Blog > Salesforce Invoicing: Complete Guide to Native Invoice Generation

Salesforce Invoicing: Complete Guide to Native Invoice Generation

Invoicing may not be the most glamorous part of running a business, but it’s one of the most critical. Deals don’t mean much until the money actually arrives. That’s why finance teams and operations leaders are always looking for better ways to make the invoicing process accurate, timely, and painless. For companies running on Salesforce, a question often arises: Can Salesforce generate invoices directly? The short answer is yes—and done right, it can do so in a way that reduces manual work, cuts down on errors, and keeps both customers and internal teams happy.

This guide explores Salesforce invoicing in depth. It looks at what native invoicing is, how customization works, the role of automation, and what advanced features are available for growing businesses. It also discusses integration points, billing automation, and CPQ billing. Finally, it explains why choosing the right tools—such as a secure Salesforce payment gateway and a reliable payment processor—can make all the difference.

What is Native Invoicing in Salesforce?

Native invoicing means generating and managing invoices directly inside the Salesforce ecosystem. With Salesforce invoice management, companies no longer need to rely on exporting data into spreadsheets or passing transactions into a separate invoicing tool. Instead, invoices are tied directly to accounts, contracts, and opportunities.

The Salesforce billing platform provides the backbone for this process. It connects with CPQ (Configure, Price, Quote) so that once a deal is closed, the system automatically moves from quote to order to invoice. This reduces friction, eliminates redundant data entry, and provides one consistent source of truth for finance teams. Compared to third-party systems, native Salesforce invoicing keeps everything closer to the data already managed by sales and operations teams.

