Blog > Sage Intacct vs. NetSuite for Payment Automation: Which Wins?

Sage Intacct vs. NetSuite for Payment Automation: Which Wins?

The right ERP can transform how your team handles billing, payments, and reconciliation, while the wrong fit can leave you stuck in manual processes that cost time and money. For finance leaders, IT managers, and operations teams, understanding how each system handles payment automation and processing costs can make all the difference.

Both Sage Intacct ERP and NetSuite ERP are industry leaders in cloud-based financial management. They share similar goals—streamline accounting, unify data, and improve cash flow visibility—but they approach automation in different ways. This comparison explores how Sage vs NetSuite stack up across automation, integration, cost, and real-world usability, and why many users still rely on trusted payment tools like EBizCharge to make their systems even stronger.

Sage Intacct vs NetSuite: A General Overview

At a high level, Sage Intacct ERP focuses on modular financial management, while NetSuite ERP takes a more unified, all-in-one approach. Sage Intacct lets companies start small and expand by adding modules as they grow. This flexibility appeals to mid-market organizations that want control over customization without overpaying for unused tools. NetSuite ERP system, on the other hand, delivers everything under one roof—financials, CRM, inventory, and HR. It’s powerful but can feel heavy-handed for smaller teams that need agility.

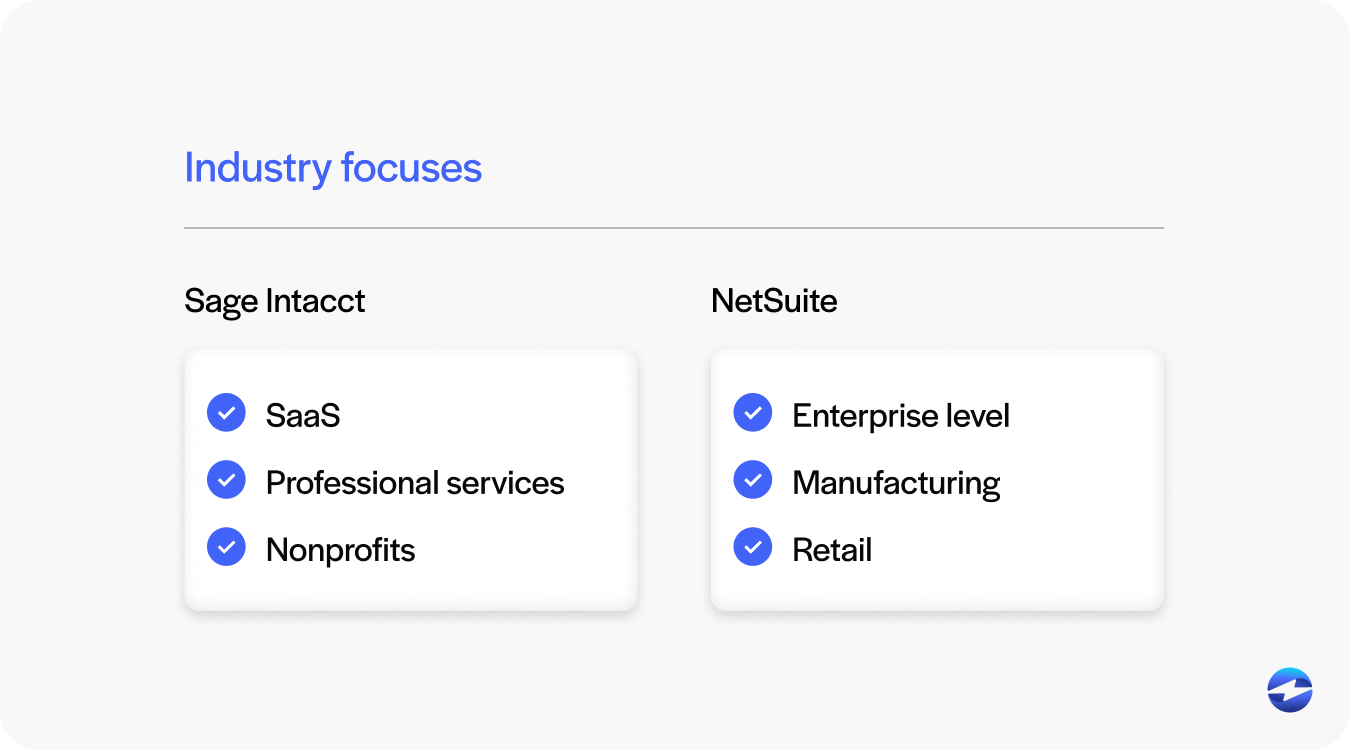

In terms of industry focus, Sage Intacct shines in areas like SaaS, professional services, and nonprofits where flexibility and reporting precision matter most. NetSuite shines with enterprise-level operations, especially in manufacturing and retail. Both offer strong application programming interfaces (APIs) and integration networks, but Sage’s open framework often gives it the edge for those looking to tailor workflows through certified Sage Intacct integration partners.

When it comes to user experience, Sage is often described as straightforward and finance-driven, while NetSuite leans more toward operational breadth. In short, Sage Intacct feels like an accountant’s tool that’s evolved for modern needs, while NetSuite feels like a broad ERP that happens to include accounting.

Sage Intacct vs NetSuite for Payment Automation

Payment automation is where both systems prove their worth. NetSuite vs Sage Intacct showcases two distinct philosophies—NetSuite relies on SuitePayments, its built-in automation framework, while Sage leverages its open integration design to connect with third-party payment processors.

In NetSuite, SuitePayments handles most transactions directly. It’s designed to work seamlessly with NetSuite’s billing and reconciliation tools, reducing the need for manual oversight. However, that convenience often comes at the cost of flexibility. Customizing or extending SuitePayments can be difficult without specialized technical support or middleware.

