Blog > Integrating Accounting with Salesforce: A Complete Guide to Streamlined Financial Management

Integrating Accounting with Salesforce: A Complete Guide to Streamlined Financial Management

As companies continuously seek ways to enhance efficiency and accuracy, business processes such as accounting operations are seeing significant innovation via integrations with platforms like Salesforce.

Therefore, businesses can optimize their financial processes by learning how to utilize accounting functions within Salesforce.

What is Salesforce?

Salesforce is a cloud-based software company that provides a customer relationship management (CRM) platform that enables businesses to manage and analyze customer interactions and data throughout the customer lifecycle, aiming to improve customer service, drive sales, and enhance profitability.

Salesforce offers a range of tools and applications for tasks such as sales, customer service, marketing automation, analytics, and application development, all accessible via the cloud. Its flexibility and scalability make it a popular choice for businesses of all sizes.

Does Salesforce have an accounting feature?

Salesforce doesn’t natively offer a dedicated accounting solution. However, it can integrate into popular accounting and enterprise resource planning (ERP) software to effectively handle complex accounting processes. This seamless integration ensures real-time visibility into financial health while minimizing manual data entry and reducing potential accounting errors.

Companies that require accounting functions on the Salesforce platform can choose from various third-party accounting applications on Salesforce’s AppExchange. These third-party solutions offer features from native accounting products, such as accounts payable (AP) and accounts receivable (AR), vendor payment tracking, and comprehensive financial reporting, giving businesses a complete 360-degree operational overview.

By adding an accounting application to Salesforce, an enterprise can enjoy a unified system that combines the sales process, customer records, and financial management. This synergy between systems improves efficiency and provides the accounting team with tools to support in-depth financial analysis and better manage the company’s financial health — all within the Salesforce ecosystem.

4 benefits of integrating accounting with Salesforce

Integrating your accounting/ERP system with Salesforce can yield numerous benefits that revolutionize how you manage financial and customer relationship information.

The synchronization of accounting tools and CRM systems enables a company to consolidate critical business functions, resulting in streamlined operations, enhanced productivity, and improved accuracy in financial reporting.

Seamless data flow between CRM and accounting

By integrating Salesforce with your accounting software, you can create a seamless flow of data that drastically reduces the need for double entry.

Customer records captured in the Salesforce CRM are automatically synced with accounting systems, ensuring that every interaction or transaction is accurately reflected in a company’s financial records. This enhances data integrity and provides a real-time view of financial transactions directly associated with customer interactions, sales opportunities, and leads, aligning sales efforts with the company’s financial goals.

Automated, hands-free accounting cycles

An automated, hands-free accounting cycle is one of the standout features when integrating accounting systems with Salesforce.

This feature enables businesses to automate the entire accounting lifecycle, from quoting and order management to invoice creation, revenue recognition, and cash application.

Automation results in a hands-free accounting process that increases productivity, limits manual errors, and accelerates the cash flow cycle, allowing for better capital management and planning.

Improve accounting accuracy with ease

Accounting integrations with Salesforce reduce the scope of human error and administrative burden usually associated with manual data entry and processing while also improving financial record accuracy.

By eliminating unnecessary paperwork and streamlining financial processes, businesses can receive the benefits of cost savings and redirect them to areas that drive business growth.

Enhanced financial reporting and analytics

Businesses can enhance financial reporting and analytics by maintaining accounting data within Salesforce.

Decision-makers gain a high-level view of a company’s financial health with advanced dashboards and reporting tools that unveil insights into cash flow trends, revenue forecasts, and profitability analyses. Businesses can then use this data to make informed decisions backed by a comprehensive and up-to-the-minute financial perspective.

A robust accounting integration with Salesforce provides a unified platform where sales and accounting teams can access up-to-date information. This simplifies complex accounting processes and ensures that the ERP components work in harmony with CRM systems. This synergy between CRM and accounting/ERP systems is pivotal for business professionals wanting comprehensive insights into their company’s performance and financial standing.

Now that you know the various benefits of integrating accounting with your Salesforce software, the next step is to learn how to integrate your ERP system into Salesforce.

