Blog > Picking The Best Merchant Services Provider for your Sage Software

Picking The Best Merchant Services Provider for your Sage Software

When managing a business with Sage software, choosing the right merchant services provider (MSP) can significantly impact payment processing, cash flow management, and overall efficiency. With so many options available, it’s important to understand what sets a great merchant services provider apart.

From seamless integration with Sage accounting software to transparent pricing and robust security features, selecting the right provider ensures smooth transactions and financial accuracy.

This article will explore the key factors to consider when choosing a merchant services provider for Sage, helping you find a solution that aligns with your business needs.

What is Sage software?

Sage ERP software is an advanced enterprise resource planning (ERP) solution designed to help businesses manage and streamline their core operations.

Sage provides a comprehensive suite of tools that integrate key business functions, including accounting, finance, inventory management, supply chain, human resources, and customer relationship management (CRM).

By centralizing data and automating workflows, Sage ERP enhances efficiency, improves decision-making, and supports business growth.

That said, merchant services providers are integral to Sage payment processing.

What is a merchant services provider?

A merchant services provider helps businesses process payments like debit and credit cards, Automated Clearing House (ACH)/eChecks, and other online transactions. These providers act as intermediaries between merchants, banks, and payment networks, ensuring transactions are processed securely and efficiently.

MSPs work with financial institutions to ensure merchants can accept electronic payments smoothly.

Here are some of the services MSPs offer:

- Payment processing: MSPs manage payment processing operations for businesses to process customer payments using various payment methods.

- Merchant accounts: Merchant accounts are business bank accounts that allow companies to accept and process credit and debit cards and other electronic payments. They act as holding accounts where funds from customer transactions are temporarily deposited before being transferred to the business’s primary bank account.

- Payment gateways: Payment gateways facilitate communication between merchants’ banks, card-issuing banks, and credit card networks to complete card transactions.

- Point-of-sale (POS) system: A POS system is a combination of hardware and software (physical or virtual terminals) that businesses use to accept transactions, manage sales, and track inventory. Modern POS systems can also integrate with customer relationship management (CRM) tools, inventory management, and analytics to help businesses streamline operations and improve customer service.

Many merchant services providers also assist with regulatory compliance, chargeback management, and reporting tools to help businesses streamline their financial operations.

With a powerful merchant services provider, businesses can take advantage of an all-in-one payment platform with integration capabilities into the Sage accounting software. This accelerates and simplifies accounts receivable (AR) operations and improves cash flow management.

When choosing an MSP, it’s important to keep certain factors in mind to ensure the best payment processing experience.

6 factors to consider when choosing a Sage merchant services provider

Selecting the right merchant services provider is crucial for businesses using the Sage software.

With so many options available, it’s essential to consider several factors to enhance your payment processing operations, such as a seamless integration, transparent and competitive pricing, security, and more.

1. Seamless integration with Sage

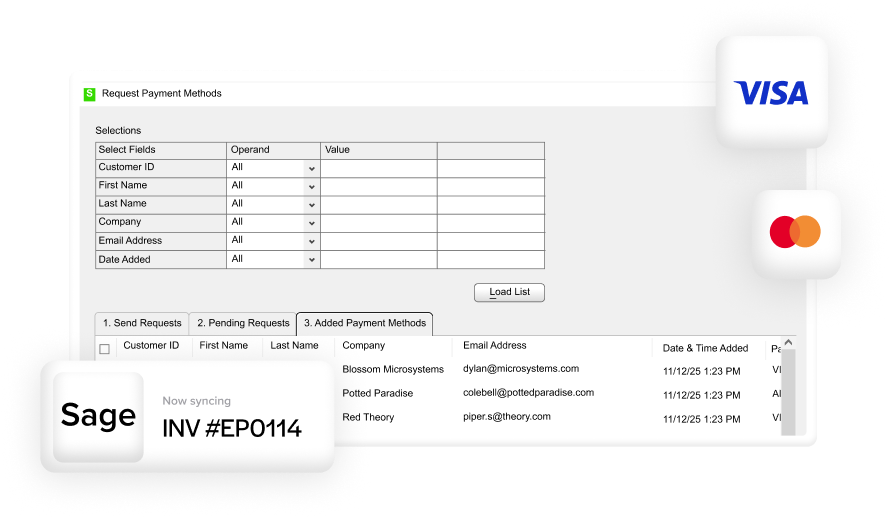

A merchant services provider should offer a direct and seamless integration with Sage software to automate transaction processing, reduce manual data entry, and improve financial accuracy.

