Blog > Lockbox Banking: What is it and how is it used for payments?

Lockbox Banking: What is it and how is it used for payments?

Maintaining an organized payment collection process can be a difficult task for many businesses, especially when they receive large volumes of payments from their customers.

Luckily, businesses can enlist the help of lockbox solutions to ease this stress by managing payments in a more simplified and secure fashion.

What is a lockbox?

A lockbox in banking is a bank-operated mailing address or post office (PO) box that a business can use to collect payments from its customers. This commercial service bank offer helps simplify the payment process by allowing the bank to receive, process, and deposit checks on behalf of the business, ensuring faster and more secure transactions.

Merchants can choose from two different types of lockbox services:

- Retail: Retail lockbox services are geared toward companies that receive high volumes of payments that consist of lower amounts.

- Wholesale: Wholesale lockbox services are geared toward companies that receive fewer payments but of higher value — these services typically benefit B2B merchants.

Some banks will also allow businesses to set up a custom bank lockbox if their accounts receivable needs require a unique solution outside the two above.

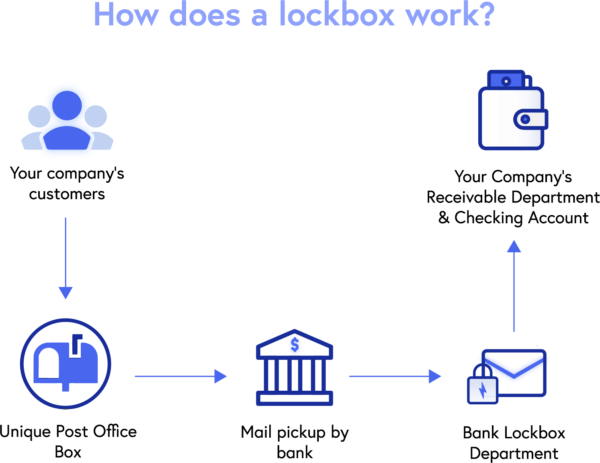

How does a lockbox work?

Lockbox services work by directing a company’s in-mail customer payments (checks and cash deposits) and remittance documents to a secure PO box location or mailing address that’s easily accessible to their bank.

Once customers send their payments to the secure bank lockbox, the bank withdraws and processes these payments, creates an accounting entry, and deposits these funds into the company’s bank account.

Merchants can incorporate lockbox payments to enhance payment collections

Merchants can incorporate lockbox payments into their infrastructure to encourage faster transactions with their customers.

Lockbox payments, also referred to as remittances, are directed to the designated mailing address or PO box where banks can withdraw them on a daily or weekly basis or multiple times a day.

If a business has multiple locations or branches, it can use multiple lockboxes to make the payment collection process even more efficient. Many lockbox service providers also offer same-day deposits for merchants.

Once a bank processes a lockbox payment, the affiliated company is notified. Banks may also scan remittance slips and checks to provide businesses with a digital receipt.

Lockbox payments can be especially helpful for businesses that receive large volumes of payments, as they can accelerate the accounts receivable process and improve cash flow.

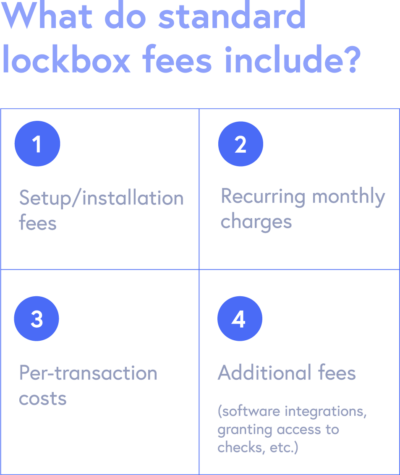

What are the costs associated with lockbox banking?

While lockbox pricing generally includes similarly structured fees, these costs may vary depending on the lockbox service provider your business works with and other variables.

Standard lockbox fees include:

- Setup/installation fees

- Recurring monthly charges

- Per-transaction costs

- Additional fees (software integrations, granting access to checks, etc.)

Since lockbox payment processing can be time-consuming for banks, they typically charge for their time as well.

The cost of lockbox services can be expensive, especially for smaller merchants with fewer mail-in transactions or B2B merchants with larger payment amounts that require more security.

Since lockbox fees can and will add up over time, merchants should evaluate their accounts receivable operations to ensure that a banking lockbox service will be financially advantageous.

Merchants would be wise to calculate how many payments they’ll likely direct to their lockbox, the number of lockboxes they require, and if the overall costs of bank lockbox services outweigh the benefits.

