Blog > Sage Accounts Receivable (AR) Automation: The Complete Guide to Reducing Manual Tasks and Errors

Sage Accounts Receivable (AR) Automation: The Complete Guide to Reducing Manual Tasks and Errors

Managing accounts receivable can be one of the most repetitive and time-consuming tasks in any finance department. If you’re using a Sage ERP system—whether it’s Sage Intacct ERP, Sage 100, Sage 500, or Sage 50—you already know the importance of keeping invoices accurate, payments on time, and records in sync. But when so much of this work is manual, it’s easy for errors to slip in and for your team to waste hours chasing the same tasks every month.

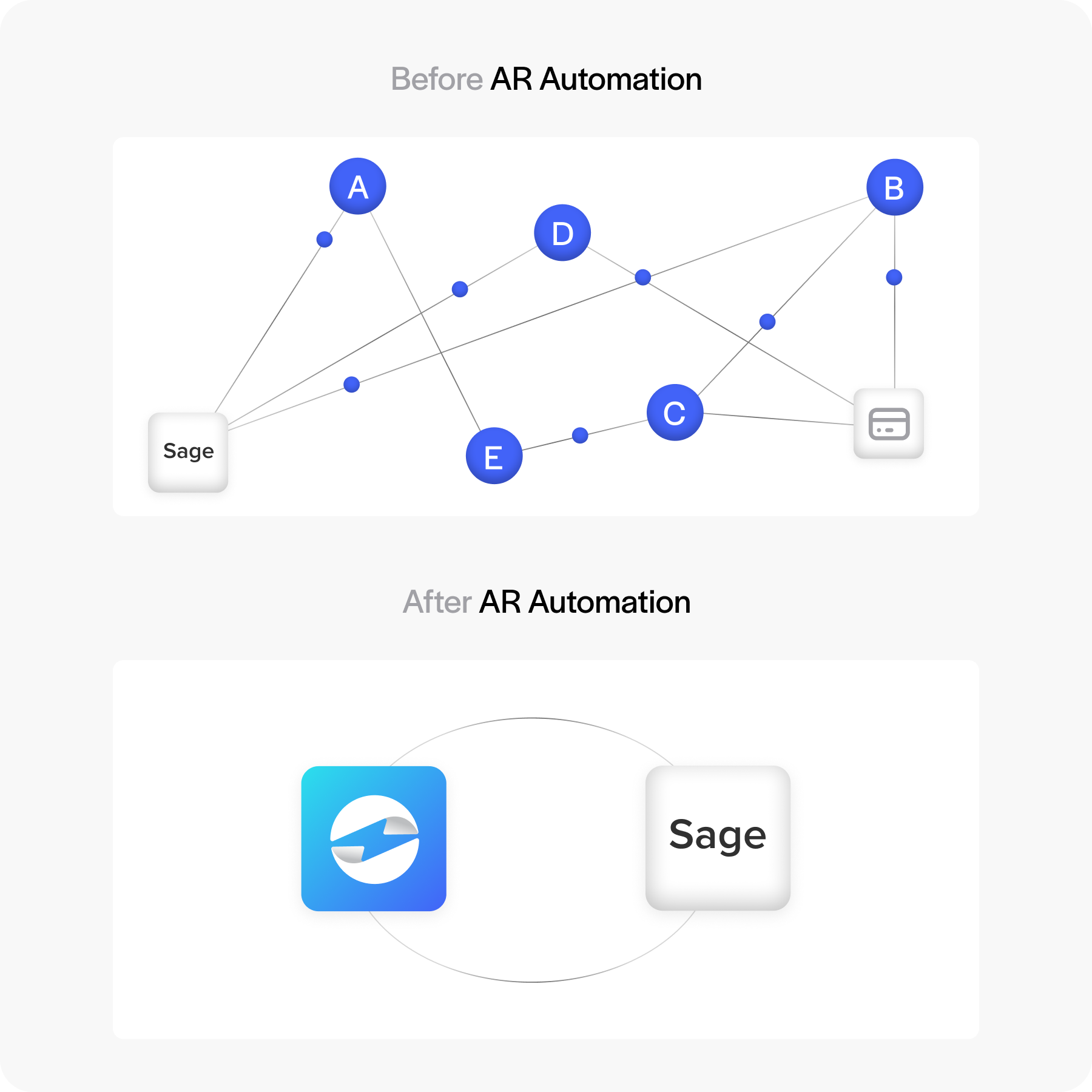

That’s where Sage AR automation comes in. By automating the core processes, you can cut down on manual data entry, speed up collections, and dramatically reduce errors—without sacrificing accuracy or control.

