Blog > Salesforce Payment Integration: Implementation Guide for IT Teams

Salesforce Payment Integration: Implementation Guide for IT Teams

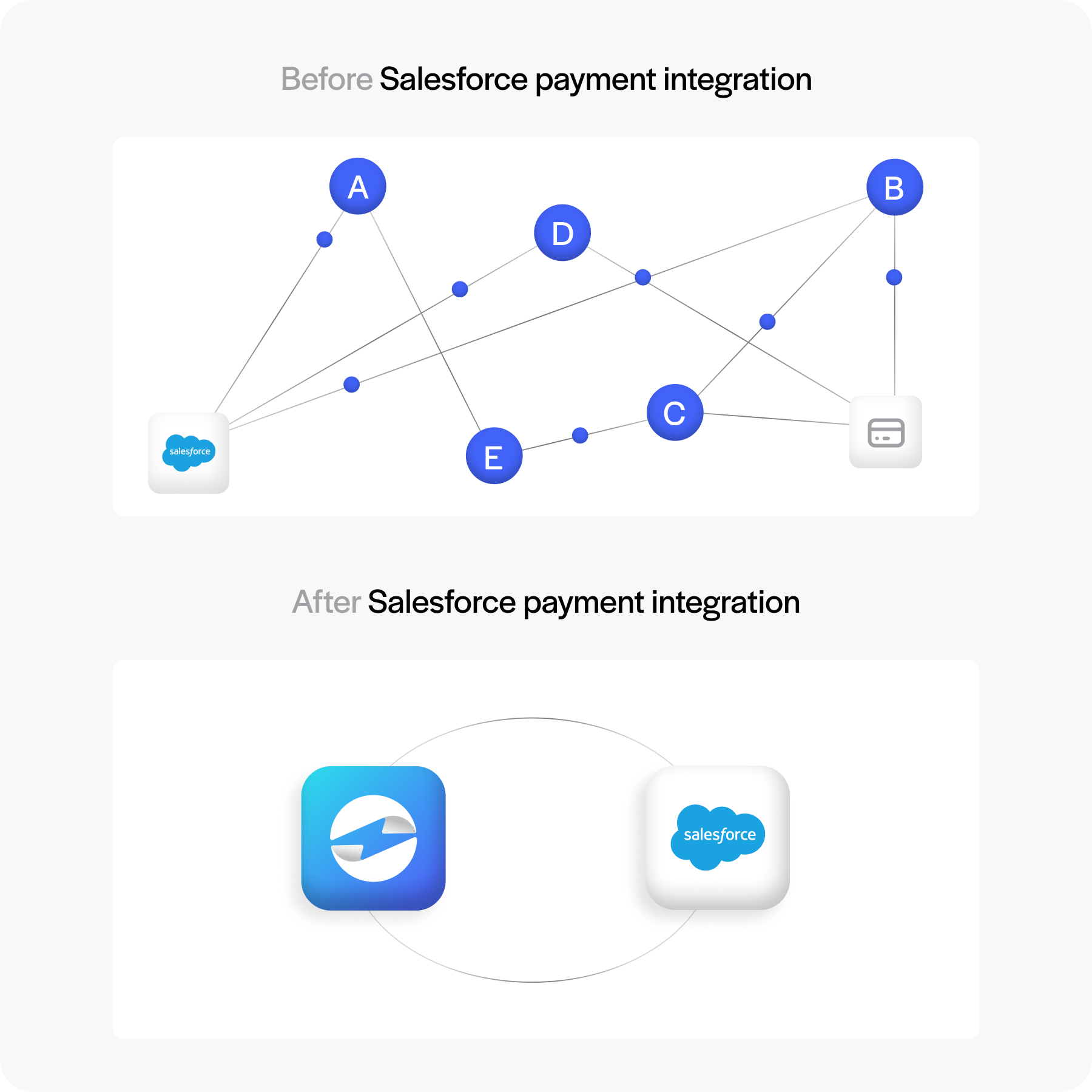

For IT teams managing Salesforce, payments often end up being one of the trickiest pieces of the puzzle. Sales and finance rely on smooth payment processes, but payments often live in systems that don’t communicate with Salesforce. That disconnect creates headaches—manual reconciliation, mismatched data, compliance risks, and frustrated stakeholders. A well-executed Salesforce payment integration solves these problems. It gives IT teams a framework for handling transactions directly in Salesforce, aligning finance and operations without the extra baggage of disconnected systems.

