Blog > How to Verify a Check Online

How to Verify a Check Online

For businesses that accept electronic checks as well as physical checks, electronic check verification is a valuable tool that can significantly reduce the rate of fraud.

In simple terms, eCheck verification is the process of verifying payment to ensure it’s legitimate and can be processed by validating the customer’s checking account prior to the completion of the transaction. Verification can be used for both in-person transactions and online transactions. With fraud as prevalent as it is, eCheck verification is more important than ever.

The importance of online check verification

One of the main advantages of electronic check verification is its speed. eCheck verification can take as little as a few minutes to verify account information but in some cases, it can take a few hours if there are discrepancies involved. These few minutes can be all it takes to significantly reduce the rate of fraud which has been an increasingly prevalent issue among checks and ACH debits.

Unfortunately, some banks won’t allow over-the-phone check verification to reduce the risk of fraud. In this case, you will need to go to the closest branch of the bank to complete the verification process. Completing the check verification process in person will typically be a longer process — the average in-person check verification process will take about two business days.

How can I verify a check?

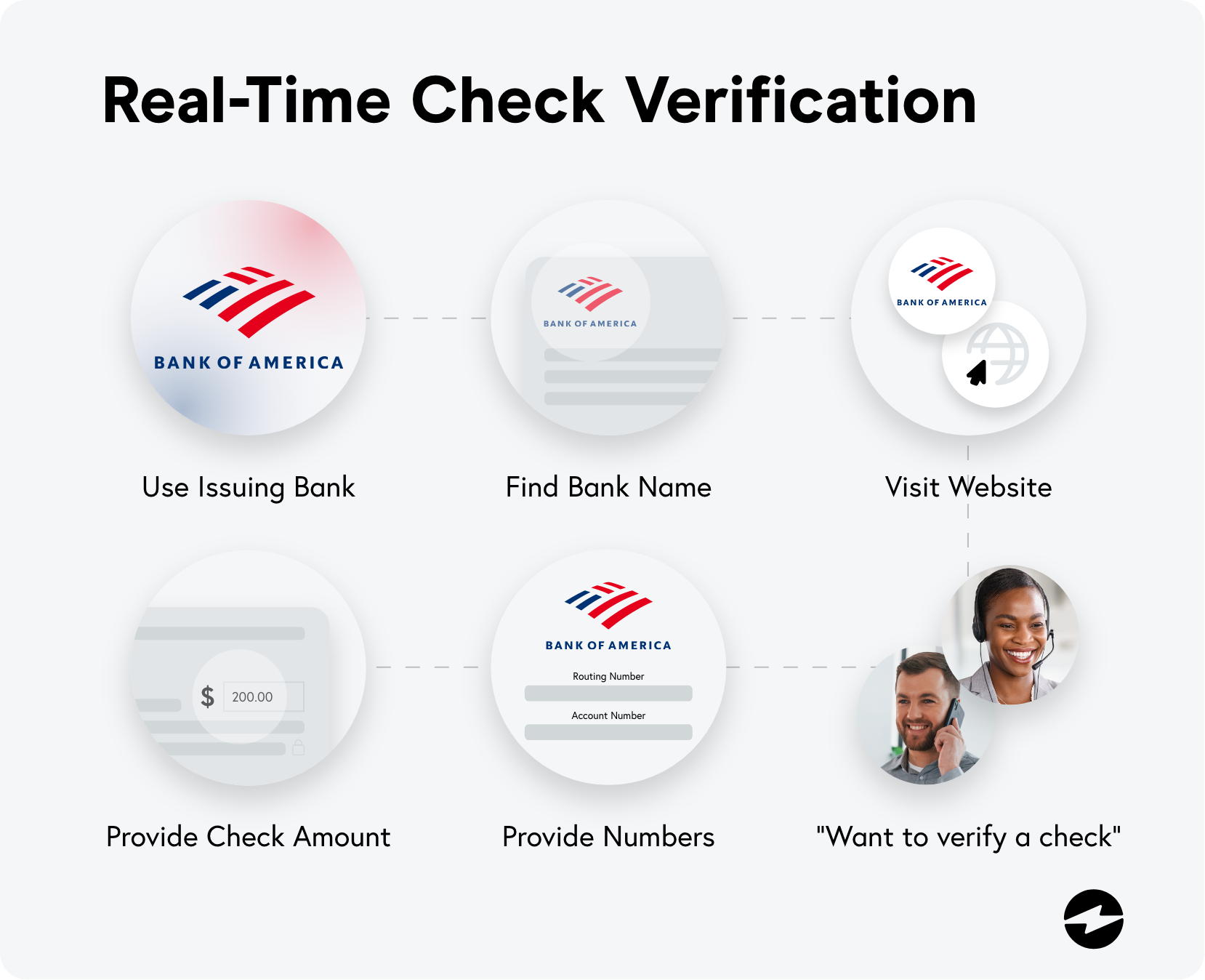

Now that you know what check verification is and why it’s so important, let’s break down how real-time check verification works:

