Blog > Sage Intacct Payment Processing: Integration Best Practices

Sage Intacct Payment Processing: Integration Best Practices

Efficient payment processing is something every finance team depends on, but it’s also an area that can quickly become complicated if systems don’t communicate. If your enterprise resource planning (ERP) system and payment tools are disconnected, you’re left reconciling transactions manually, re-entering data across platforms, and spending too much time cleaning up mistakes. That’s wasted energy and, more importantly, wasted time that could be spent on more strategic work.

That’s where Sage Intacct payment processing comes into play. By connecting payments directly within your Sage Intacct ERP, you can create a streamlined process that reduces manual effort and ensures accuracy across the board.

This article will explore best practices for Sage Intacct payment integration, offering practical advice that finance teams can apply right away. We’ll also look at how tools like EBizCharge can strengthen your setup with reliable third-party integration.

Understanding Sage Intacct Payment Processing

Sage Intacct is designed as a flexible, cloud-based enterprise resource planning (ERP) built to handle the complexities of modern businesses. Within it, payment processing is more than just collecting money—it’s about ensuring that cash flow is steady, records are accurate, and your customers have a smooth experience when paying.

When you use Sage Intacct payment processing, billing connects directly to accounts receivable (AR) and general ledger (GL). That means invoices and payments aren’t floating around in separate systems. Instead, you get real-time updates across your financials. Billing in Sage Intacct ensures invoices are accurate, while integrated payment workflows ensure that the books reflect it instantly once a payment is made.

This combination of billing and payments inside one platform removes much of the friction that comes with managing finances. Rather than juggling spreadsheets or relying on after-the-fact reconciliations, you’re working with a single source of truth.

Key Features of Sage Intacct Payment Processing

To get the most out of Sage Intacct software, it helps to know what its payment tools are built to do. Here are a few of the features that stand out.

Multiple Payment Methods

Customers expect flexibility in how they pay. With Sage Intacct payment processing, you can accept credit cards, ACH transfers, and even newer options like digital wallets. This makes it easier to support one-time transactions as well as recurring billing. For businesses with subscriptions or long-term contracts, that flexibility is critical.

Real-Time Integration with Modules

Payments don’t happen in isolation. They tie back to accounts receivable, the general ledger, and even order management. With Sage Intacct payment integration, every transaction posts in real time, giving your team immediate visibility. This eliminates guesswork and keeps everyone—accountants, controllers, and CFOs—on the same page.

Security and Compliance

Any payment processor you use must be secure. Sage Intacct supports Payment Card Industry (PCI) compliance, which protects sensitive payment data. Add fraud prevention tools and role-based permissions, and you have a strong foundation for safe financial operations. Security isn’t just about meeting requirements—it’s about building customer trust.

Reporting and Analytics

Efficient payment processing isn’t just about moving money; it’s also about insight. Sage Intacct offers reconciliation tools, dashboards, and analytics that show payment trends. By spotting bottlenecks, you can identify where customers get stuck and find ways to improve. Strong reporting transforms payments from a back-office function into a source of strategic value.

Together, these features provide more than convenience – they create a reliable system for managing payments end-to-end. With the right configuration, they help finance teams maintain accuracy, ensure compliance, and gain the kind of visibility that leads to smarter decisions.

Best Practices for Integrating Payment Processing with Sage Intacct

Getting started with Sage Intacct payment integration isn’t complicated, but there are best practices worth following. These steps help ensure your Sage Intacct setup is both efficient and secure.

Choose the Right Payment Processor

Not all processors are the same. Look for a payment processing solution that integrates directly with Sage Intacct. Compatibility matters—you want payments to post automatically, without extra steps. Consider transaction fees, support, and the ability to scale as your business grows. For many teams, choosing a processor with proven third-party integration like EBizCharge is the easiest way to check all those boxes.

