Blog > Is Zero Cost Credit Card Processing Suitable for Your Small Business?

Is Zero Cost Credit Card Processing Suitable for Your Small Business?

As businesses navigate credit card processing fees, zero cost credit card processing has emerged as a valuable alternative. This option focuses on eliminating processing fees for the merchant by passing them onto customers, a practice that’s steadily gaining traction.

To understand if zero cost credit card processing is suitable for your business, it’s essential to know how these fees work and the available alternatives.

What are credit card processing fees?

Credit card processing fees are charges merchants are responsible for when accepting and processing credit card payments.

Each time a customer uses a card to make a purchase, the business must pay a small fee to its payment processor. These fees are essential for covering the costs of handling, authorizing, and securing card transactions.

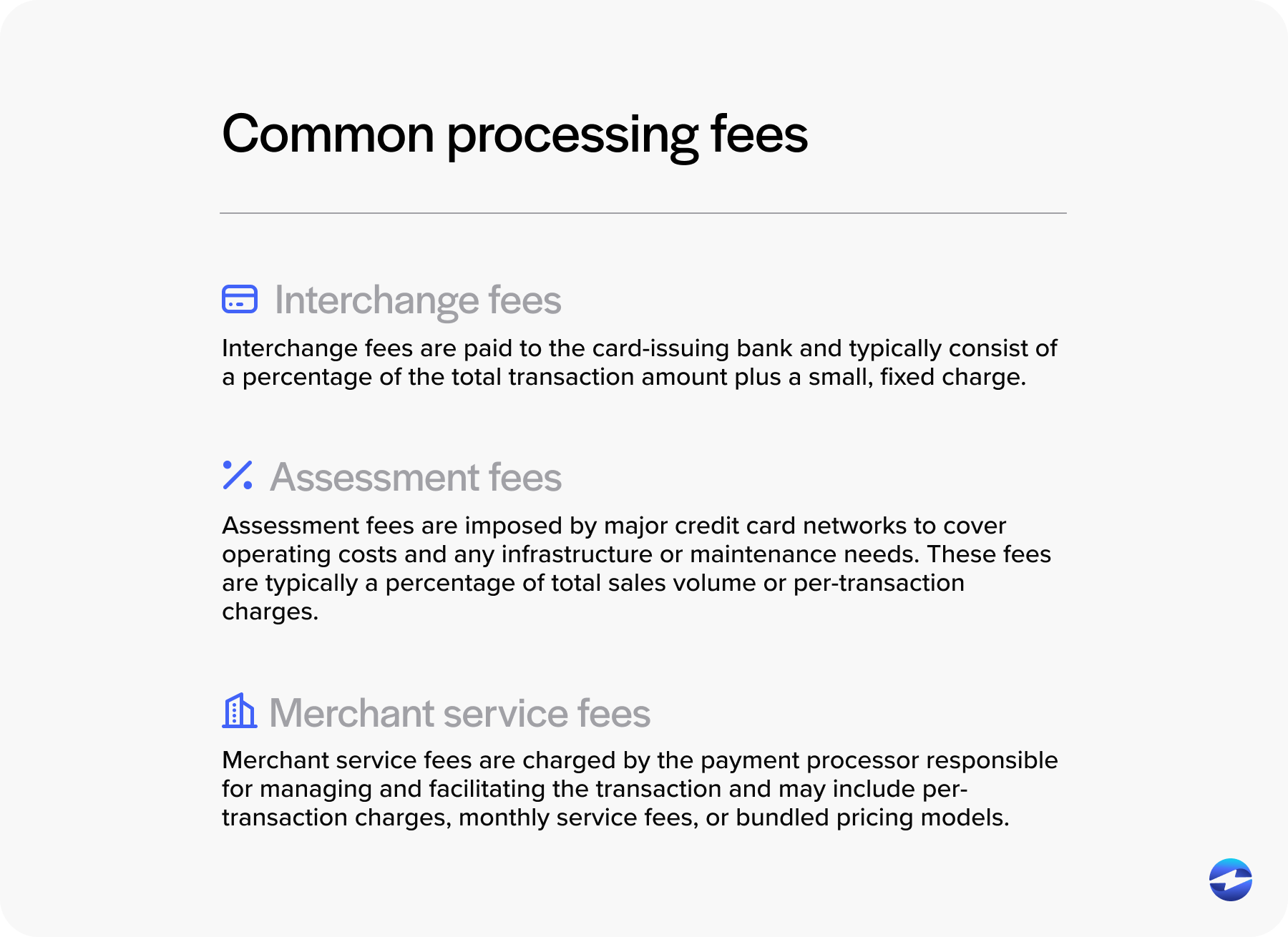

Credit card processing fees are comprised of several fees, such as:

- Interchange fees: Interchange fees are paid to the card-issuing bank and typically consist of a percentage of the total transaction amount plus a small, fixed charge.

- Assessment fees: Assessment fees are imposed by major credit card networks (Visa, Mastercard, etc.) to cover operating costs and any infrastructure or maintenance needs. These fees are typically a percentage of total sales volume or per-transaction charges.

- Merchant service fees: Merchant service fees are charged by the payment processor responsible for managing and facilitating the transaction and may include per-transaction charges, monthly service fees, or bundled pricing models. These fees can vary significantly depending on the provider.

Additional charges can result from various circumstances, such as chargeback fees, Payment Card Industry (PCI) non-compliance fees, monthly minimum fees, and gateway fees.

Since these costs can stack up for small businesses, zero cost credit card processing provides an attractive solution for merchants to ensure a solid financial position.

What is zero cost credit card processing?

Zero cost credit card processing is a pricing strategy that enables businesses to eliminate the cost of processing fees by shifting those fees to customers who choose to pay with credit cards. Instead of the merchant absorbing the transaction fees (ranging from 1.5% to 3.5% of the sale), the customer pays a small additional fee when using a credit card.

This approach is often framed as granting customers flexibility in how they pay while maintaining competitive pricing for those who use cash.

Zero cost credit card processing particularly appeals to small and medium-sized businesses looking to protect their margins in the face of rising operating costs. It can also create transparency in payment costs and incentivize cost-effective payment behavior without increasing base prices.

How does zero cost credit card processing work?

