Blog > Sage Intacct Payment Processing Costs: Complete Pricing Guide 2026

Sage Intacct Payment Processing Costs: Complete Pricing Guide 2026

Understanding how payment processing costs work inside Sage Intacct isn’t just about comparing fees — it’s about understanding where your money goes and how the system fits your business model. Whether managing a nonprofit, running a SaaS company, or leading construction projects, knowing what influences your total Sage Intacct cost can make the difference between a smooth financial workflow and one filled with hidden expenses.

This guide explores how Sage Intacct payment solutions work, what Sage Intacct pricing structures look like, and how to reduce payment processing fees. We’ll also touch on nonprofit and SaaS use cases and help you understand what to expect when evaluating your next payment processor.

Understanding Sage Intacct Payment Processing and Integration

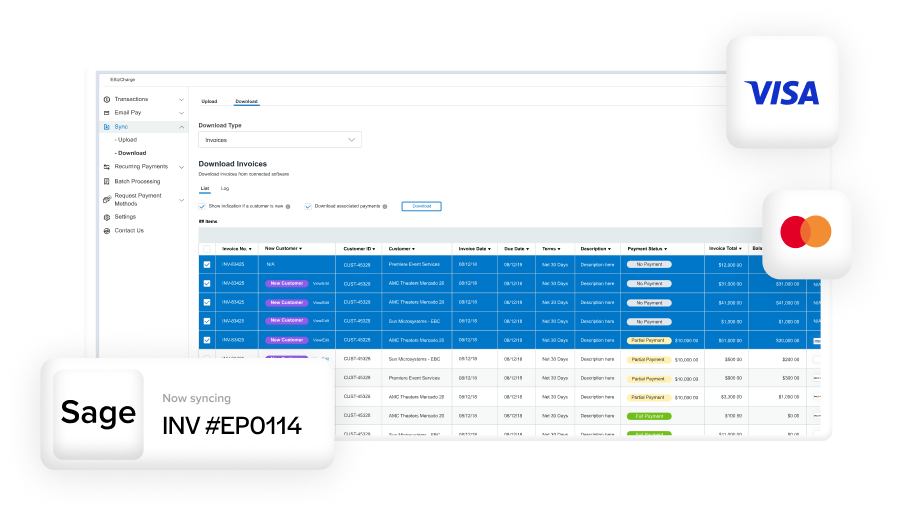

At its core, the Sage Intacct ERP system handles far more than accounting. It’s designed to unify billing, payments, and financial reporting into one streamlined process. When a customer makes a payment—whether through a credit card, ACH transfer, or digital wallet—that transaction flows through your chosen payment processor and into Sage Intacct for reconciliation.

This process is powered by Sage Intacct integration, which links payment gateways directly to your financial modules. Payments sync with accounts receivable, invoices update automatically, and finance teams get a clear view of cash flow in real time. The result is fewer manual entries, fewer reconciliation errors, and more predictable financial data.

From a pricing standpoint, Sage Intacct pricing is modular. The base Sage Intacct cost depends on the number of users, transaction volume, and any added modules—such as advanced reporting or automation features. So, how much does Sage Intacct cost? It depends on the payment processor you choose and the type of transactions you handle. Businesses that rely heavily on credit card payments may see higher interchange rates, while those using ACH transfers tend to pay less.