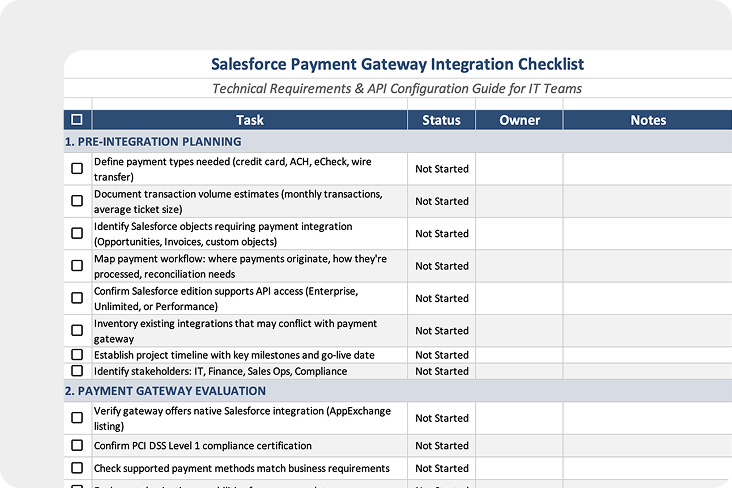

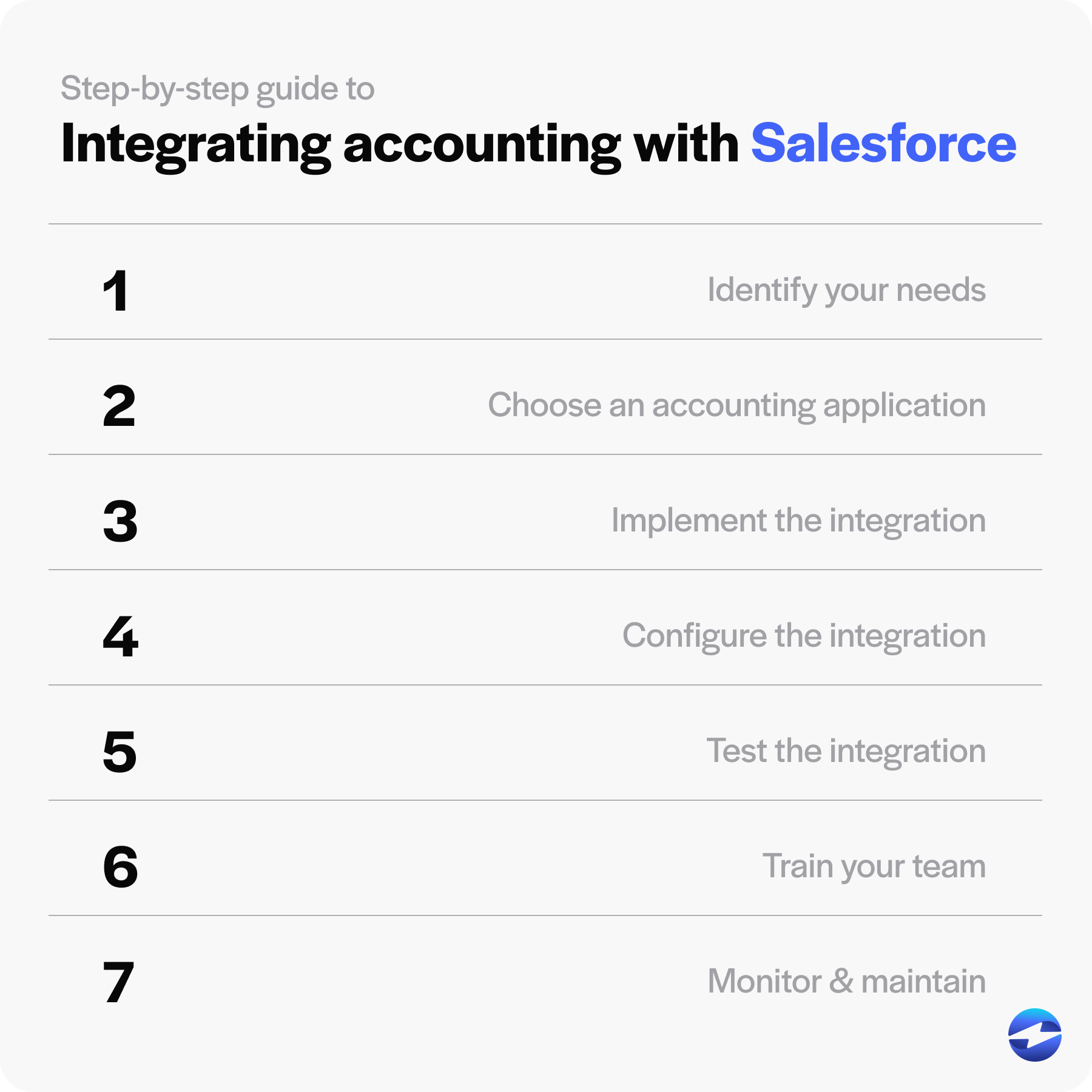

Step-by-step guide to integrating accounting with Salesforce

Since Salesforce doesn’t include an out-of-the-box accounting solution, it can be integrated with various accounting software to streamline the sales process and financial management.

