Blog > Surcharge vs. Cash Discount: What’s Better for You?

Surcharge vs. Cash Discount: What’s Better for You?

Credit card processing fees have been increasing over the years and eating into the profit margins of small and mid-sized businesses. To combat these costs, many merchants are turning to two different strategies: credit card surcharges and cash discount programs.

In this article, we’ll break down cash discount vs credit card surcharge programs, highlight the differences and help you decide which one is best for your business. Whether you’re a retailer, restaurant or B2B company, understanding these models can help protect your bottom line.

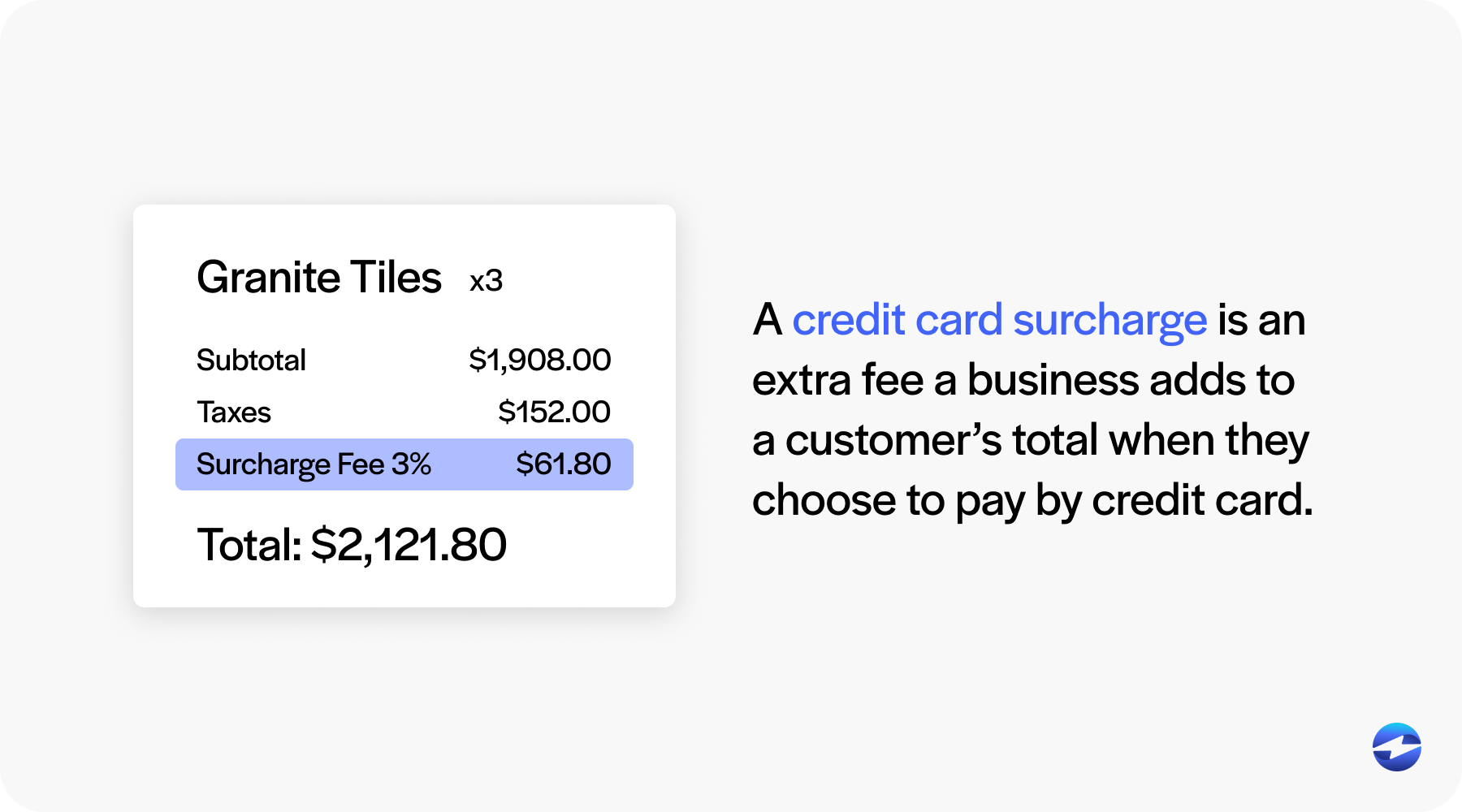

What is a Credit Card Surcharge?

