Blog > Optimizing B2B Payment Processes in NetSuite

Optimizing B2B Payment Processes in NetSuite

Business-to-business (B2B) payments aren’t simple. Unlike business-to-consumer (B2C) transactions, they often involve large invoices, extended payment terms, credit approvals, and multi-step internal approvals. You’re not just swiping a card—you’re managing a process that can impact cash flow, operations, and even customer relationships.

If you’re using NetSuite ERP, you already have access to tools that can help streamline this complexity. However, to fully optimize your NetSuite B2B payment processes, you need more than the default settings. You need to align the platform with how your business and customers operate.

This guide is for finance leaders, AR teams, and NetSuite administrators looking to reduce friction, increase speed, and modernize their payment experience without reinventing the wheel.

Understanding the B2B Payment Landscape in NetSuite

B2B payments come in all forms: ACH transfers, checks, credit card payments, and wire transfers. Each method brings its own timing, risk, and workflow requirements.

NetSuite ERP supports these options, but making the most of them requires clear setup. Whether dealing with recurring invoices or one-time sales, NetSuite B2B billing capabilities let you define payment terms, apply discounts, and assign customer-specific payment methods.

What matters most is mapping these tools to your real-world processes. If you have customers who always pay by wire, build that into their vendor record. If your sales cycle requires multiple internal approvals, automate those steps with workflows. With the right NetSuite integration, this level of control isn’t just possible—it’s scalable.

