Passing Credit Card Fees to Customers: How to Do It Legally

Passing Credit Card Fees to Customers: How to Do It Legally

EBizCharge is a 100% compliant surcharge solution and is rated 5 stars on G2.

When accepting credit card payments from customers, merchants are expected to pay fees to various parties — card issuers, card networks, and payment processors — which can add up over time.

Luckily, businesses can alleviate these costs by directly or indirectly passing credit card fees to customers using several methods.

4 ways to pass credit card fees to customers

Merchants can pass credit card fees to customers using four main methods:

- Credit card surcharging

- Minimum purchase requirements

- Convenience fees

- Cash discounting

1. Credit card surcharging

With surcharging, merchants are able to automatically pass credit card fees to their customers when a credit card is used at checkout.

Credit card surcharging allows businesses to pass on the financial burden of credit card processing fees by attaching an extra fee to each customer’s credit card transaction. Surcharges are regulated by credit card brands and state governments and can range from 1.5% to 4%, depending on a merchant’s preference.

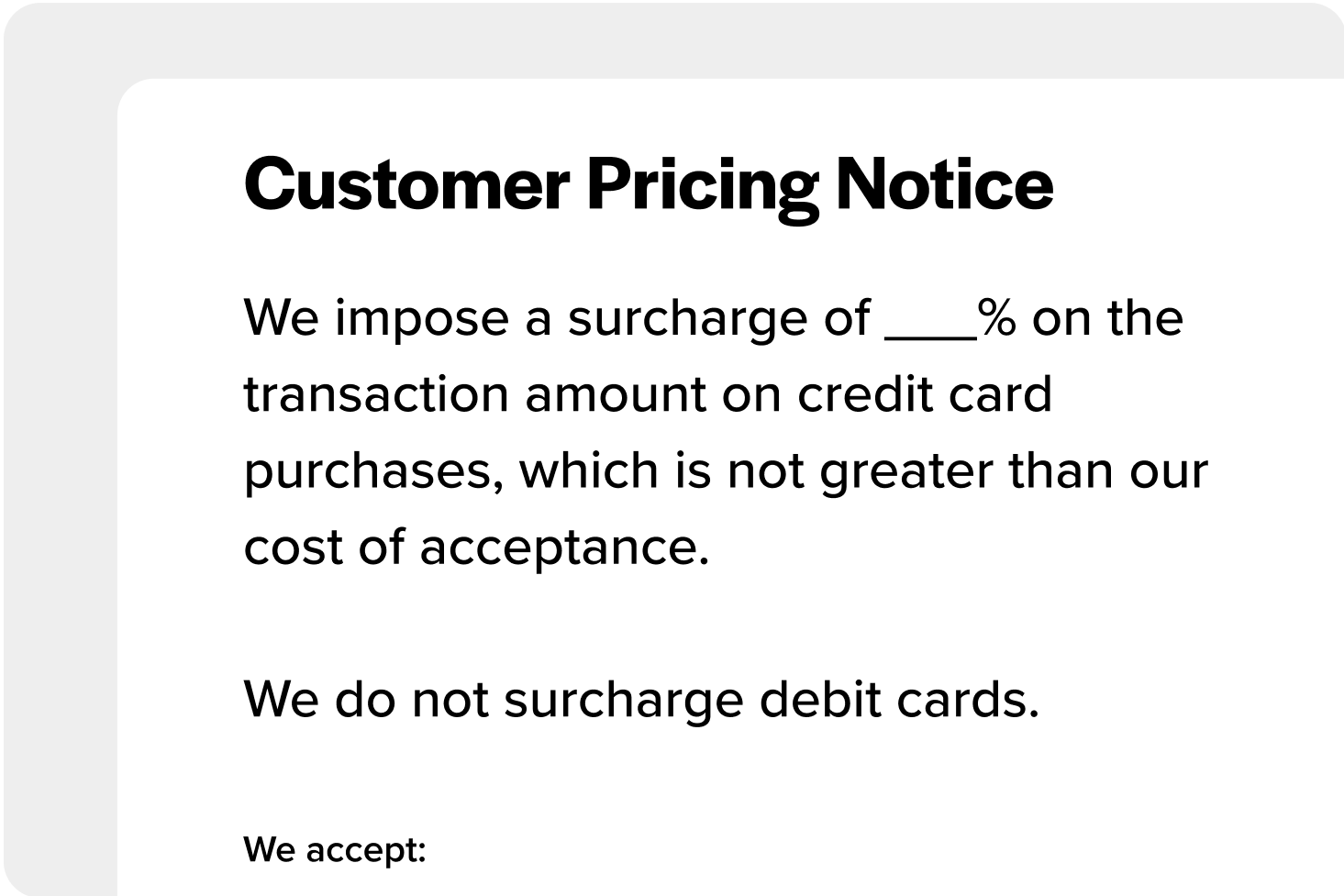

It’s important to note that merchants can only use surcharging to offset processing costs — they cannot profit off of these charges — and must disclose any charges to their customers with credit card surcharge signage.

Businesses need to review and stay up-to-date on their state laws since surcharging is illegal in some states.

2. Minimum purchase requirements

Businesses that process many small-ticket purchases can still be subject to high processing costs. Thankfully, minimum purchase requirements provide a legal way to pass credit card fees to customers to mitigate these charges.

With minimum purchase requirements, merchants can enforce a credit card minimum purchase amount — no more than $10 — which helps them avoid and minimize processing fees on smaller tickets. Customers unable to meet this threshold will be directed to use cash to complete their transactions.

Minimum purchase requirements tend to favor smaller businesses like convenience stores since they typically handle low-ticket items and can use this method to offset the associated processing costs.

While merchants are not required to disclose minimum purchase requirements, signs and verbal communication with customers can encourage a more transparent transaction process.