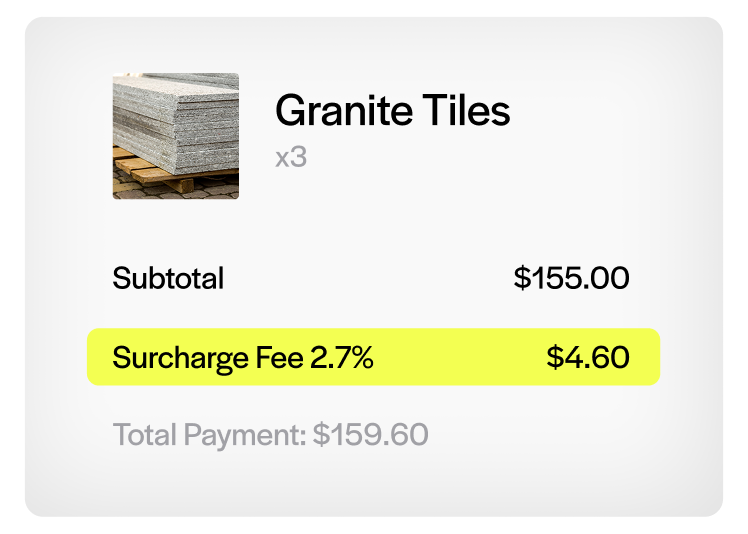

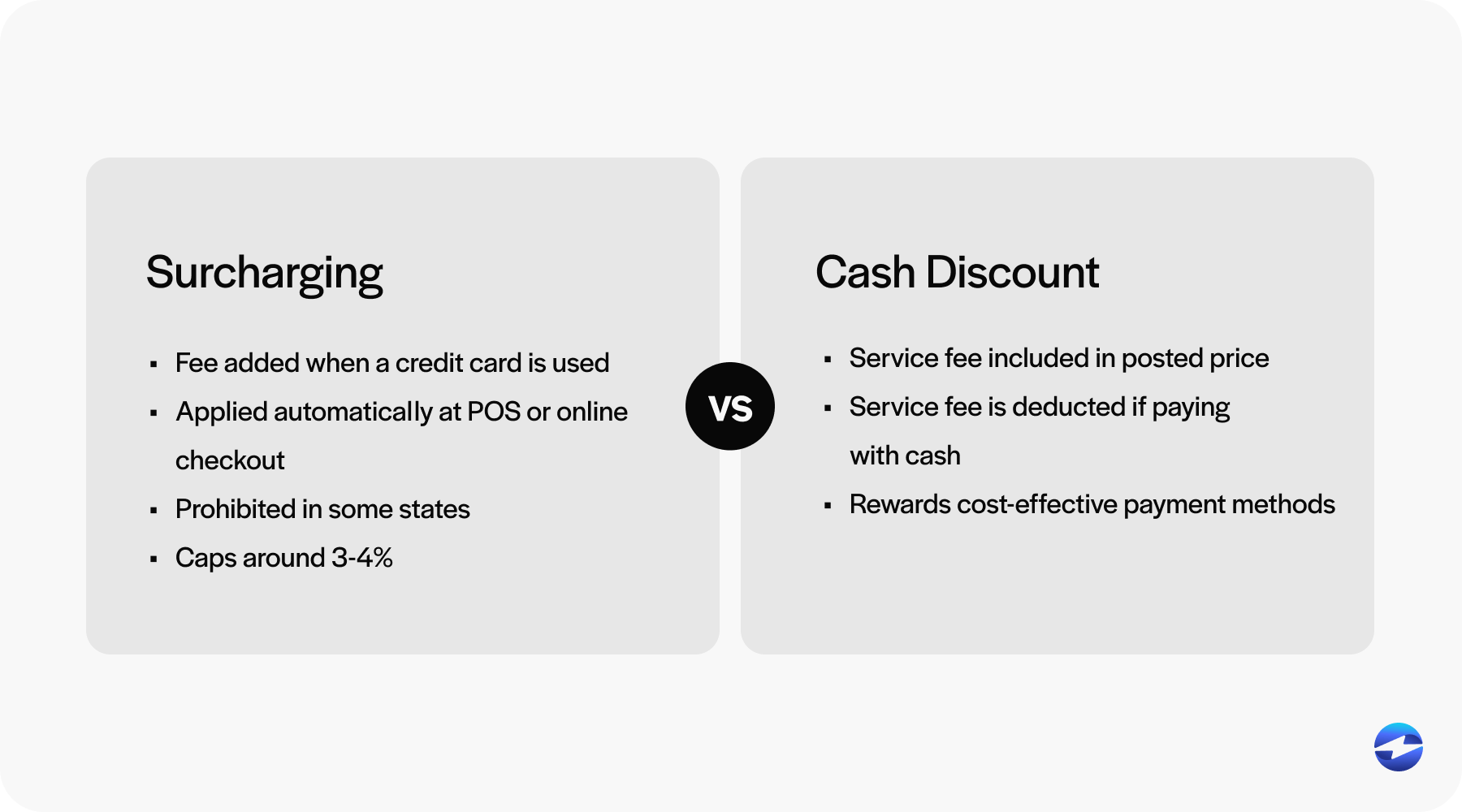

Zero cost credit card processing typically uses a surcharge or a cash discount model, each with distinct mechanics.

In a surcharge setup, the business adds a fee to the customer’s total only when a credit card is used, making the cost of card acceptance visible at checkout. This surcharge is calculated and applied automatically by the point-of-sale (POS) or payment software, ensuring accuracy and compliance with legal and card network regulations.

While surcharging is permitted in most U.S. states, there are a few states where this program is prohibited — merchants must verify state laws before implementing them. Additionally, credit card networks typically cap surcharge amounts around 3-4% of the transaction total, and merchants must notify the card brands prior to adding a surcharge.

