Blog > Sage Invoice Payments: Streamlining Customer Payment Collection

Sage Invoice Payments: Streamlining Customer Payment Collection

Cash flow is what keeps every organization running. If you’re responsible for accounting, accounts receivable (AR), or daily operations, you know how crucial it is. But collecting payments often takes more time and energy than it should. Invoices can sit unopened in inboxes, reminders sometimes go out late, and manual reconciliation too often becomes a repetitive weekly burden.

Sage invoice payments aim to remove that friction. Instead of sending invoices from a Sage ERP system and then chasing the money in a separate portal, you add a direct, secure way to pay—right on the invoice—and let the system post results for you. Sage billing and collection finally live in the same lane.

If you already work in a Sage ERP environment (Sage 100, Sage 50, Sage 500, or Sage Intacct), this isn’t a reinvention. It’s a straightforward upgrade to the Sage billing workflow you use today.

What Are Sage Invoice Payments?

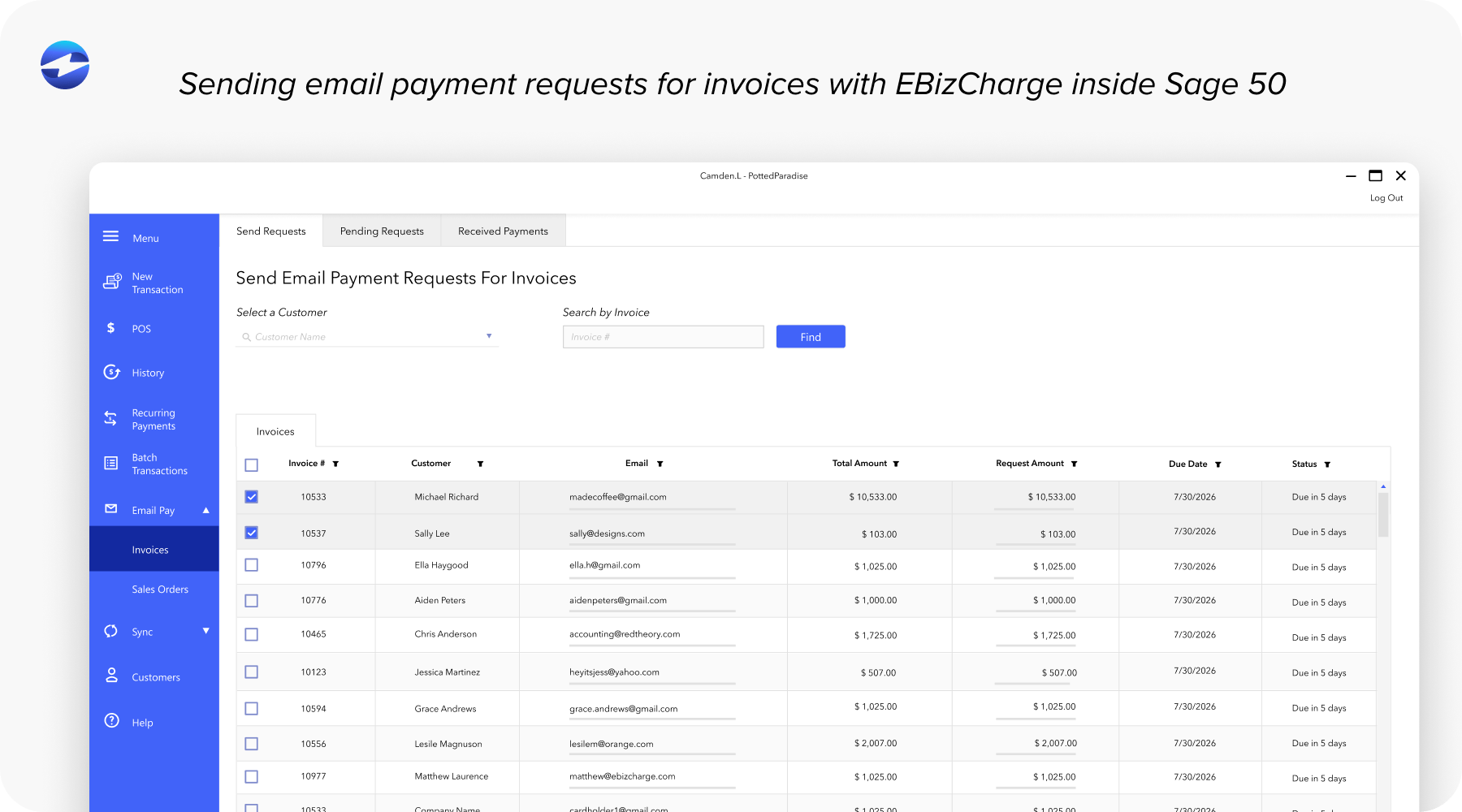

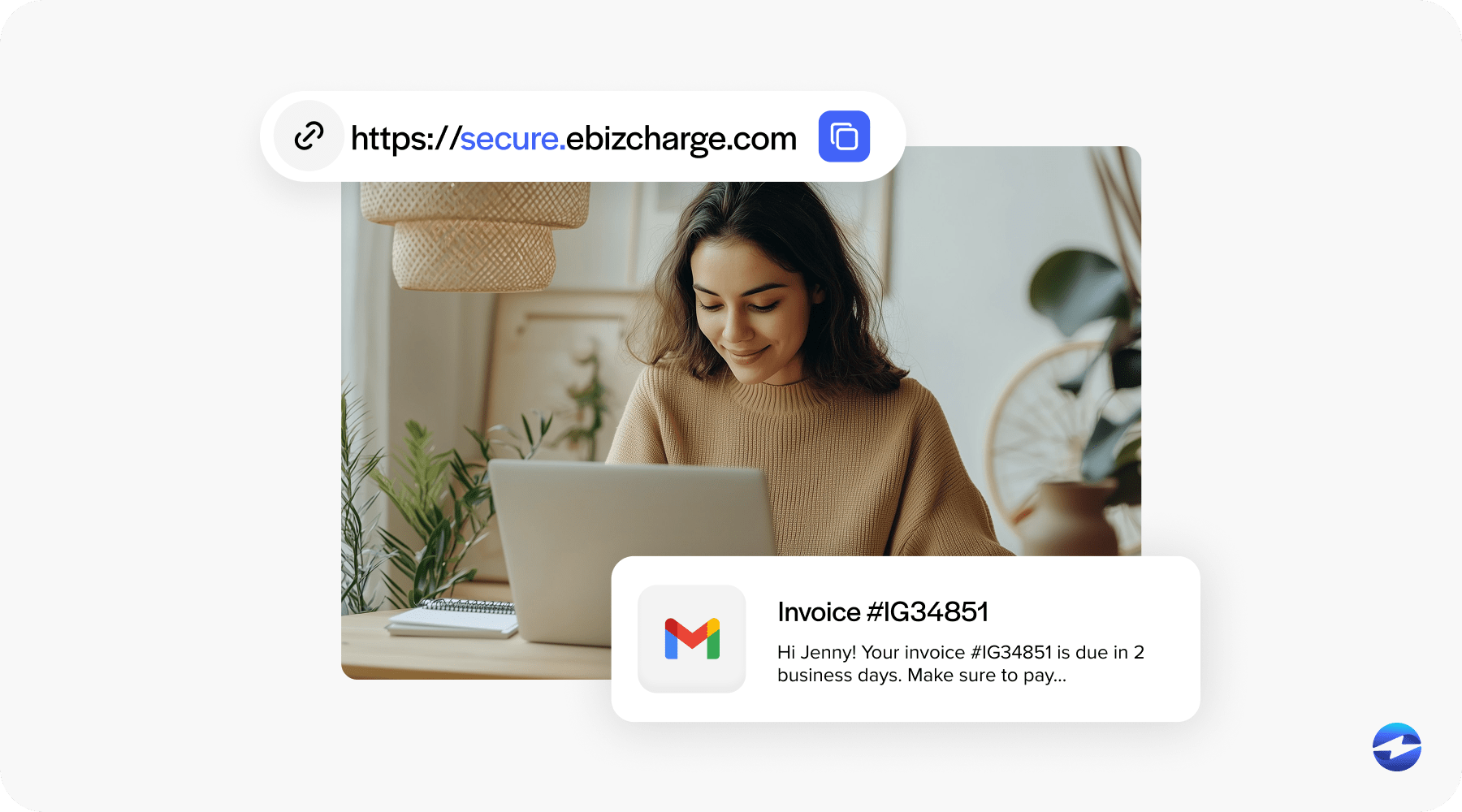

Sage invoice payments allow customers to pay directly from the invoices you send—no extra steps, no separate login. They connect the final mile between sending a bill and recording the cash. The customer clicks a secure link, chooses a payment method, and completes the request. Your Sage payment gateway processes the transaction and your Sage ERP system automatically updates the invoice and customer account.