Sage Intacct Payment Processing Solutions

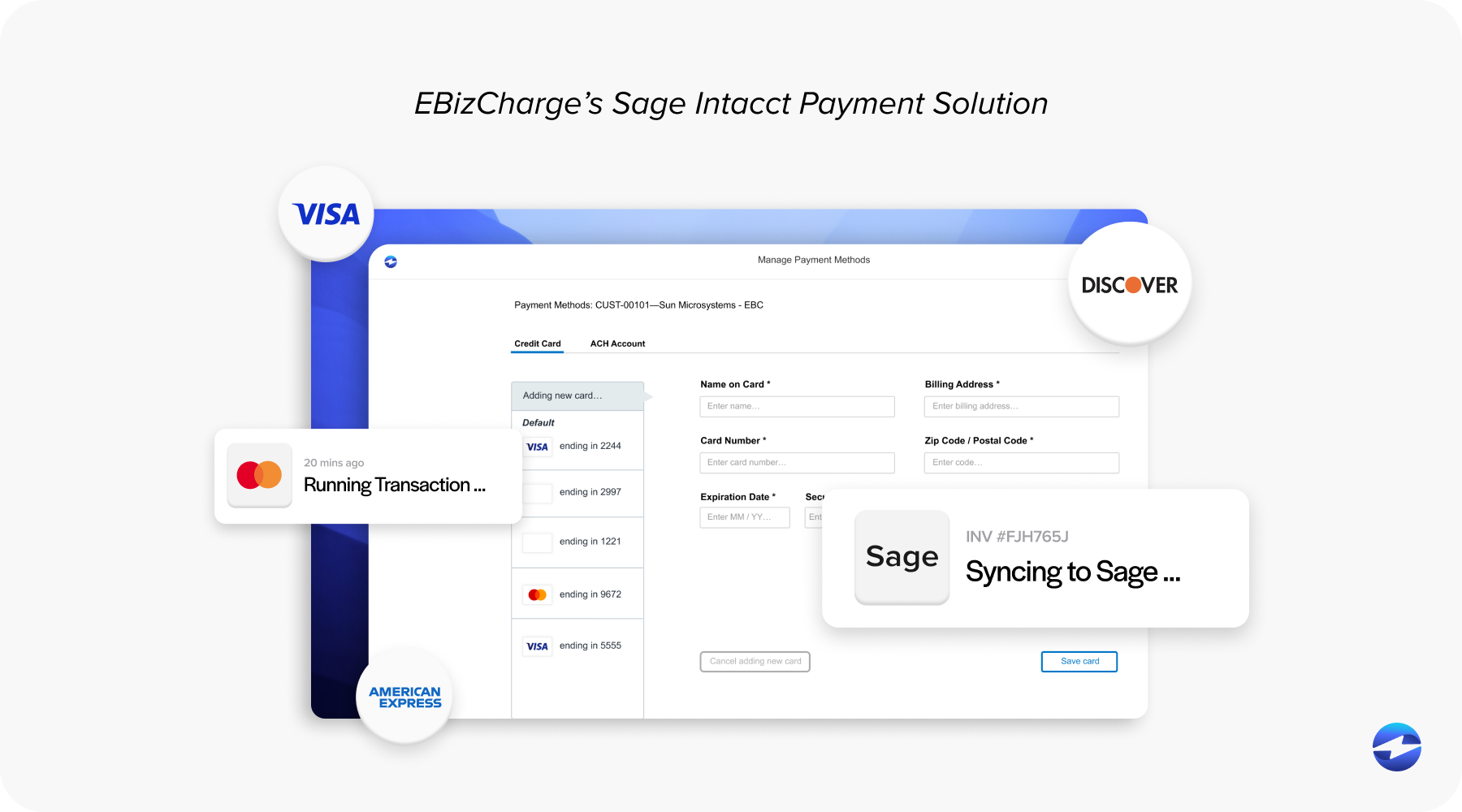

Sage Intacct payment solutions come in different forms. You can stick with the built-in Sage Payment Solutions or use third-party integrations like EBizCharge. Each has its advantages depending on your transaction mix and business size.

Sage Payment Solutions offers native functionality within the Sage Intacct ERP system, which means setup is simple and workflows stay centralized. However, its pricing tends to be more standardized, often using bundled rate models that may not favor high-volume or enterprise-level users. This approach works fine for teams that value predictability, but it can lack flexibility for those seeking cost transparency.