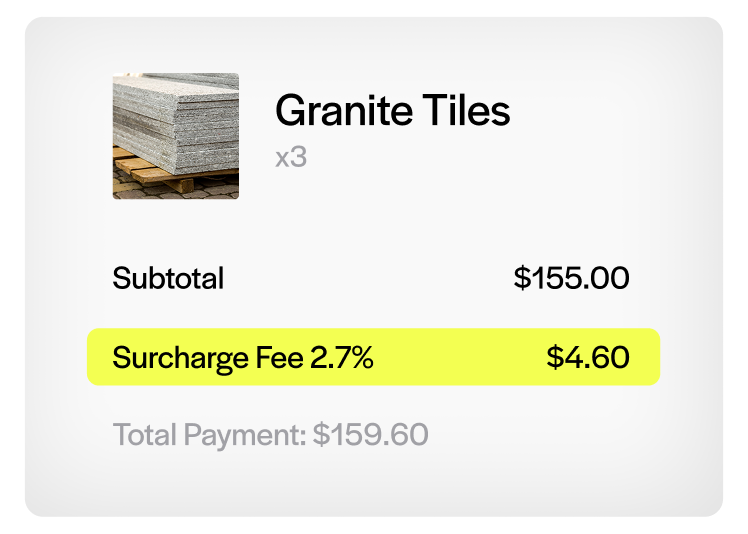

A credit card surcharge is an extra fee a business adds to a customer’s total when they choose to pay by credit card. It’s designed to offset the cost of card processing by passing that cost directly to the cardholder.

How It Works

Surcharging is a simple way for businesses to recover the cost of accepting credit cards without inflating their prices.

- The surcharge is a percentage (up to 4%) of the transaction total.

- It’s applied only to credit card transactions, not debit or prepaid cards.

- Customers are notified before completing the purchase, both in-store and on receipts.

Compliance and Legality

Before you roll out a surcharge program, you need to understand the rules that govern how it must be implemented.

- Surcharges are legal in most—but not all—states. You need to check state laws and card network rules.

- Visa, Mastercard and other networks require merchants to register their intent to surcharge.

- Proper signage is required at the point of sale and online.

Use Case and Business Types

Surcharging is great for businesses that rely on credit card payments and manage high-value transactions, where processing fees can eat into profit margins.

- Good for B2B companies, professional services and high-ticket retail businesses.

- Protects profit margins without raising base prices.

What is a Cash Discount Program?

A cash discount program allows businesses to offer a lower price to customers who pay with cash, check or ACH instead of credit cards.

How It Works

Cash discounting works by encouraging customers to pay using methods that avoid credit card fees, such as cash, check or ACH. This approach can help businesses save on transaction costs while offering a tangible benefit to the customer.

- Prices include card processing costs.

- When a customer pays with cash or check, they get a discount at checkout.

Compliance and Legality

Easier to implement from a legal standpoint, but still requires clear communication and consistent execution to avoid confusion.

- Legal in all 50 states when done correctly.

- Merchants must display pricing and communicate the discount structure.

Use Case and Business Types

Cash discounting works best in industries where customers are already using cash and where speed and simplicity at checkout are key.

- Common in quick-service restaurants, gas stations and small retailers.

- Targets customer segments that already pay in cash.

Unlike a surcharge, this is a positive spin—it feels like a reward rather than a penalty.

Surcharge vs Cash Discount

Here’s a quick comparison of credit card surcharge vs cash discount to help you understand how each works in real-world business scenarios. This overview highlights not only the legal and operational differences but also the varying impact on customer experience and perception.

| Feature | Credit Card Surcharge | Cash Discount Program |

|---|---|---|

| Customer Perception | May feel like a penalty | Feels like a reward |

| Legality | Not allowed in some states | Legal in all 50 states |

| Setup Complexity | Requires registration and compliance | Needs clear signage and pricing model |

| Pricing Transparency | Fee added at checkout | Discount subtracted at checkout |

| Customer Loyalty | Some pushback possible | Generally more acceptable |

Both options recoup fees, but how they’re presented can impact customer satisfaction.

