Blog > Sage Credit Card Processing: Features, Setup, and Best Practices

Sage Credit Card Processing: Features, Setup, and Best Practices

If you’re handling credit card payments inside your Sage ERP system, you already know how important it is to keep everything efficient, accurate, and secure. The ability to process payments directly in Sage saves time, reduces errors, and simplifies reconciliation—especially when dealing with high volumes or recurring customer billing.

This guide will walk you through Sage credit card processing: what features are available, how to get set up, and best practices to help your team stay on top of payments without burning out.

Whether you’re part of a lean accounts receivable (AR) team or managing billing at scale, this article is for you.

Why Credit Card Processing Matters in Sage

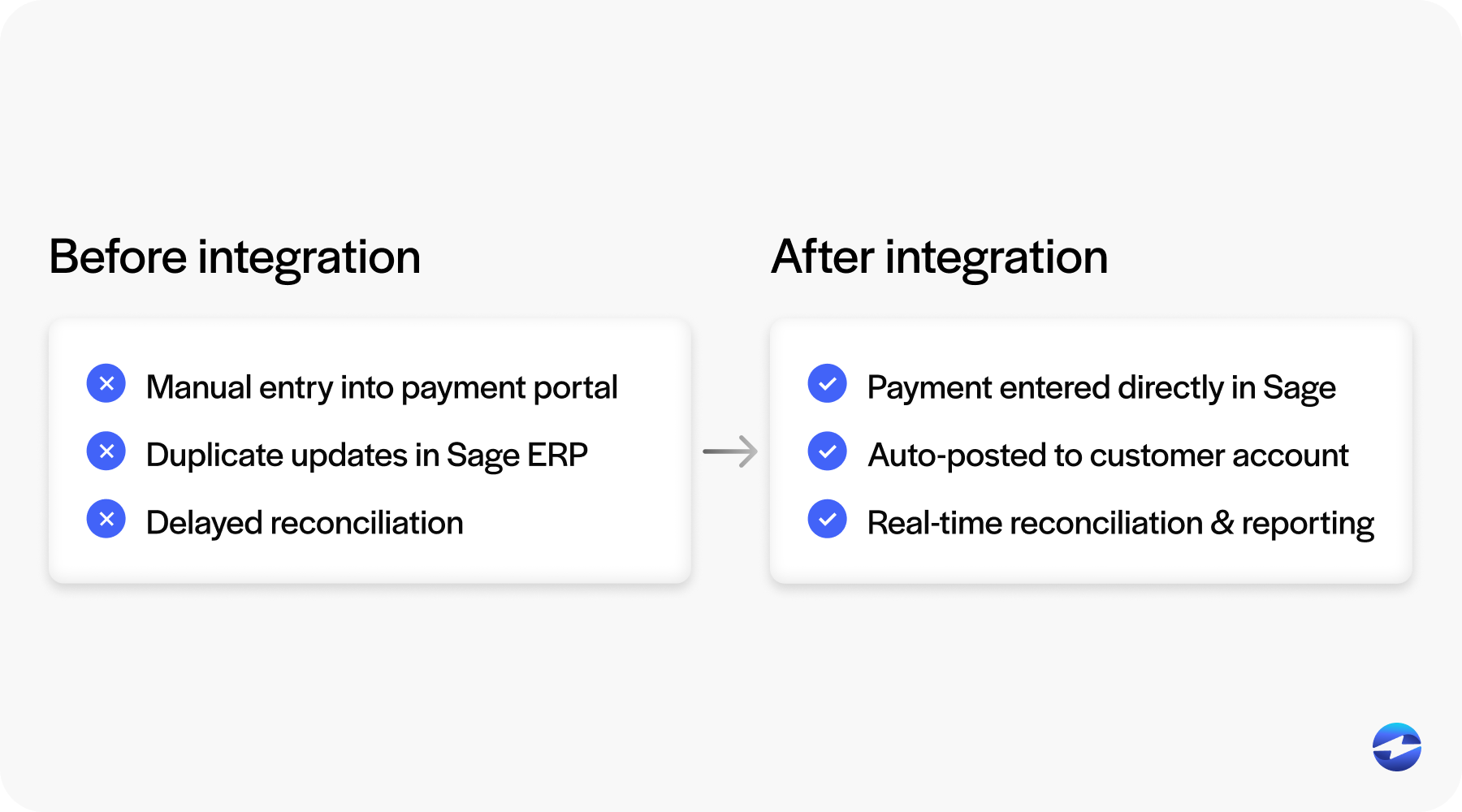

Credit card processing inside Sage isn’t just about convenience. It’s about eliminating double entry, keeping your books clean, and making life easier for everyone involved in accounts receivable. If your workflow currently involves running transactions outside of Sage—through a terminal, a third-party website, or manually keyed entries—you’re missing out on the speed and control an integrated system can provide.