Alternatively, the cash discount model includes a service fee in the posted price, which is deducted at checkout when a customer pays with cash. This method effectively reverses the transaction flow – rewarding cost-effective payment methods rather than penalizing credit card use.

Both models rely on compliant signage, itemized recipients, and proper payment system configurations to function smoothly. When implemented correctly, zero cost processing enables businesses to retain more revenue without compromising customer choice.

Do ACH transactions support zero cost credit card processing?

Automated Clearing House (ACH) transactions aren’t technically associated with zero cost credit card processing since they’re a different form of payment. However, they are a cost-effective solution.

While zero cost processing programs pass the cost of credit card processing fees onto the customer, ACH/eCheck payments avoid credit card fees altogether by transferring funds across bank accounts via the ACH Network. Thus providing a parallel, fee-friendly alternative for customers who prefer to avoid surcharges.

Since these electronic transfers are routed through the ACH network rather than credit card networks, the fees are significantly lower, often just a flat rate or a small percentage per transaction. This incentivizes businesses to promote ACH payments as a cost-saving option for them and their customers.

In this way, ACH transactions can balance the merchant’s goal of minimizing payment processing costs while maintaining flexibility and convenience in how customers can pay.

Now that you know how zero cost processing works, a common question still arises.

Is zero cost credit card processing actually free?

Simply put, zero cost credit card processing isn’t entirely free since it shifts the burden of credit card fees from the business to the customer. While merchants no longer pay the processing fees directly, customers who pay with credit cards cover those costs via surcharges or a cash discount.

Additionally, businesses may still incur costs related to setup, software, compliance, or equipment, depending on their provider.

While the zero cost credit card processing model can significantly reduce or eliminate traditional processing fees for companies, it’s not entirely cost-free in a broader sense. Instead, it offers a strategic way to manage and offset payment processing expenses.

If you decide that no fee credit card processing is right for your business, you’ll need to consider a few factors before implementing it.

Implementing zero cost credit card processing

To successfully implement no fee credit card processing, your company must navigate a complex web of legal, technical, and operational considerations.

