Blog > Reducing Payment Processing Fees in Sage Intacct: 7 Proven Strategies

Reducing Payment Processing Fees in Sage Intacct: 7 Proven Strategies

Reducing payment processing fees doesn’t have to be a guessing game. For teams working in the Sage Intacct ERP environment, every transaction that moves through your system carries a small but important cost. Over time, those fees add up, and often in ways that aren’t immediately visible. The good news is that with the right tools and habits, those costs can be brought under control without compromising convenience or accuracy.

This guide walks through seven proven strategies to help you lower your overall Sage Intacct payment processing expenses. You’ll see how automation, smarter workflows, and thoughtful adjustments can improve efficiency and help your bottom line. Whether using Sage payment solutions, third-party integrations, or looking for alternatives, these methods apply across the board.

1. Automate and Streamline Payments

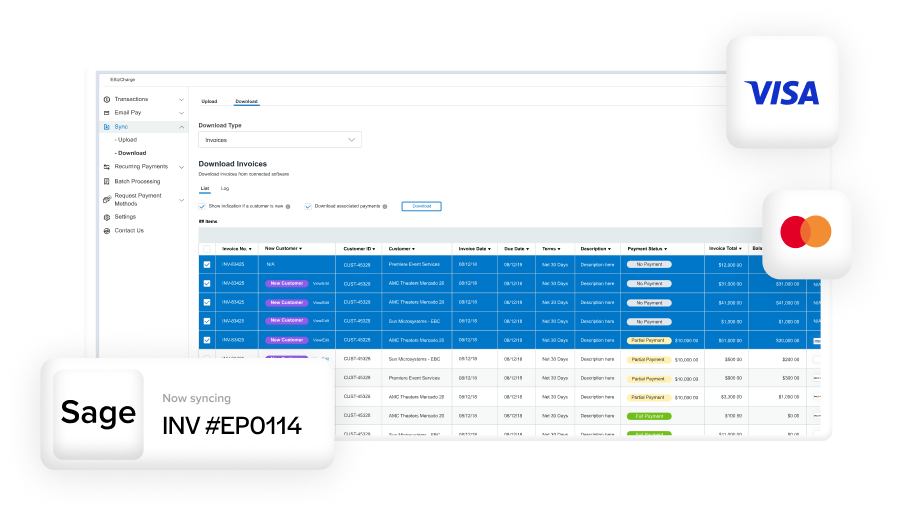

Manual work is expensive. Every time your team touches a transaction—entering data, reconciling records, or tracking missing payments—it costs time and increases the chance of errors. Automation is one of the simplest ways to cut those costs. With a Sage Intacct integration, payments can flow automatically from invoicing to posting, eliminating the need for repeated data entry.

Using built-in tools or integration partners, like EBizCharge, helps centralize payment activity. Payments are posted instantly to invoices, reports update automatically, and reconciliation happens behind the scenes. In short, automation saves time, reduces labor costs, and creates a smoother cash flow cycle—all while making the accounting team’s job easier.