In a traditional setup, your team issues invoices from Sage billing software, the customer pays somewhere else (card site, bank transfer, or even a check), and then someone has to re-key or import the payment back into the ERP. That’s slow, error-prone, and frustrating. With Sage payment processing tied directly to the workflow, the data stays consistent and the handoffs disappear.

Because this is native to the Sage ERP stack, it works across reporting, audit trails, and general ledger (GL) posting. In short: fewer screens, fewer clicks, and cleaner books.

Key Features

Before you configure anything, it helps to know what you get out of the box—and how these features fit together in everyday use.

Integrated payment links

Every invoice can carry a secure “Pay Now” link. Customers don’t have to ask how to pay; it’s right there. Less friction leads to faster payment, which brings down days sales outstanding (DSO) and gives your cash flow breathing room.

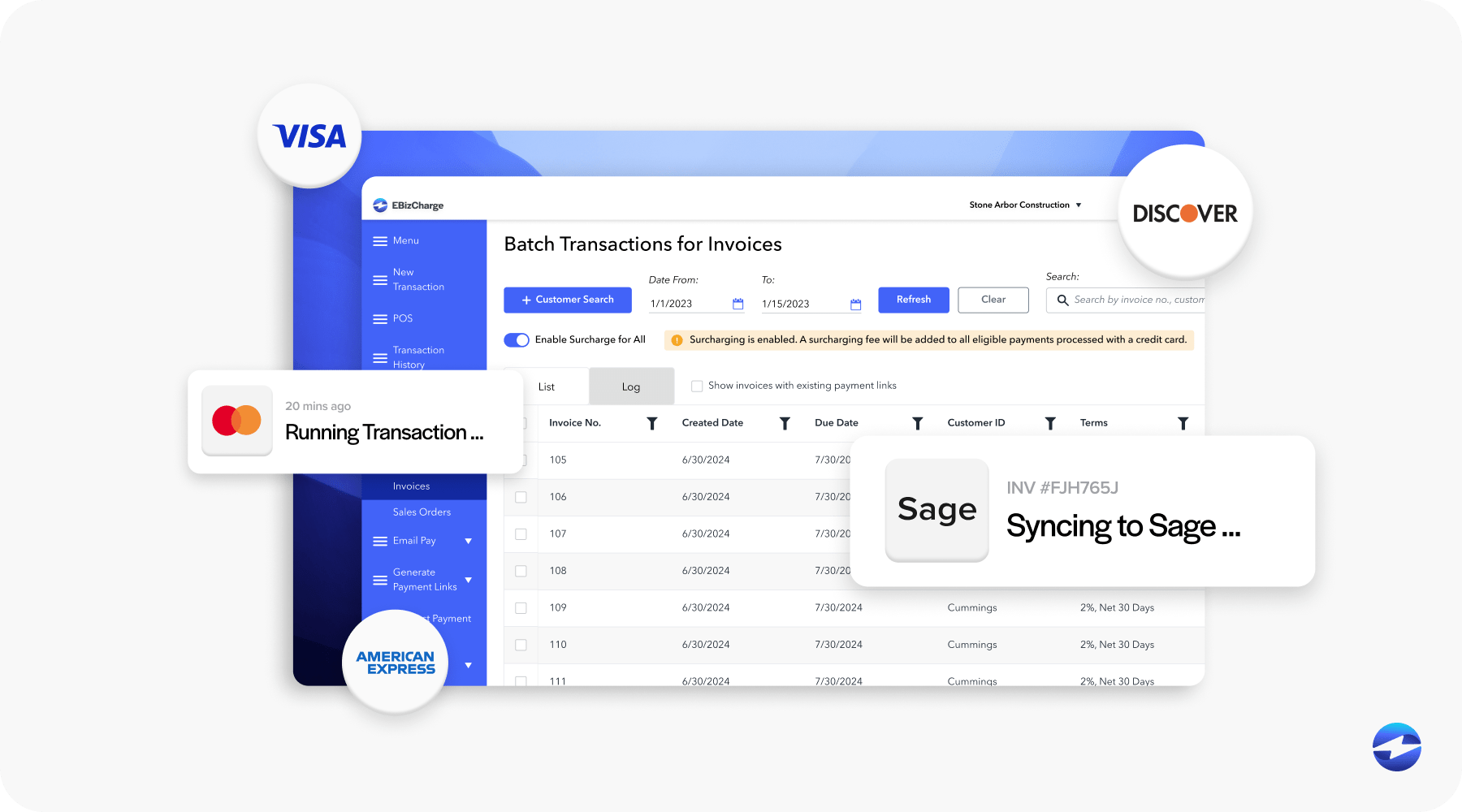

Multiple payment methods

Your Sage payment processing configuration can accept credit cards, ACH, and other supported payment methods. Some customers prefer cards for rewards and simplicity. Others prefer ACH. Supporting both caters to customer preferences and helps you get paid sooner.

Real-time posting back to Sage

Payments collected through the Sage payment gateway flow straight into the correct invoice and customer record. In many setups, GL posting happens automatically. No swivel chair between systems, no late-night spreadsheet cleanup. Your Sage ERP remains the source of truth.

Security and compliance built in

Payment Card Industry (PCI) compliance and encryption are non-negotiable. Sage invoice payments route sensitive data through secure channels and include fraud prevention tools that protect your customers and your brand. That makes auditors happier and reduces risk.