A well-integrated MSP ensures that payments sync effortlessly with AR, invoices, and financial reports, eliminating errors and saving valuable time. This enhances operational efficiency, allowing businesses to focus on growth rather than administrative tasks.

2. Transparent and competitive pricing

Pricing structures vary widely among MSPs, making choosing a provider that offers transparent, competitive, and predictable pricing essential.

Merchants should look for transparent fee structures without hidden costs, excessive markups, or long-term contracts with high early termination fees. The best providers offer flexible pricing models, such as interchange-plus pricing, which provides greater visibility into transaction costs.

Lower processing fees can result in significant long-term savings, especially for businesses with higher transaction volumes.

3. Security and PCI compliance

Since payment processing involves handling sensitive financial data, security should be a top priority. A reliable Sage merchant services provider must comply with Payment Card Industry Data Security Standards (PCI DSS) to ensure secure transactions and protect against fraud.

Additional security features, such as tokenization, encryption, fraud detection, and chargeback prevention tools, help safeguard customer data and reduce the risk of fraudulent transactions.

Compliance with various security protocols and regulations is crucial to maintaining a secure and trustworthy payment environment in Sage.

4. Payment flexibility and features

A good MSP should support multiple payment methods to meet customer preferences and business needs. These methods should include terminal payments, email pay, customer portals, and hosted checkouts to facilitate in-person and on-the-go payments.

Popular payment methods typically include credit and debit cards, ACH/eChecks, digital wallets, recurring billing, and mobile payments.

Advanced features such as automated invoicing, custom payment portals, and business-to-business (B2B)-specific processing tools can further enhance payment operations.

5. Customer support and reliability

Since dependable customer support is essential when dealing with payment processing issues, finding a trustworthy merchant services provider with reliable support is vital.

A top-tier MSP should offer 24/7 customer service, dedicated account managers, and fast response times to quickly resolve any technical problems or transaction disputes.

A provider with a strong reputation for reliability can guarantee minimal downtime for your business and efficient handling of transactions without unexpected interruptions.