2. Incentivize Lower-Cost Payment Methods

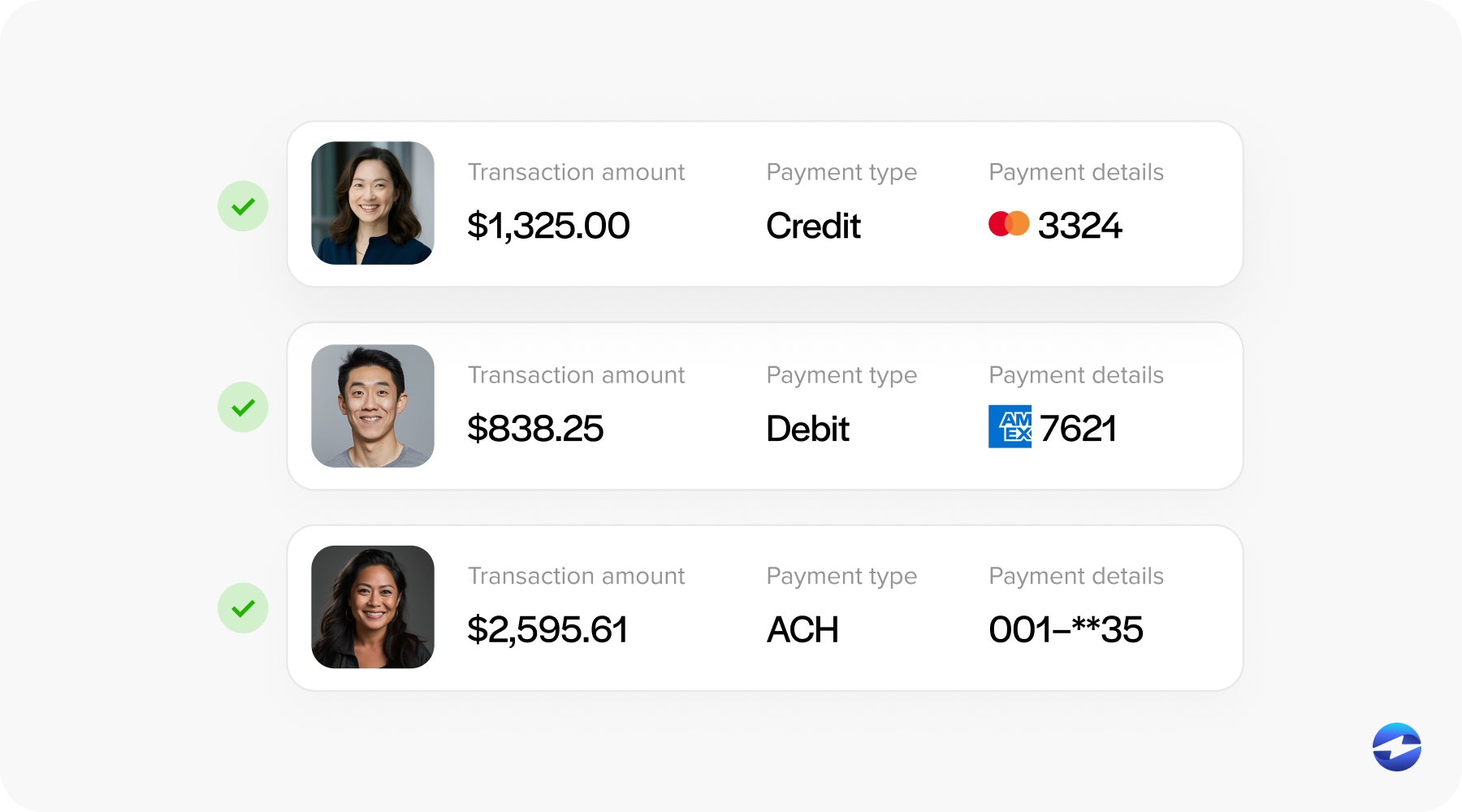

Not all payment types are created equal. Credit card transactions are fast and convenient, but often carry higher interchange rates than ACH or eCheck payments. Encouraging customers to choose lower-cost methods can make a noticeable difference in your Sage Intacct payment processing costs.

Consider offering small incentives for ACH or direct bank transfers—such as discounts for early payment or reduced service fees. With Sage Intacct ERP integrations, these incentives can be tracked automatically, ensuring accurate reporting and a clear view of cost impact. Over time, this small shift can significantly reduce fees without affecting customer satisfaction.

3. Negotiate with Your Processor

Even with competitive Sage Intacct pricing, your processing costs depend largely on your agreement with your payment processor. Many companies set up their payment systems once and never revisit their contracts—but payment rates and structures change over time. Negotiating with your provider can lead to lower rates and better terms.

Review your statements carefully for unnecessary markups or outdated rate structures. If you use Sage payment solutions, compare those costs with independent providers to see if there’s room to improve. You might find that an external partner, like EBizCharge, offers lower transaction fees or more transparent pricing through Sage API integration. The effort to negotiate—even once a year—can translate into thousands in savings annually.