What Sage AR Automation Is and Why It Matters

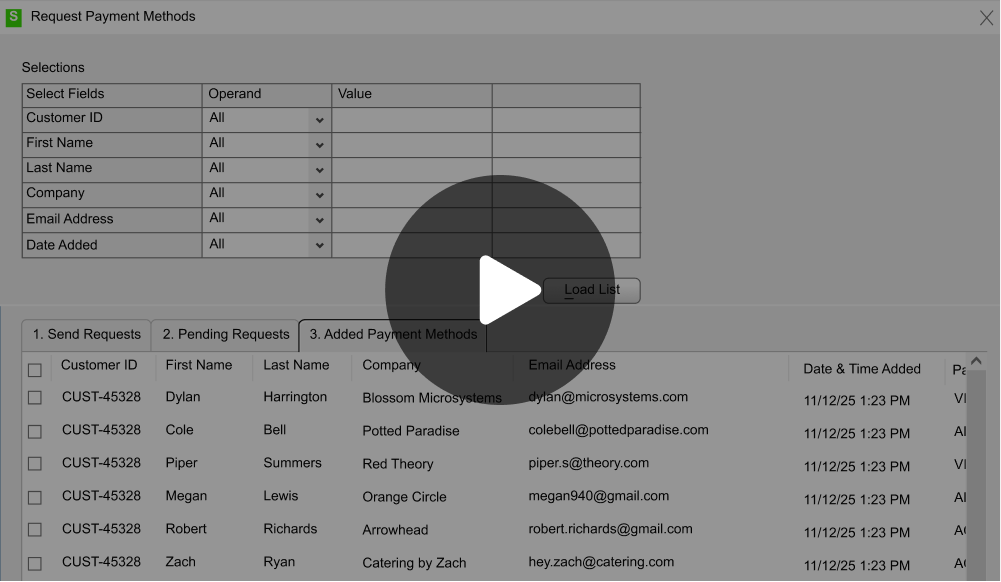

At its core, AR automation means letting your Sage ERP system handle repetitive tasks like generating invoices, sending payment reminders, and posting payments. Instead of manually keying in the same information over and over, you set rules and workflows once, and the system does the rest.

For businesses running Sage Intacct ERP or other Sage products, this automation is a game-changer. It reduces human error, improves cash flow by speeding up collections, and frees your team to focus on higher-value work—like resolving disputes or analyzing payment trends.

How AR Works in Sage and Its Limitations

Out of the box, Sage ERP systems can manage AR just fine, but much of it still requires manual work. You’re entering invoices, applying payments, and sending reminders by hand. This might work for small transaction volumes, but it quickly becomes unmanageable for companies with hundreds or thousands of invoices each month.

The problem? Manual processes are slow, prone to error, and inconsistent. Missed reminders or mismatched payments lead to delayed collections and inaccurate financial reports.

What AR Automation Adds to Sage ERP

With Sage AR automation—or more specialized tools like Sage Intacct AR automation software—you get:

- Automated invoice creation and delivery

- Payment links embedded directly in invoices

- Recurring billing for subscriptions or repeat customers

- Automatic payment reminders and escalation notices

- Real-time payment posting to the Sage ERP system

- Integration with multiple payment methods (credit card, ACH, etc.)

- Built-in reporting dashboards for tracking outstanding balances

These aren’t just conveniences—they’re real productivity boosters that reduce manual touchpoints and errors.

Setting Up AR Automation in Sage

Before jumping into the nuts and bolts, it’s helpful to understand that a good setup is the foundation for a smooth automation experience. Taking the time to get each step right at the beginning will save you from chasing errors or redoing work later.