Pros and Cons of Each

Both surcharge and cash discount programs offer meaningful benefits, but each comes with unique trade-offs that businesses must weigh carefully.

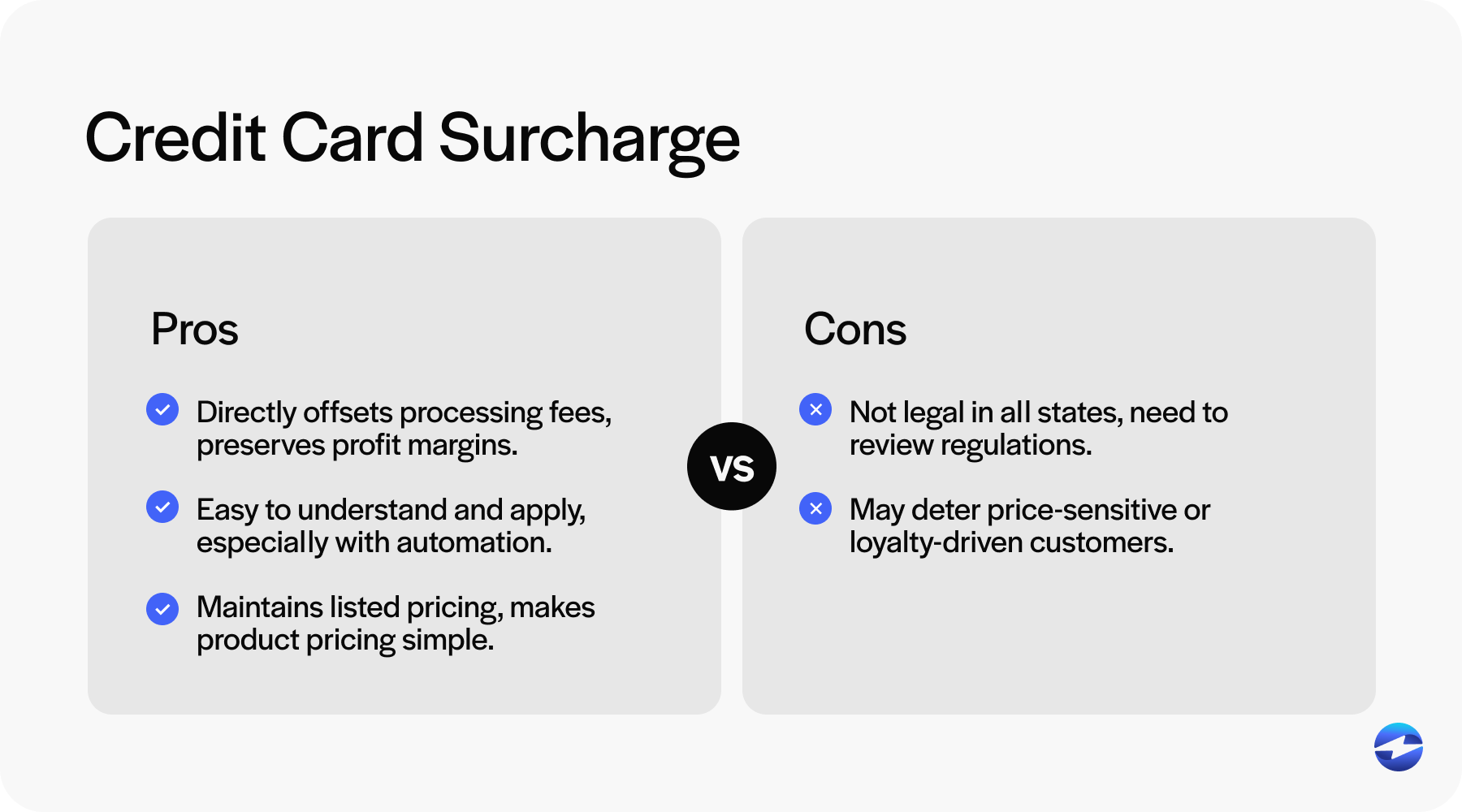

Credit Card Surcharge

Implementing a credit card surcharge has several strategic advantages for businesses, especially those with high transaction volumes or narrow profit margins. It allows you to pass the processing fees onto the customer, helping to preserve your margins without raising your base pricing.