Businesses can reap many benefits from lockbox services

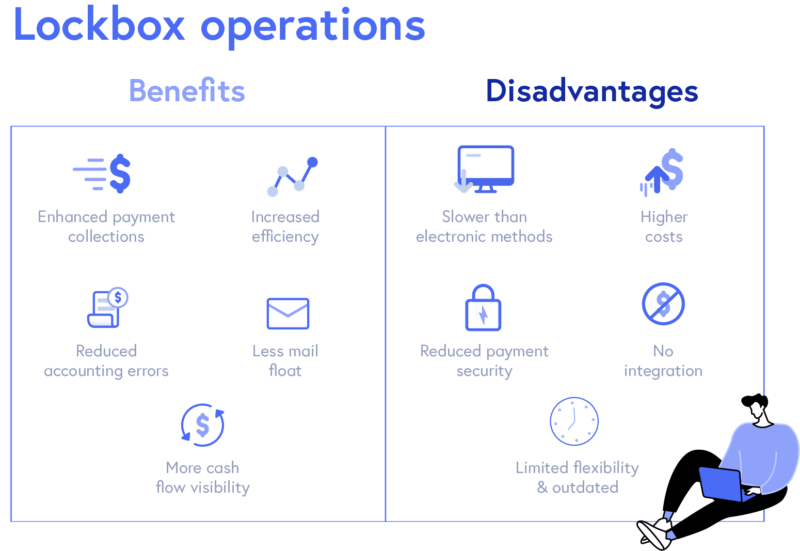

Like any financial service, there are pros and cons that should be considered before implementing a bank lockbox into your infrastructure.

Traditional lockbox services can yield a variety of benefits for businesses that receive a lot of mail-in payments, enabling them to improve their workflow and accounts receivable operations.

Some benefits of lockbox operations include…

- Enhanced payment collections: Lockbox solutions eliminate the need for merchants to sift through the mail and accept and process payments. Instead, banks handle these operations and have the ability to collect payments multiple times throughout the day to enhance and accelerate the payment collection process. Lockbox banking’s manual aspect also protects businesses against credit card processing outages that may occur with major card networks like Visa, Mastercard, American Express, Discover, etc…

- Increased efficiency: Since banks handle lockbox processing, businesses have more time and resources to allocate to other important areas instead of tedious tasks like bank trips, reporting, and drafting deposit slips.

- Reduced accounting errors: Banks are responsible for the lockbox accounting process which can reduce accounting errors. Banks process and scan lockbox deposits and deposit them in the merchant’s bank account. Payment records are backed up, stored, and easily accessible.

- Less mail float: Lockbox systems allow businesses to set up PO boxes closer to their customers to reduce the time these payments are traveling through the mail (also known as mail float). Mail float may also be reduced thanks to banks offering direct, same-day deposits for merchants.

- More cash flow visibility: Thanks to same-day deposits, updated payment records, and a more streamlined payment collection process, lockboxes allow merchants to increase their cash flow visibility.

Lockbox services also come with their share of drawbacks

Despite the many benefits a lockbox service can offer, some businesses may encounter more disadvantages than rewards from this service.

Some disadvantages of a traditional lockbox operation include…

- Slower than electronic methods: Compared to electronic collection methods that offer real-time payments, lockbox functions require more time to process. While lockboxes do decrease mail float, there’s still a lag during the depositing and processing stages where funds are not yet available.

- Higher costs: Although lockboxes help reduce labor and accounting costs, lockbox fees (monthly, per transaction, etc.) may result in higher overall costs for your business. Lockboxes are typically only cost-effective for larger companies with various locations and/or companies with large volumes of mail-in payments.

- Reduced payment security: While there are some security benefits associated with lockbox banking, they run the risk of being exposed to intentional fraud (counterfeit checks) or accidental threats (resulting from human error) from bank employees or contractors that handle data entry and processing tasks.

- No integration: Most lockbox providers don’t offer built-in accounting integrations. After setting up a lockbox bank account, merchants receive payment reports from their banks, which they must manually sync and reconcile with their CRM or ERP records.

- Limited flexibility to support other payments: Traditional lockbox banking supports checks and cash deposits but not other payment methods like credit and debit cards, ACH, etc. Some electronic lockbox solutions support additional payment types.

- Outdated compared to other payment methods: With check usage declining and digital payment methods rapidly evolving, lockboxes may be viewed as an obsolete service.

- Manual operations and training: As previously mentioned, lockbox services still require some manual operations and training which can be counterproductive and costly.

Digital lockbox services help businesses streamline their accounts receivable process

Due to the rapid expansion of online payment services, traditional lockboxes are no longer a viable option for many business models.

Today, online payment methods are necessary for most businesses and industries to successfully operate. Many banks have caught on to this and transformed the lockbox experience to offer digital/electronic lockbox payments.

Instead of banks regularly collecting lockbox mail, digital lockboxes replace the physical lockbox address with a virtual address to support online payments like eChecks, ACH, credit cards, debit cards, and electronic bank transfers. These electronic services offer more real-time payments which streamline the payment collection process for merchants.

Digital lockbox services offer more advanced security and efficiency over traditional lockboxes by automatically scanning and reconciling remittances, and integrating to accounting systems to mark invoices as paid. This limits human interaction and allows for funds to be available much faster.

Choosing the right payment collection process to promote the most growth

Whether it be a digital lockbox service or an all-in-one payment solution, merchants should thoroughly evaluate their needs to ensure they choose the best payment software that provides robust payment methods, efficient accounting technology and collection tools, and a seamless payment experience for their customers.

FAQs

FAQs

Summary

- What is a lockbox?

- How does a lockbox work?

- Merchants can incorporate lockbox payments to enhance payment collections

- What are the costs associated with lockbox banking?

- Businesses can reap many benefits from lockbox services

- Lockbox services also come with their share of drawbacks

- Digital lockbox services help businesses streamline their accounts receivable process

- Choosing the right payment collection process to promote the most growth

- FAQs