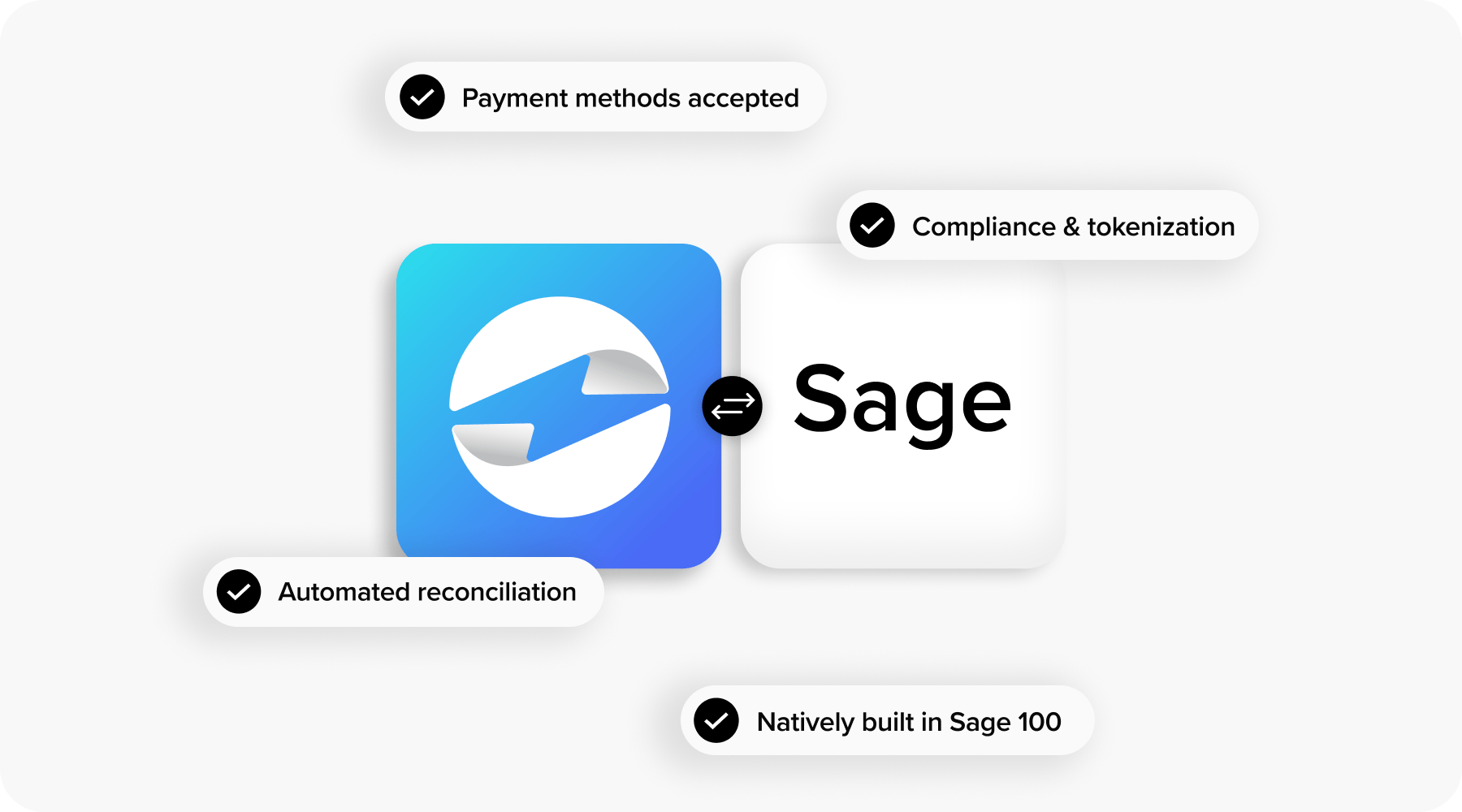

Tight integration with EBizCharge

If you use a payment processing solution like EBizCharge, you extend the core experience with faster funding, a simple customer payment portal, and richer reporting. Because EBizCharge is embedded in Sage billing software, your team can process Sage payment activity without leaving the ERP, and results post automatically.

Together, these capabilities turn a basic invoicing flow into a connected payment processing solution that is easier for customers and more reliable for finance.

Setting Up Sage Invoice Payments

Setup isn’t hard, but a careful pass prevents headaches later. Treat it like a checklist rather than a sprint.

1. System requirements