Pros:

- Directly offsets processing fees, preserves profit margins.

- Easy to understand and apply, especially with automation.

- Maintains listed pricing, makes product pricing simple.

But it has some drawbacks. Surcharges are not legal in all states so you need to check local laws. Some customers may feel penalized for using their preferred payment method which can impact repeat business.

Cons:

- Not legal in all states, need to review regulations.

- May deter price sensitive or loyalty driven customers.

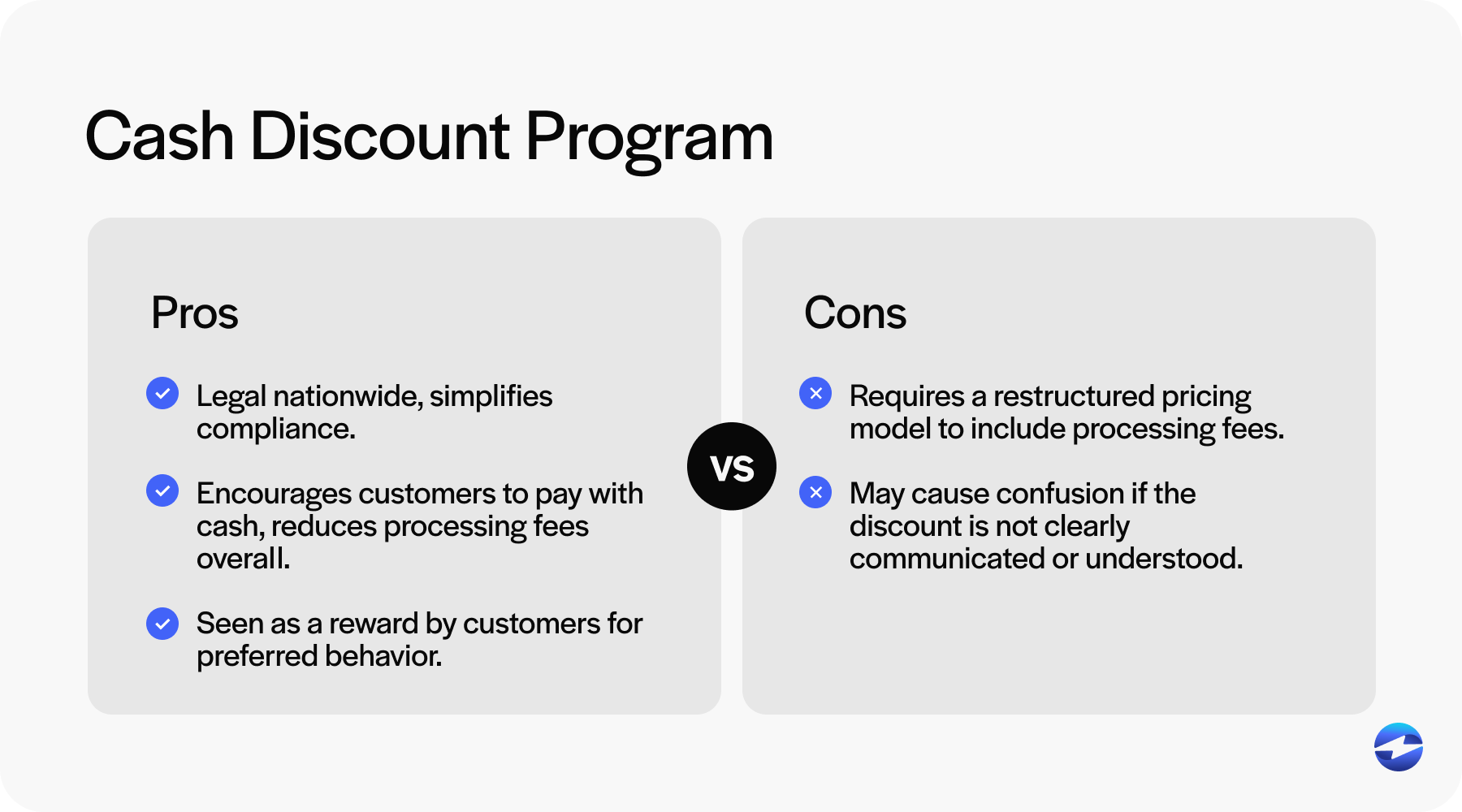

Cash Discount Program

Cash discount programs offer an alternative approach by rewarding customers who pay with cash or other non-credit methods. Instead of adding fees, businesses build processing costs into listed prices and then offer a visible discount for preferred payment types.

Pros:

- Legal nationwide, simplifies compliance.

- Encourages customers to pay with cash, reduces processing fees overall.

- Seen as a reward by customers for preferred behavior.

But it requires changes in pricing strategy and employee training. Without proper explanation at the point of sale, it can create confusion and mistrust among customers.

Cons:

- Requires a restructured pricing model to include processing fees.

- May cause confusion if the discount is not clearly communicated or understood.

