directly in Sage: Embedded payments let you invoice customers, accept payments within the Sage interface, and update financial records in real-time. This means you can monitor everyday payment activities without navigating away from your accounting view.

- Real-time transaction information: An embedded payment processing solution will give your business access to detailed transaction records that sync with Sage products. This allows you to make informed business decisions based on up-to-the-minute data on your cash flow.

- Receive automatic deposits: Eliminate the manual work involved in reconciling bank statements. The embedded payment processing solution automatically deposits payments into your account, posting these transactions to the appropriate ledger in Sage.

- Support and updates: Whether it be questions or new payment trends, your payment processing solution should provide reliable support and consistent updates to ensure your Sage payment module is always ahead of the curve.

Integrating payments in Sage enables businesses to accept various payment types with greater ease, contributing to an understanding of the business direction and immediate insights into finance and customer behavior trends.

4 benefits of using embedded payments in Sage

By embedding payment solutions directly within the Sage ecosystem, businesses can benefit from an unrivaled convenience that enhances their entire financial cycle.

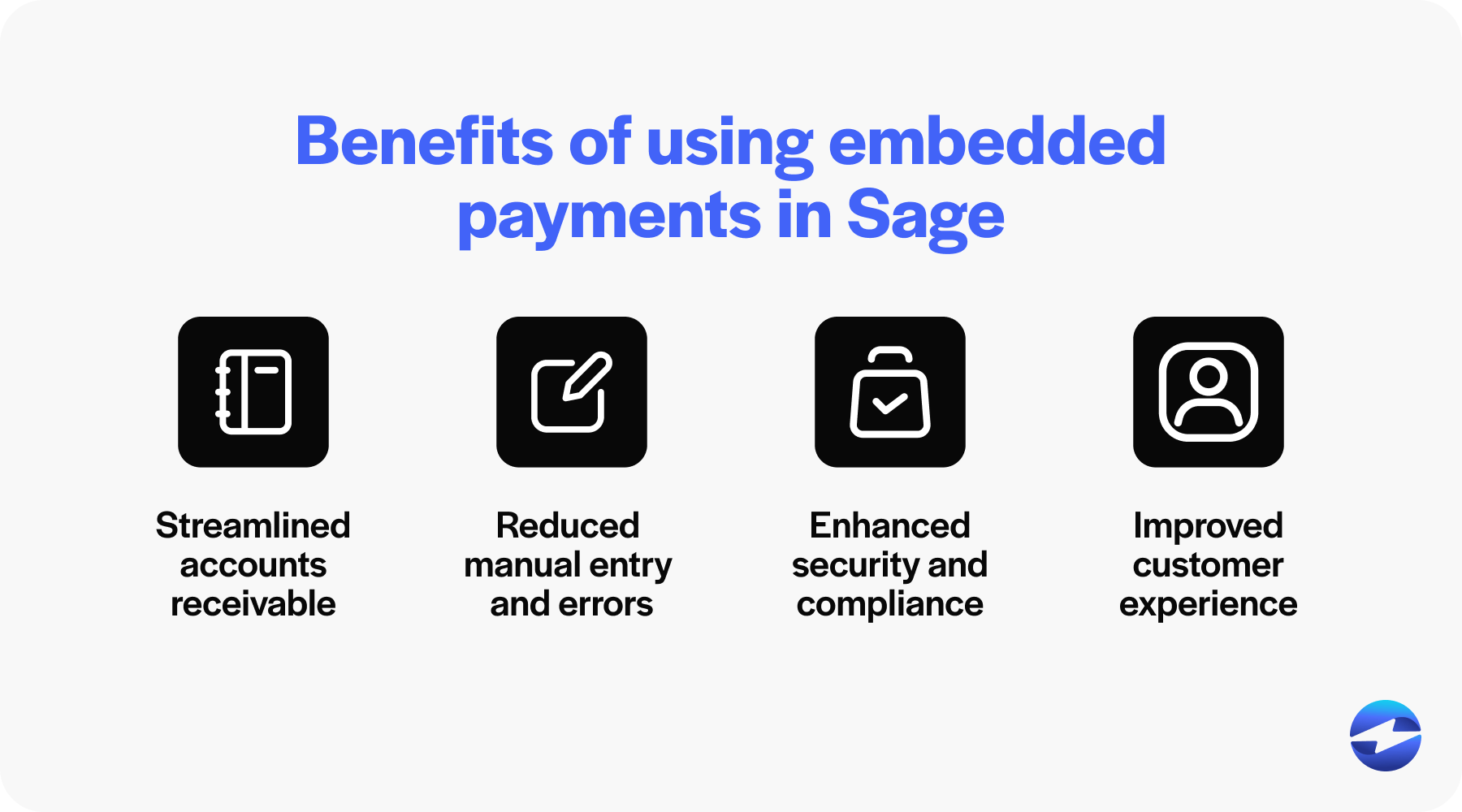

This powerful feature streamlines accounts receivable (AR), diminishes the dependency on laborious manual processes, augments security and compliance standards, and elevates the customer service experience.

