Blog > NetSuite Payment Plugins vs. Native Integrations: Making the Right Choice

NetSuite Payment Plugins vs. Native Integrations: Making the Right Choice

If you’re running payments through NetSuite, how you choose to connect those payments into your system matters—a lot. Whether you’re managing eCommerce sales, B2B invoicing, or recurring subscriptions, the setup behind your NetSuite payment processing can either streamline your day-to-day or create a mess of manual work.

Most teams end up comparing two main paths: NetSuite payment plugins and native NetSuite integration options. At first glance, they may look similar. Both get payments into NetSuite. However, the experience, reliability, and long-term fit can be very different. This article will explore the pros and cons of each approach, helping you figure out what makes the most sense for your business.

Understanding NetSuite Payment Plugins

NetSuite payment plugins are typically third-party apps or connectors added onto your system to enable payment processing. These plugins act as bridges between your enterprise resource planning (ERP) and payment processor, offering features like basic card acceptance, tokenization, or invoice payment links.

They’re often flexible and relatively fast to install, which makes them popular for smaller teams or businesses looking for a quick fix. Plugins may also offer support for multiple NetSuite payment methods, like ACH or credit cards, and provide some level of customization.

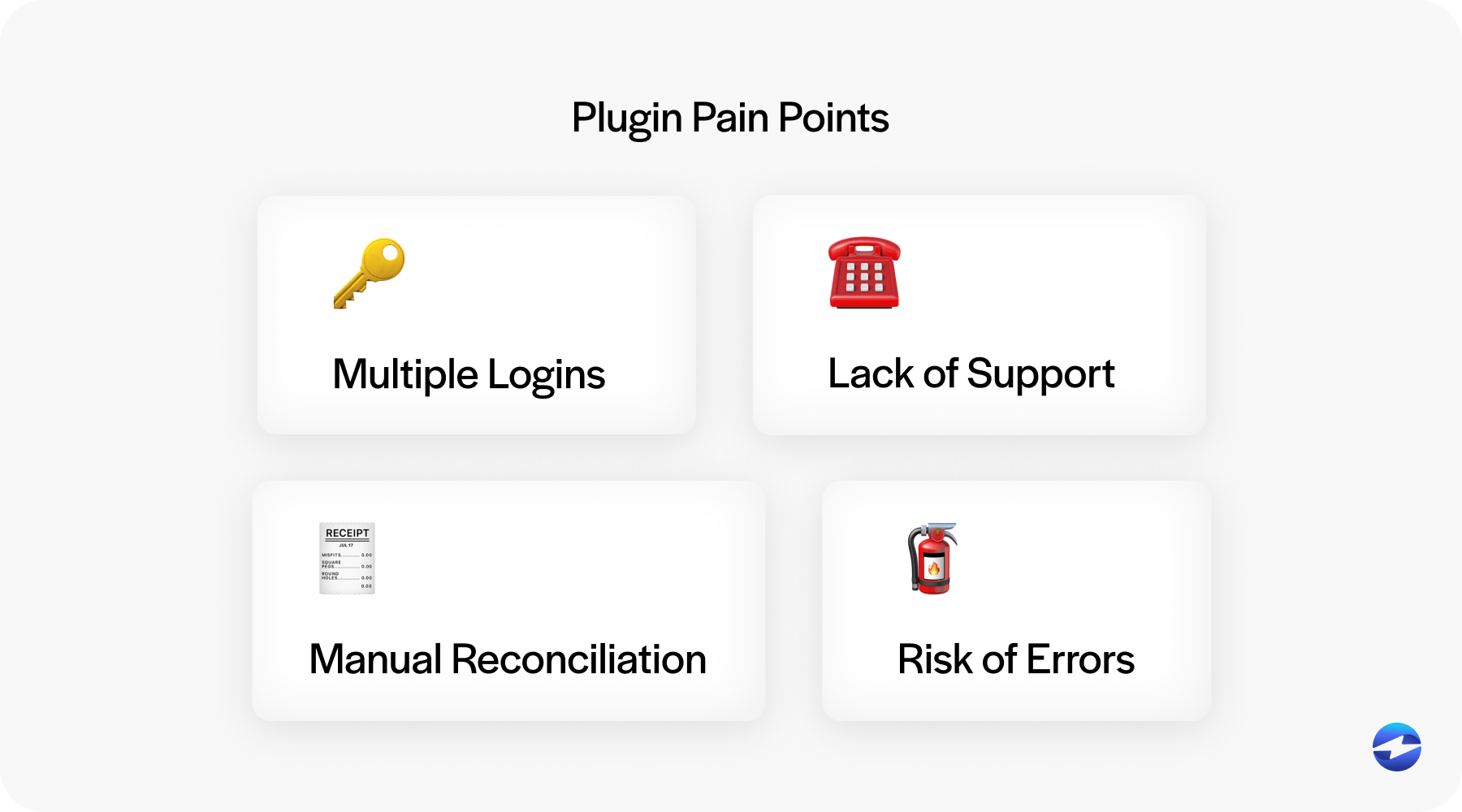

But they come with trade-offs. Because NetSuite payment plugins are not deeply embedded into the ERP, data often syncs in batches or with delays. That can mean missed updates, reconciliation issues, or manual cleanup. Plugins may also require separate logins or admin panels outside of NetSuite, creating more silos than solutions.

Exploring Native NetSuite Integrations

Native NetSuite integrations take a different approach. These solutions are purpose-built to work inside the ERP—no jumping between systems or waiting for data to catch up. Everything from credit card processing to payment reconciliation happens within the same platform.

With a native tool, your finance or accounts receivable (AR) team can accept payments directly through a NetSuite payment portal, apply them instantly to open invoices, and trigger automated workflows—all without ever leaving the environment they already use.