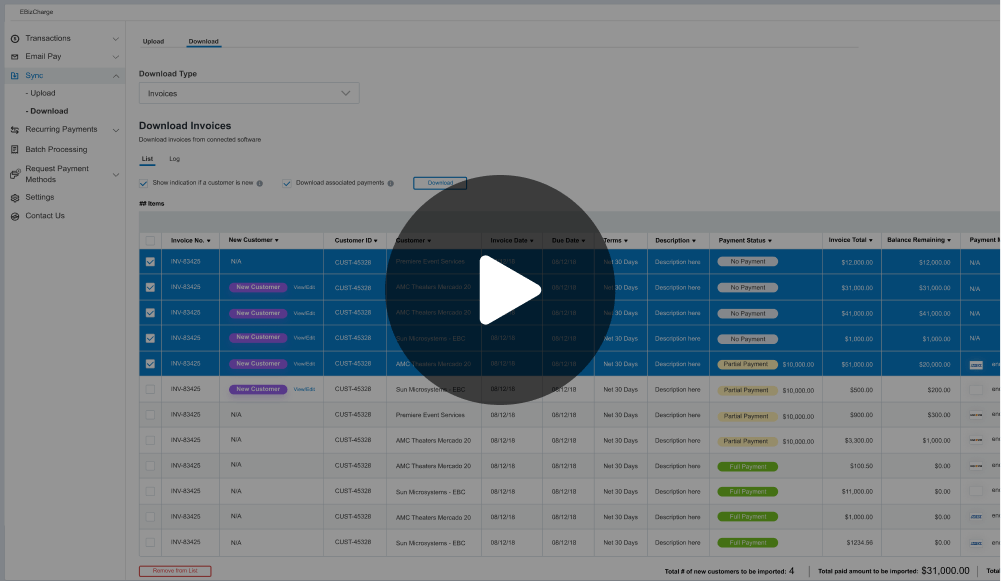

Automate Workflows

Automation is where the real savings come in. Configure your system to automatically post payments, send reminders, and reconcile accounts. This reduces the risk of manual errors and speeds up the entire billing cycle. With automation in place, billing in Sage Intacct feels less like a chore and more like a dependable process.

Prioritize Security

Security isn’t optional—it’s essential. Ensure your payment solution supports PCI compliance and includes fraud monitoring. Review role-based permissions regularly to confirm that only the right people have access to sensitive data. Strong security protects your customers and keeps your organization in compliance.

Train Finance Teams

Technology is only as strong as the people who use it. Make sure your finance teams are trained not just on how to process payments, but also on how to troubleshoot, interpret reports, and maintain workflows. Training builds confidence, reduces mistakes, and helps your team get the most from Sage Intacct ERP.

Leverage Reporting Tools

Don’t overlook the value of reporting. Use dashboards in Sage Intacct software to monitor payment timelines, track late accounts, and identify recurring issues. Data-driven insights can reveal which customers need more reminders, which payment methods are most popular, and where your process can be streamlined.

These best practices form a roadmap for building a smooth, reliable integration. By focusing on compatibility, automation, security, training, and reporting, finance teams can create a payment process inside Sage Intacct that works well and scales well.