1. Confirm Your System and Access

Make sure you’re on a supported Sage version—Sage Intacct ERP, Sage 100, Sage 500, or Sage 50—and that you have admin access. This ensures you can configure automation settings without restrictions.

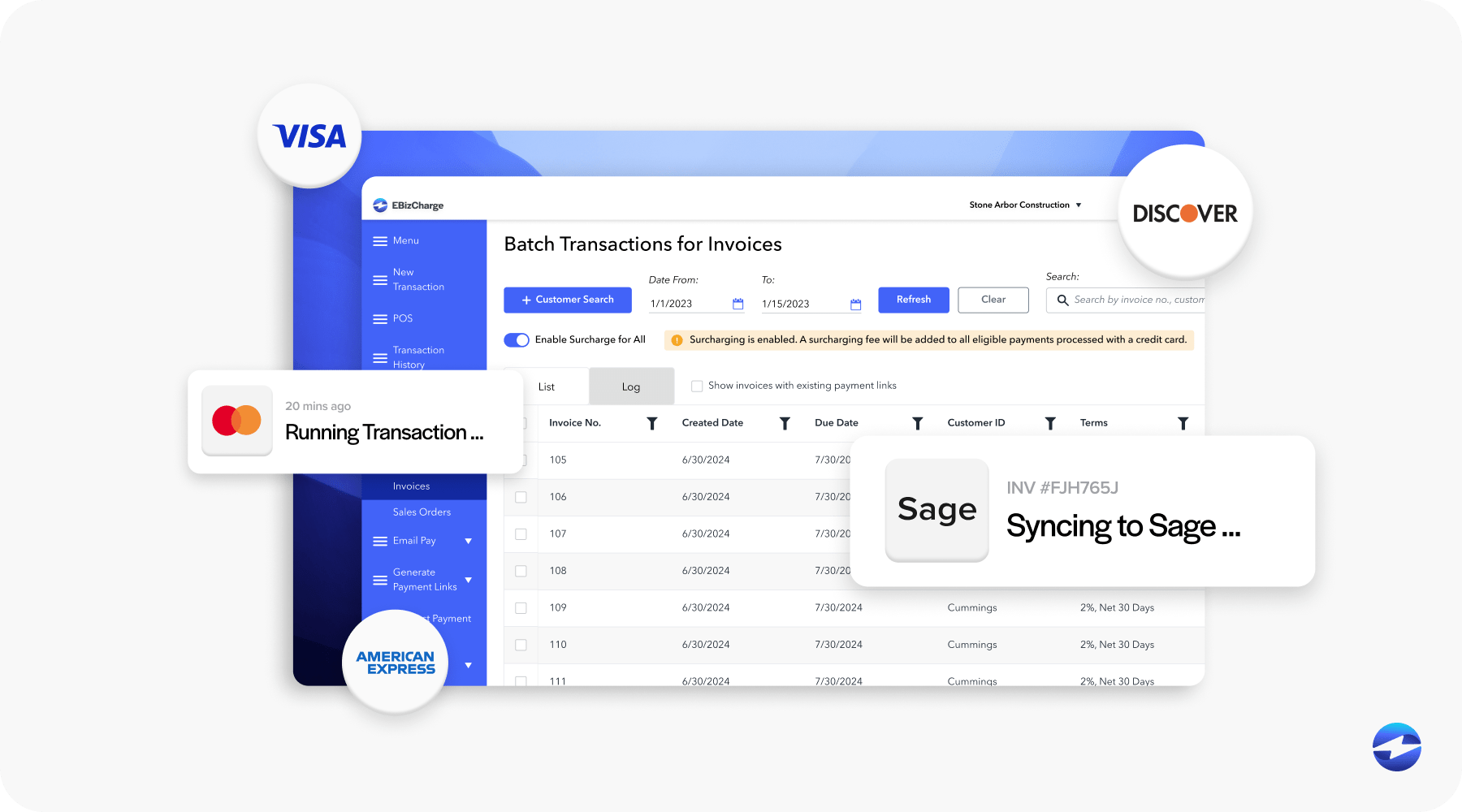

2. Choose the Right Payment Processing Solution

Your automation is only as good as your payment processor. If you’re looking for AR automation solutions for Sage Intacct, consider providers like EBizCharge, which integrate directly into the Sage ERP interface. This keeps the experience seamless for your team.