Third-party processors like EBizCharge, on the other hand, often provide more flexible pricing options. EBizCharge, in particular, offers a native Sage Intacct integration, providing flexibility in both pricing and functionality. Many third-party processors offer interchange optimization, which automatically routes transactions through the lowest-cost interchange category. Over time, this can save a meaningful amount of money for companies with large transaction volumes. Others, such as Paya or Repay, use tiered or volume-based pricing to accommodate growing businesses.

When comparing Sage Intacct pricing structures across these providers, the difference often comes down to transparency. Sage’s native option is easy to manage but less customizable, while external integrations can provide better visibility and control over each cost component.

Reducing Payment Processing Fees in Sage Intacct

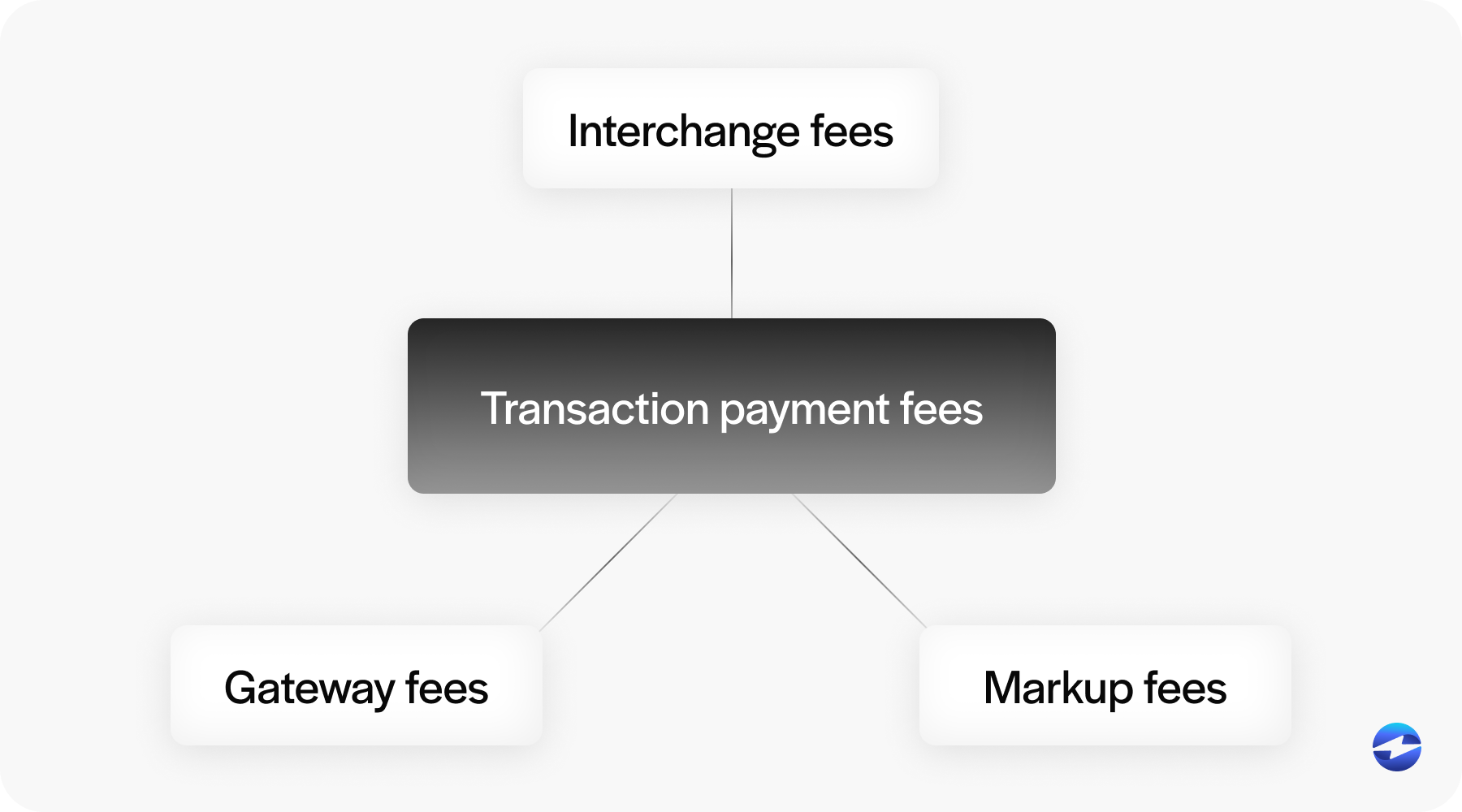

If you’ve ever wondered how to lower your payment processing costs in Sage Intacct, the answer lies in understanding where the fees come from. Every transaction includes three core elements: interchange fees (set by card networks), gateway fees (for processing data), and markup fees (added by processors). Reducing these costs starts with visibility.

One of the most effective ways to cut costs is through interchange optimization. Payment processors like EBizCharge use technology to automatically categorize transactions into the least expensive interchange rates. That can mean significant savings, especially for companies processing large numbers of credit card payments each month.

Beyond interchange optimization, there are practical ways to reduce fees. Using integrated payment processing solutions that route transactions directly to Sage Intacct eliminates unnecessary middle layers and hidden markups. Negotiating pricing tiers based on your volume can also make a difference. And automation—such as auto-reconciliation—saves time that would otherwise be spent correcting payment data or tracking down mismatched invoices.

Over time, these small changes add up. A company processing hundreds of transactions a day could save thousands annually by optimizing how payments are processed and recorded inside the Sage Intacct ERP system.

Sage Intacct Payment Solutions for SaaS Companies

SaaS companies face unique billing challenges. Between recurring subscriptions, renewals, and variable usage fees, manual billing isn’t sustainable. That’s where integrated Sage Intacct payment solutions shine. With the right setup, renewals can be automated, revenue recognition becomes seamless, and payments post instantly to the correct accounts.

EBizCharge, for instance, provides a payment processing solution built for automation-heavy environments like SaaS. It helps reduce churn by managing recurring payments efficiently, sending reminders for expiring cards, and retrying failed transactions automatically. Everything connects through the Sage Intacct integration, keeping your financial data consistent and audit-ready.