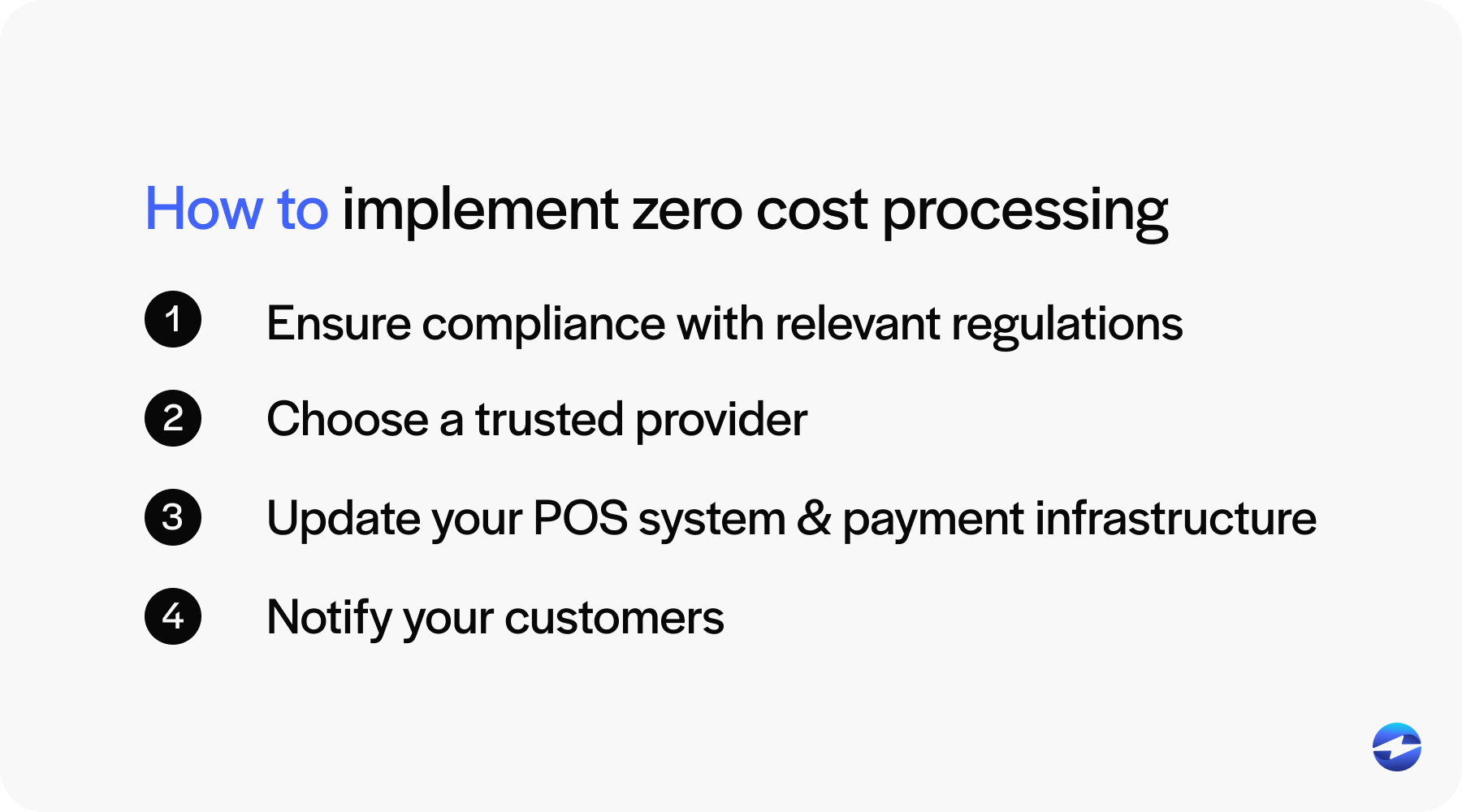

Merchants can integrate zero cost processing into their business by complying with relevant regulations, finding a trusted provider, updating POS systems and payment infrastructures, and notifying customers.

1. Ensure compliance with relevant regulations

Before launching a zero cost processing program, it’s essential to understand the legal and regulatory environment.

Credit card surcharging is permitted under federal law but is regulated at the state level and governed by card brand rules. Some states don’t allow surcharging at all. Therefore, businesses must research state laws and card network policies to ensure full compliance.

Cash discounting, on the other hand, is legal in all 50 states and generally involves offering a lower price to customers who pay with cash rather than adding a credit fee. With this approach, the listed price includes a built-in service fee, which is removed at checkout when a customer pays with cash. This method avoids many regulatory complexities associated with surcharging, though proper signage and disclosures are still necessary.

To ensure you’re operating within regulations, consult a trusted compliance expert or payment provider who understands the legal limitations of surcharging and cash discounting.

2. Choose a trusted provider

For the most effective zero cost credit card processing, merchants must use reliable technology and work with an experienced payment processor.

It’s essential to find a provider that offers compliant surcharging and cash discounting solutions with built-in safeguards to help you follow card brand regulations and state laws.

The ideal payment processing provider will assist with configuring your POS system and ensure receipts, signage, and pricing structures meet all disclosure requirements.

Processors should also provide thorough training so merchants can clearly communicate these programs to their customers and use flexible tools to switch between or combine surcharging and cash discounting strategies as needed.

Transparency, automation, and compliance support are the hallmarks of a reliable provider in this space.

3. Update your POS system and payment infrastructure

Whether implementing a surcharge or offering a cash discount, your POS system must be configured to support the changes.

When surcharging, the POS system must identify when a customer uses a credit card, automatically apply the appropriate surcharge fee, and clearly itemize this fee on the receipt.

When cash discounting, the POS system should display the card-inclusive price by default and deduct the discount at checkout when a customer pays with cash.

Integrating these features may require software updates or hardware replacements. Nonetheless, merchants should work with providers to thoroughly test their systems and ensure all touchpoints (in-store, mobile, or online) apply the program uniformly.

Investing time in properly training your staff will also enable team members to confidently and professionally handle customer inquiries.