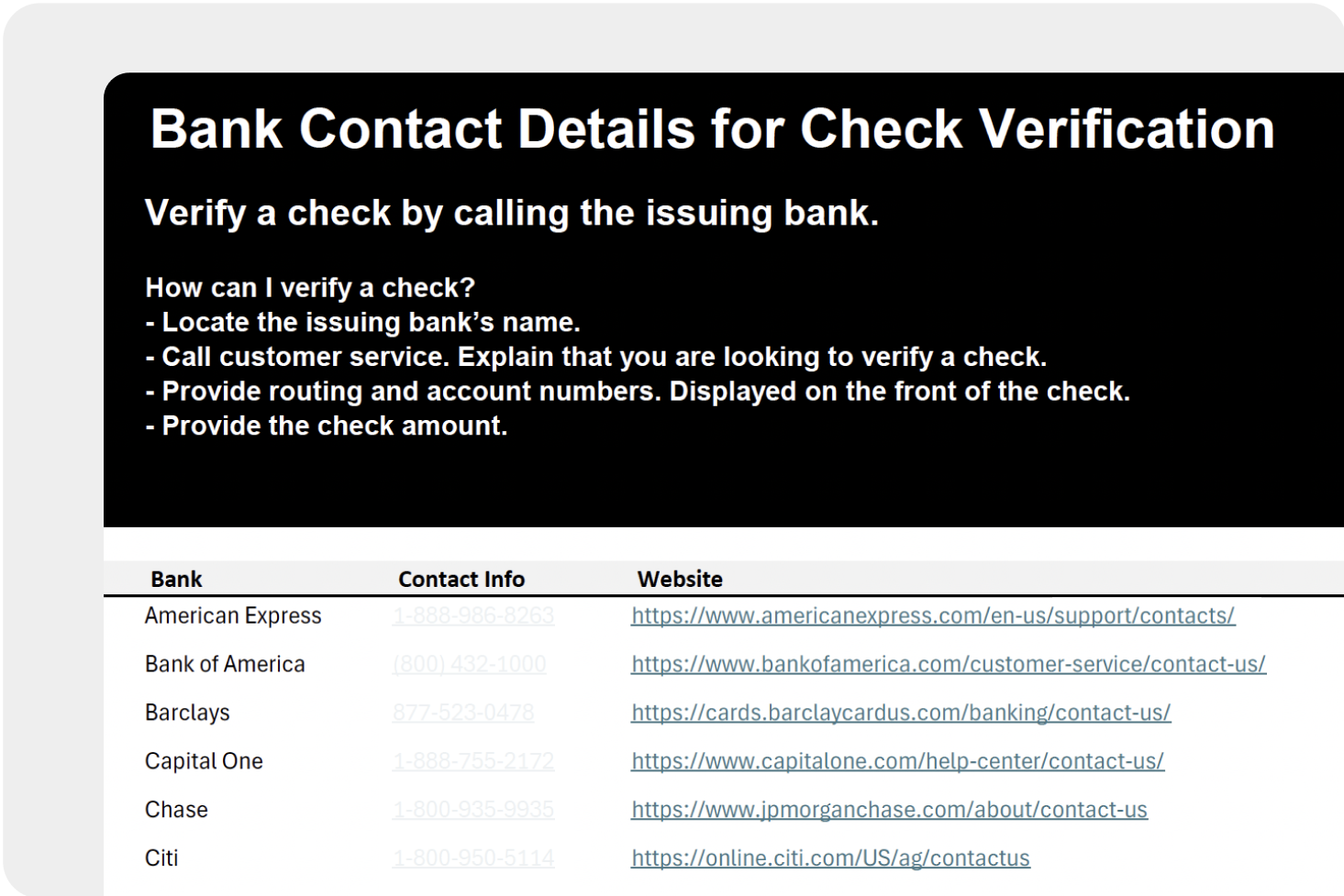

- Use the issuing bank. Although you can use other banks, it’s best to use the bank that issued the check to complete this process.

- Locate the issuing bank’s name. Locate the name of the issuing bank on the front of the check. If you can’t find the name of the bank, you can contact the account holder to ask for the name of his or her bank.

- Visit the bank’s website. Once you’ve identified the name of the check-issuing bank, visit the bank’s website to acquire its customer service number.

- Call customer service. Call the bank. When you have the customer service agent on the line, explain that you are looking to verify a check.

- Provide routing and account numbers. You will then need to provide the customer service agent with the routing number and account number. Both numbers should be displayed on the front of the check.

- Provide the check amount. Lastly, provide the customer service agent with the amount written on the check.

Once you’ve provided all the necessary information, the customer service agent will match the account number and routing number to the ones listed by the original account holder (the one who first issued the check) to verify the account is active and contains sufficient funds to complete the transaction.

If you’re looking for immediate check verification, it’s best to verify funds over the phone because verifying checks in person at a bank branch usually takes a few business days to process.

Can you verify a check online for free?

One of the most frequently asked questions is, can I verify check funds online for free?

While you can’t verify a check online for free, you can call a bank to have a customer service agent complete this process which is usually free of charge.

You can also use the verification services provided through a merchant account but keep in mind, merchant service providers often charge subscription fees and flat fees.

Average check verification services will charge $0.15 to $0.25 per transaction, but the monthly statement fees can range between $20 to $50 per month. These prices vary depending on the organization issuing the merchant account.

If you’re looking for free check verification, physically going into a bank branch (preferably the one listed on the check) to complete the verification process is the cheapest way to go given that it’s often a complimentary service.

