How To Scale Your Business with Enterprise Merchant Services

How To Scale Your Business with Enterprise Merchant Services

EBizCharge makes it easy for large businesses to manage payments with a high-volume merchant services account built for speed, security, and scalability.

As your transaction volume increases and your systems expand, so does the need for infrastructure that can handle the pressure without slowing you down. Luckily, enterprise merchant services step in to meet that demand.

Rather than a one-size-fits-all solution, enterprise merchant services are purpose-built tools that help large businesses process payments efficiently, reduce risk, and stay aligned with customer expectations.

If you’re running a growing business, the right merchant services provider can play a key role in making sure your back-end system can keep up with your front-end growth.

This article will explore common features of enterprise merchant services, the benefits of an integrated payment solution, and how to choose the right enterprise merchant services provider for your business.

What are enterprise merchant services?

Enterprise merchant services are specialized solutions designed to help large businesses manage their payment processing needs. These services cater to enterprise merchants by providing tools for handling high transaction volumes, varying payment types, and multiple payment methods.

These services are essential for business growth, offering scalable solutions that support secure and efficient payment processing. They’re an invaluable asset for enterprise businesses looking to enhance their financial operations and customer service.

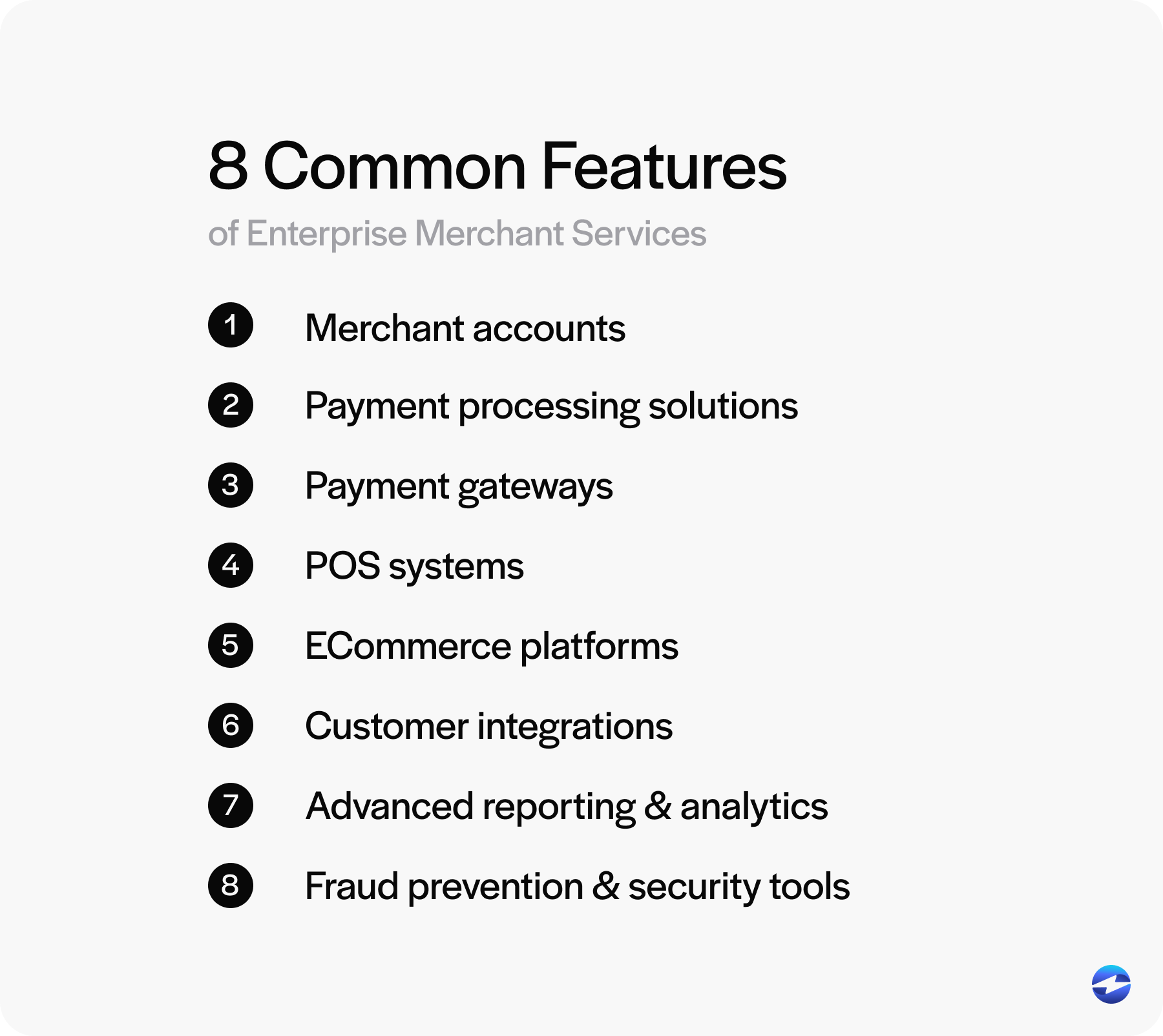

8 common features of enterprise merchant services

- Merchant accounts are specific types of bank accounts that allow enterprise merchants to accept credit, debit, Automated Clearing House (ACH)/eCheck, and other payments. This account holds funds from sales until they’re deposited into a business’s primary bank account.