This guide is meant to walk through the practical side of payment integration. It covers architecture options, the differences between native and API-based setups, and the timeline most IT managers should expect. It also addresses compliance, security, and best practices for implementation. Along the way, you’ll see how solutions like EBizCharge and Stripe fit into the conversation, and why making the right choice early saves a lot of time later.

Understanding Salesforce Payment Integration

At its core, Salesforce payment integration means connecting payment systems to Salesforce so invoices, payments, and revenue records all live in one place. Without it, teams rely on exports, spreadsheets, or third-party tools that increase the risk of errors. With it, a payment flows directly from the customer to the bank account, and Salesforce records update in real time.

In this setup, the Salesforce payment gateway handles the secure handoff of data, while the payment processor actually moves funds. Together, they form the backbone of any payment processing solution. For IT teams, integrating these components into Salesforce is about more than efficiency—it’s about reducing manual work, cutting reconciliation time, and ensuring compliance obligations like Payment Card Industry Data Security Standards (PCI DSS) are consistently met.

Integration Architecture

Architecture is the foundation of any implementation project. There are three common approaches to Salesforce payment integration.

One approach is native integration. This involves using a solution built directly for Salesforce, like EBizCharge, that connects payment functionality into Salesforce objects and workflows. Payments post in real time, invoices flip to “Paid,” and finance gains immediate visibility. The advantage for IT is reduced maintenance and fewer custom jobs to manage.

Another option is Salesforce payment API integration. Here, IT teams use APIs, middleware, or connectors to bring payment data into Salesforce from an external system. It’s flexible and works well if you already have a payment system outside Salesforce. But flexibility comes with tradeoffs—more mapping, more monitoring, and usually more IT overhead.

Finally, some organizations use a hybrid approach. Certain transactions flow natively through Salesforce, while others remain in external systems. This can balance needs, but it also adds complexity to data reconciliation.

The right choice depends on business requirements, technical expertise, and how much IT wants to maintain it long-term.

