Blog > A Comprehensive Overview of Salesforce

A Comprehensive Overview of Salesforce

Salesforce is a leading Customer Relationship Management (CRM) software offering a comprehensive suite of tools to support business operations and growth. This software is often used by sales teams but extends far beyond this, providing a unified platform that combines multiple business operations into one place.

Salesforce is the go-to solution for businesses seeking to streamline their processes and achieve business outcomes that reflect efficiency and market responsiveness.

The benefits of processing payments in Salesforce

Salesforce payment processing integrates seamlessly into the CRM ecosystem, offering numerous advantages. Its commitment to innovation means continuous enhancements in payment functionalities that align with evolving business needs and customer expectations.

Here are five significant benefits of using processing payments in Salesforce:

- Customer insight: Leveraging Salesforce merchant services for payment processing provides customer insights that assist in crafting targeted marketing strategies and personalized services. It captures transactional data, which, combined with other customer interactions tracked by Salesforce, can be analyzed to uncover purchasing patterns and preferences.

- Flexibility: The agility and adaptability of Salesforce payment integrations means businesses can choose from various payment gateways and options tailored to their specific requirements. From credit cards to alternative payment methods like mobile wallets, companies can cater to a global customer base with diverse payment preferences.

- Time efficiency: Salesforce payment integrations facilitate a quicker cash flow cycle and reduce administrative burden by automating billing and collection processes. By automated invoicing and providing recurring Salesforce payments, you can free up time for staff to focus on core business activities rather than manual payment processing tasks.

- Security: Salesforce adheres to stringent security protocols, such as PCI compliance, multi-factor authentication (MFA), and advanced data encryption, to safeguard payment data. Encryption, fraud detection systems, and regular security audits protect business financial information and customer payment data.

- Customer support: Salesforce is known for its comprehensive customer service, which extends to its merchant services. Users can access extensive support resources, including 24/7 technical support, maintenance checks, onboarding, and Salesforce training services.

By taking advantage of these features, businesses can optimize their payment processes while maintaining security and efficiency.

For a more comprehensive payment experience, users can integrate with third-party processors that provide various tools and features to streamline payment operations.

Now that you know some of the benefits of processing payments in Salesforce, it’s essential to understand the roles of payment gateways and payment processors. While both are crucial for facilitating online transactions, they serve different purposes and functions.

What’s the difference between payment gateways and payment processors?

A payment processor is a service that manages the transaction process by transmitting data between the merchant, the issuing bank, and the acquiring bank. It ensures payment information is verified, and funds are transferred from the customer’s bank account to the merchant’s account upon a successful transaction.

In contrast, a payment gateway is an application that authorizes credit cards or direct payment processing for online retailers or traditional brick-and-mortar businesses. It acts as the interface between a merchant’s website and its acquirer, encrypting sensitive credit card data to ensure information passes securely from the customer to the merchant.

When looking for a payment processor to integrate with, it’s important to note that not all processors are the same. Whether it’s pricing or included tools and features, it’s important to thoroughly research each payment processor to ensure you’re getting the best bang for your buck.

10 features to look for when choosing a payment processor for Salesforce

When integrating a payment processor with Salesforce merchant services, a range of features should be examined to ensure they align with your business’s goals and enhance your sales and customer management capabilities.

Here are 10 features to look for:

- Top-notch security: Security is a paramount concern in payment processing, making it essential for businesses using Salesforce to adhere to strict security measures. This includes compliance with the Payment Card Industry Data Security Standards (PCI DSS), encryption technologies, and fraud detection systems. Since Salesforce handles sensitive customer data, the payment processor must secure all transactions to maintain customer trust and prevent data breaches.

