Blog > Invoice Reconciliation: An In-Depth Look

Invoice Reconciliation: An In-Depth Look

Invoice reconciliation is vital to any company’s infrastructure since it safeguards cash flow and financial integrity. It works as the guardian of accounts, shielding your business from inaccurate reporting, fraudulent activities, and compliance woes while improving operational sales and supplier alliances.

This article will explore invoice reconciliation to help you better understand how it works, its associated benefits, and strategies for speeding up this process.

What is invoice reconciliation?

Invoice reconciliation is an essential accounting process that involves cross-checking and validating the amounts charged on invoices against other financial records. It helps ensure the accurate recording and reporting of transactions and provides a more reliable view of a business’s financial standing.

During invoice reconciliation, billing details on supplier or vendor invoices are compared against company records such as bank statements, purchase orders, and payment confirmations. Invoice reconciliation ensures that all the financial transactions are accounted for, providing clear insights into outstanding or unpaid invoices.

Discrepancies may indicate billing errors, human errors, overdue payments, or fraud. Consequently, thorough and regular invoice reconciliation can help maintain an accurate account of business finances, manage cash flow effectively, and reduce the risk of errors in financial statements.

Since invoice reconciliation involves managing invoices, it is important to understand what invoices are and the distinction between them.

Invoices vs. reconciliation

While invoices and invoice reconciliation go hand in hand, businesses must understand their differences.

Invoices are documents a seller sends to the buyer detailing the products or services provided and the payment amount due. These can be incoming invoices for items purchased or outgoing invoices for sales made.

Conversely, reconciliation is the process of comparing invoices with other financial data to confirm accuracy and resolve any inconsistencies. Routine reconciliation is fundamental for businesses to verify the precision of their accounting records.

The two terms combined into invoice reconciliation come with a lot of benefits to businesses.

What are the benefits of invoice reconciliation?

Invoice reconciliation offers many benefits that directly contribute to the stability and growth of an enterprise.

Through rigorous cross-checking of invoices against financial records, companies can:

- Improved financial recording accuracy

- Enhanced data integrity

- Compliance with regulatory standards

- More fraud protection

- Better operational efficiency

- Stronger supplier relationships

Below, each of these benefits is explored in depth, outlining why reconciling invoices is a cornerstone practice for prudent financial management.

Improved financial recording accuracy

Accurate financial records are the foundation of a sound business operation. By performing billing reconciliation, a company can manage on-time payments and ensure every penny spent or received is accounted for.

This clarifies financial positions, aids in reporting, and allows for informed decision-making. Financial accuracy also saves business owners from errors during tax season or when assessing the financial viability of new projects or investments.

Enhanced data integrity

Since any invoicing mistakes, whether due to human error or system glitches, can distort the accurate financial picture, reconciling billing fortifies the integrity of a company’s data.

Transaction records can be validated through regular invoice reconciliation processes, thus bolstering the reliability of accounting records. More robust data integrity enhances stakeholder trust in a company’s reported figures and improves strategy and planning.

Compliance with regulatory standards

Staying in line with industry regulations and tax laws is imperative for any business. Billing reconciliation helps by keeping a tight ship where all financial transactions are logged and accounted for correctly.

This meticulous record-keeping is often a requirement by regulatory authorities and having it in place can prevent costly penalties or legal complications.

Fraud protection

One overlooked yet critical aspect of invoice reconciliation is its role in fraud detection and prevention.

Companies can more readily spot unauthorized transactions or altered amounts by frequently reconciling invoices. This sets a high bar for internal control measures and discourages malfeasance by increasing the likelihood of early detection.

Better operational efficiency

Efficiency in operations often begins with a seamless financial management system.

Invoice reconciliation software can streamline the accounting process, reducing the time spent on manual data entry and error-spotting. This frees up your staff to focus on more strategic tasks, such as negotiating better payment terms or identifying cost-saving opportunities.

Stronger supplier relationships

Lastly, regular invoice reconciliation practices can significantly enhance relationships with suppliers.

Businesses demonstrate reliability and professionalism by ensuring payments are correct and on time. This can lead to better payment terms, discounts, or priority service from suppliers, which can positively impact a company’s bottom line and market reputation.

Businesses can take advantage of invoice reconciliation benefits by following a few simple steps.