Verify that your Sage ERP version supports invoice payment features and that any required modules or permissions are in place. Sage 100, Sage 50, Sage 500, and Sage Intacct each have slightly different paths to enablement, so skim your edition notes before you start.

2. Enable payment functions in billing

Inside Sage billing software, turn on invoice payment functionality and confirm your invoice templates include live payment links. This switch turns an invoice into an actionable request rather than a static PDF.

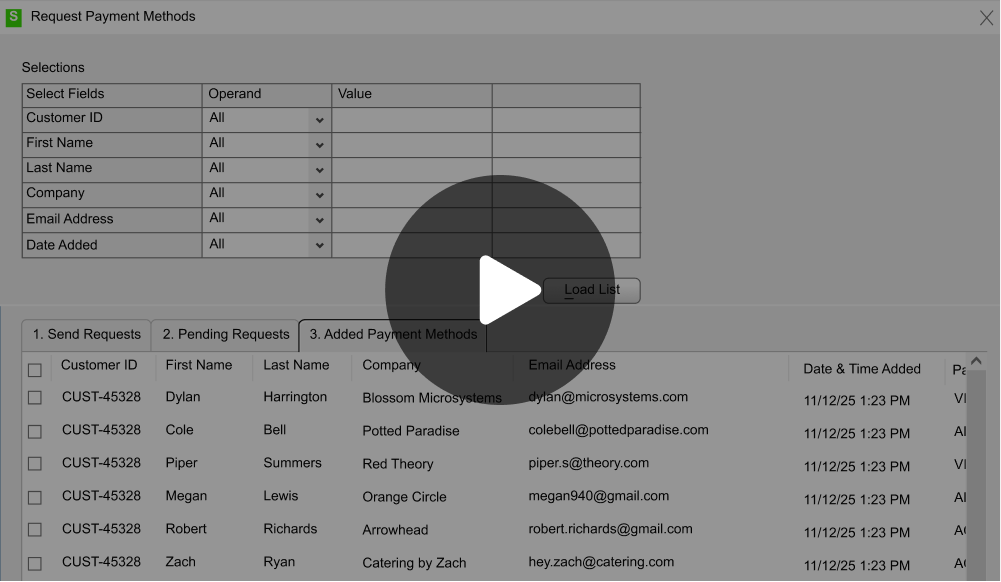

3. Link a payment processor

Connect the Sage payment gateway to a payment processor you trust. If you choose EBizCharge as the payment processor, use its direct integration so you can handle every Sage payment without leaving the Sage ERP system. Store API keys or credentials securely and document who has access.