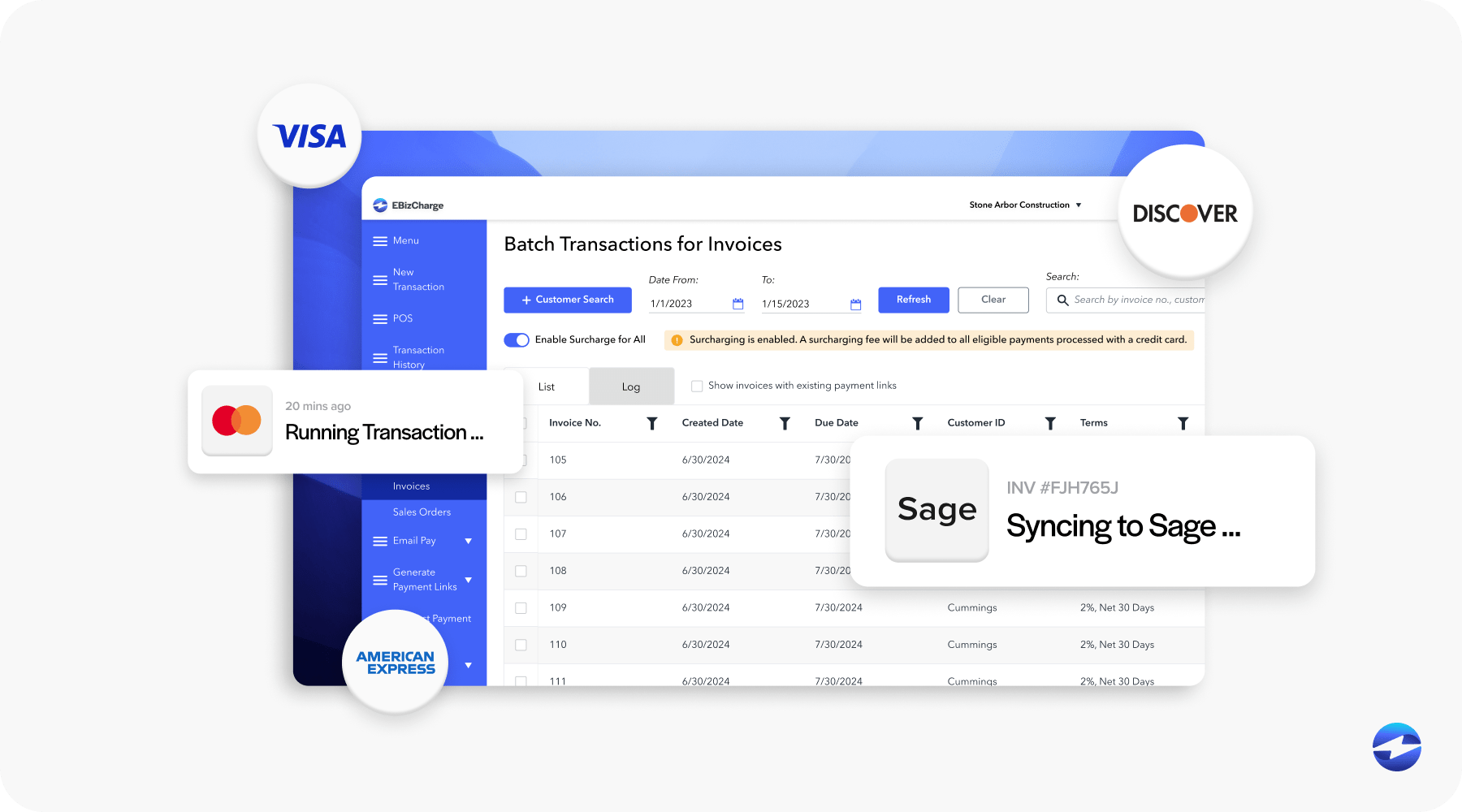

Benefits of Using EBizCharge with Sage Intacct

While Sage’s built-in features are strong, adding EBizCharge provides an extra layer of efficiency. EBizCharge connects through third-party integration and extends the value of Sage Intacct payment processing in several practical ways.

- Streamlined posting: Transactions flow directly into Sage Intacct without extra manual entry.

- Cost savings: Many businesses experience lower processing fees compared to traditional providers.

- Faster collections: Customers can pay through an easy-to-use online portal, reducing delays.

- Better visibility: Payment data syncs automatically with Sage Intacct, making reconciliation faster and more transparent.

By combining Sage Intacct ERP with EBizCharge, you get a more powerful payment processing solution. Billing, payments, and reporting all work together, reducing busy work and improving both internal efficiency and customer experience.

Future of Payment Processing in Sage Intacct

Payment technology is evolving quickly, and Sage Intacct payment processing will continue to adapt. We’re seeing more businesses adopt digital wallets, mobile payments, and AI-driven automation. As these trends grow, integration between systems will only become more critical.

Expect deeper connections between Sage billing, customer relationship management (CRM) platforms, and e-commerce tools, creating an even more unified view of financial operations. The role of Sage Intacct payment integration will expand as businesses demand more automation and real-time insight from their tools.

Turning Best Practices into Real Results

At the end of the day, payment processing is about more than moving money. It’s about accuracy, speed, and trust. By following best practices for Sage Intacct payment integration, finance teams can create a system that reduces manual effort, improves compliance, and enhances the customer experience.

When you combine Sage Intacct software with a strong payment processor and extend it through third-party integration, you’re setting your organization up for success. Add in reliable automation and solid reporting, and you have a payment processing solution that supports growth rather than holding it back.

For finance teams already working with Sage Intacct ERP, now is the time to optimize how payments fit into the bigger picture. With the right setup, billing in Sage Intacct becomes seamless, payment workflows stay secure, and your business is ready to handle whatever comes next.