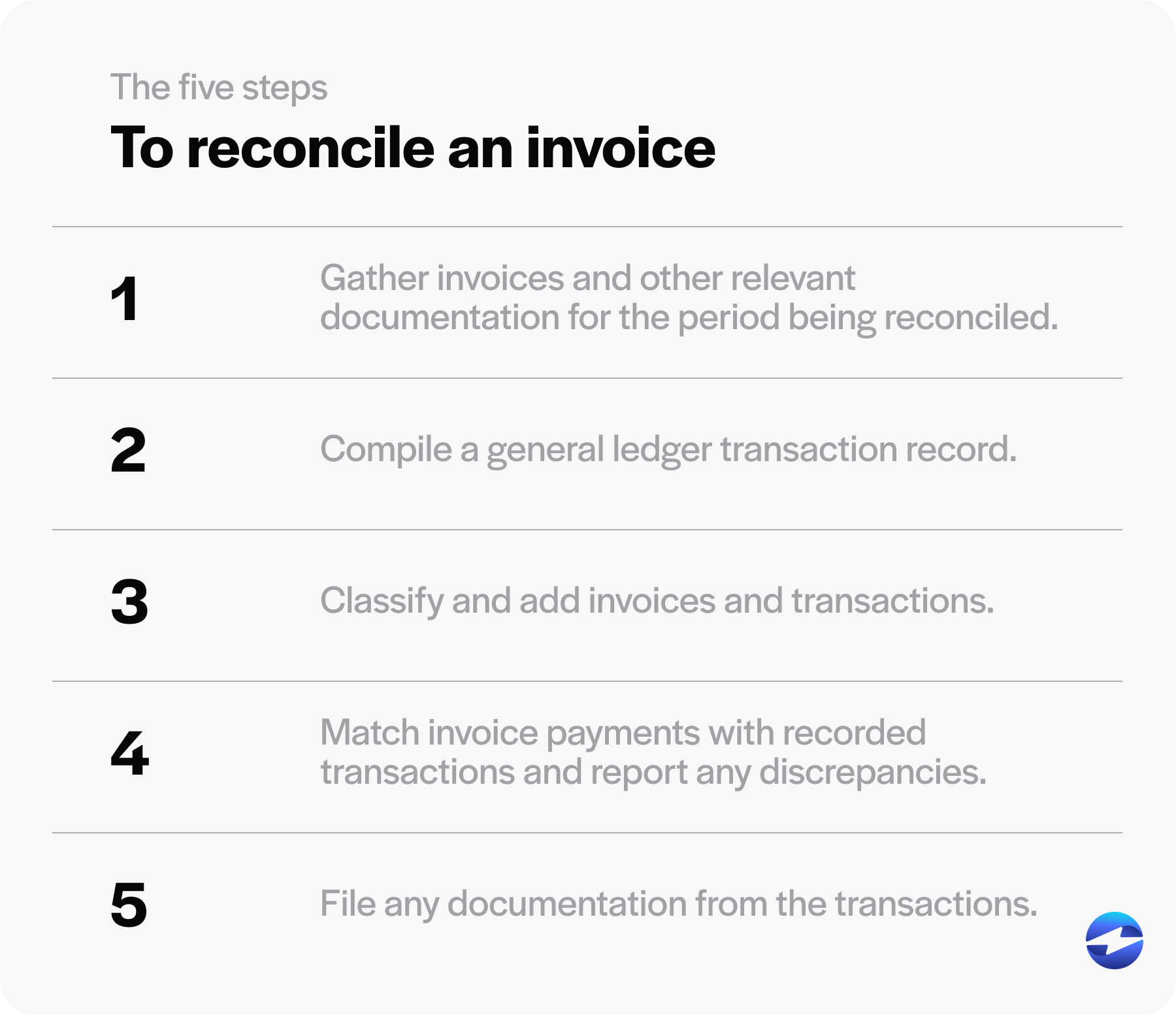

5 steps to reconcile an invoice

Reconciling an invoice is crucial to ensure financial recording accuracy and consistency. To implement invoice reconciliation in your business, follow the five steps below.

1. Gather invoices and other relevant documentation for the period being reconciled

The first step in reconciling an invoice is to gather all invoices for the period being reconciled, ensuring you have a complete and accurate set of records.

Your business should also collect any supporting documentation, such as purchase orders, receipts, and delivery notes, to provide a comprehensive basis for cross-referencing and verifying the details of each transaction. This preparation is crucial for identifying discrepancies and ensuring a thorough and accurate reconciliation process.