3. Convenience fees

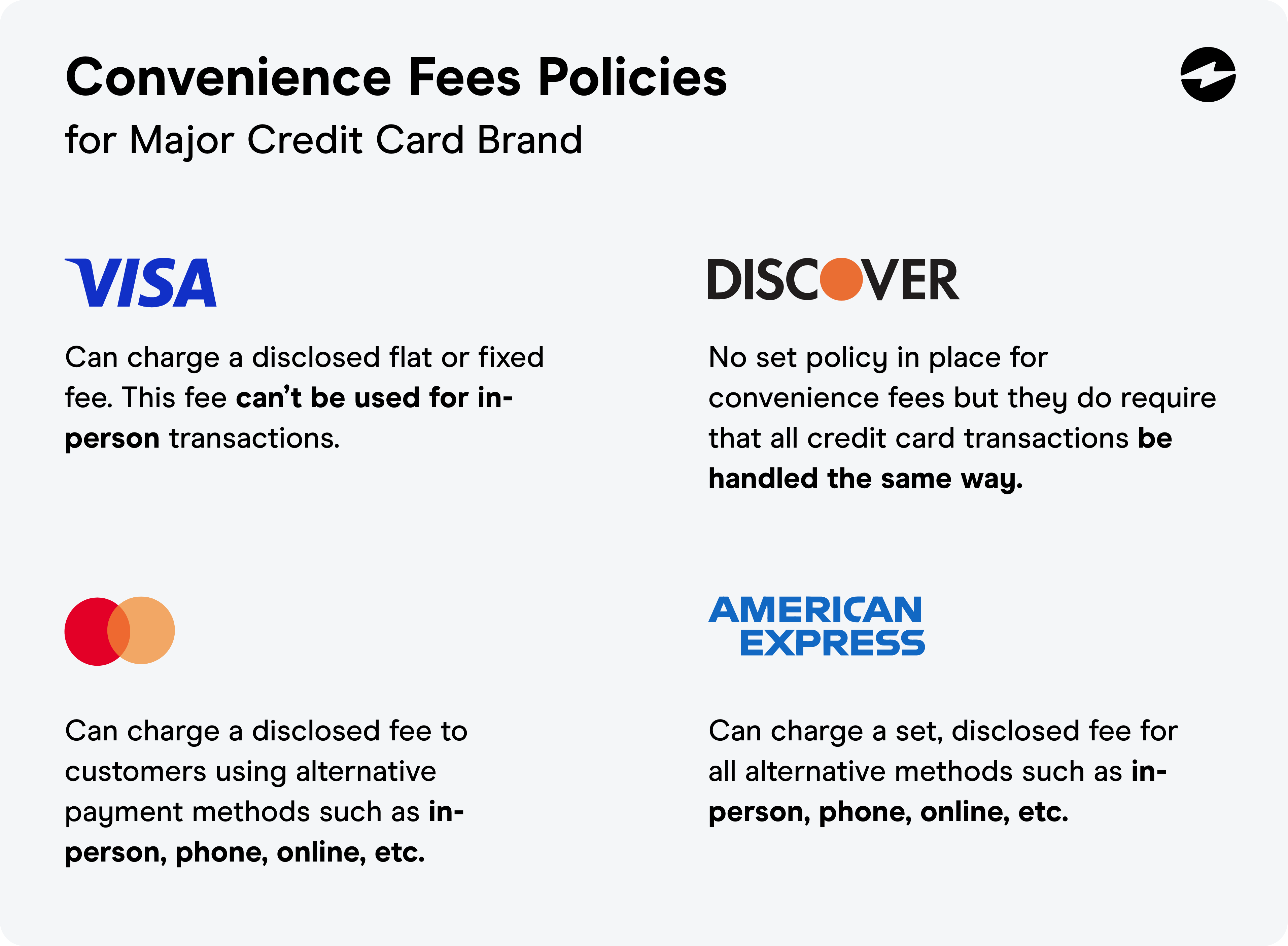

While convenience fees offer another effective option for merchants passing credit card fees to customers, they can’t be applied to every credit card purchase and may vary by the card issuer.

Convenience fees are typically implemented when products or services are purchased using alternative or unconventional payment methods, or if there’s another preferred form of payment. Each major credit card network has its own set of policies for convenience fees:

- Visa: Merchants can charge a disclosed flat or fixed fee for the convenience of using a Visa credit card as an alternative payment method. This fee can’t be used for in-person transactions.

- Mastercard: Merchants can charge a disclosed credit card convenience fee to customers using alternative payment methods such as in-person, phone, online, mailed-in payments, etc.

- American Express: Merchants can charge a set, disclosed fee for all alternative payment methods which include in-person transactions, recurring payments, subscriptions, etc.

- Discover: Discover has no set policy in place for convenience fees but they do require that all credit cards are handled the same way. This means merchants can’t limit convenience fees to one network — these charges must be added for all networks.

For transparency purposes, merchants can also send a credit card convenience fee letter to customers if they decide to add this extra charge on transactions.

Convenience fee vs surcharge

It’s important to not confuse convenience fees with surcharges. Merchants can add surcharges to any credit card transaction with the intent to offset processing costs. Whereas, convenience fees can only be added to transactions that use an unusual or alternative form of payment.

4. Cash discounting

Merchants that want to avoid charging their customers extra can also look into cash discounting to incentivize a different payment method instead of penalizing their customers.

Rather than passing credit card fees to customers, businesses can use cash discounting to offer a discounted rate to customers who purchase with cash. This discount can encourage more people to pay with cash which helps merchants minimize or avoid processing fees altogether.

Cash discounting is most common for businesses like gas stations, convenience stores, and service-related businesses such as automotive shops. Cash discounting can be a great option for merchants in states where surcharging is illegal or has limitations.

Is it legal to charge credit card fees?

Depending on which method is used and what your state regulations are, passing credit card fees to customers can be done legally or illegally if you’re not careful.

