Blog > Sage Payment Processing: Complete Integration Guide

Sage Payment Processing: Complete Integration Guide

Getting paid shouldn’t be harder than the work itself. Yet for many businesses, collecting payments can be full of delays, manual steps, and disconnected systems. If you’re running a Sage ERP system, integrating your payment processor directly into your workflow can cut out a lot of the friction.

This guide will walk you through Sage payment processing from the ground up—what it offers, how to set it up, and how to get the most out of it.

Understanding Sage Payment Processing

Sage payment processing refers to the ability to accept and manage payments directly within your Sage ERP system. Whether you use Sage 100, Sage 50, Sage 500, or Sage Intacct, the goal is the same: bring your payment processor into the same space where you handle billing, customer accounts, and reporting.

Compared to juggling separate platforms, built-in Sage payment tools keep your records consistent and reduce manual entry. This matters whether you’re processing a few transactions a week or hundreds a day.

Key Features of Sage Payment Processing

Before you integrate anything, it helps to know what’s available. Sage payment processing comes with a mix of core features designed to simplify how you handle money coming in.

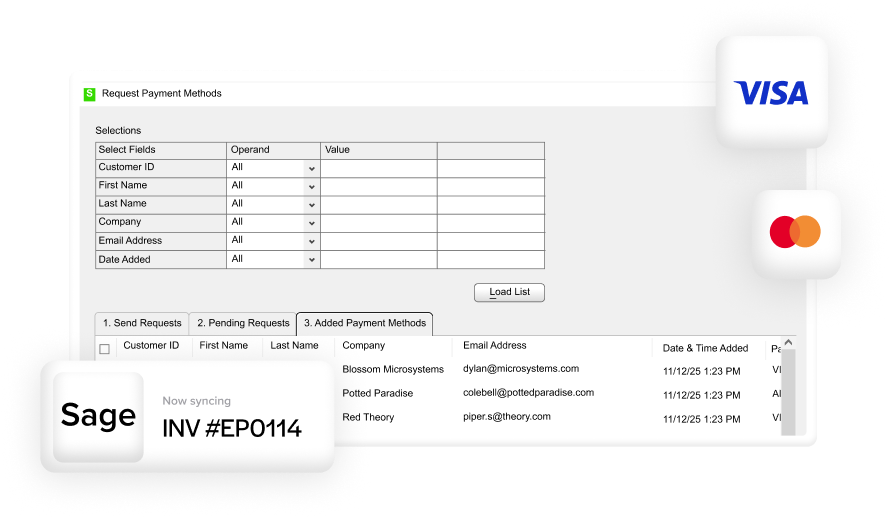

Multiple Payment Methods

Depending on your setup, you can accept credit cards, ACH, debit cards, and sometimes alternative methods. This flexibility allows you to meet customers where they are—whether they prefer a one-time payment on a terminal or need a recurring billing schedule set up virtually.

Security and Compliance

Payment Card Industry (PCI) compliance isn’t optional—it’s essential. Sage payment gateways encrypt sensitive data and use fraud prevention tools to protect both your business and your customers.