Streamlining Invoice-to-Cash Workflows

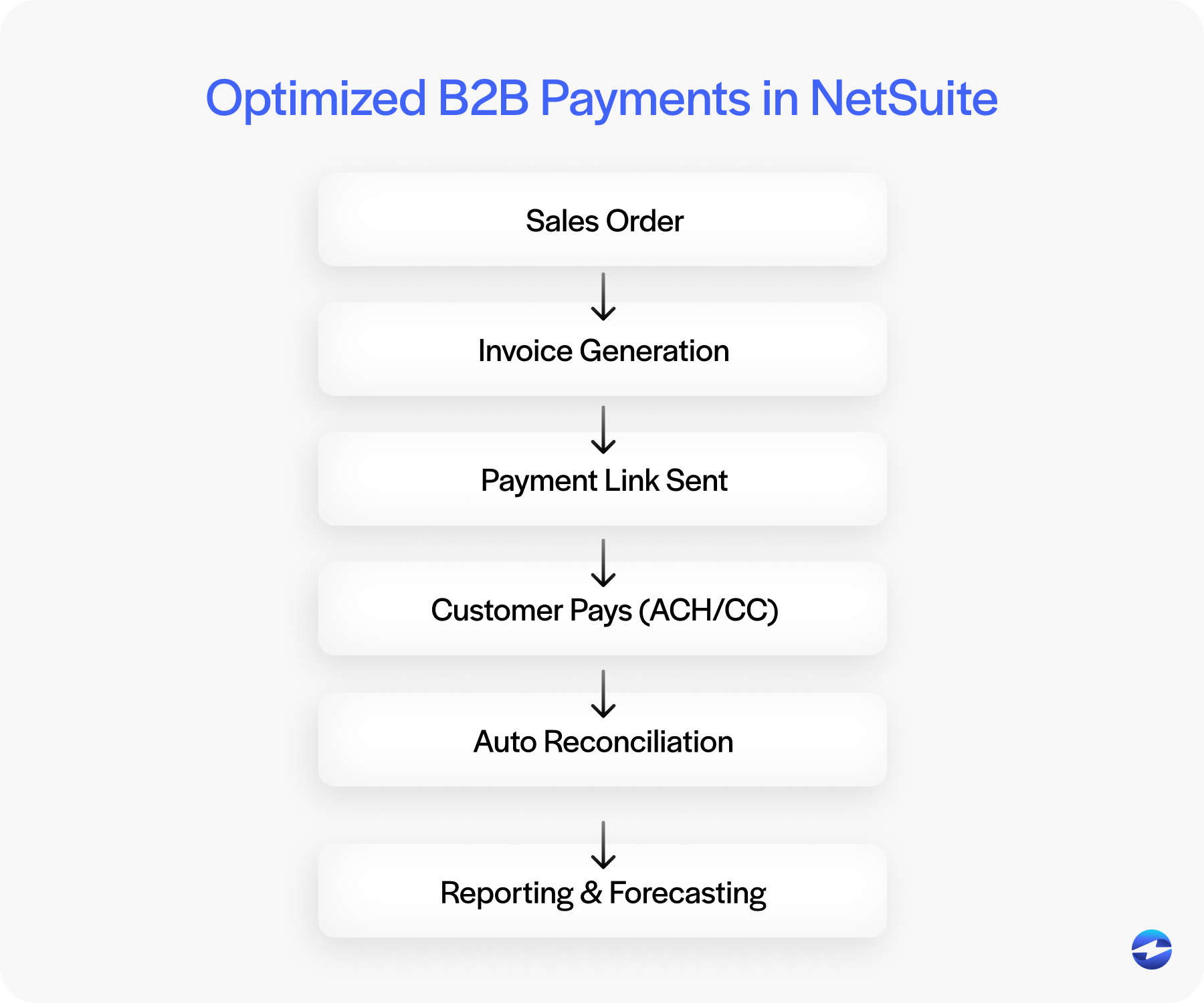

At the core of any good payment process is a smooth invoice-to-cash workflow. NetSuite billing tools can generate invoices automatically based on sales orders, subscriptions, or milestones. From there, you can customize how and when those invoices are delivered.

One effective approach is to embed payment links directly into your invoices. This lets customers pay via credit card or ACH right away—no logins or extra steps required. Combined with automated reminder emails and follow-ups, you can reduce average days to pay without a lot of manual chasing.

And because everything is tied into your NetSuite ERP environment, you maintain a single source of truth for what’s been billed, what’s been paid, and what’s overdue.

Reducing Friction with Payment Processing Integrations

A key part of any optimized B2B payment workflow is the connection between your record system and your payment processor. When NetSuite payment processing isn’t integrated, you’re stuck with batch imports, delays, and reconciliation headaches.

A proper NetSuite integration with your payment processing solution makes a major difference. It allows real-time sync of payment activity, automatic application of payments to open invoices, and fewer gaps in your data. This reduces errors, improves speed, and helps your AR team stay on top of things.

It also means fewer back-and-forth emails asking “Did you get my payment?”—because now, you’ll know right away.

Improving Payment Flexibility for Customers

Giving customers flexibility doesn’t mean giving up control. NetSuite B2B tools support a wide range of payment terms, methods, and options—without increasing your workload.

You can let customers pay by credit card, ACH, or other methods, and store payment preferences securely. You can also set up self-service portals so customers can view open invoices, make payments, and manage account details on their own schedule.

NetSuite credit card processing and ACH support is available natively or through third-party integrations, making it easier to meet customer expectations without compromising compliance or security.