With Sage ERP, you can bring everything under one roof. That includes payments, invoice tracking, and customer records—no switching between platforms, no manual updates, and no disjointed reporting. This is especially useful for teams managing complex Sage billing schedules or working across multiple departments.

Key Features of Sage Credit Card Processing

Here’s what to expect when you’re using Sage for credit card payments:

- Support for credit cards, ACH, and recurring billing: Whether you’re handling one-off payments or setting up ongoing schedules, it’s all possible from within your ERP system.

- Real-time payment posting: Payments get applied directly to invoices as they happen, so your records stay automatically updated.

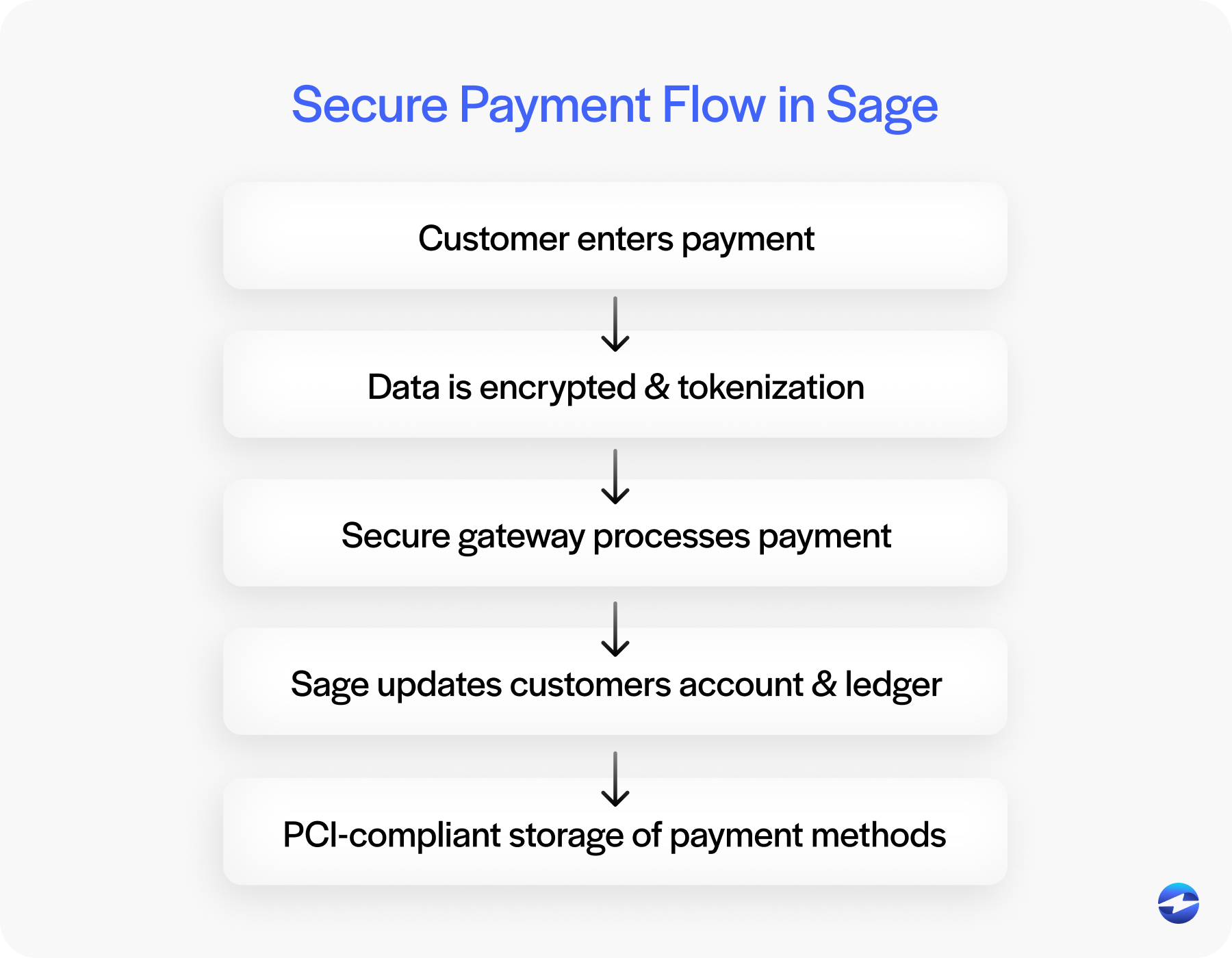

- Secure storage of payment methods: Tokenization helps you store customer payment details safely without exposing sensitive data.

- PCI compliance features: When paired with the right payment processing solution, Sage supports a compliant environment for card transactions.

- Integration with multiple Sage versions: Most features are available across Sage 100, Sage 300, and other versions.