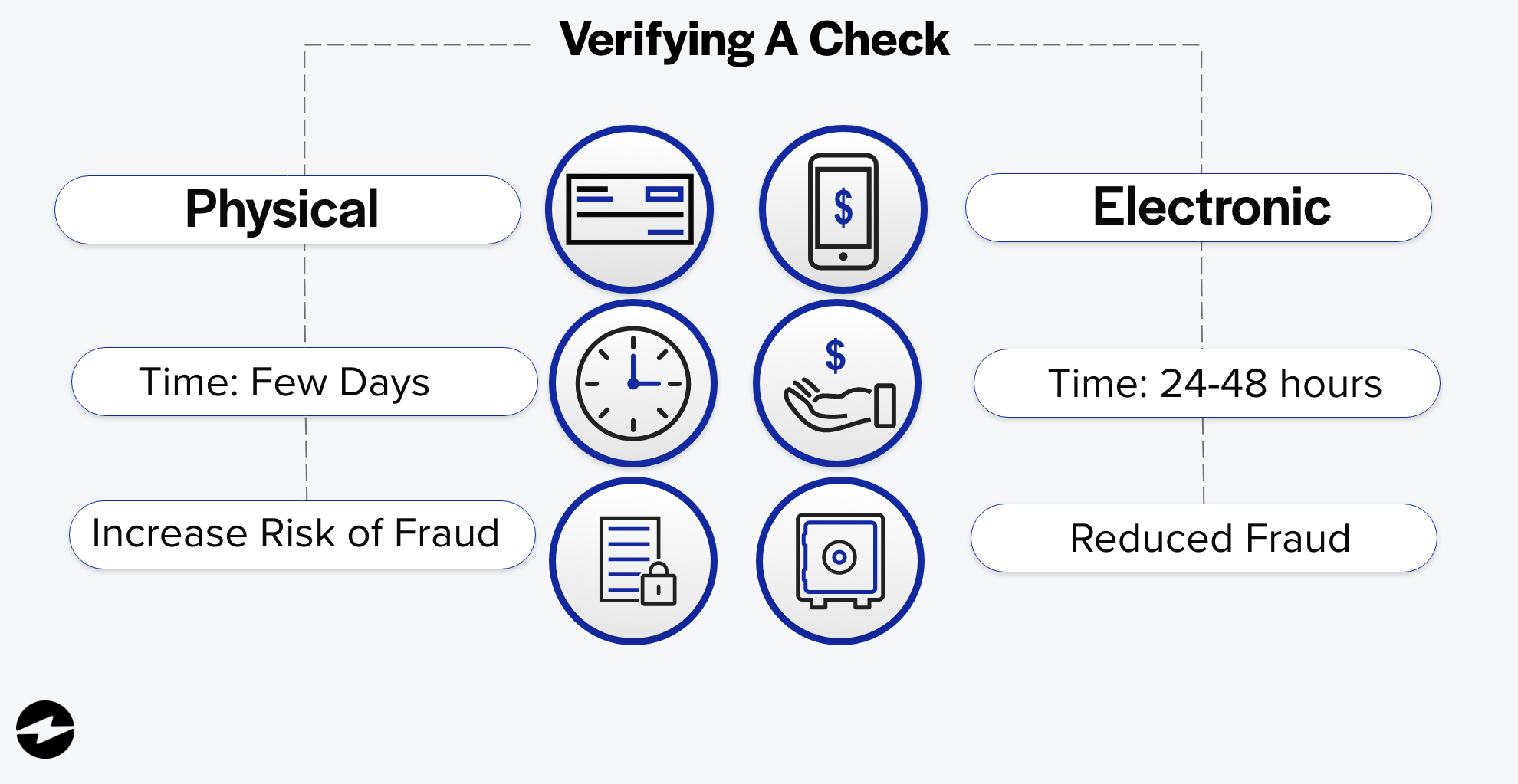

Verifying a physical check vs. an electronic check

Verifying a physical check can take a few days for the funds to be transferred and can sometimes take a bit longer depending on the volume of daily transactions your business processes. Whereas, eCheck verification tends to be a bit of a quicker process in facilitating electronic fund transfer (EFT) payments to your bank account. Once submitted eChecks typically take around 24 to 48 hours for banks to verify the payment.

Electronic check verification can greatly reduce a merchant’s risk of check fraud since their verification process tends to be significantly more secure than physical checks thanks to its built-in encryption. eCheck payment processors also use tools that confirm your bank account number, bank account status, identification information, and sufficient funds.

Physical checks can be dangerous if you lose them or if they’re stolen because of the sensitive information that resides on the check itself. Businesses that use traditional lockbox payment methods run the risk of being exposed to intentional fraud and accidental threats from bank employees/contractors that handle processing tasks. If this sensitive information lands in the wrong hands, this can mean bad news for the account holder. An encrypted eCheck makes it significantly more difficult for fraudsters to acquire that sensitive information.

Cashier’s checks can also be verified the same way as physical checks. Simply contact the check-issuing bank, provide the service agent with the necessary information, and you’re good to go!

Now that you’ve explored how to verify a check, you can learn more about who can actually carry out this service.

Sources to verify check funds

The three main sources that can verify your check funds include your bank, your customer’s bank, or a third-party check verification service.

It’s important that the sources you use to verify check funds are legitimate. For example, calling the bank to validate a check sounds simple, but there are safer routes to take when acquiring the bank’s phone number. Some checks have a check verification phone number listed directly on the front of them but it’s safer to pull the phone number directly from the bank’s website as scammers have been known to print fake checks with fraudulent phone numbers in an attempt to acquire your banking information.

Merchant service providers can also assist you with finding check verification services.

Bank policies on check verification

Although banks are implementing more privacy and safety features, it can sometimes feel like a double-edged sword. With privacy and security issues becoming more prominent, banks are doubling down on how they combat these issues.

Some banks won’t verify checks over the phone. Instead, they may verify if the checking account involved is legitimate, but they may be reluctant to verify the check funds. Some banks may not even be willing to discuss this information over the phone which means you will have to visit one of the bank’s branches to complete the verification. Restrictions vary depending on the bank or credit union.