Leveraging NetSuite Features for B2B Payment Optimization

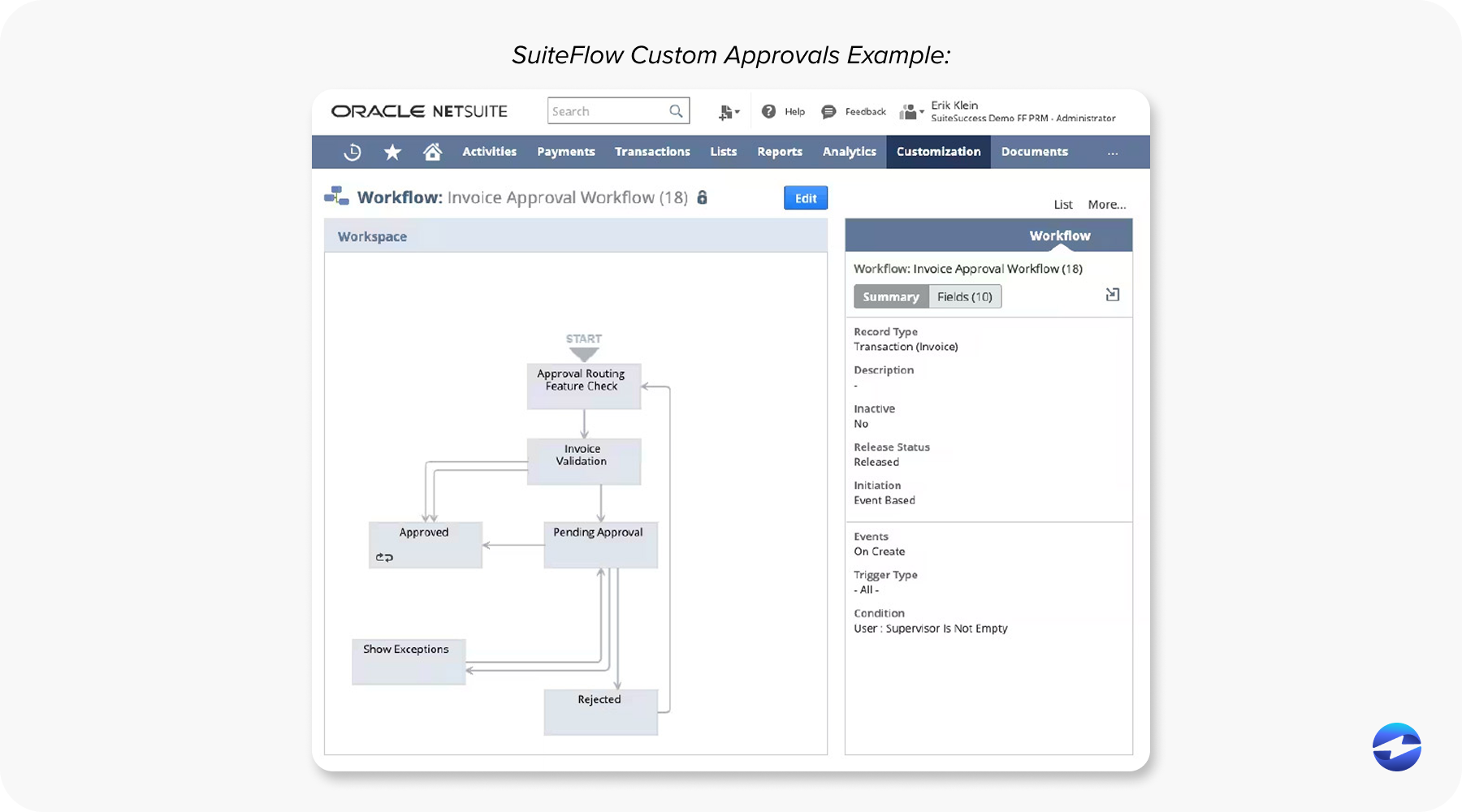

NetSuite ERP includes powerful tools that often go underused—tools that can significantly impact how efficiently your business manages B2B payments. SuiteFlow, for example, allows you to build custom approval workflows based on specific criteria like payment size, customer risk profile, or internal department ownership. This can help automate and enforce policy compliance while removing unnecessary bottlenecks.

Beyond approvals, NetSuite allows you to create saved searches and surface real-time KPIs on dashboards. These features can highlight overdue invoices, track aging balances, or analyze payment timelines across customer groups. In short, they offer valuable insights that let you refine your NetSuite B2B billing capabilities and adjust your strategies proactively.

You can also take advantage of credit limits, customer-specific terms, dunning processes, and custom automation rules—all of which reduce payment delays and financial risk. This makes it easier to maintain control over receivables without adding manual overhead. When fully leveraged, these built-in NetSuite features allow finance teams to scale operations, improve cash flow forecasting, and reduce friction in every stage of the B2B payment lifecycle.