4. Minimize Credit Card Costs and Fraud

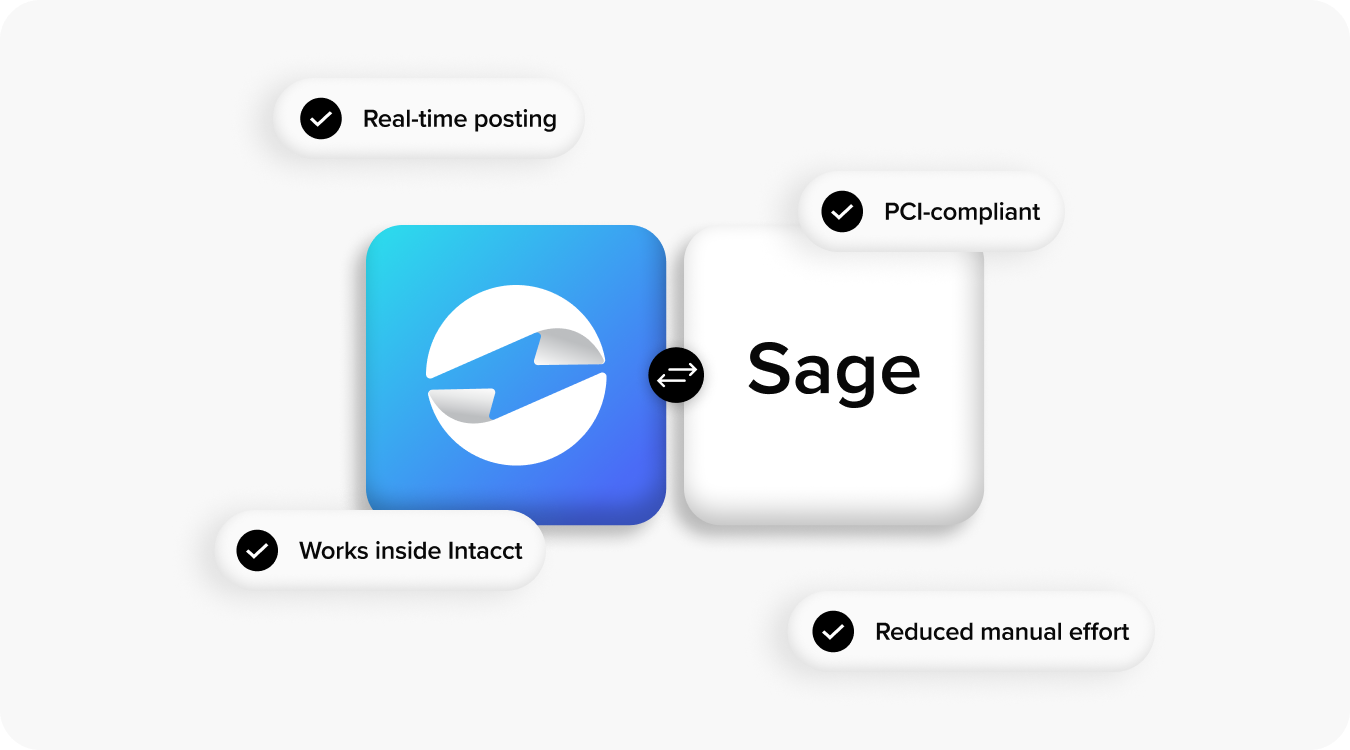

Fraud prevention and credit card management play a direct role in reducing expenses. Chargebacks, failed transactions, and disputes all come with hidden fees. Integrating secure, PCI-compliant systems through Sage Intacct integration reduces this risk and saves money long-term.

Many modern processors use interchange optimization, which automatically classifies transactions into lower-cost categories. Others offer built-in fraud prevention tools that identify suspicious activity before it becomes a costly problem. For example, EBizCharge integrates these protections natively within Sage Intacct ERP, combining efficiency with advanced security. By minimizing both fraud and processing risk, your business keeps costs predictable and your financial data safer.

5. Adjust Fees and Incentives

Another overlooked approach is adjusting your fee structure. If you’re absorbing all transaction costs, consider offering early-payment discounts for ACH transfers or small surcharges for high-fee card types. This balances convenience for your customers with financial sustainability for your business.

With Sage Intacct ERP reporting tools, it’s easy to monitor how these adjustments affect your margins. For businesses that manage high transaction volumes, even a fractional difference in fees can have a measurable impact. The goal isn’t to penalize credit card use—it’s to create an informed pricing structure that reflects real costs.

6. Diversify Your Payment Options

Putting all your eggs in one basket—especially when it comes to payment methods—can lead to higher fees. By expanding your payment mix, you can optimize transaction routes and take advantage of lower-cost channels.

Sage Intacct payment processing makes it possible to manage multiple methods, including credit cards, ACH, and digital wallets, all from a single system. Integrated tools like EBizCharge simplify this process even further, allowing you to diversify payment options without complicating reporting. This flexibility not only reduces dependence on high-fee networks but also provides a smoother customer experience.

7. Educate Your Team

Sometimes, the most effective cost-saving tool is awareness. Your finance team handles payments every day, so they’re in the best position to identify inefficiencies. Educating your staff on how different payment types and fee structures work helps prevent costly mistakes and encourages smarter habits.

Training sessions, performance dashboards, and periodic reviews can go a long way. Encourage your team to analyze data within Sage Intacct payment solutions, track transaction costs, and look for trends. When everyone understands how small actions—like preferring ACH payments or avoiding manual reconciliations—affect costs, savings happen naturally.