The result? Fewer errors, faster transactions, and stronger internal controls. These solutions are also better aligned with NetSuite’s user roles and security settings, helping you stay on top of compliance and access management.

Key Considerations When Comparing Plugins vs. Native Integrations

When weighing these two approaches, consider more than just features. Think about how each fits into your day-to-day and your long-term plans.

Plugins are usually quicker to install but can require more hands-on management later. Native integrations may take more planning upfront but are easier to scale and maintain. If your business has unique workflows or heavy payment processing needs, flexibility is important—but so is dependability.

Security and compliance should also be a top priority. Native integrations tend to have better alignment with NetSuite’s audit trail and role-based permissions. That matters when dealing with sensitive credit card processing or large volumes of customer data.

Support and performance can vary, too. Many NetSuite payment plugins rely on third-party support teams, while native tools often have dedicated NetSuite experts behind them. If something breaks, who’s there to fix it—and how quickly?

Choosing the Right Fit for Your Business

There’s no one-size-fits-all answer. The best solution depends on how you operate and where your pain points are.

If you’re a lean team with simple needs, a plugin might be enough to get started. But if you’re processing a high volume of transactions, handling multiple payment types, or supporting recurring revenue models, a native NetSuite integration will likely save you time and headaches in the long run.

Examine your broader technology ecosystem. Does your billing or invoicing process depend heavily on other platforms outside of NetSuite? If so, then third-party integration support becomes much more important. You should also consider your team’s capacity to learn new systems. Will the solution require extensive onboarding or ongoing support to be effective? The more intuitive the interface and well-integrated the tool, the easier it will be for your team to adopt and maintain.

And don’t forget to factor in cost—not just license fees, but time spent troubleshooting, fixing mismatches, or chasing down support.