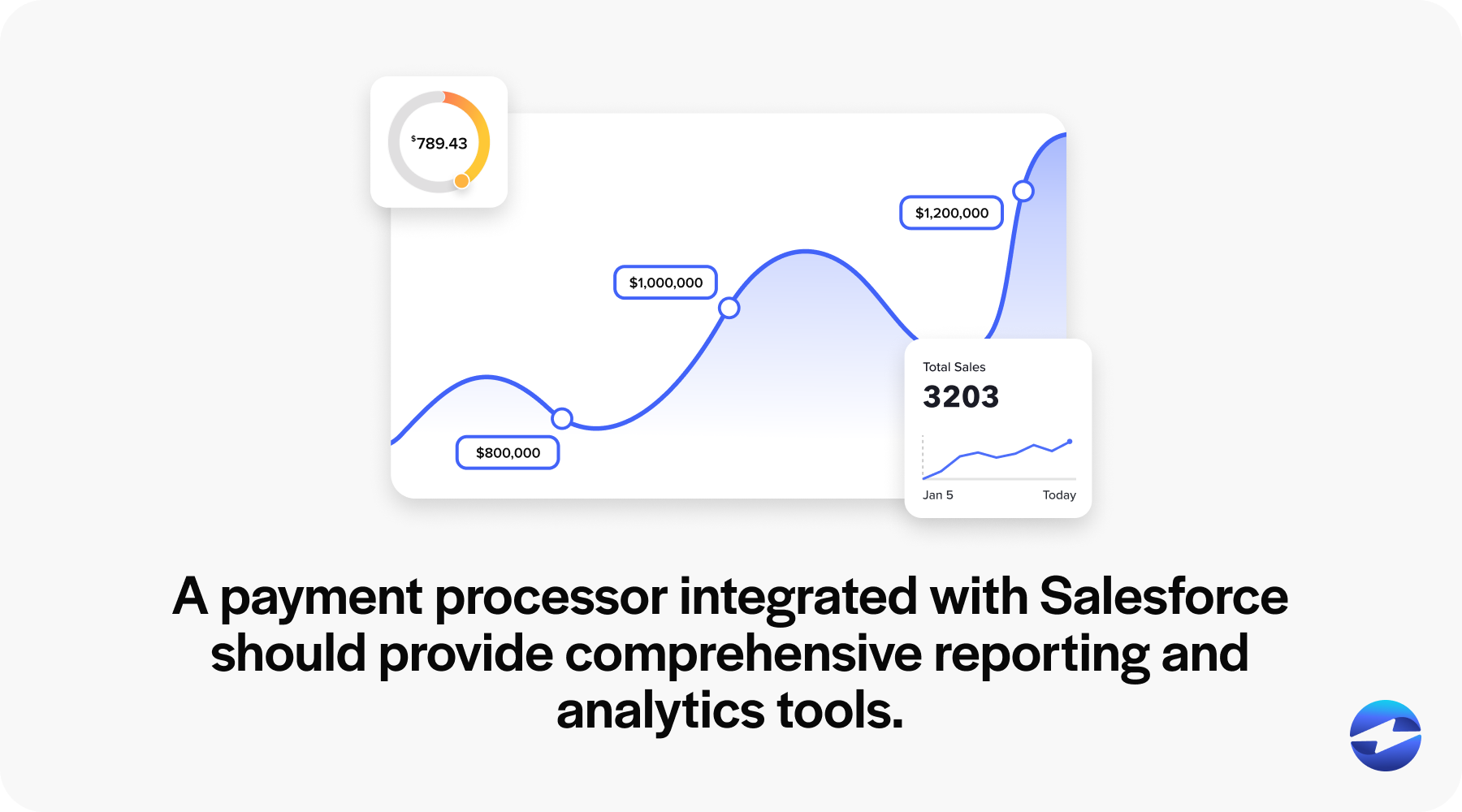

- Reporting and analytics: A payment processor integrated with Salesforce should provide comprehensive reporting and analytics tools. This enables businesses to gain valuable insights into customer behavior, sales trends, and payment data. Analyzing this data can help optimize sales strategies, marketing campaigns, and overall operational efficiency, providing a 360-degree view of customer interactions.

- ACH payment processing: Automated Clearing House (ACH) payment processing is essential for businesses looking for cost-effective and efficient payment options. ACH payments process large volumes of credit and debit transactions in batches. Incorporating ACH payment processing in Salesforce can streamline recurring payment collections and provide customers with more payment choices to enhance overall satisfaction.

- Subscriptions and automated recurring billing: Automated billing is a critical feature for businesses that offer subscription-based products or services. A payment processor that can handle subscriptions and recurring payments seamlessly within Salesforce can save time and reduce potential errors. This allows businesses to provide personalized user experiences and continuous service provision without interruption.

- Transaction fees: Transaction fees are an important factor to consider as they directly affect the profitability of each sale. When choosing a payment processor, businesses should evaluate the fee structure for compatibility with their pricing models and the average transaction size.

- Integration capabilities: Smooth integration with Salesforce software is vital for maintaining data integrity and an orderly workflow. Your payment processor should provide a seamless Salesforce integration that supports customization to align with the business’s needs.

- Transaction speed: Transaction processing speeds impact operational efficiency and customer satisfaction. Therefore, payment processors should be able to complete payments in real-time, reducing customer wait times and ensuring sales teams can quickly move on to their next tasks. Fast transaction processing is necessary to keep pace with the high-speed nature of modern commerce.

- Scalability: As a business grows, its payment processing needs evolve as well. A payment processor should be scalable to accommodate increased transaction volumes and expansion into new markets without requiring a major overhaul of the existing Salesforce payment processing setup or service interruptions.

- Global reach: Businesses that operate globally or plan to expand internationally need a payment processor with global capabilities. It should support multiple currencies, comply with international payment regulations, and offer localization features to cater to a diverse customer base. This helps Salesforce software users tap into new markets and create stronger customer relationships worldwide.

- Customer support: Exceptional customer support from a payment processor is essential to quickly resolve issues that may arise during payment transactions. Support teams and resources should be readily accessible to provide prompt assistance, ensuring minimal disruptions to the sales process and user experience.

By selecting the best payment processor for Salesforce, your company can secure customer transactions, provide efficient invoicing practices, scale its payment operations, and enhance customer relationships.

EBizCharge: A top-rated payment processing solution for Salesforce users

EBizCharge is a top-rated payment processor due to its effortless Salesforce integration. This integration streamlines payment collection for sales teams, enhancing operational efficiency and enabling more time to be spent fostering stronger customer relationships.

By incorporating EBizCharge into Salesforce, businesses can easily accept credit, debit, and eCheck payments directly on any Salesforce object or in the EBizCharge Salesforce app. This software can also easily sync payment processing data between Salesforce and your accounting system.

Merchants that integrate the EBizCharge payment integration into their Salesforce system will have access to payment collection tools like recurring billing, secure email payment links, auto-pay, and online customer payment portals.

As a PCI-compliant solution, EBizCharge is known for its advanced security measures, including tokenization, encryption, off-site data storage, 3D Secure, and fraud detection and prevention.

Business owners employing EBizCharge with Salesforce witness an immediate impact on their cash flow management and gain deeper insights into customers’ buying behaviors.

With EBizCharge, Salesforce users have the tools they need to improve payment processes and maintain a competitive edge in the marketplace, ultimately leading to a measurable increase in the bottom line.