Customization Options for Invoicing

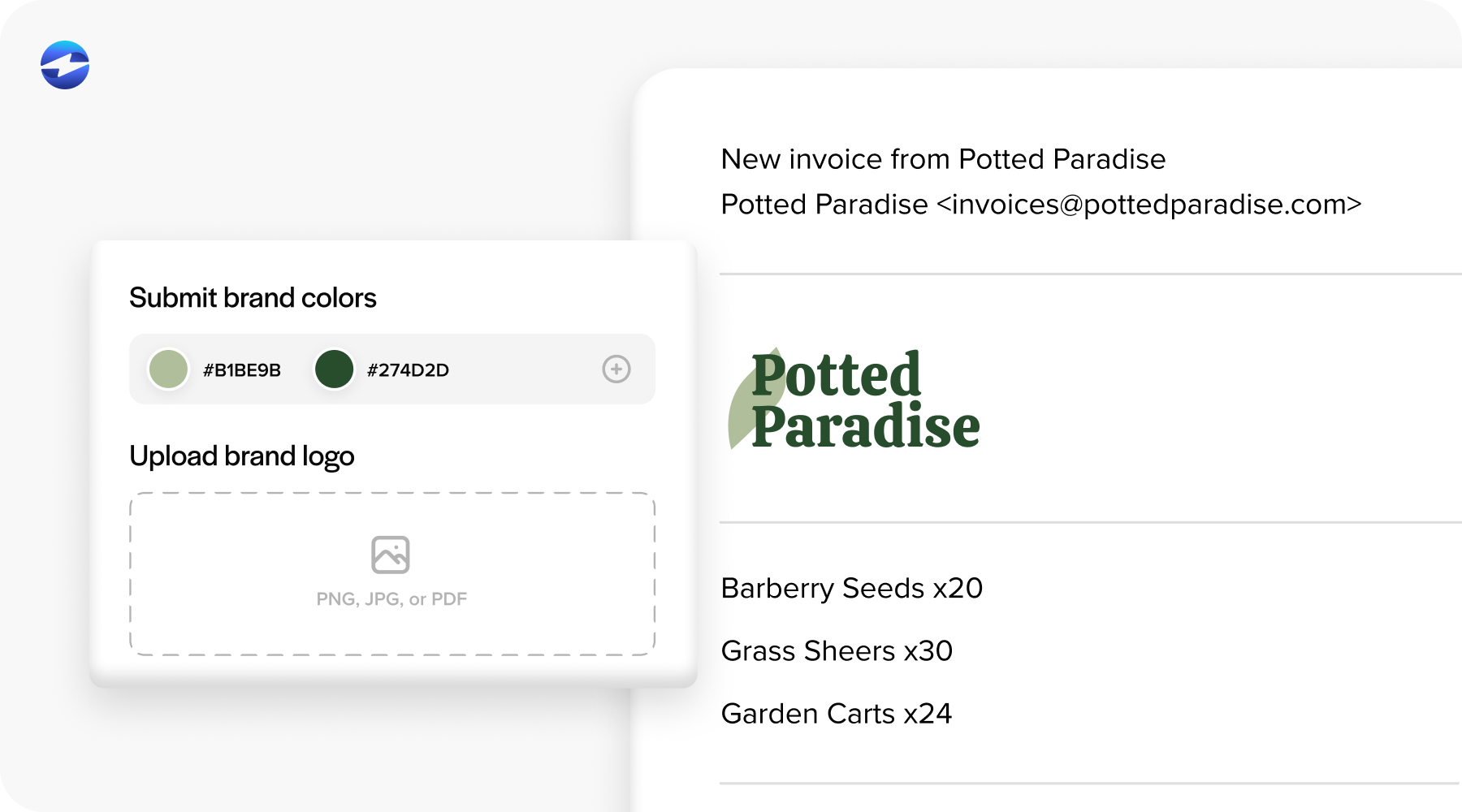

Invoices need to reflect a company’s brand and meet local regulatory requirements. That’s why Salesforce invoicing offers broad customization. Templates can include company logos, colors, and messaging. Custom fields can be added for taxes, discounts, or regional compliance notes. Multi-currency support means the same template can be adapted for different countries without creating confusion for the customer.

For example, a B2B company offering both subscriptions and one-time services can configure invoices that clearly show each line item, tax rates, and discounts. This level of customization doesn’t just improve clarity—it builds customer trust. When invoices look polished and accurate, clients are more likely to pay quickly and without dispute.

Automated Workflows in Salesforce Invoicing

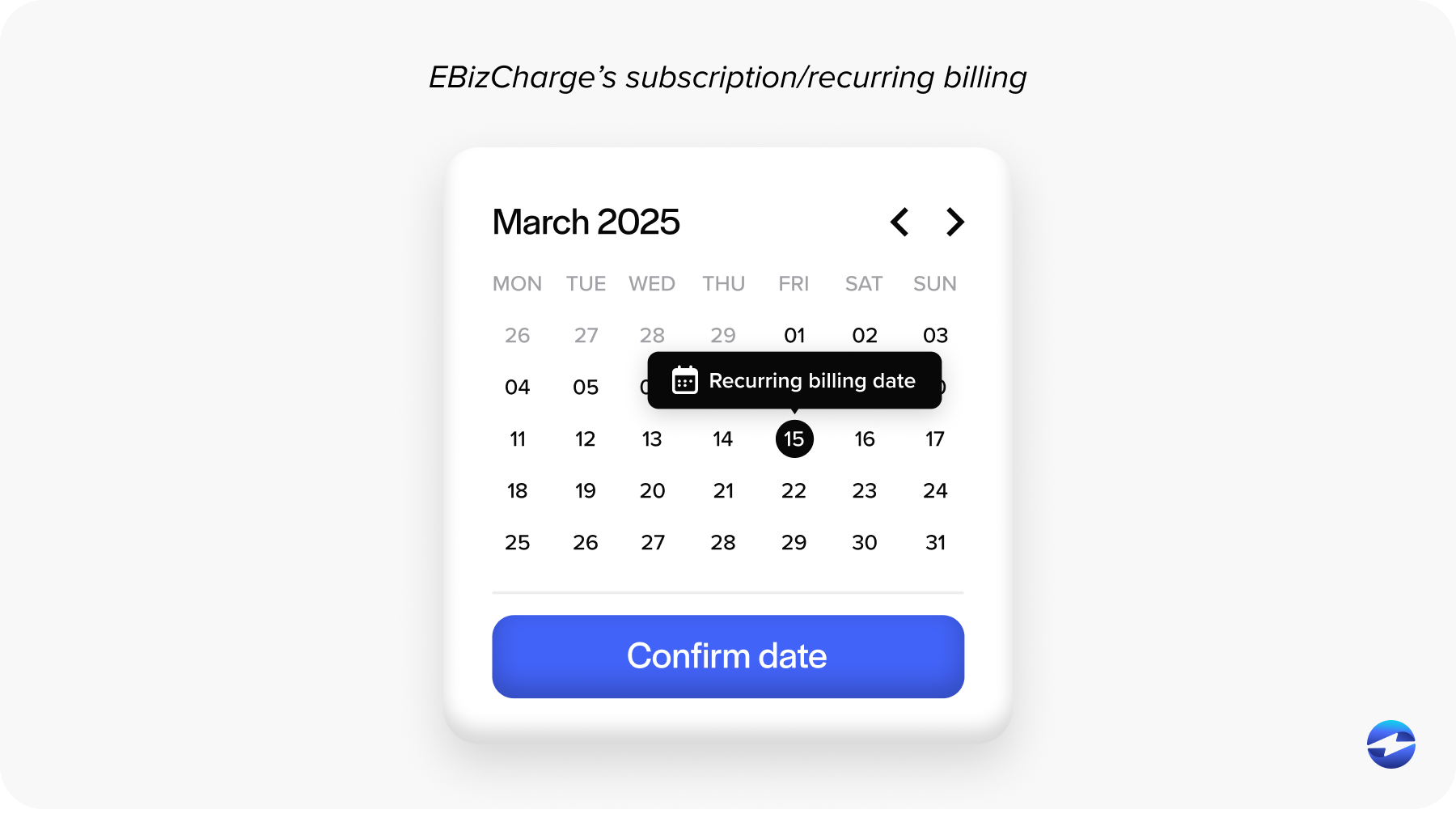

Manual invoicing is time-consuming and error-prone. Automated workflows help avoid these problems. With the Salesforce billing platform, teams can set up recurring invoice runs on schedules—monthly, quarterly, or tied to milestones. This is especially useful for companies running subscription models.