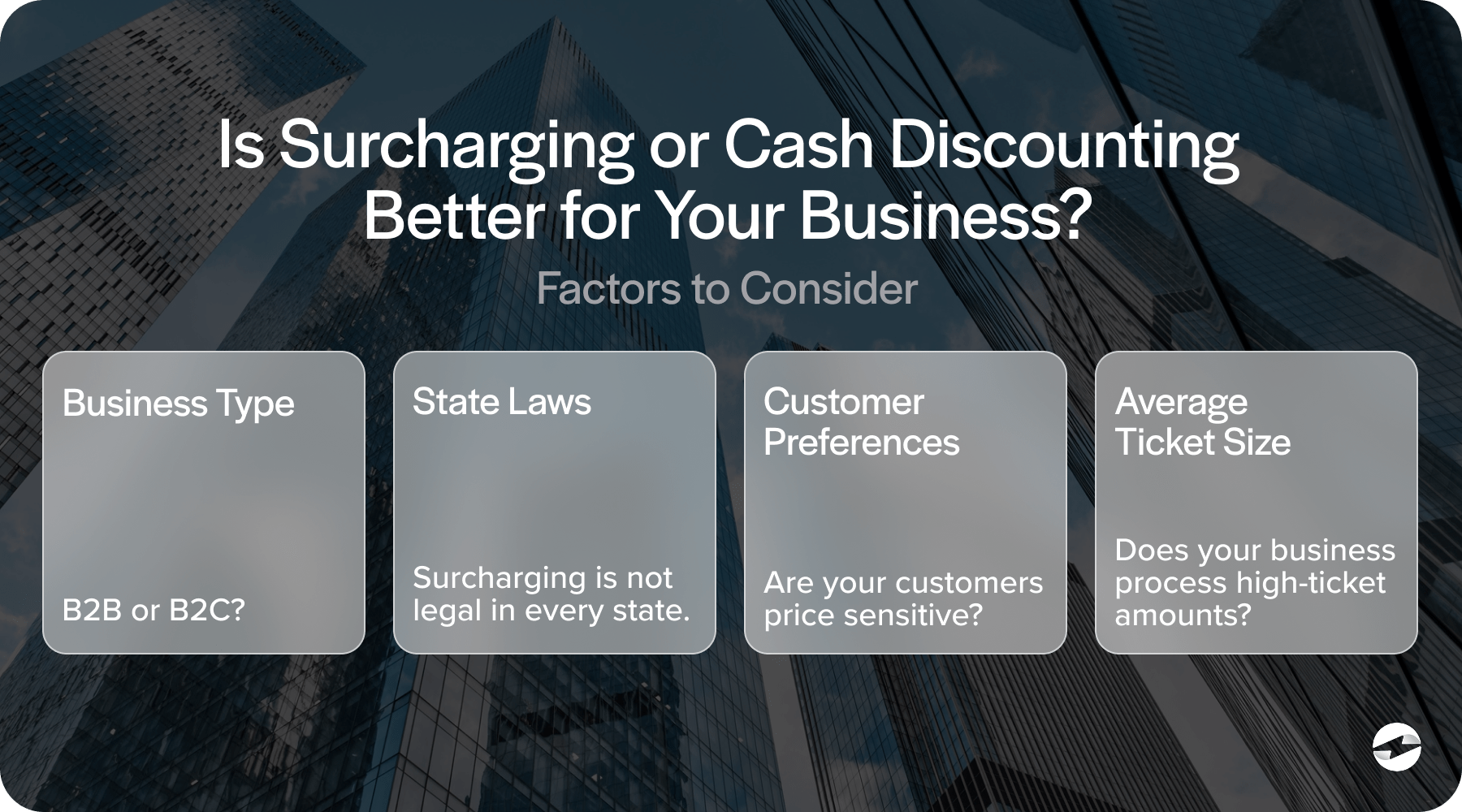

Which One is Better for Your Business?

Deciding between a surcharge and a cash discount program depends on what works best for your business type and customer experience goals. Both options can reduce your credit card processing costs but serve different needs.

- Business Type: B2B and service-based businesses often benefit from surcharges since their customers expect to pay with credit cards. Retail businesses, quick-service restaurants and gas stations may find cash discount more acceptable and easier to explain to customers.

- State Laws: Check your state’s rules. Surcharging isn’t allowed everywhere but cash discount is legal nationwide.

- Customer Preferences: If your customers are price sensitive or fee averse, a cash discount may go over more smoothly. If they’re used to seeing convenience fees (like in the B2B world), a surcharge won’t be a surprise.

- Average Ticket Size: High-ticket businesses can recover significant fees through surcharging. Cash discounts may be more beneficial for smaller, high-volume transactions.

If you want a hassle-free way to implement surcharges, EBizCharge has the tools and automation to keep you compliant and efficient.

How to Get Started With Each

If you’re ready to explore surcharging or cash discounting, the first step is understanding what implementation looks like for each approach.