2. Compile a general ledger transaction record

Creating a comprehensive general ledger transaction record is vital, as it’s an official account for all financial transactions within the reporting period.

This record typically includes information from various sources, such as bank statements, outgoing invoices, and payment receipts.

3. Classify and add invoices and transactions

Efficiently categorize the gathered invoices and transaction records. Organize them by date, amount, supplier, or payment status.

Then, add each entry into the accounting software or a spreadsheet, ensuring all data is systematically recorded for the invoice reconciliation process.

4. Match invoice payments with recorded transactions and report any discrepancies

Carefully compare the recorded invoice payments against the general ledger entries to ensure each payment aligns with the corresponding ledger transaction, verifying that the amounts, dates, quantity, totals, and other payee details are accurate and match.

By matching transactions with invoices, your company can identify any billing errors or inconsistencies and report them immediately. It’s essential to investigate each discrepancy for potential causes, such as human error, late payments, or unauthorized charges.

Businesses can also use invoice reconciliation software to simplify this matching process.

5. File any documentation from the transactions

All physical and digital documentation will be securely stored once reconciliation is complete and all discrepancies are addressed.

Efficient filing supports future audits and can help track the company’s financial health and cash flow over time. It also contributes to keeping accurate financial statements and maintaining up-to-date financial records.

Now that the proper steps for reconciling an invoice are laid out, the following section provides four unique strategies to speed up your invoice reconciliation process.

3 strategies to accelerate your invoice reconciliation

Implementing an efficient billing reconciliation process can save you time and lower the risk of errors.

Your business can adopt several strategies to accelerate its invoice reconciliation, such as a standardized process, expense policy, spend management tools, and automation software.

1. Implement a standardized procedure to streamline reconciliation

Implementing a standardized procedure can enhance and accelerate your invoice reconciliation. This includes setting uniform guidelines for submitting, reviewing, and approving invoices.

By doing so, everyone involved knows exactly what steps to take, reducing confusion and preventing bottlenecks. Consistently organizing incoming invoices, payment terms, and financial transactions allows for a swift review process, cutting down the time necessary for invoice reconciliation.

2. Enforce an expense policy

A clear expense policy can significantly reduce complications during invoice reconciliation. It should outline acceptable spending limits, required documentation like receipts, and the process for expense submissions.

With policy adherence, there’s less likelihood of encountering vague or unexpected entries, simplifying the reconciliation of billing statements and financial records.

3. Use spend management tools

Investing in advanced spend management tools can provide a clear view of your business’s cash flow and outgoing invoices.

These tools often include features to track real-time spending, categorize expenses, and flag irregularities, assisting in a regular invoice reconciliation routine. Such systems enhance visibility and control over a company’s finances, reducing surprises during reconciliation.

While incorporating these strategies can enhance the accuracy and speed of your invoice reconciliation efforts and your business’s overall financial scope, automation software will further optimize this process.

How automation enhances the invoice reconciliation process

Automation plays a crucial role in improving invoice reconciliation. With automated technology, businesses can efficiently match financial records with invoice payments, mitigating the risk of errors typically associated with the manual handling of bills.