Invoices can also be automatically delivered via email, posted to customer portals, or made available through application programming interfaces (APIs). If adjustments are needed—like issuing credits or partial refunds—the system can handle those without disrupting the rest of the workflow. Automation doesn’t just save time; it ensures consistency. For finance teams, that consistency translates into fewer disputes and faster payment cycles.

Enhanced Features for Advanced Needs

As businesses scale, invoicing gets more complex. Native Salesforce tools offer enhanced features that address these challenges. Subscription billing, for instance, allows companies to manage recurring charges with precision. Usage-based invoicing makes it possible to bill for metrics like API calls, data usage, or seat counts.

There are also tools for handling failed payments and sending dunning reminders. Built-in revenue recognition ensures compliance with ASC 606 or IFRS 15 standards. Dashboards allow leadership teams to monitor key performance indicators (KPIs), such as average days sales outstanding (DSO) or collection rates. Together, these features turn Salesforce invoicing into more than just invoice creation—they make it a comprehensive Salesforce invoice management solution.

Integration with Other Systems

No invoicing process stands alone. Invoices need to be recorded in accounting systems, taxes need to be calculated, and payments need to flow back into financial records. That’s why Salesforce billing supports integration with ERP systems, general ledgers, and tax engines like Avalara or Vertex.

Perhaps most importantly, integration with a Salesforce payment gateway allows for true end-to-end billing automation. Customers can pay invoices using the Salesforce payment option that suits them—whether that’s a credit card, ACH transfer, or a digital wallet. When payments are processed through a connected payment processor, the invoice status in Salesforce updates automatically. This eliminates the need for manual reconciliation and reduces the risk of errors.

Billing Automation and Efficiency Gains

One of the biggest advantages of using the Salesforce billing platform is automation. When invoices, payments, credits, and adjustments sync in real time, finance teams spend less time on reconciliation and more time on analysis. Businesses that adopt billing automation often close their books faster and with fewer surprises.

For example, instead of manually matching a wire transfer to an invoice, the system posts the payment as soon as it’s confirmed by the payment processing solution. Exceptions are flagged automatically so that finance teams can resolve them before they become bigger problems. This kind of automation makes the entire billing cycle more predictable and reliable.

CPQ Billing and the Quote-to-Cash Connection

For businesses using Salesforce CPQ, the link to billing is critical. CPQ billing ensures that once a quote is generated and accepted, the same details are carried forward into the order and invoice. Discounts, contract terms, and special pricing rules all remain intact.

This continuity is one of the strongest arguments for native Salesforce invoicing. Instead of introducing breaks between systems, the flow from quote to cash remains consistent. Finance teams don’t have to double-check whether the invoice reflects the contract—because it does, automatically.

Best Practices for Salesforce Invoicing

Implementing Salesforce invoice management effectively requires preparation. Start with clean product and pricing data—garbage in, garbage out applies here as much as anywhere else. Test invoice templates and workflows thoroughly before going live. Don’t just test the easy cases; test edge cases like mid-cycle subscription changes or partial refunds.

It’s also smart to plan for exceptions. Refunds, chargebacks, and disputes are inevitable, and the system should be configured to handle them gracefully. Finally, align sales and finance teams early in the design process. If sales can sell it but finance can’t bill it, you’ll end up with bottlenecks and manual workarounds.

Building Confidence in Salesforce Payments with EBizCharge

At the end of the day, the effectiveness of your invoicing setup depends on how payments are handled. A native Salesforce payment gateway like EBizCharge makes this much easier. It posts payments directly to invoices and accounts in real time, which removes the need for manual reconciliation. Support for multiple Salesforce payment options—credit cards, ACH, digital wallets, and multi-currency—ensures customers can pay in the way that works best for them.

EBizCharge also includes features like secure tokenization, customer portals, and Level 2/3 data support for corporate cards. These tools reduce costs, improve compliance, and give finance teams confidence that their billing process is both secure and efficient. For companies that rely on Salesforce invoicing, using EBizCharge as the payment processor turns invoicing into a seamless end-to-end payment processing solution.

For IT managers, finance leaders, and eCommerce teams, the message is simple: Salesforce invoicing works best when paired with native tools that respect the data already in the system. With the right combination of automation, customization, and integration, invoicing can move from being a headache to being a dependable backbone of the business.