How EBizCharge Supercharges B2B Payments in NetSuite

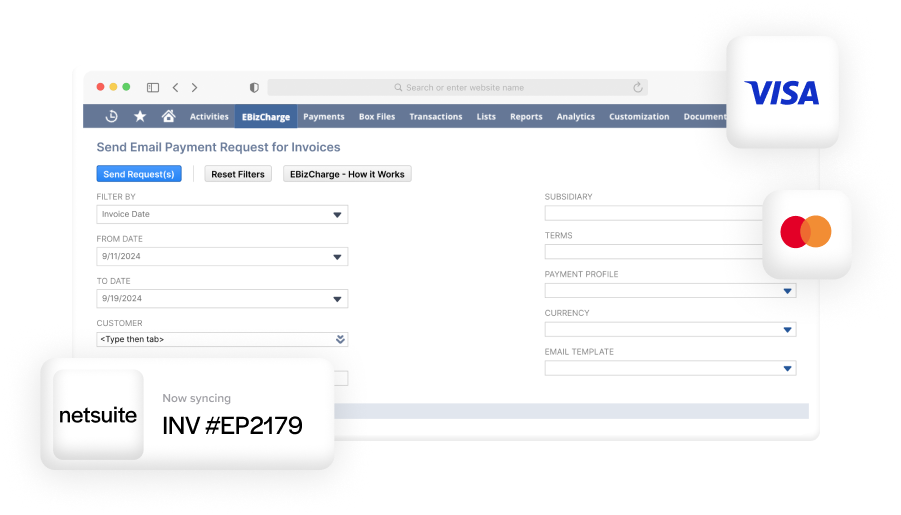

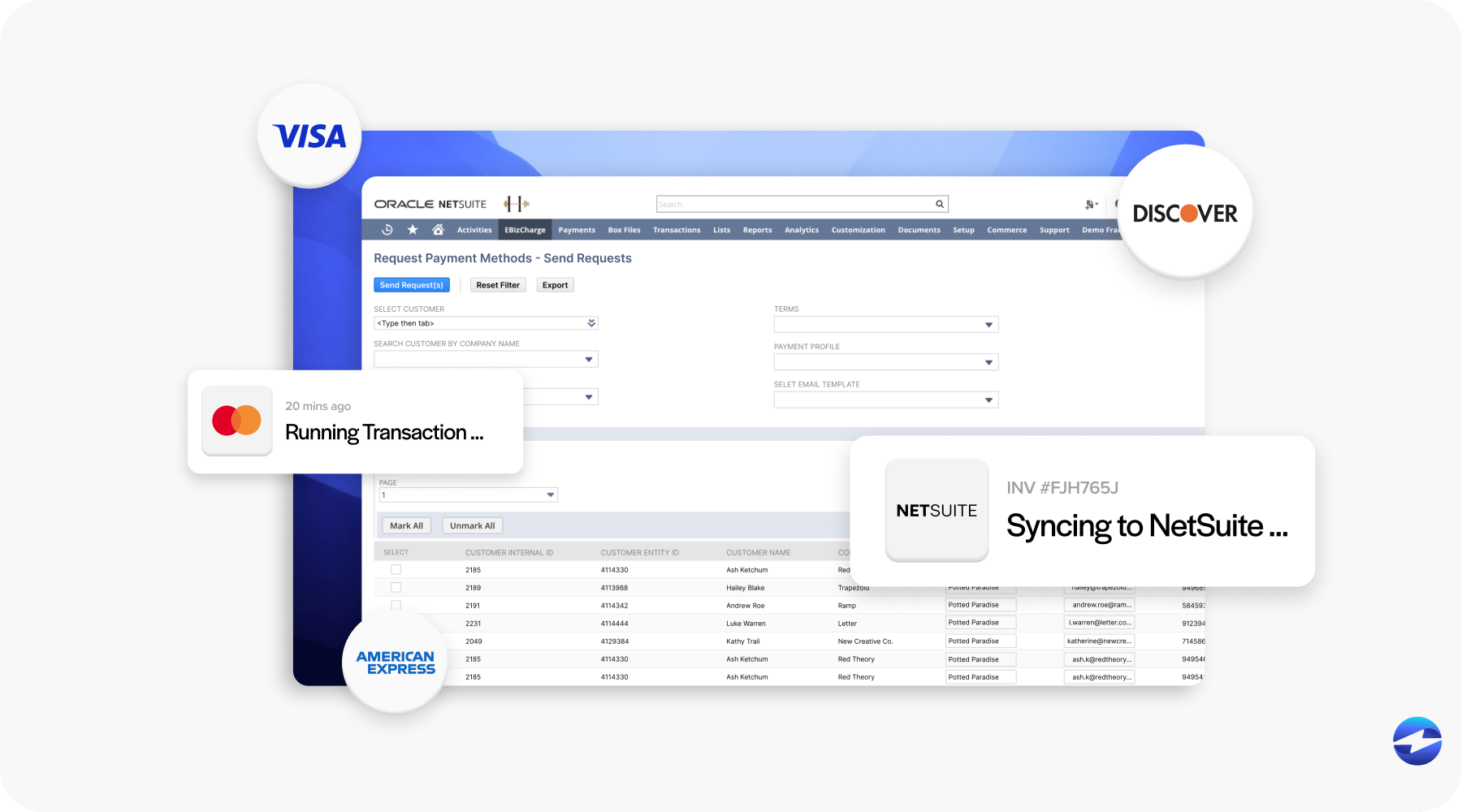

When it comes to optimizing NetSuite B2B payment workflows, integration is everything—and EBizCharge delivers where it counts. Designed specifically for NetSuite ERP, EBizCharge embeds directly into the platform, giving you a secure, PCI-compliant payment processing solution that supports both credit card and ACH payments.

What sets EBizCharge apart is how naturally it fits into your existing system. Its NetSuite integration syncs payment data in real time, eliminating the delays and batch imports that slow down other workflows. This means faster reconciliation, immediate insight into what’s been paid, and far fewer opportunities for manual errors.

With EBizCharge, you can also track declined payments, store payment methods securely, and manage refunds—all from within the same NetSuite interface you’re already using. For businesses processing a high volume of B2B payments, this embedded functionality can drastically reduce friction, improve customer satisfaction, and accelerate the cash conversion cycle.

And the benefits go beyond the payments themselves. By combining EBizCharge with your NetSuite B2B billing capabilities, you create a more intelligent, responsive workflow. Collections become faster, visibility improves, and teams spend less time chasing payments and more time optimizing strategies.

If you’re evaluating your current system, ask: where are your bottlenecks? What’s still manual that shouldn’t be? These are the areas where an embedded, flexible payment processor like EBizCharge can have the biggest impact. It’s not about adding more tools—it’s about using the right ones to make your NetSuite payment processing smarter, faster, and easier to scale.