Below is a step-by-step guide to incorporating accounting with Salesforce:

- Identify your needs: Determine the complexity of your accounting processes and select native or popular accounting software that meets these requirements.

- Choose an accounting application: Find a native solution with a seamless integration or a third-party accounting tool that offers a Salesforce connector.

- Implement the integration: Connect Salesforce with your accounting software using a pre-built integration from Salesforce AppExchange or create a custom integration. Map out data transfer objects such as customer records, vendor payment information, and financial transactions.

- Configure the integration: Adjust settings for real-time visibility or periodic syncing to ensure a complete view of customer and financial data.

- Test the integration: Conduct tests to detect technical issues and adjust for optimal performance before going live.

- Train your team: Ensure your accounting team understands how to use the integrated system to minimize manual entry and accounting errors.

- Monitor and maintain: Regularly check the integration for consistency and accurate data flow and run necessary updates to manage complex accounting functions efficiently.

After setting up its accounting software in Salesforce, your business can look for several tips to enhance these operations.

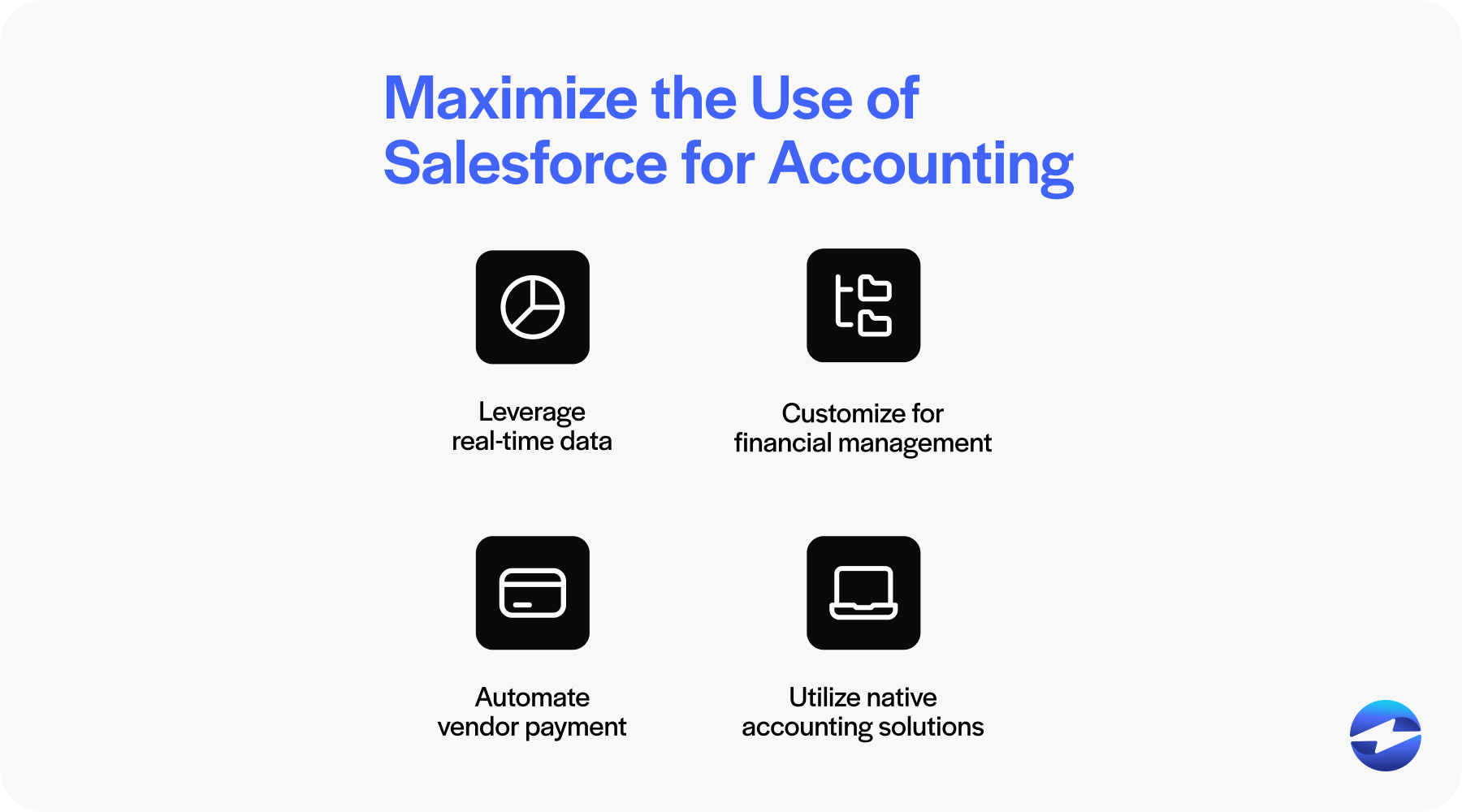

4 tips to maximize the use of Salesforce for accounting

Salesforce also extends its capabilities to manage the financial health of businesses by streamlining accounting processes.

Here are four tips to help you maximize the use of Salesforce in your accounting operations:

- Leverage real-time data: Leverage Salesforce to gain real-time access to essential financial data, providing a comprehensive view of customer records and supporting well-informed business decisions.