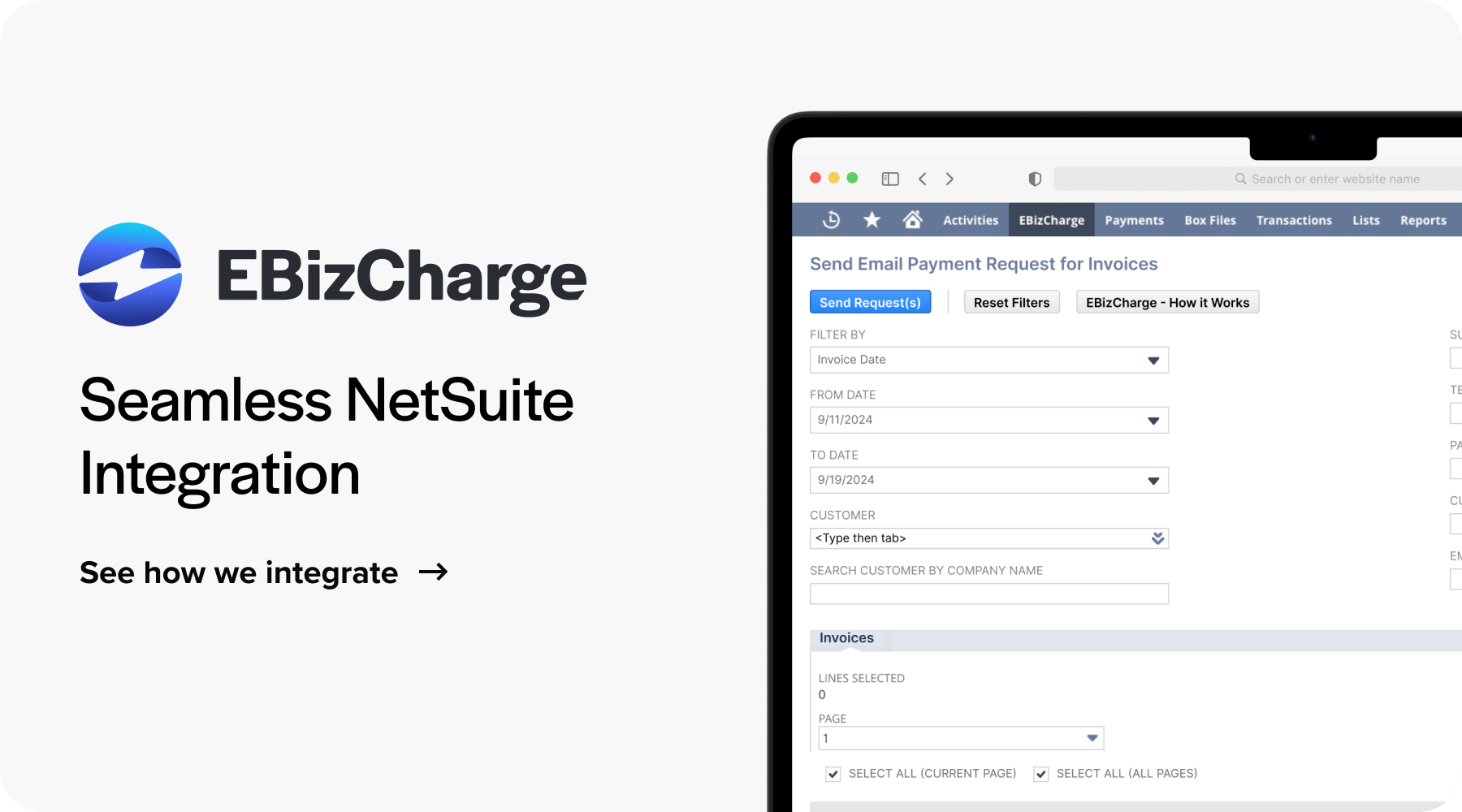

EBizCharge’s Native NetSuite Integration

EBizCharge is a great example of what a native NetSuite payment processing solution can look like. It embeds directly into NetSuite, allowing users to accept payments, apply them in real time, and reconcile without switching systems.

It’s more than just a payment processor hookup. EBizCharge handles everything from automated reconciliation to secure tokenization. Teams can use its built-in NetSuite payment portal to let customers pay invoices online, and those payments sync directly with your financials. There’s no need to export reports, rekey data, or manually match payments.

For businesses looking to move away from clunky NetSuite payment plugins, EBizCharge offers a cleaner, more seamless experience.

Find a payment integration that works for you

NetSuite payment plugins can be a fast, flexible entry point for teams looking to add payment processing to their ERP. But native integrations offer deeper functionality, stronger reliability, and a smoother user experience.

Whichever path you choose, the key is to match your payment tools with your business needs. Focus on usability, security, and scalability. The best setup is the one that works inside your NetSuite environment without friction—whether that’s managing NetSuite credit card processing, streamlining reconciliation, or giving customers a user-friendly NetSuite payment portal.

If you’re exploring options, EBizCharge is worth a close look. It combines the depth of a native NetSuite integration with the flexibility