How secure is live check verification?

If you take the necessary steps, live check verification is very secure. As mentioned in the previous section, knowing where to get the correct information for check verification is essential. The bank’s website is always a reliable source and will usually provide answers to commonly asked questions that can simplify the process for you.

Avoiding problems with check verification

While it’s possible to go through your own bank to issue the check verification process, it’s safer to go through the financial institution that issued the check — the bank listed directly on the check. Using the check-issuing bank reduces and can, in some cases, eliminate the risk of fraud.

There’s also the possibility that the check-issuing bank doesn’t have any nearby branches. Although you can go to another bank to cash or deposit checks, you should always wait until the check has cleared before spending any of its funds. This is because if the check bounces, you’re responsible for reimbursing the bank for any lost funds.

Simplifying the process with merchant check verification

Merchant check verification is an essential service for businesses to provide their clients with peace of mind. Merchant accounts offer fraud management tools such as check verification and many other benefits for merchants, making them invaluable tools.

The other benefits of merchant accocunts

Some of these other benefits of a merchant account include streamlined payment collection services, simplified and speedy processing, and relatively low fees. A merchant account like EBizCharge also integrates directly with the software you already use. Whether you need QuickBooks payment processing to sync transactions automatically or NetSuite credit card integration for enterprise-level automation, payments post straight to your ledger without manual data entry.

In other words, merchant accounts are a great way to improve efficiency while simultaneously reducing the risk of fraud.

Verify check funds online

With the right tools, check verification doesn’t have to be a hassle. Not only is it important to know how the process works, but it’s also important to use resources that minimize the risk of fraud for all parties and the amount of time it takes to process checks. Businesses that use verification services can significantly improve customer satisfaction which in turn promotes return customers.

Online Check Verification FAQs

Can I verify a check online for free?

No, you can’t verify a check online for free. However, you can verify a check for free over the phone by calling the issuing bank or going in person to make the deposit.

How to verify a cashier’s check?

To verify a cashier’s check, follow the same process as physical checks. Reach out to the issuing bank, supply the required information to the service agent, and you’re all set!

How do I verify a treasury check?

To verify a treasury check, you will have to visit the official website of the U.S. Department of the Treasury.

Is immediate check verification possible?

For immediate check verification, verifying funds over the phone is recommended, as verifying checks in person at a bank branch usually takes a few business days to process.

How to spot a fake check?

Texture Differences: Authentic checks typically have rough or perforated edges.

Examine the Emblem: Genuine checks bear the bank’s emblem. Faded or missing emblems suggest a fake.

Validate Bank Address: Confirm that the address on the check aligns with the official bank details.

Cross-Check Check Numbers: Verify consistency between the check number’s positions.

Inspect the MICR Line: Real checks display a smooth magnetic ink character recognition line (MICR). Raised or glossy sections indicate a counterfeit.

Scrutinize the Paper: Authentic checks are printed on durable, coated paper with a non-glossy finish. Thin, glossy paper warrants caution.

Inspect for inconsistencies: Look closely at the signature and all information on the check. Does it match, has anything been added or erased, and is everything spelled correctly?

How to check if a bank account is valid?

Follow these steps for bank account verification to determine if a bank account number is likely to be valid.

Length Verification: Begin by confirming that the account number matches the expected length for the respective country and banking institution. Deviations from the standard length may indicate potential errors.

Format Confirmation: Validate that the account number adheres to the prescribed format established by the bank. This includes verifying any specific patterns or rules governing the structure of the account number.

Checksum Validation: Employ the appropriate checksum algorithm, such as Modulus 10, to assess the mathematical integrity of the account number. This validation method can detect common errors or inconsistencies.

Utilize Authoritative Sources: Leverage official databases or application programming interfaces (APIs) provided by regulatory bodies or financial institutions. These resources offer a reliable means of cross-referencing the account number with verified banking records, enhancing validation accuracy.

Conduct Test Transactions (Optional): Consider initiating test transactions, such as nominal deposits or withdrawals, as an additional measure. This practical validation approach enables confirmation of the account’s operational status and capability to process transactions effectively.

Remember that validation doesn’t guarantee the account’s authenticity or status.