- Customize for financial management: Tailor Salesforce to suit your complex accounting and sales process, ensuring it aligns with your business needs.

- Automate vendor payment: Automate recurring tasks such as vendor payments and workflows, allowing accounting teams to focus on strategic financial planning.

- Utilize native accounting solutions: Salesforce offers robust, native accounting products integrated within its platform that are tailored specifically to streamline financial management. These tools offer dedicated accounting features, such as invoicing, expense tracking, financial reporting, and accounts receivable (AR) or accounts payable (AP) management, all designed to work seamlessly.

By following these tips, business owners can harness Salesforce’s full potential as a CRM and robust financial management tool.

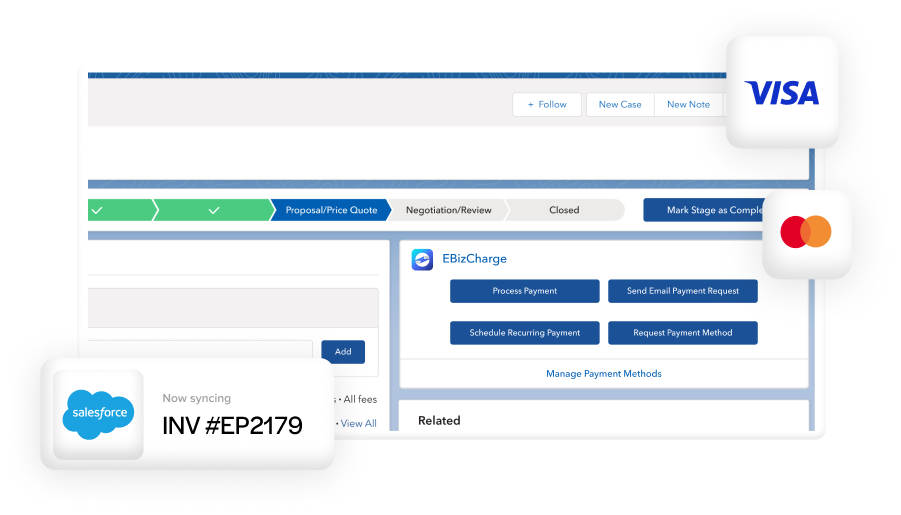

The seamless integration of EBizCharge and Salesforce

EBizCharge is a comprehensive payment processing platform that efficiently integrates with Salesforce. This integration allows business owners to simplify sales by enabling secure payment processing directly within Salesforce.

EBizCharge provides top-rated integrations into Salesforce and over 100 accounting/ERP systems, acting as a crucial bridge that facilitates communication between these platforms. By integrating EBizCharge, businesses can automatically sync payment data, invoices, and transaction records across Salesforce and their accounting or ERP software. This ensures that customer information and financial data remain consistent and up-to-date in real-time across all systems.

EBizCharge simplifies payment processing, reduces manual data entry, and enhances the overall efficiency of managing financial and customer data, allowing for smoother operations and more informed decision-making.