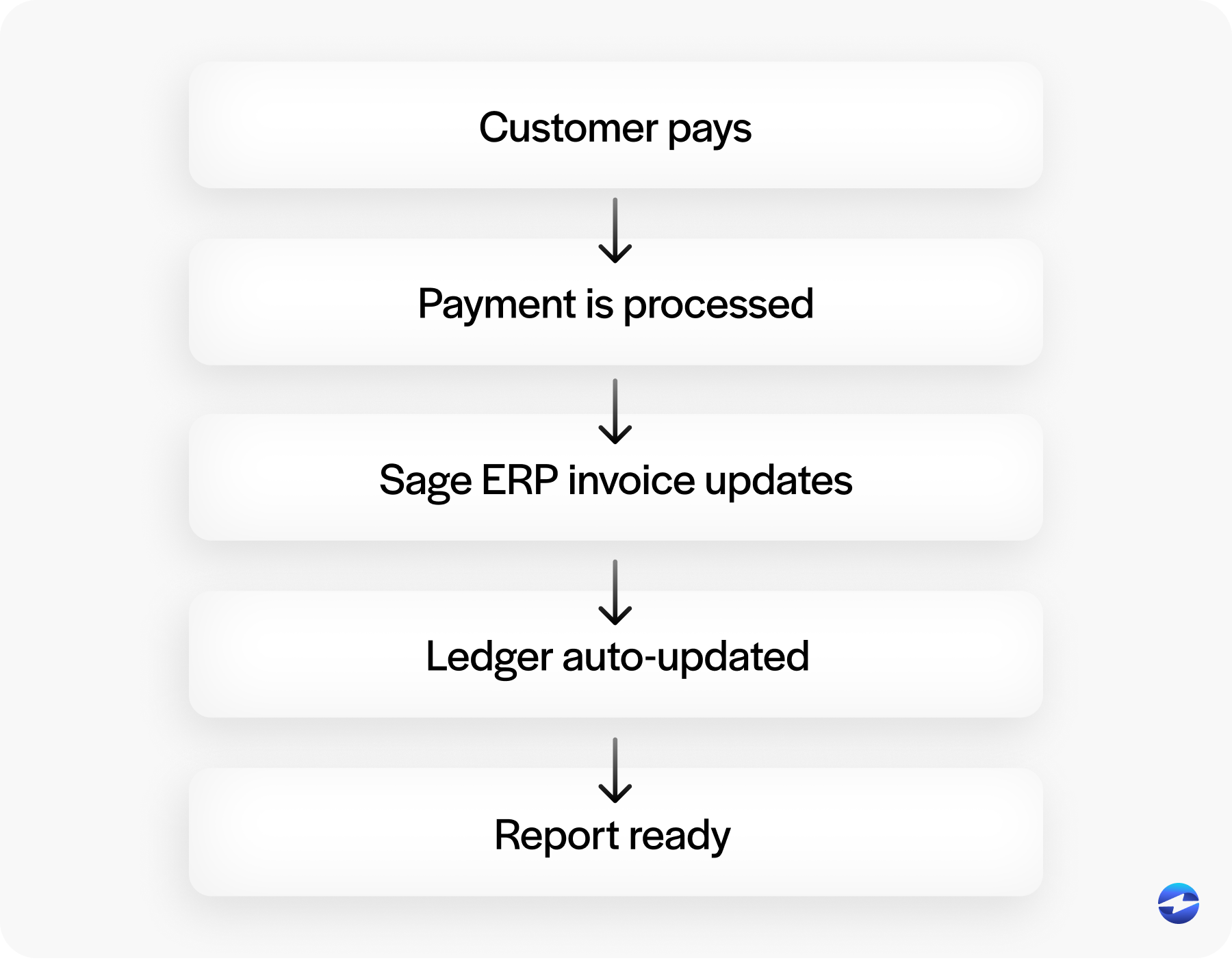

Real-Time Payment Posting

When a payment clears, Sage ERP automatically updates the corresponding invoice and customer account. No extra spreadsheets. No end-of-day manual reconciliations.

Reporting and Analytics

Transaction histories, reconciliation reports, and performance insights are all accessible without leaving Sage. These aren’t just for your accountant—they’re useful for spotting trends and improving cash flow.