Businesses should regularly review state legislation to follow surcharging laws and also stay up-to-date on card network policies when it comes to other methods of adding extra charges.

Pros and cons of passing credit card fees to customers

Passing credit card fees to customers has its share of pros and cons for both merchants and customers. Therefore, you should review each method to determine if it’s beneficial for your business.

Pros

Cost savings is the most obvious advantage for merchants that pass credit card fees to customers, as it’s the main objective behind these methods. When merchants opt for zero processing fees by passing along processing costs, they can offset, reduce, and avoid these fees altogether.

More specifically, surcharging benefits merchants by allowing them to automatically pass charges to customers paying with credit cards for a more streamlined approach, and also give customers the option to pay with cash or debit cards instead.

Cash discounting can benefit both merchants and customers since it incentivizes customers to pay with cash to receive a discounted rate while simultaneously allowing merchants to avoid processing fees.

Other processing costs reduction methods like minimum purchase requirements, cash discounting, and convenience fees may allow for more flexibility for some merchants.

Cons

Passing credit card fees to customers also comes with its share of disadvantages that can be damaging for some businesses.

Passing credit card fees to customers can be great for merchants but puts the financial burden onto your customers which may result in fewer sales, fewer return purchases, and a weakened brand image.

Implementing surcharging or convenience fees means staying up to date on evolving state laws, card network regulations, etc. Failing to do so may result in your business going against guidelines or conducting illegal business practices.

Tips for properly passing credit card fees to customers

Merchants that want to effectively pass credit card fees while also avoiding turmoil from their customers can look to these three tips:

- Be upfront and transparent with customers about extra charges

- Follow state legislation and card issuer policies

- Offer additional payment methods besides credit cards to help customers avoid fees

If done right, merchants can successfully pass off credit card fees, conduct legal business operations, and maintain good rapport with customers.

EBizCharge helps merchants reduce credit card fees and optimize this process

Lastly, merchants can look to an all-in-one payment processor like EBizCharge to significantly reduce credit card processing fees by offering zero hidden fees, no setup costs, no cancellation charges, and more.

In addition to a seamless payment experience, EBizCharge allows merchants to surcharge customers to further minimize processing fees and save more money.

Merchants can maximize these savings by connecting their payment solution directly to the software they already use. With credit card processing for QuickBooks, surcharges and fees are automatically calculated and recorded in your accounting software. Manufacturers and distributors can do the same with Epicor payment processing or Acumatica payment processing, both of which sync every transaction to your ERP so you can track exactly how much you’re saving by passing fees to customers. When your payments and accounting are connected, managing surcharges and compliance becomes much simpler.

Frequently Asked Questions

Can stores charge a minimum for debit cards?

No, businesses are generally not permitted to set a minimum purchase amount for consumers paying with a debit card.

Can you pass credit card fees to consumers

Yes, businesses can pass credit card processing fees to customers through a practice called surcharging. This adds a small percentage to credit card transactions to offset the cost of processing.

However, there are rules to follow:

- State laws: Surcharging is prohibited in a few states. Rules vary, so check your state’s regulations.

- Card brand rules: Visa, Mastercard, and other networks cap surcharges (typically around 3%) and require proper disclosure at the point of sale.

- Credit only: Surcharges can only be applied to credit card transactions, not debit cards.

- Disclosure: You must clearly inform customers about the surcharge before they complete their purchase.

An alternative to surcharging is cash discounting, where you offer a lower price for non-card payments rather than adding a fee. This approach is legal in all states and often feels more customer-friendly.

What does standard credit card convenience fee wording look like?

The standard credit card convenience fee wording typically includes a clear and concise explanation of the additional fee charged for the convenience of using a credit card for payment. A standard wording could be:

“A credit card convenience fee of [percentage or flat amount] will be applied to all transactions. This fee is charged to cover the processing costs associated with credit card payments. Please note that this fee does not apply to other payment forms such as cash or debit cards.”

It will vary by merchant.