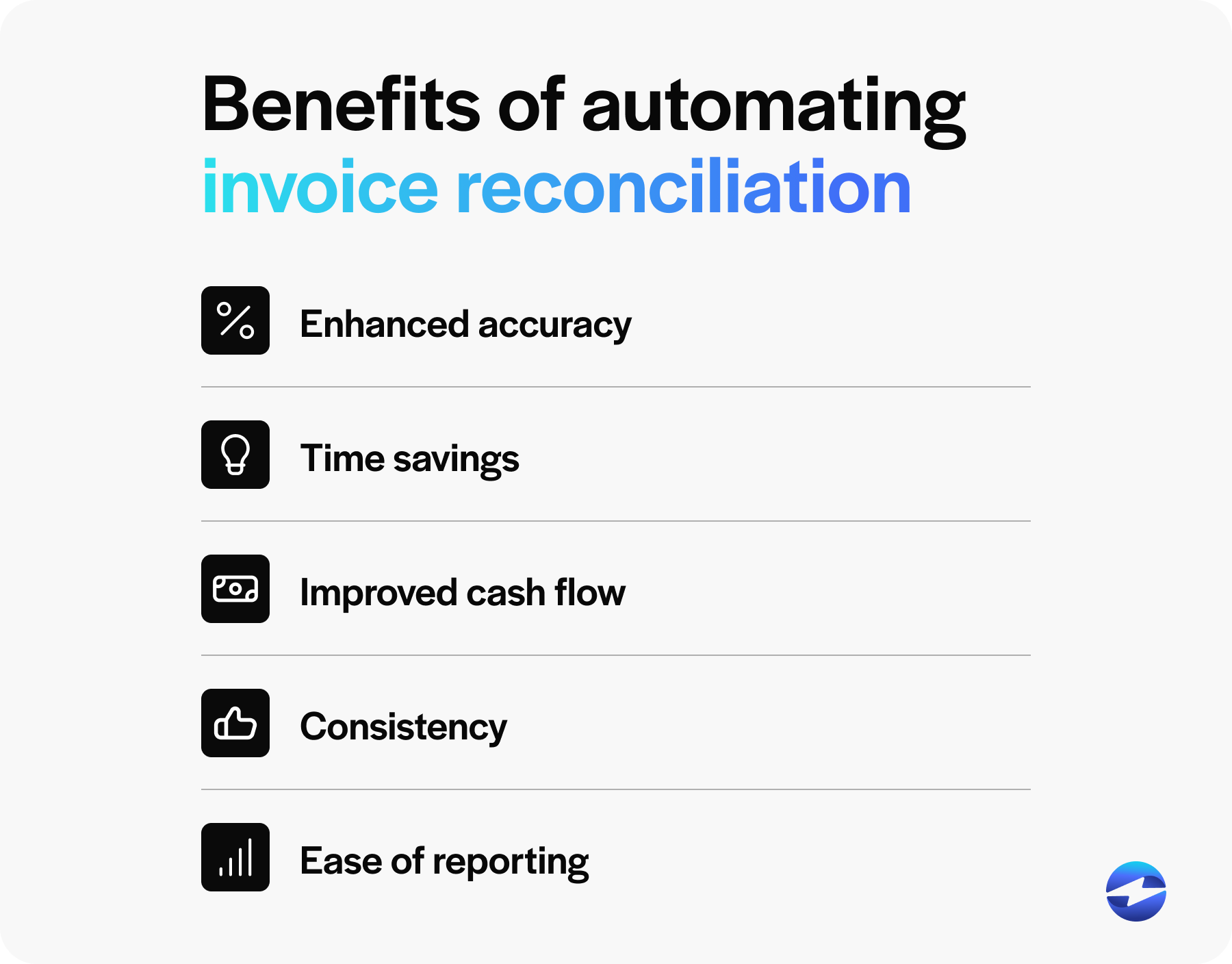

Here are some top benefits of automating invoice reconciliation:

- Enhanced accuracy: Automation reduces human error, ensuring incoming and outgoing invoices correspond accurately with bank statements and accounting records.

- Time savings: Processing can be conducted much faster, freeing up valuable time for focusing on other areas of business operations.

- Improved cash flow: Timely reconciliation helps identify overdue payments and manage cash flow more effectively.

- Consistency: Automated reconciliation allows for a consistent process and helps maintain regular invoice reconciliation regularly.

- Ease of reporting: It simplifies gathering data for financial reporting, which is crucial for assessing the business’s financial health.

Invoice reconciliation software provides a powerful tool for businesses to reconcile invoices, detect billing errors, and ensure that all financial transactions are logged within the appropriate reporting period.

Since the business landscape continues to evolve, automating accounting tasks like invoice reconciliation is vital to maintaining accurate and reliable financial statements.

Simplify the invoice reconciliation process with EBizCharge

Integrating a solution like EBizCharge can streamline invoice reconciliation, enhance cash flow, and reduce the risk of errors.

With EBizCharge, merchants gain access to user-friendly payment processing software that automatically matches incoming and outgoing invoices against financial records directly within their ERP or accounting software. This system speeds up the billing reconciliation process and ensures all invoices are accurately accounted for, thus reducing human error.

Summary

- What is invoice reconciliation?

- Invoices vs. reconciliation

- What are the benefits of invoice reconciliation?

- 5 steps to reconcile an invoice

- 3 strategies to accelerate your invoice reconciliation

- How automation enhances the invoice reconciliation process

- Simplify the invoice reconciliation process with EBizCharge

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.