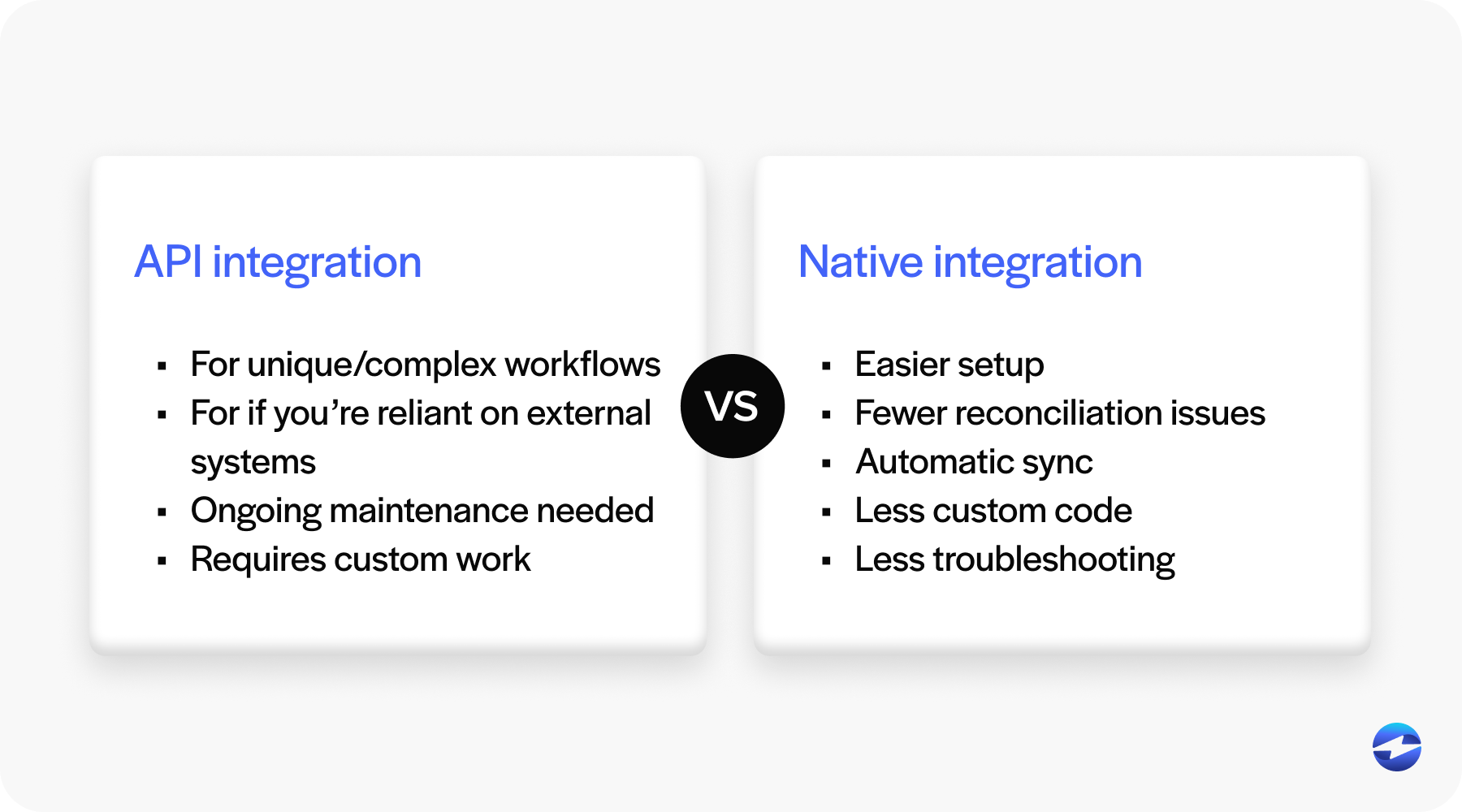

API vs Native Integration

Choosing between API-based and native integration is one of the biggest decisions IT will face. Native integrations typically offer easier setup, tighter alignment with Salesforce data models, and fewer reconciliation issues. Finance teams like them because invoices and payments are in sync without manual fixes. IT likes them because less custom code usually means fewer late-night troubleshooting sessions.

Salesforce payment API integration, on the other hand, is better suited for organizations with complex or unique workflows. If your company relies heavily on external systems, API-driven approaches give you the flexibility to tailor data flows exactly as you need them. But they also mean ongoing maintenance, more testing, and more points of potential failure.

A simple comparison illustrates the difference. EBizCharge is a native integration, posting payments directly inside Salesforce. Stripe, by contrast, is API-first. It offers strong global coverage and developer-friendly tools, but usually requires connectors or custom work to reach the same level of alignment within Salesforce. For IT teams, the choice often comes down to whether simplicity or flexibility matters more.

Implementation Timeline

IT managers often ask how long a payment integration project will take. The answer depends on scope, but most follow a similar structure.

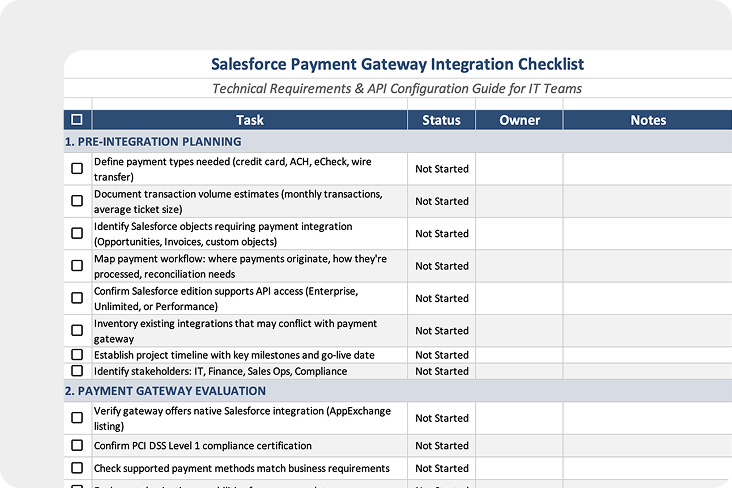

- Discovery and requirements gathering: Align IT, finance, and sales on objectives. Clarify which Salesforce payment options are required (ACH, credit cards, digital wallets).

- Architecture: Decide between native integration and API-based approaches.

- Sandbox setup and configuration: Configure payment objects, gateways, and workflows in a safe environment.

- Integration of payment gateways and testing transactions: Run test payments through your chosen payment processor to validate posting and reconciliation.

- Compliance checks: Confirm PCI DSS standards, tokenization, and encryption are in place.

- User training and documentation: Ensure finance and operations know how to handle refunds, disputes, and exceptions.

- Go-live and monitoring: Move to production, monitor dashboards, and resolve any issues quickly.

For small deployments, this might take a few weeks. Enterprise-level projects with multiple regions and currencies can take months. However, partnering with the right payment processor can speed up this process, so it’s important to do your research. Setting realistic expectations helps IT and business leaders stay aligned.