This isn’t just about handling transactions—it’s about making the entire process—from invoicing to Sage credit card reconciliation—smoother.

Setting Up Credit Card Processing in Sage

Getting started isn’t complicated, but it’s worth approaching the process with some planning. The right setup ensures you’re not only processing payments smoothly from day one, but also setting your team up for fewer issues down the road.

1. Check Your Setup

You’ll need a compatible Sage ERP system and admin-level access. Just as important: you’ll want to choose a third-party payment processor that integrates cleanly with Sage. Not all gateways are built the same—some create more friction than they solve.

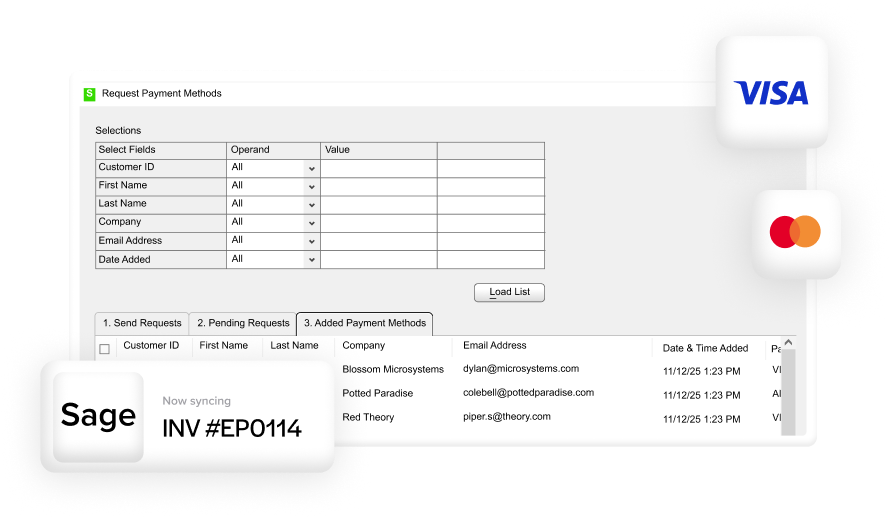

2. Connect Your Payment Processor

Once you’ve picked your provider, follow their integration steps. Typically, this means entering application programming interface (API) keys or credentials into Sage and confirming that the systems can talk to each other. A provider like EBizCharge offers a native integration, which keeps the whole experience within the Sage interface.

3. Configure Settings

Decide which payment types you’ll accept (credit card, ACH, etc.), how you want settlements handled, and whether to post payments in real time or batch them for later. These small settings make a big difference in how your team works.

4. Test and Train

Run a few test transactions to ensure everything posts correctly to your Sage billing software. Then, train your team on the updated workflows. Clear expectations now will save you from confusion later.

Setting things up right the first time is an investment in smoother daily operations. Once the system is live and your team is comfortable, Sage credit card processing becomes second nature – freeing up more time for the parts of your job that actually move the business forward.

How to Use It Day-to-Day

Once it’s live, Sage credit card processing becomes a natural part of your daily workflow.

You can apply payments directly from an open invoice or customer account. Or you can use the virtual terminal for phone orders and manual card entry. Saved payment methods make it easy to handle recurring payments, and refunds or voids can be issued from within the system.

Everything syncs to your ledger in real time, making Sage credit card reconciliation easier and faster. You’ll also have access to detailed reports on transactions, batch activity, and customer balances—ideal for end-of-month closeouts.

Best Practices for Smooth, Secure Processing

To get the most out of your Sage setup, there are a few habits worth building into your routine. These aren’t just technical settings; they’re operational checkpoints that help you avoid headaches down the line.

- Review user permissions regularly: Only give payment access to those who truly need it, and revisit these settings every quarter or after role changes. This keeps your system secure and reduces the risk of internal errors.

- Enable tokenization: By ensuring that sensitive card data is never stored in plain text, tokenization protects your customers and keeps you aligned with industry standards.

- Stick with real-time posting: This minimizes reconciliation delays, improves cash flow visibility, and cuts down on mismatches between your bank statements and Sage records.

- Stay compliant: Choose a payment processor that actively helps with PCI compliance and fraud prevention. This isn’t just a box to tick – it’s an ongoing responsibility.

Also, make it a point to check for updates from Sage or your third-party payment processor. These updates often include important security patches, feature enhancements, or subtle changes that can make your system faster and safer. Treat them as part of your regular maintenance, not just an afterthought.