6. Reporting and reconciliation tools

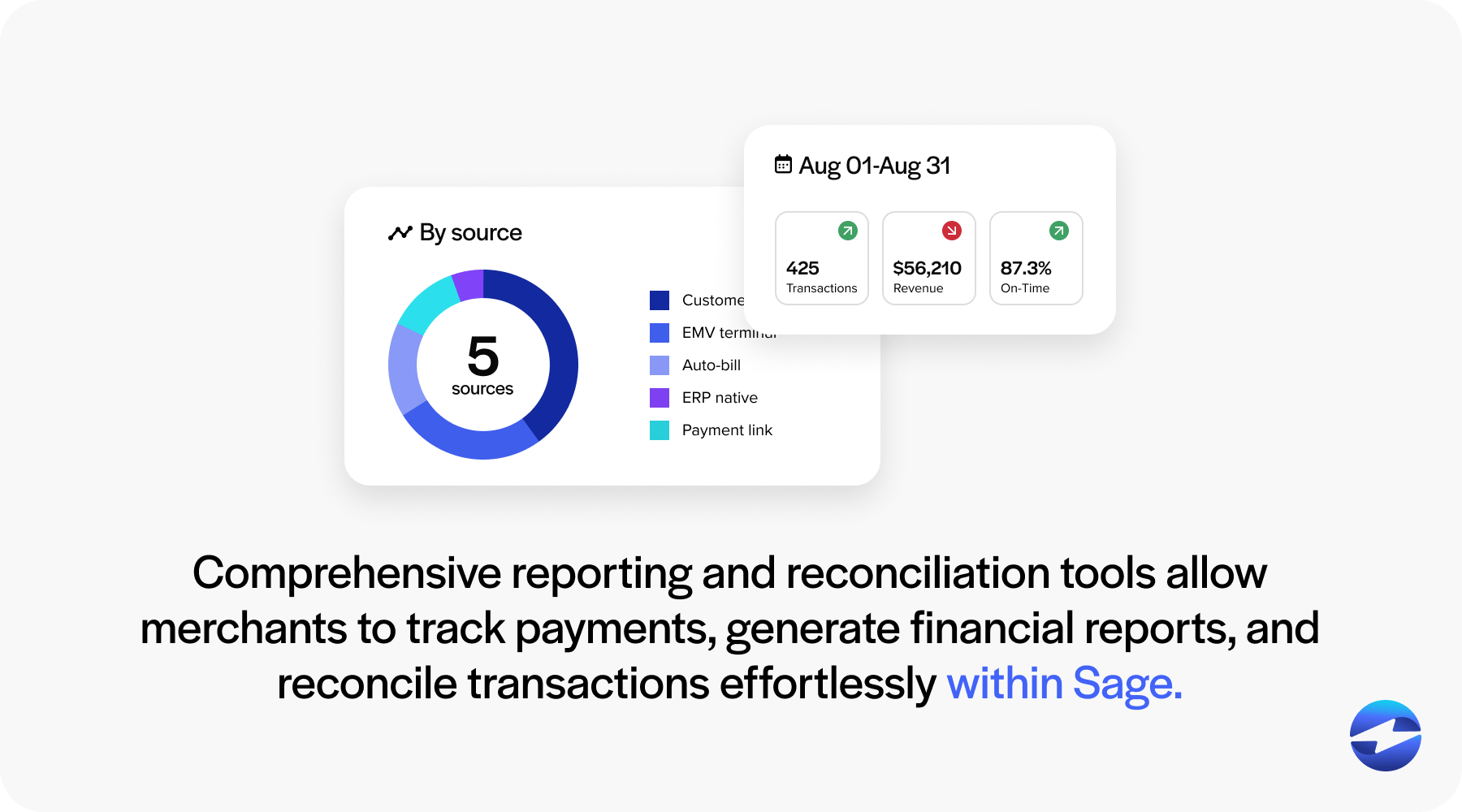

Comprehensive reporting and reconciliation tools allow merchants to track payments, generate financial reports, and reconcile transactions effortlessly within Sage.

A high-quality MSP provides real-time analytics, detailed transaction history, and automated reconciliation features to simplify accounting processes.

With these key factors in mind, your company can choose a merchant services provider that enhances your payment processing operations in its Sage software.

For the best Sage payment processing experience, look for trusted MSPs like EBizCharge.

Transform your payments in Sage with EBizCharge

EBizCharge is a trusted merchant services provider for Sage, offering an all-in-one platform that includes a robust payment gateway, seamless integrations, and a comprehensive suite of tools that streamline payment processing operations.

With EBizCharge, Sage ERP software users can enhance transactional efficiency by processing credit, debit, and ACH/eCheck payments online, in person, or on the go directly in their Sage system.

In addition to its seamless payment gateway, EBizCharge allows Sage users to effortlessly accept payments using various collection tools and gives customers the convenience of selecting their preferred payment method. EBizCharge offers standout features such as secure email payment links, an online customer billing portal, mobile pay, recurring billing, hosted checkouts, physical payment terminals, and more.

EBizCharge offers competitive, customized pricing that guarantees the lowest rates for businesses, thus optimizing cash flow by reducing transaction fees and making it a cost-effective payment processing solution. It also comes with complimentary, in-house support from experts specializing in the EBizCharge for Sage software to ensure reliable and prompt assistance.

Moreover, its robust security measures protect customer data and maintain full PCI compliance with financial industry standards, providing peace of mind for businesses handling sensitive payment information.

Thanks to its seamless Sage integrations and gateway functionality, flexible payment options, enhanced security, numerous payment features, and cost savings, EBizCharge is a comprehensive payment software that syncs with Sage to transform your payments.