3. Configure Workflows

Set up invoice templates, choose how and when reminders are sent, and define rules for recurring charges. Decide on settlement preferences and payment method options.

4. Test and Train

Run test invoices and payments to ensure everything posts correctly. Then walk your AR team through the new workflows so they know how to handle exceptions and review automated processes.

Once these steps are in place, your Sage AR automation will be ready to run smoothly, freeing up your team for more strategic, value-driven work.

Best Practices for Reducing Manual Tasks and Errors

Before diving into specific tips, it’s worth noting that the goal of best practices is not just efficiency—it’s consistency, accuracy, and building workflows that hold up under daily use. Good habits now mean fewer problems later.

- Keep customer contact and payment details accurate: Clean data reduces invoice errors and failed payment attempts.

- Use tokenization for secure payment storage: Protects sensitive data while enabling faster repeat transactions.

- Limit manual overrides unless absolutely necessary: Every manual change is a chance for inconsistency or mistakes.

- Review automation settings quarterly: Ensures your rules and workflows still match your current business needs.

- Leverage reports to spot anomalies early: Regularly review dashboards to catch unusual payment patterns or posting errors.

By implementing these practices, you’re setting your Sage AR automation up for long-term success. They help ensure the system works for you, not against you, and that your AR processes remain accurate, secure, and predictable over time.