4. Test end-to-end

Run test transactions for the methods you’ll accept—credit cards and ACH at a minimum. Try full payments, partial payments, a refund, and a void. Validate that invoice status changes correctly, cash posts to the right account, and reports reflect reality. An hour of testing here saves days of cleanup later.

5. Roll out with a pilot group

Consider piloting with a small customer set for one billing cycle. Gather feedback on the payment link experience and iron out template or email nuances before a broader rollout.

Bottom line: When Sage payment processing is wired correctly from day one, your collections improve immediately—and your team will trust the system.

Best Practices for Streamlining Collections

Tools help, habits sustain. These practices keep momentum once Sage invoice payments are live.

- Automate polite reminders. Schedule friendly nudges before and after due dates. Keep them short, include the payment link, and avoid accusatory language.

- Offer real choice. Keep both card and ACH available. Let customers save a preferred method when policy allows. Choice reduces excuses.

- Keep invoices clean. Clear descriptions, accurate totals, and straightforward terms minimize disputes. Clean in equals clean out—and faster Sage payment collection.

- Clarify handoffs. Align sales, operations, and billing on when an invoice should go out and what “complete” means. Fewer discrepancies mean fewer delays.

- Review the numbers. Use your Sage ERP dashboards and reports to watch aging, method mix, exception rates, and write-offs. Small adjustments to terms or cadence can move the needle quickly.

- Document quick fixes. When you solve a hiccup, write the steps down. The next time, it’s a two‑minute fix instead of a 20‑minute guess.

Benefits of Using EBizCharge with Sage Invoice Payments

You can run the workflow with built‑in tools, but EBizCharge adds practical advantages that you feel every billing cycle.

- Stay inside Sage. Process Sage payments in the screens your team already knows. No extra portals, fewer credentials, faster training.

- Faster collection, less effort. The customer portal is straightforward—open the invoice, click, pay. Payments flow into the Sage ERP system, update the invoice, and appear in reports without manual steps.

- Multiple methods, one workflow. Credit cards, ACH, and recurring schedules all run through the same Sage payment gateway path. Posting is consistent across methods.

- Lower total cost. Competitive rates and fewer third‑party add‑ons can reduce your overall processing spend. Over a year, that matters.

- Better visibility. Transaction details live where finance needs it—inside Sage billing and financial reports—so reconciliation and month‑end close are calmer.

EBizCharge helps turn Sage invoice payments into a tighter payment processing solution that favors speed, accuracy, and control.

Troubleshooting Common Issues

Even well‑configured systems have the occasional off day. Here are a few troubleshooting tips.

- Payment link not appearing: Check that your active invoice template includes the payment token and that the feature is enabled in Sage billing software.

- Transactions failing intermittently: Confirm payment processor credentials and permissions. Look for expired keys, disabled users, or firewall rules blocking calls to the Sage payment gateway.

- Invoice status not updating: Verify that posting jobs are running and that the integration user has rights to update invoices and customer accounts inside the Sage ERP. Re-run a test transaction to isolate the step.

- ACH delays: Remember, ACH settlement isn’t instant. Communicate timelines to customers and set internal expectations accordingly.

Create a lightweight runbook so anyone on the team can work through these checks quickly.

Streamlining Payments and Strengthening Cash Flow

Sage invoice payments close the loop between sending an invoice and recording the cash. By embedding secure links, supporting multiple methods, and posting results instantly through the Sage payment gateway, you remove busywork and shorten the time to payment. It’s a practical upgrade to your Sage billing routine rather than a wholesale change.

Layer EBizCharge on top and the workflow gets even smoother. You process every Sage payment without leaving the Sage ERP system, customers get a clear and secure way to pay, and finance gets accurate data without late‑night spreadsheet work. For teams that value reliability over flash, this is the kind of payment processing solution that quietly pays for itself—month after month.

If you’re responsible for cash flow, you don’t need lofty promises—you need a system that works the same way every time. Set up Sage billing software carefully, connect a dependable payment processor, and keep your habits consistent. Your collections will become more predictable, less stressful, and much faster.