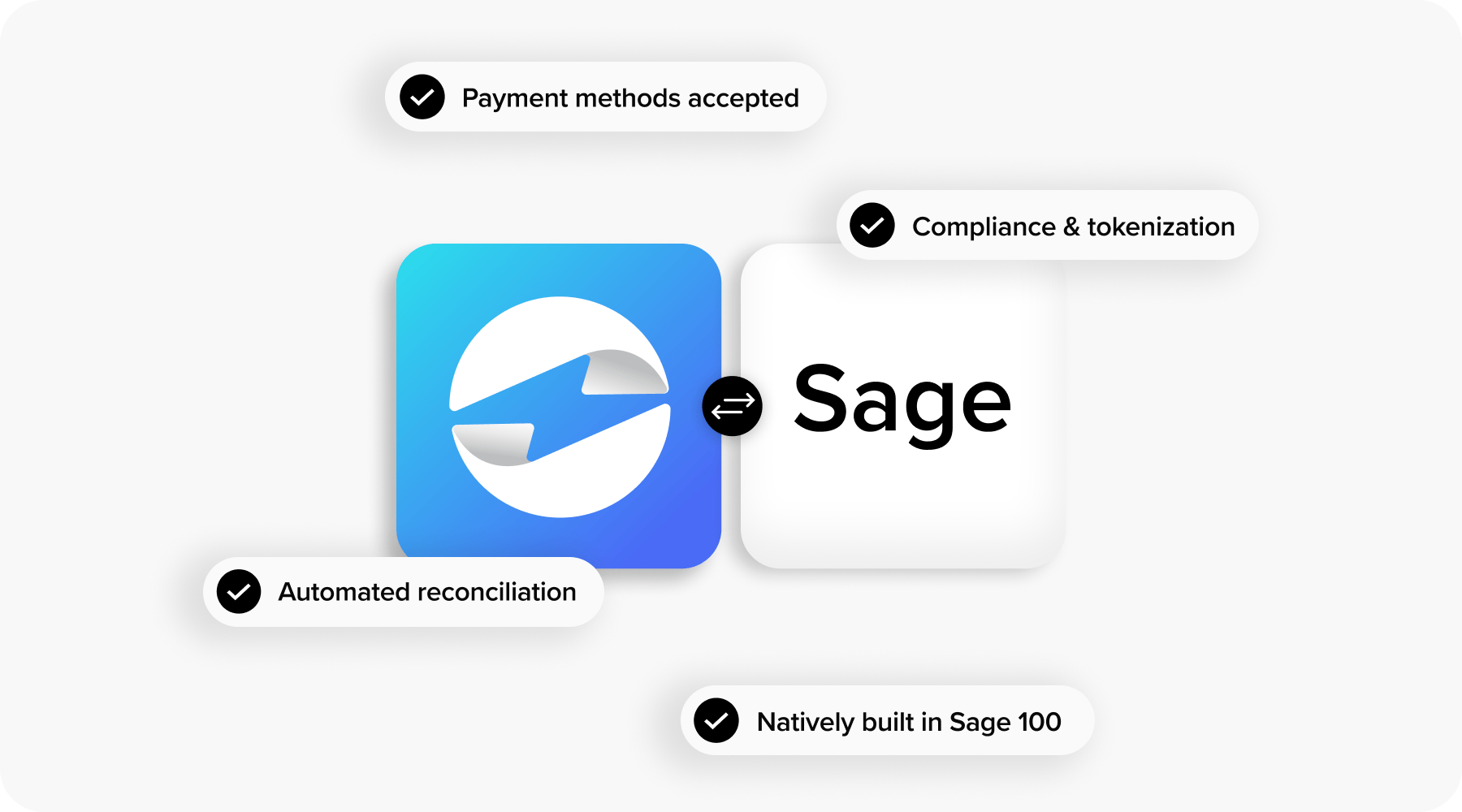

Integration with EBizCharge

EBizCharge takes Sage payment processing further by offering lower fees, advanced reporting, and a customer payment portal. With EBizCharge, you can keep everything in one place while giving customers a simple way to pay.

When you combine these features, you end up with a payment processing solution that’s faster, safer, and easier to manage.