4. Notify your customers

Clear and upfront communication is vital regardless of whether you use a surcharge or cash discounting program. Merchants must inform customers of any charges or discounts before completing transactions to comply with card brand rules and build trust.

For surcharges, businesses must display signage at their storefront entrance, POS system, and on their online checkout page so customers are aware of these charges before paying. Receipts should also itemize the surcharge separately.

For cash discounts, businesses should indicate that listed sales prices reflect card payments and notify customers that they’ll receive a discount for using cash. POS systems should print receipts showing the original amount and the discounted cash price.

It’s crucial to prepare your team to effectively and professionally explain how these programs can help manage rising costs while still providing several beneficial options for its customers. When framed as a way to keep prices lower for everyone, many customers are receptive.

By ensuring legal compliance, working with a knowledgeable provider, syncing its POS system, training staff, and clearly communicating these programs to customers, your business can navigate this transition smoothly.

Evaluating different programs and providers to select the best option for your business is essential.

How to choose the best zero cost credit card processing program

Choosing the best zero cost credit card processing program for your small business involves careful consideration.

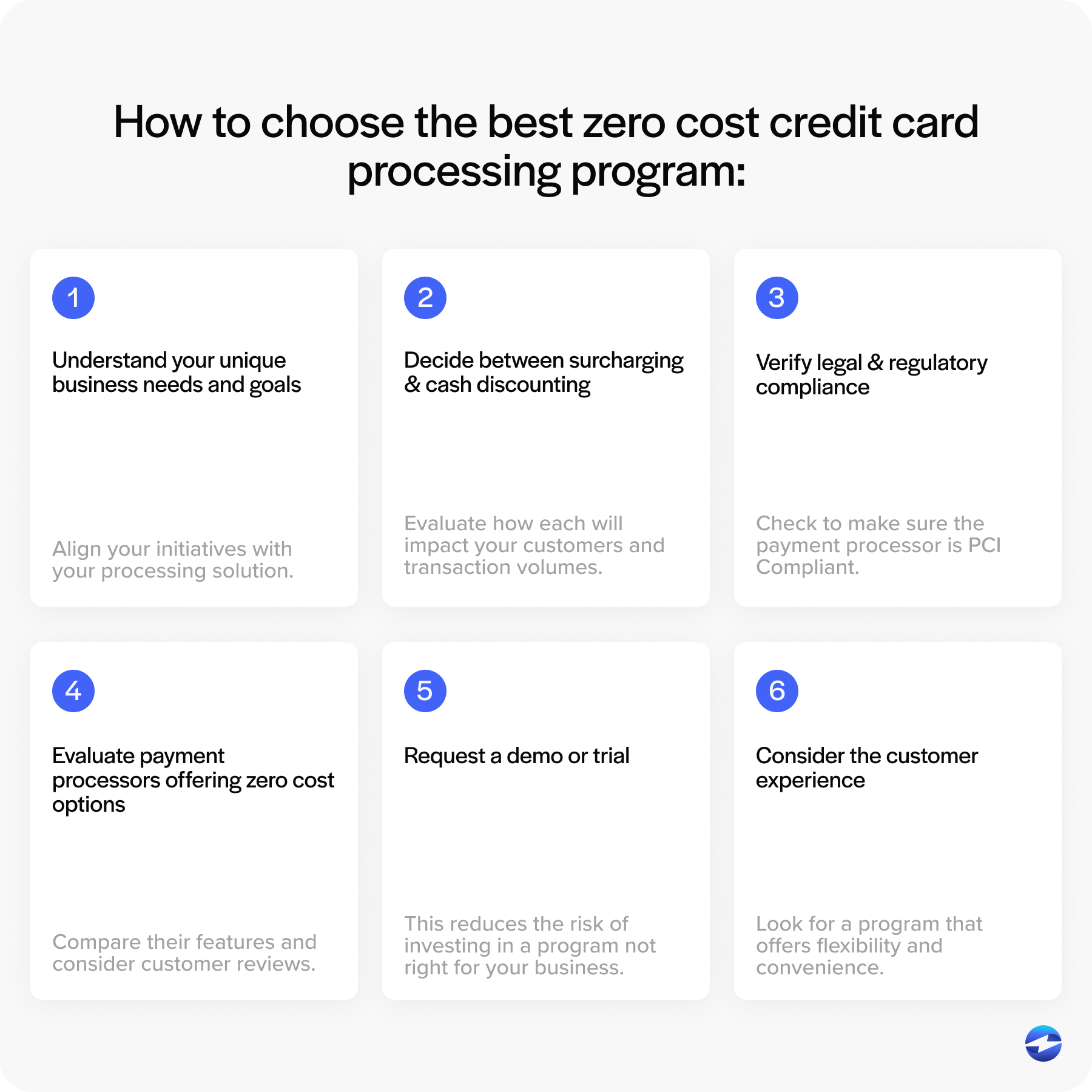

Here are six factors to consider when looking for an efficient zero cost processing solution:

- Understand your unique business needs and goals. Review your average sales volumes and whether you primarily process in-person or online transactions. Knowing your goals will guide you in choosing a program that supports growth. If your business operates primarily online, you’ll want a program that supports digital payments. If your focus is increasing cash flow, a program that reduces fees is optimal. Identifying and aligning these initiatives with your processing solution will ensure long-term benefits.

- Decide between surcharging and cash discounting. Each option has its benefits and implications — surcharging can recover transaction fees but may deter some credit card users, while cash discounts encourage cash payments and reduce processing needs — so it’s important to evaluate how each will impact your customers and transaction volumes.

- Verify legal and regulatory compliance. Different states have varying laws about surcharging and cash discounting, so businesses must understand the applicable regulations for their infrastructure. Non-compliance can result in legal implications fines, and damage reputation. Verify that the program aligns with state laws and meets industry standards. Compliance also involves adhering to card network rules and maintaining PCI compliance to protect sensitive card information and build customer trust.