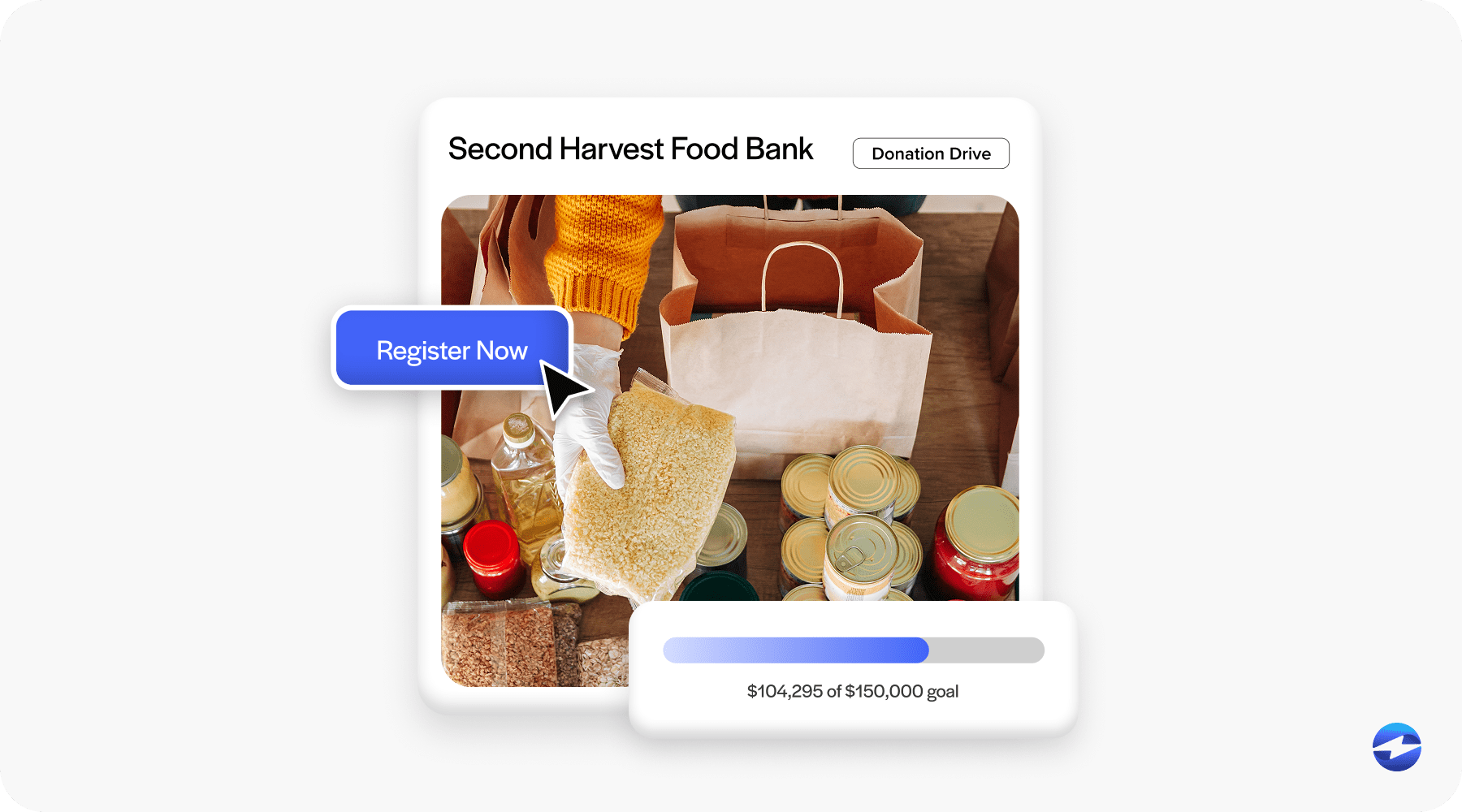

The same advantages apply to other industries. Nonprofits, for example, use Sage Intacct to manage donations, grants, and fund allocations. With automated reconciliation and donor tracking built into the ERP, payment data stays transparent and compliant for audits. Sage Intacct nonprofit pricing often includes discounts or tailored packages for charitable organizations, making advanced payment processing accessible without breaking the budget.

Construction firms benefit as well. Sage Intacct construction pricing varies based on project complexity and volume, but integrating payments within the ERP system allows them to manage retainage, progress billing, and subcontractor payments efficiently—all while maintaining accurate financial reporting.

Whether you’re in SaaS, nonprofit, or construction, the ability to integrate payments directly into Sage Intacct ensures every transaction supports a smoother operation. Instead of treating payment processing as a separate function, it becomes part of your financial backbone.

Choosing the Right Payment Strategy in 2026

At the end of the day, your Sage Intacct cost isn’t just about software licensing—it’s about how effectively your payment system works within it. The best setup is one that keeps fees low, automates repetitive work, and provides visibility into every transaction.

Sage Intacct pricing structures vary, but the principles for managing them stay the same: choose integrations that minimize manual effort and use payment processors that optimize rates. If you’re relying solely on Sage Payment Solutions, it might be worth exploring how third-party integrations like EBizCharge can improve both cost control and workflow efficiency.

A payment processing solution should feel like a natural extension of your ERP—not an added burden. With the right setup, Sage Intacct ERP system users can turn payment processing from a line-item expense into a strategic advantage. The question isn’t just how much does Sage Intacct cost—it’s how much value it delivers when optimized for your business.