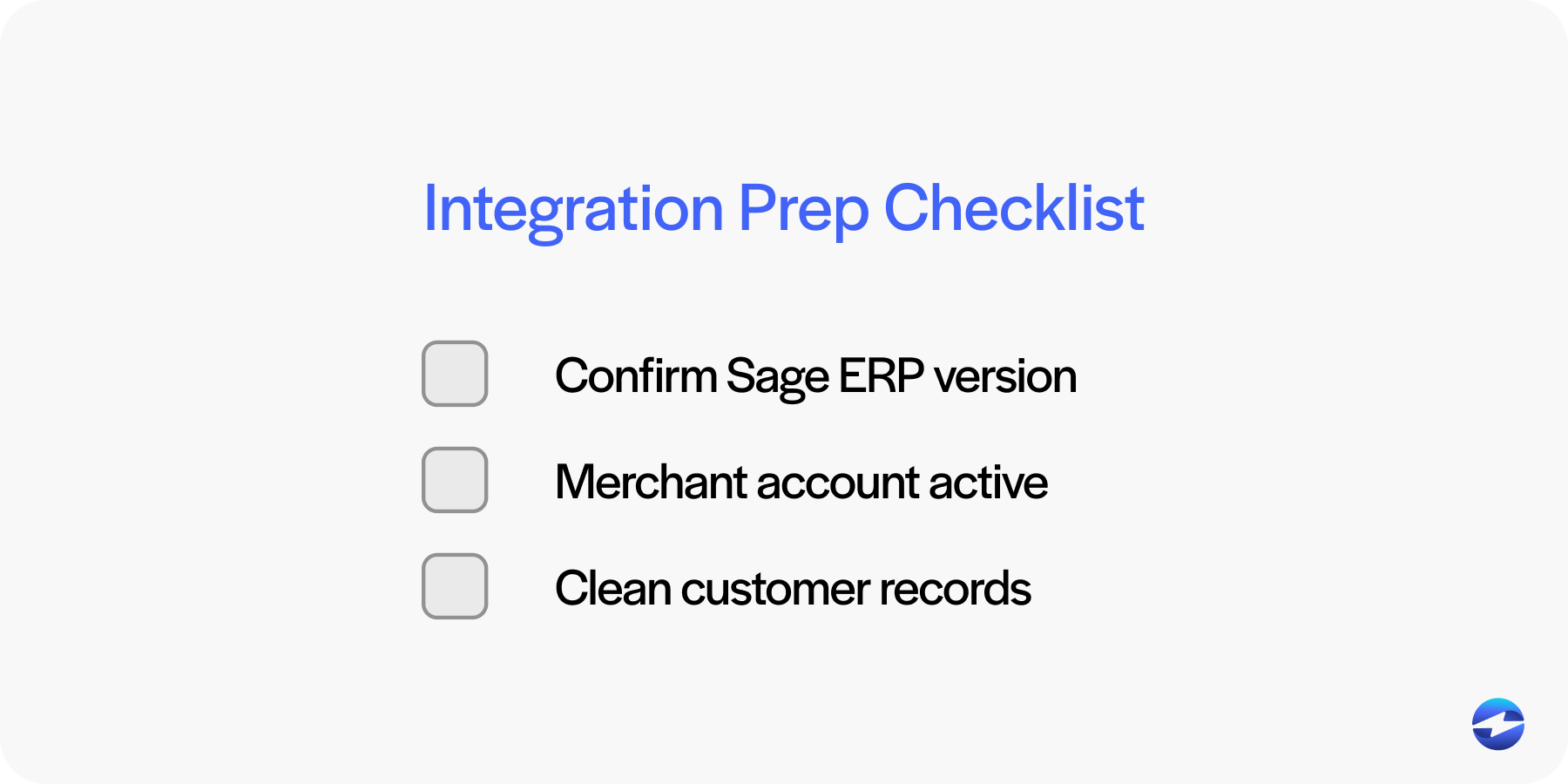

Preparing for Integration

Smooth integrations start with preparation. This is where you ensure your Sage ERP system and your chosen payment processor are ready to work together.

System Requirements: Check that your version of Sage ERP supports payment processing. Different versions—like Sage 100 or Sage Intacct—may have slightly different setup requirements.

Account Setup: You’ll need a merchant account with your payment processor. Make sure your banking details are correct and your account is active before moving forward.

Data Review: Clean up your customer records and open invoices. Accurate data now means fewer headaches once transactions start flowing.

Integration Process Step-by-Step

The integration process will vary depending on your Sage ERP version and payment gateway, but the general steps are similar. Think of this as your blueprint – it’s meant to keep the process organized and ensure nothing gets missed along the way.

Installing the Payment Module

Enable the Sage payment module within your ERP. This is usually done through the Sage billing software’s settings. If you’re unsure where to start, consult Sage’s module documentation for your ERP admin, as the menu paths can vary slightly between Sage ERP system versions.

Configuring Payment Options

Set the payment types you’ll accept – credit cards, ACH, and so on – and define your payment terms. This is also the time to decide if you’ll allow partial payments, deposits, or recurring billing, so your Sage payment setup matches your business model.

Connecting to EBizCharge

If you’re using EBizCharge as your payment processor, connect it via API keys or direct integration tools. The connection process is usually straightforward, but testing here is critical to avoid issues later. EBizCharge’s Sage payment gateway integration ensures that payments flow directly into your Sage ERP without manual entry.

Testing Transactions

Run a few test payments in different scenarios – credit card, ACH, full payment, partial payment. Confirm that invoices are updated, payment records are created, and the amounts post correctly in your Sage ERP system. A little extra time spent testing now will save you from troubleshooting in front of a customer later.

Taking the time to test and verify each step ensures a smooth launch and fewer disruptions for your team and customers.

Best Practices for Optimization

Once your Sage payment processing is live, you can fine-tune it for better results.

- Automate payment reminders to reduce late payments.

- Offer customers a self-service payment portal.

- Monitor transaction reports regularly for unusual activity.

- Schedule regular security audits for your Sage payment gateway.

- These practices keep your payment processing solution running smoothly and securely.

Troubleshooting Common Issues

Sometimes a transaction fails, a payment doesn’t post, or the gateway connection drops. When that happens, check your payment processor’s settings first. Confirm that your Sage payment gateway credentials are correct and your internet connection is stable. If reconciliation reports don’t match, review transaction logs for errors or duplicate entries.

The faster you address small problems, the less likely they are to cause bigger ones.

Future of Sage Payment Processing

The world of payment processing is moving toward more automation, smarter fraud detection, and expanded payment methods. Future Sage payment gateways will likely integrate more deeply with e-commerce platforms and mobile apps, making it even easier to collect payments wherever your customers are.

EBizCharge: Powering a Faster, Smoother Sage Payment Workflow

Integrating Sage payment processing directly into your Sage ERP system is about more than convenience – it’s about creating a smoother, more reliable payment flow from the moment a customer receives an invoice to when the funds hit your account. With the right setup, whether through Sage’s built-in tools or enhanced with EBizCharge, you can reduce manual work, get paid faster, and keep your records clean.

EBizCharge adds another layer of efficiency by letting you process payments without ever leaving Sage, automatically applying them to the correct invoices, and providing customers with easy payment options through a secure portal. This not only saves time for your team but also improves the payment experience for your customers, cutting down on delays and errors. For anyone already using Sage billing software, adding a connected payment processor like EBizCharge is a smart step toward a more streamlined, hassle-free operation.