1. Streamlined accounts receivable

Embedded Sage payments into your accounting software can drastically streamline the AR process.

By automating standard payment operations such as credit and debit card payment acceptance, businesses can gain access to real-time transaction data, facilitating quicker recognition of revenue and enabling finance teams to spot AR trends efficiently.

This synchronization means less time chasing payments and more time for high-priority tasks, ultimately leading to a sleeker cash management system and accelerated business cycles.

2. Reduced manual data entry and errors

Embedded Sage payments also reduce the necessity for manual data entry, thus mitigating the risk of human error and freeing up valuable resources.

Automating payment information recording into the Sage system improves data accuracy and ensures that transaction fees are accounted for. This eradicates the repetitive task of manually inputting data, allowing your finance team to focus on more critical aspects of customer service and business management.

3. Enhanced security and compliance

Embedded payment systems typically come equipped with advanced security measures that align with the highest compliance standards.

Most embedded Sage payment solutions adhere to strict regulations, including PCI-DSS compliance and Secure Sockets Layer/ Transport Layer Security (SSL/TLS) protocols.

By securely managing credit card data and transactions, businesses can protect their operations against fraud and data breaches.

4. Improved customer experience

The convenience and ease of use of embedded payments in Sage translate into an improved customer experience.

Customers enjoy the flexibility of selecting their preferred payment method without navigating away from the platform. This seamless integration provides swift and straightforward transactions to enhance customer satisfaction and loyalty.

By eliminating procedural delays and offering convenient payment options, embedded payments in Sage help businesses deliver top-tier customer service to generate positive engagement and repeat business.

With a reliable embedded payment provider, businesses will be equipped with the necessary tools to facilitate seamless transactions in Sage, make informed financial decisions, and strengthen their cash flow management and stability.

Tips for implementing embedded payments in Sage

Merchants should stay current on the latest tips and guidelines to leverage the full potential of their Sage payment solutions.

For optimized embedded payments in Sage, it’s essential to select a suitable payment processing solution, apply reliable data security measures and compliance protocols, and train its employees on payment processing workflows.

Choose a payment processing solution that meets your needs

Selecting the most suitable payment processor that meets the needs of your Sage system integration is crucial.

To make choose the best embedded payment processing solution, you should:

- Start by assessing your payment needs. Identify the types of payments your business handles most frequently and any unique requirements it may have.

- Consider integration capabilities. Look for solutions that seamlessly integrate with Sage, minimizing description to existing workflows.

- Pay close attention to fee structures, including transaction fees, to avoid unexpected costs.

- Security features should also be a priority. Ensure the processor follows industry-standard security protocols like encryption and fraud prevention tools.

- Review testimonials and reviews of various processors to determine their reliability.

- Future-proof to determine if a solution can scale and adapt to evolving payment trends and technologies. Thinking ahead ensures long-term compatibility with your business’s needs.

In addition to working with secure embedded payment solutions, it’s vital for businesses to implement their own set of security measures and protocols.

Ensure data security and compliance

When implementing embedded payments in Sage, certain security practices must be followed to safeguard data and maintain compliance.

After confirming the chosen embedded payment solution adheres to PCI DSS Standards to ensure compliance, businesses should ensure all sensitive payment data transmitted in Sage is encrypted.

Next, implement strict access controls to ensure that only authorized personnel can process or view payment information. Your company should also schedule routine security audits and compliance checks to detect any vulnerabilities instantly.

Lastly, staff should be educated about best practices in data security and the importance of compliance measures to reinforce a culture of security within the organization.

Train employees on new payment processing workflows

Proper training is essential to maximize the efficiency of your embedded payment processing system in Sage.

To achieve this, incorporate engaging training programs such as interactive sessions, webinars, and hands-on workshops to teach employees the new workflows. Thorough documentation that outlines step-by-step procedures will also be essential.

Businesses should encourage feedback during training sessions to understand pain points and adapt the training accordingly. They should continuously update the training material with new features or changes to maintain a knowledgeable workforce.

Establishing an internal support system to assist employees with any difficulties during the transition will also be helpful. This holistic approach to training fosters a smooth and successful integration of embedded payments in your Sage software.

By adhering to these tips and guidelines, businesses can confidently and efficiently implement embedded payment solutions into Sage and reap the benefits of a streamlined, secure, and robust financial management ecosystem.

Integrating embedded payments with EBizCharge

Integrating embedded payments in Sage can yield numerous benefits for your business, such as enhanced efficiency and integrity throughout the payment processing journey.

EBizCharge is a top-rated payment solution that stands out for its ability to facilitate embedded payments seamlessly within Sage. It enhances security with advanced encryption and fraud prevention tools, protecting sensitive payment data.

With EBizCharge, businesses have access to features like a convenient online payment portal where customers can securely view and pay invoices and secure email payment links for customers to pay invoices directly from their inboxes. EBizCharge also provides comprehensive reporting and analytic tools, delivering valuable insights into payment processing activities and financial performance.

By leveraging EBizCharge’s robust features, businesses can automate customer payments, streamline AR processes, diminish manual errors, bolster security, improve cash flow, and elevate the overall customer experience.