Compliance and Security

Payments always bring compliance obligations, and IT plays a central role in managing them. PCI DSS is the baseline. Native integrations often reduce scope because sensitive data never touches your servers—it’s tokenized and handled by the payment processing solution. Encryption, audit trails, and strict permission controls are also essential. Don’t forget about privacy regulations like General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA), which can shape how long payment data is stored and how it’s deleted.

A reliable Salesforce billing platform should make compliance easier by embedding these controls into the workflows. IT must confirm that these features are configured correctly and monitored over time.

Best Practices for IT Teams

Getting payment integrations right takes more than plugging in a gateway. It starts with recognizing that IT doesn’t work in isolation. Finance, sales, and operations all depend on accurate payment data, so the integration process should be approached as a shared project rather than a purely technical one. Thinking this way helps set the stage for smoother collaboration and fewer surprises.

- Engage finance and operations teams early so workflows match real-world requirements.

- Test edge cases, like ACH failures, chargebacks, and refunds, not just basic card payments.

- Build monitoring dashboards inside Salesforce so IT and finance can track payment success rates and exceptions in real time.

- Document every customization and integration flow—future admins will thank you.

In practice, IT managers know that the problems don’t usually happen when everything goes right —they crop up in the edge cases and exceptions. By planning for those scenarios from the beginning, teams avoid last-minute scrambling and keep confidence in the system strong over the long term.

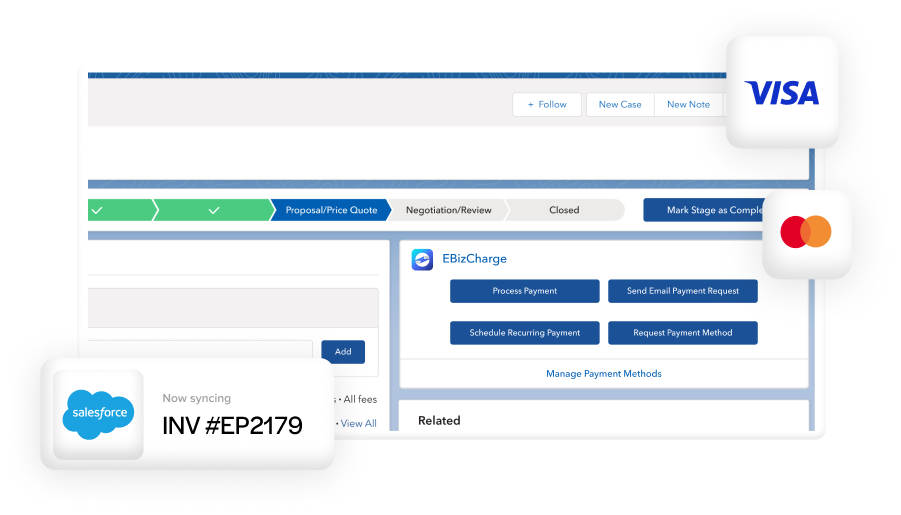

Why Consider EBizCharge

Among the available tools, EBizCharge is a strong fit for IT teams that want to minimize ongoing maintenance. It’s a native Salesforce payment gateway that posts payments directly to invoices, contracts, and accounts in real time. Features like secure tokenization, multi-currency support, and customer portals come built in. This reduces the need for extra connectors or nightly sync jobs.

When compared to Stripe, the differences become clearer. Stripe shines in global coverage and developer APIs, making it attractive for custom applications and international expansion. However, it often requires more integration effort to achieve smooth Salesforce billing alignment. EBizCharge, by contrast, keeps things inside Salesforce, simplifying IT workloads and providing finance with consistent, real-time data.

For IT teams tasked with balancing efficiency, compliance, and support, that simplicity is often the deciding factor.

Creating Reliable Payment Integration for IT Teams

Getting payments right in Salesforce is as much about planning as it is about technology. The architecture you choose, the timeline you set, and how you involve other teams shape the outcome. For IT managers, the goal isn’t just moving money—it’s building a setup that people across sales and finance can rely on without constant fixes.

The choice often comes down to what works best for your organization. Native tools like EBizCharge keep everything inside Salesforce and reduce the day-to-day upkeep, while API-driven options like Stripe give flexibility at the cost of added complexity. With clear requirements, thoughtful testing, and a dependable payment processing solution, you can create a Salesforce billing platform that keeps revenue flowing smoothly and builds confidence across the company.