Sage Intacct takes the opposite approach. Its flexibility lies in the partnerships it fosters through Sage Intacct integration apps. Users can connect their preferred payment processor or payment processing solution, giving them control over pricing, automation depth, and reporting. This means that companies can tailor automation workflows—such as recurring billing, tokenization, and automatic reconciliation—without being locked into one vendor’s pricing or capabilities.

In practice, this makes Sage’s automation more customizable, while NetSuite’s is more centralized. For teams that want standardized processes with minimal management, NetSuite’s approach may be appealing. However, for organizations that prioritize flexibility and cost efficiency, Sage’s modular setup usually wins.

Payment Processing Costs

When comparing costs in Sage Intacct vs NetSuite, both have distinct pricing structures that influence long-term ROI. Sage Intacct pricing is modular, meaning companies pay for what they use. The open structure allows for competitive payment options through external partners like EBizCharge, often resulting in lower overall transaction costs.

NetSuite’s ERP integration model is more centralized under Oracle’s SuitePayments, which simplifies billing but limits cost flexibility. Users pay for convenience—and while it offers strong reporting and native automation, the bundled pricing can feel restrictive. Transaction fees, gateway costs, and API maintenance fees can add up, particularly for high-volume businesses.

One overlooked cost factor is time. Automated reconciliation and reporting drastically reduce the hours finance teams spend on manual corrections. Both systems can deliver savings, but Sage’s approach—especially when paired with an optimized payment processing solution—tends to minimize hidden fees and maintenance costs more effectively.

Nonprofit Payment Management in Sage Intacct

Nonprofits have unique needs, and Sage Intacct has long been recognized as one of the best solutions for this sector. Its financial modules are designed to track donations, grants, and fund restrictions seamlessly. Automated payment tools integrate directly with these workflows, allowing nonprofits to manage incoming contributions, donor payments, and recurring support with minimal manual input.

NetSuite also supports nonprofit organizations through its Social Impact program, but it often requires more configuration to achieve the same level of simplicity that Sage provides out of the box. In Sage Intacct ERP, transparency is built into the system—every payment, grant, and donor record connects directly to financial reports, ensuring compliance and audit readiness.