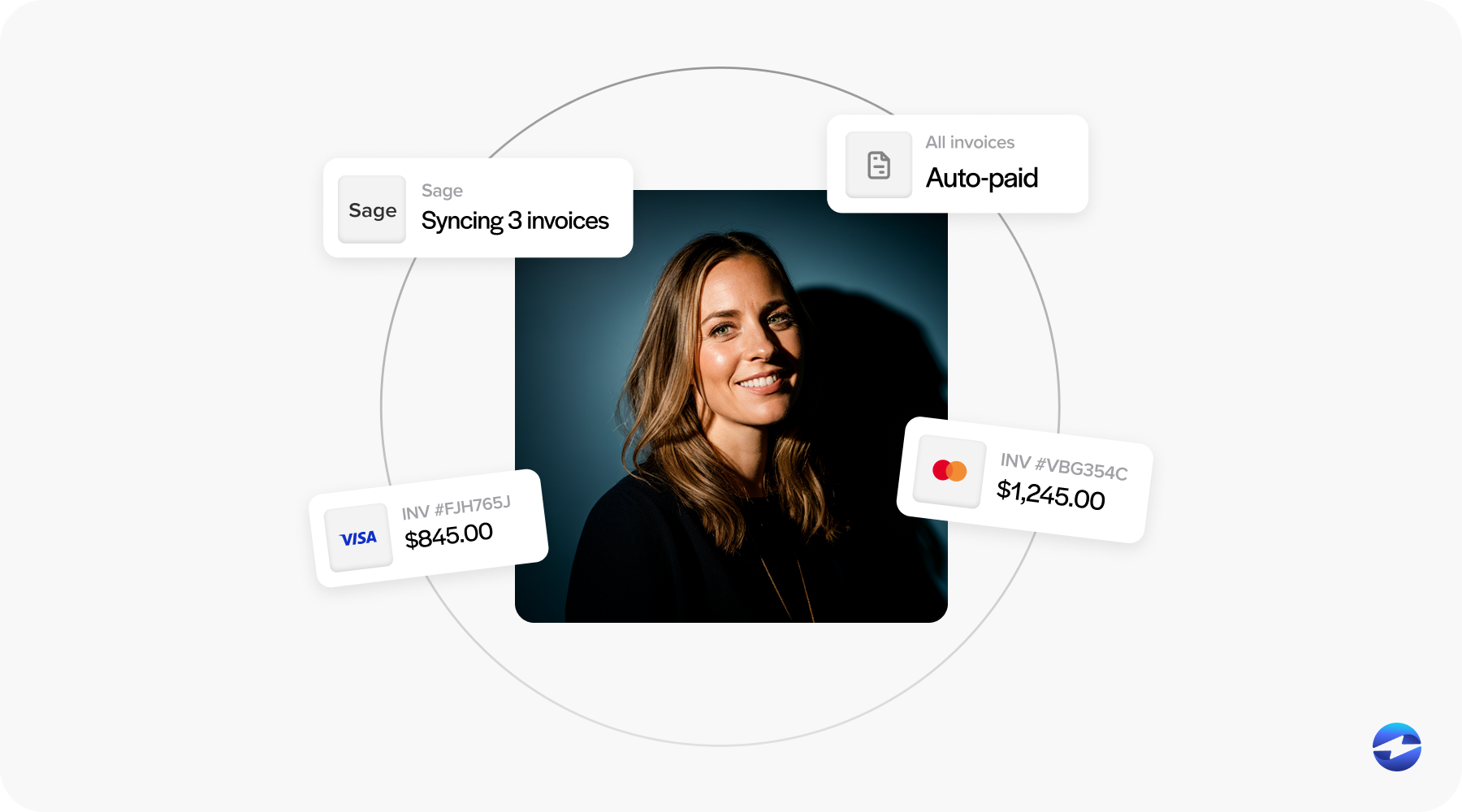

How EBizCharge Enhances Sage AR Automation

When it comes to making AR automation as seamless as possible, the technology you choose to integrate with your Sage ERP system can make all the difference. EBizCharge offers native integration with multiple Sage ERP systems, which can make all the difference. EBizCharge offers native integration with multiple Sage ERP systems, including Sage Intacct ERP, Sage 100, Sage 500, and Sage 50, so you can work entirely within the Sage environment you’re already comfortable with. This integration eliminates the need to switch between platforms or manually reconcile payments from separate systems.

With EBizCharge, payment capture happens automatically, transactions are applied to the correct accounts in real time, and reconciliation steps that used to take an hour can often be completed in minutes. The result is a cleaner, more efficient AR process with fewer manual touchpoints, meaning reduced processing times, lower error rates, and fewer missed or delayed payments. The built-in reporting and analytics features also help finance teams quickly identify trends, track outstanding balances, and stay ahead of potential collection issues.

Common Pitfalls to Avoid

Even with a well-designed Sage AR automation setup, there are challenges that can creep in if the system isn’t actively monitored or adjusted to fit your business. Many of these pitfalls are preventable with a bit of planning and regular review.

- Replying on default settings without customization: Defaults rarely align perfectly with your company’s unique workflows, billing cycles, or customer communication preferences.

- Not training staff to handle exceptions: Automation will still generate exceptions – failed transactions, disputes, or unusual activity – that require human oversight.

- Ignoring failed payment alerts: Alerts are an early warning system for potential collection delays; ignoring them can quickly lead to cash flow issues.

- Overlooking Sage credit card processing fees and costs associated with your payment processor: Without regular fee reviews, you may miss opportunities to renegotiate rates or reduce unnecessary charges.

By recognizing these pitfalls early and putting processes in place to address them, you can keep your Sage AR automation running smoothly and protect the gains in efficiency, accuracy, and cash flow that automation provides.

Why Sage AR Automation Matters

Sage AR automation isn’t just about making things faster; it’s about building a process that’s accurate, reliable, and scalable as your business grows. By replacing manual, repetitive work with automated workflows, you reduce the risk of human error, improve cash flow, and make it easier for your AR team to manage high transaction volumes without burning out. Whether you’re using Sage Intacct ERP, Sage 100, Sage 500, or Sage 50, the impact is the same: fewer errors, faster collections, and more time for strategic, value-added work.

If you haven’t already explored AR automation solutions for Sage Intacct or other Sage ERP products, now’s the time. Take a close look at your current workflows and identify where automation could save time or improve accuracy. The right combination of automation software and payment processing solution can turn your AR from a monthly grind into a streamlined, error-resistant process that supports better decision-making, stronger customer relationships, and healthier cash flow.