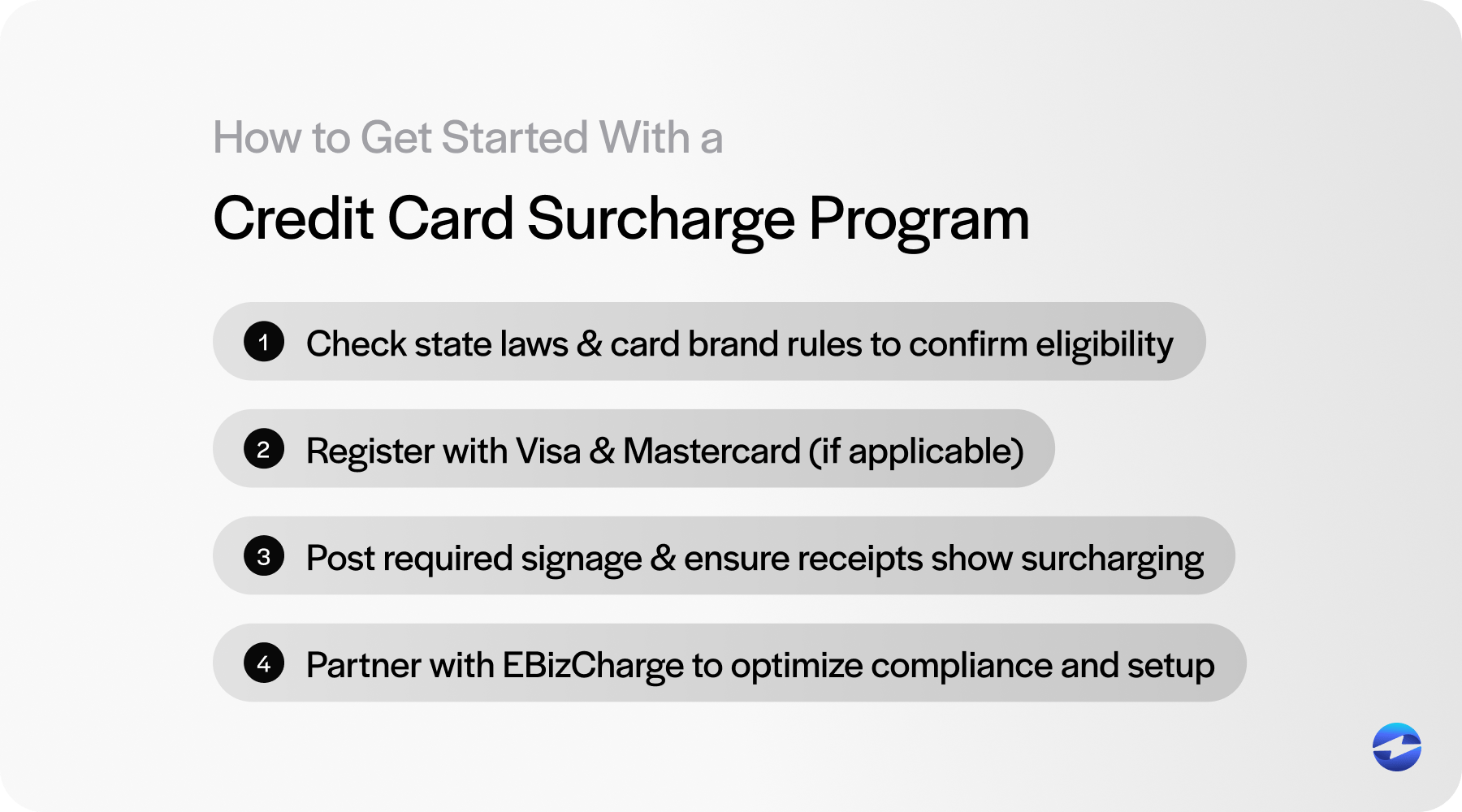

Getting Started With a Credit Card Surcharge Program

Implementing a surcharge program starts with understanding the legal landscape. You’ll need to verify if your state allows surcharging and comply with credit card network rules. Card brands like Visa and Mastercard often require formal registration and adherence to specific fee limits.

- Check state laws and card brand rules to confirm eligibility.

- Register with Visa and Mastercard, if applicable, to report your surcharge intent.

- Post required signage at the point of sale and ensure that receipts itemize the surcharge.

- Partner with a processor like EBizCharge to automate compliance and streamline the technical setup within your POS or invoicing system.

With the right provider, surcharging can be deployed quickly and with minimal disruption to operations.