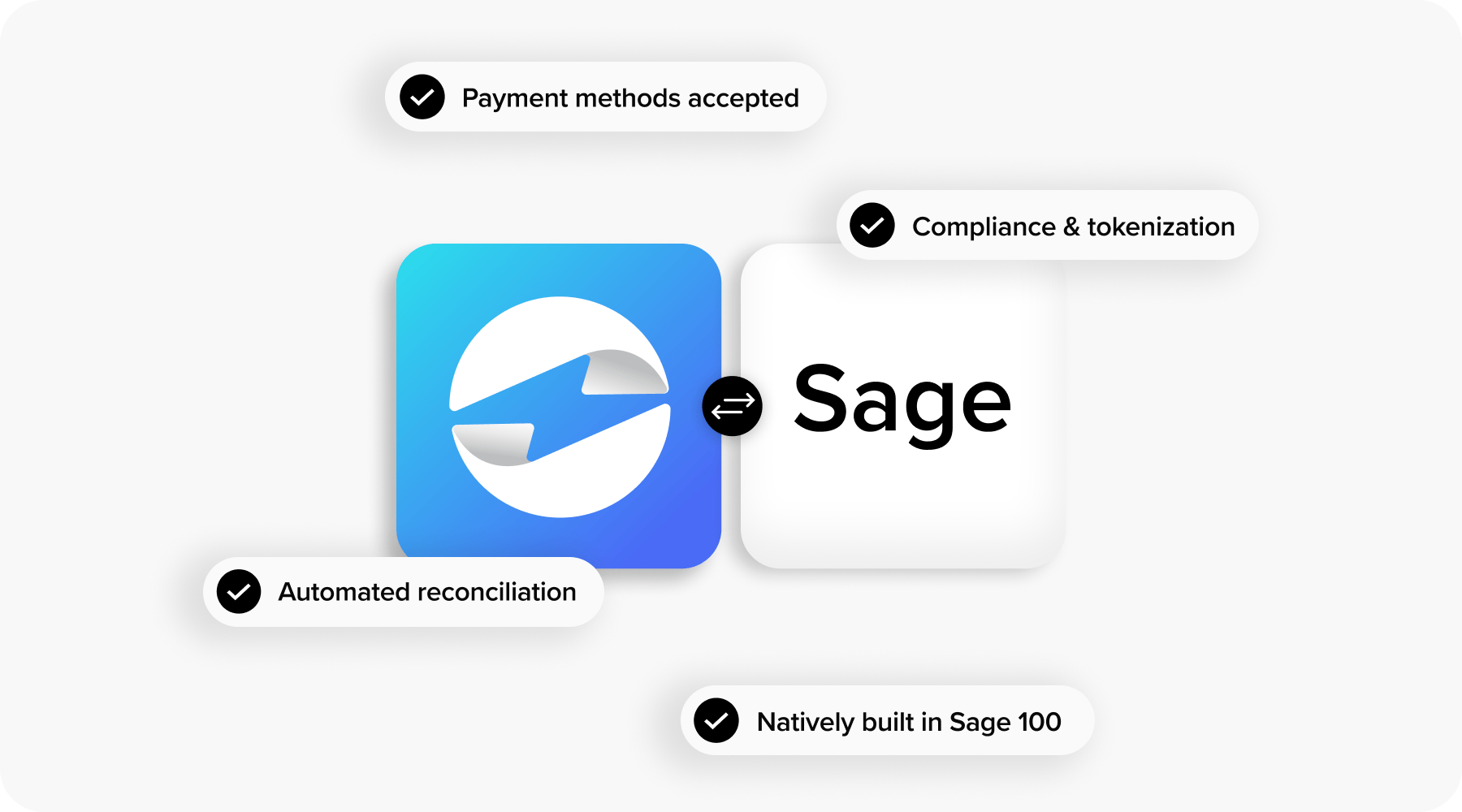

Why EBizCharge Stands Out

If you’re looking for a clean, reliable way to handle Sage credit card processing, EBizCharge is built to integrate directly with Sage ERP. Unlike generic gateways, EBizCharge is designed specifically to work within your existing Sage ERP system—no extra logins, no external portals, and no complex workarounds.

It supports all the essentials—credit cards, ACH, recurring billing—while also reducing your Sage credit card processing fees by offering level 2 and level 3 data support.

Teams using EBizCharge report faster reconciliation, fewer errors, and better visibility into transactions across departments. And because it works natively inside Sage billing software, there’s less training involved and fewer disruptions to your workflow.

Mastering Sage Credit Card Processing

Sage credit card processing is more than just a convenience—it’s a way to tighten up your entire payment workflow. From faster invoicing to simplified reconciliation, the benefits show up quickly once the system is live.

The key is pairing your Sage ERP system with the right payment processing solution that fits your needs, scales with your business, and keeps your data secure.

Whether you’re trying to lower your Sage credit card processing fees, streamline reporting, or stop switching between platforms, an integrated system is the way to go.

Need help getting started? Talk to your Sage representative or reach out to a trusted third-party payment processor like EBizCharge to see what integration would look like for your team.