- Evaluate payment processors offering zero cost options. Look for processors with a reliable track record, positive reviews, transparent rates, and excellent customer service. Assess their experience in handling similar business models or industries. Compare the features they offer, such as card reader compatibility and support for card-not-present (CNP) transactions. Consider any additional fees, like chargeback or PCI compliance fees.

- Request a demo or trial. This gives you firsthand, non-committal experience with the system to evaluate its user-friendliness and compatibility with your current equipment. A trial helps you understand the service features, identify shortcomings, and test customer support responsiveness. A demo or trial reduces the risk of investing in a program that doesn’t suit your business.

- Consider the customer experience. Since happy customers can lead to repeat business and positive word-of-mouth reviews, it’s essential to ensure the provider delivers seamless and straightforward customer payments. A program that offers flexibility and convenience will likely enhance the user experience.

While zero cost credit card processing isn’t entirely free, it can still reduce fees so you can allocate funds to other high priorities. Merchants can employ zero cost processing and leverage the most cost-effective approach using reliable providers like EBizCharge.

Leverage zero cost credit card processing with EBizCharge

EBizCharge offers comprehensive payment software for small businesses, as well as mid-sized to enterprise-level companies, to leverage zero cost credit card processing options and lower their overall costs.

The top-rated EBizCharge payment solution offers zero cost processing through its built-in surcharging feature, allowing businesses to pass processing fees directly to customers who pay with a credit card. This setup automatically calculates and applies a surcharge at checkout, ensuring compliance with card network rules and state legislation.

EBizCharge works to secure the lowest rates for merchants by providing unlimited, free support, no contracts or hidden fees, no-cost implementation, complimentary payment features and tools, and customized pricing.

Businesses also have access to real-time reporting tools that make monitoring transactions and maintaining financial oversights easier. This level of visibility supports better planning and decision-making.

Additionally, EBizCharge ensures full PCI compliance without additional charges, which helps businesses stay secure and meet regulatory requirements without added expenses.

Merchants can leverage the powerful software that EBizCharge provides to streamline card payments, take advantage of zero cost or low-cost processing, and enhance financial operations for long-lasting revenue.