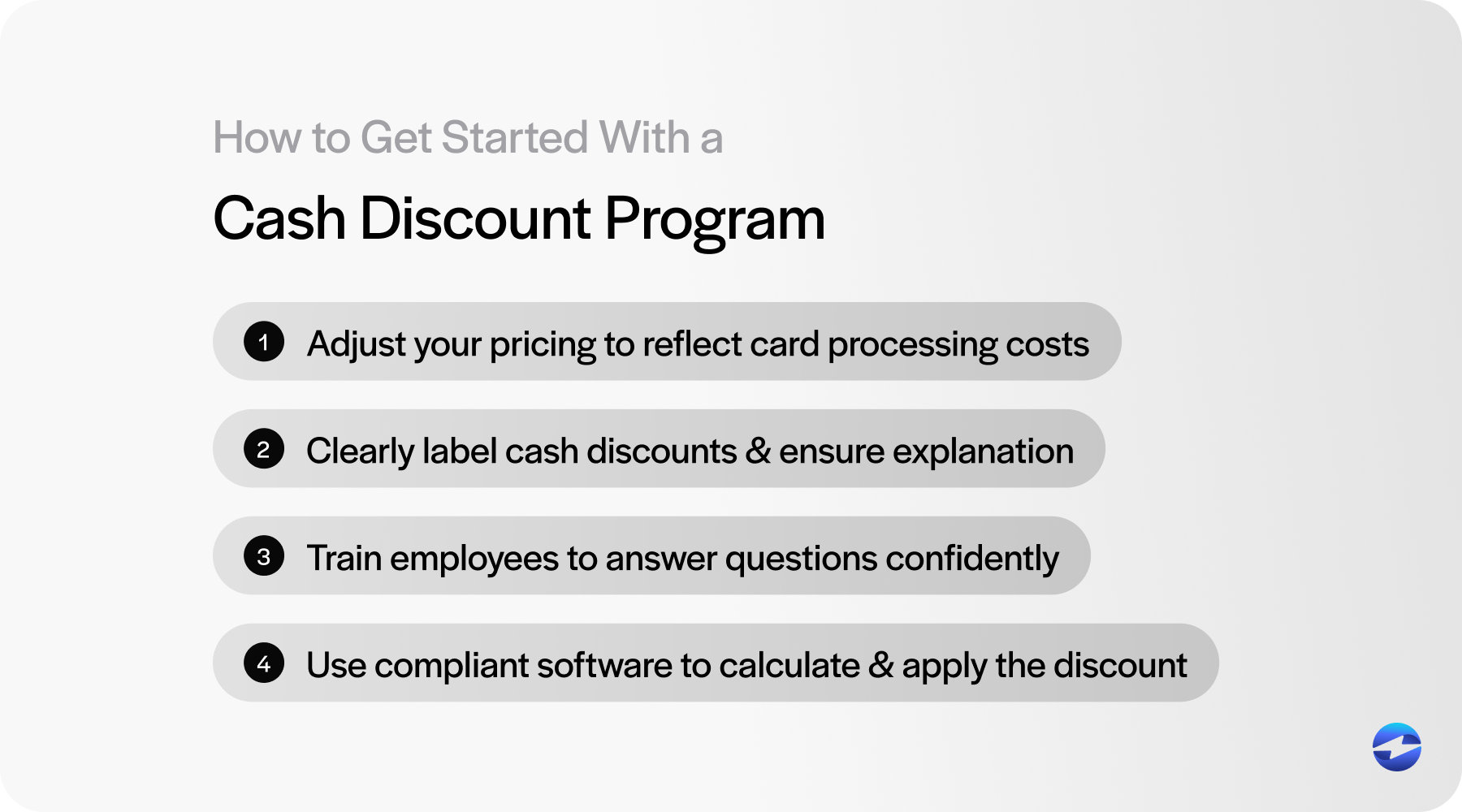

Getting Started With a Cash Discount Program

Cash discount programs require a change in how you display pricing. Instead of adding fees to card payments, you build processing costs into the listed prices and offer a discount for customers who pay with cash or check. This is legal in all states but still demands clarity.

- Adjust your listed pricing to reflect built-in card processing costs.

- Clearly label cash discount amounts at the point of sale and ensure staff can explain them.

- Train employees to answer customer questions confidently and consistently.

- Use compliant software to calculate and apply the discount across all transactions.

These programs work best when customer education and consistency are key. Proper signage, transparent receipts and a clear explanation at checkout will avoid confusion and build trust.

Both strategies require clear communication to stay compliant and customer happy. Take the time to do it right and you’ll be successful and happy in the long run.

How EBizCharge Helps With Surcharging

EBizCharge makes surcharging easy with features designed to keep you compliant and efficient. Our platform is built for businesses that want to recover processing fees while keeping the customer experience smooth.

- Automated surcharge calculation and application to ensure accuracy on every transaction

- Pre-set rules that follow card brand requirements like Visa and Mastercard to reduce your compliance burden

- Built-in compliance features for state-specific laws and restrictions

- Support for B2B and retail environments whether you’re invoicing clients or running a storefront

- Transparent reporting tools to track surcharge performance and communicate changes to your customers

In addition to software, EBizCharge offers hands-on onboarding, staff training and ongoing support to help you implement surcharging successfully. Whether you’re just starting out or fine-tuning your current setup, EBizCharge has the tools, guidance and compliance expertise to make surcharging work for your business.

Wrapping Up: Cash Discount vs. Credit Card Surcharge

Both cash discount and credit card surcharge programs help businesses offset processing costs—but the right fit depends on your goals, your customers and your location.

Surcharges are perfect for those who want to pass fees directly to customers in a compliant and automated way—especially with EBizCharge. Cash discounts work well for businesses that cater to cash users and want to incentivize behavior rather than penalize it.

Ready to get started? Contact EBizCharge to learn how we can help you with your program.