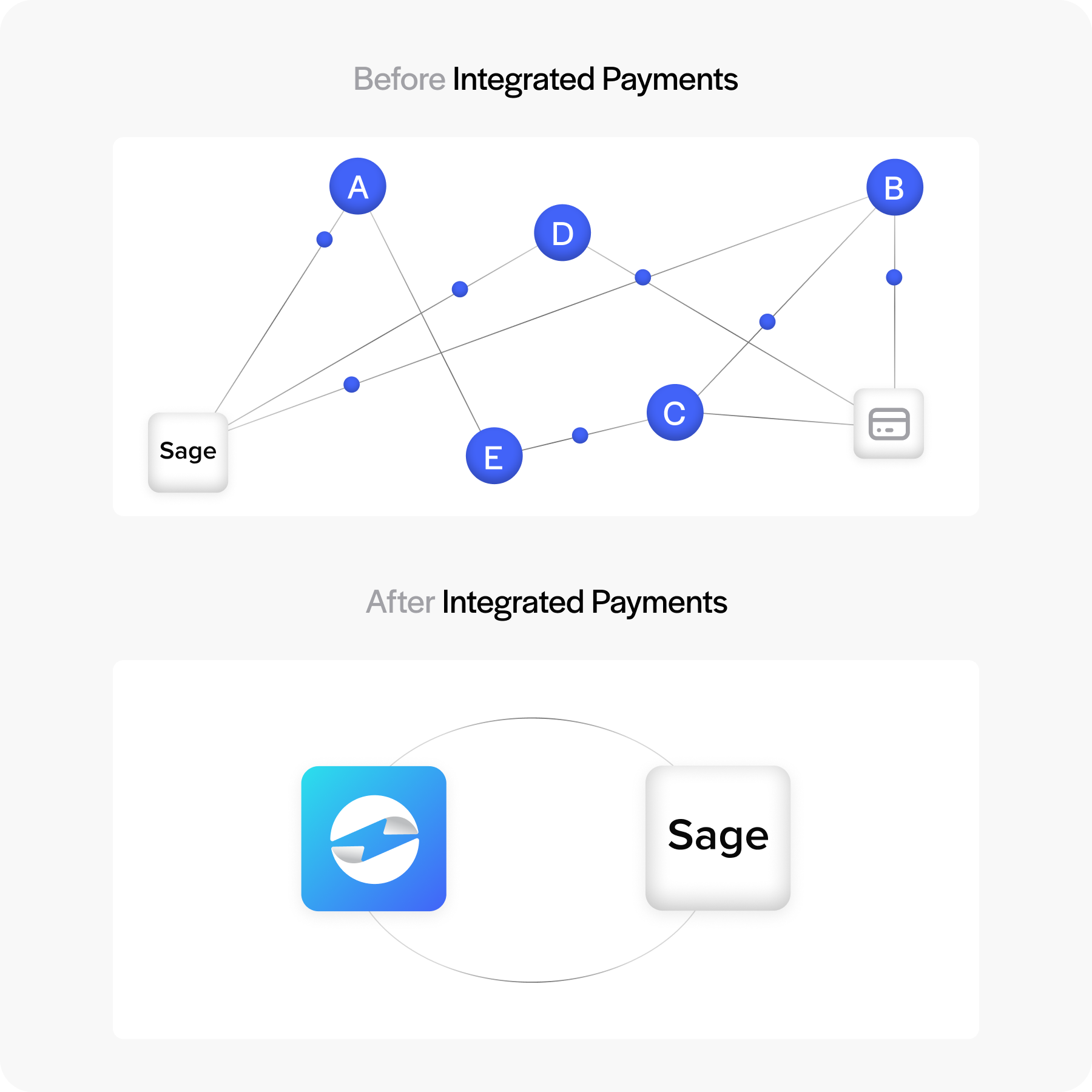

The Role of Integration Partners Like EBizCharge

If you’re serious about reducing processing fees, your integration partner matters. EBizCharge is a standout example of how the right payment processing solution can lower costs while simplifying operations. Through Sage API integration, EBizCharge posts payments directly into Sage Intacct ERP, eliminates redundant gateways, and optimizes transactions for the lowest possible interchange rates.

It also improves transparency—giving finance leaders real-time visibility into fees, transaction histories, and reconciliation status. These features add up to consistent savings and better workflow management. Whether you process hundreds or thousands of transactions a day, the combination of automation, optimization, and clear reporting makes a measurable difference.

Finding Saving in Every Transaction

Reducing payment fees isn’t about cutting corners—it’s about building smarter, more efficient systems. Through automation, better incentives, and smarter partnerships, businesses can save time and money while maintaining control over their data.

Integrating the right tools and Sage Intacct payment processing solutions makes all the difference. Partners like EBizCharge help streamline workflows, optimize rates, and deliver clearer insights into your payment ecosystem. With the right approach, every transaction becomes an opportunity to improve efficiency, transparency, and profitability—all within your Sage Intacct ERP environment.