For nonprofits that rely on accuracy and accountability, Sage Intacct’s intuitive design makes payment management smoother. Integration partners enhance that experience even further, providing automation that saves time and allows teams to focus more on their mission than data entry.

Why Sage Intacct and NetSuite Users Like EBizCharge

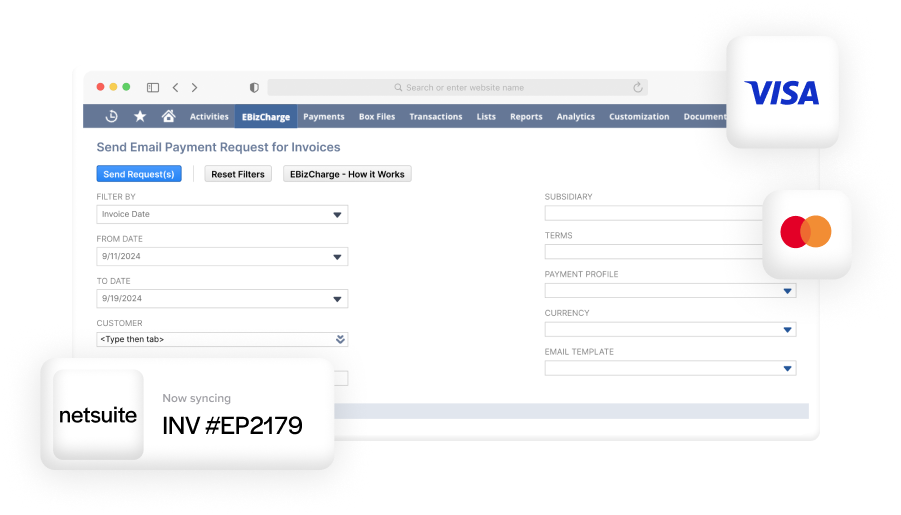

Both Sage and NetSuite users rely on EBizCharge for similar reasons: it simplifies payments and adds real automation power to each ERP. Built to integrate directly into both Sage Intacct ERP and NetSuite ERP systems, EBizCharge eliminates the need for external reconciliation tools and manual payment posting.

For Sage users, EBizCharge provides native functionality—payments post instantly to invoices, customer accounts, and projects. For NetSuite users, it connects through the SuiteApp ecosystem, bringing that same level of automation and transparency to SuiteBilling. Both platforms benefit from EBizCharge’s tokenization and PCI-compliant security, which safeguard sensitive payment data without additional software layers.

Another major reason users love EBizCharge is its cost optimization. The platform uses interchange optimization to automatically process transactions at the lowest possible rate, saving companies significant amounts over time. It’s a practical benefit that finance professionals immediately appreciate.

EBizCharge also stands out for its support and flexibility. Both Sage and NetSuite teams value that setup is quick, the interface is intuitive, and support teams understand each ERP’s unique workflows. For organizations that want automation without adding complexity, EBizCharge is often the final piece that makes their ERP payment strategy complete.

Finding the Right Fit for Your Financial Workflow

When it comes to Sage Intacct vs NetSuite, both systems deliver powerful tools for finance automation, but they serve slightly different audiences. Sage vs NetSuite is really a question of customization versus consolidation. NetSuite provides a comprehensive environment that’s hard to beat for large, complex enterprises, while Sage Intacct offers precision, modularity, and lower costs for companies that value adaptability.

For payment automation specifically, Sage often has the edge. Its open integrations, flexible pricing, and strong partner ecosystem—especially tools like EBizCharge—make it easier for finance teams to build a tailored payment processing solution that grows with their business. With its built-in SuitePayments and centralized design, NetSuite offers simplicity but can be more expensive and less flexible in the long run.

Ultimately, the right choice depends on your priorities. If you need an all-in-one NetSuite ERP integration for enterprise operations, NetSuite may be a better fit. But if your goal is control, affordability, and seamless automation, Sage Intacct integration with a trusted payment processor like EBizCharge might be the smarter move. Either way, both platforms can deliver incredible efficiency—it’s just a matter of finding the rhythm that fits your organization’s workflow and budget.