- Payment processing solutions facilitate the transfer of funds from customers to businesses. These systems support various payment methods, including card payments, ACH/eChecks, digital wallets, and mobile payments. This versatility is crucial for accommodating different customer preferences.

- Payment gateways act as intermediaries between customers and businesses, facilitating the secure transfer of payment information. For enterprise merchants, implementing a reliable payment gateway is critical for processing online payments safely.

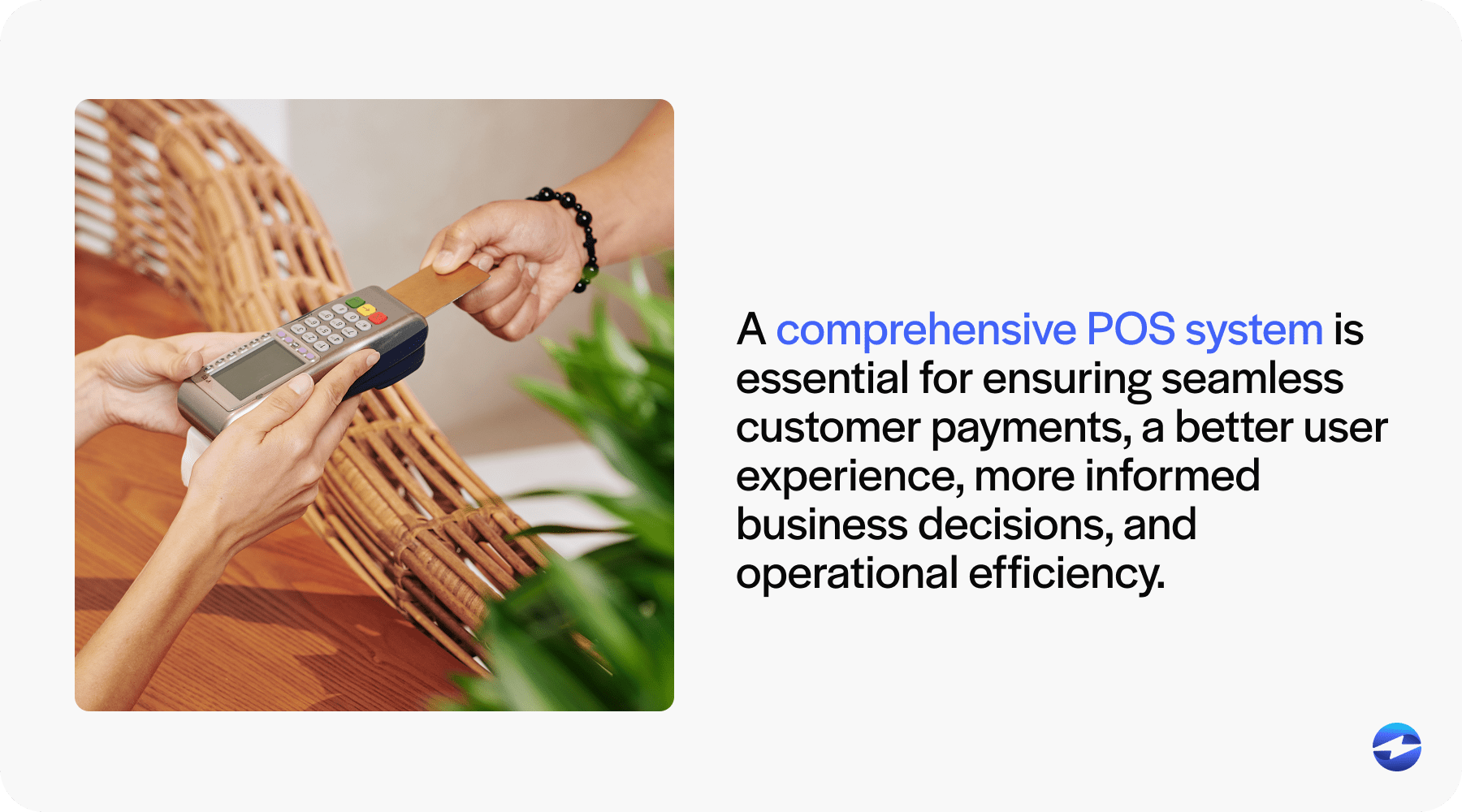

- Point-of-sale (POS) systems are physical or digital payment infrastructures that enable enterprise businesses to facilitate and manage in-person or online transactions. A comprehensive POS system is essential for ensuring seamless customer payments, a better user experience, and more informed business decisions and operational efficiency, as it enables merchants to track sales data and inventory.

- ECommerce platforms are digital software applications that allow businesses to sell products and services via an online storefront. For enterprise merchants, having a strong eCommerce platform is vital for reaching a broader audience and maximizing sales opportunities. These platforms support various payment methods and provide tools for managing product listings, customer accounts, and order processing.

- Customer integrations refer to the compatibility of enterprise merchant services with other customer relationship management (CRM) tools and software. These integrations enable businesses to have a unified view of their customer interactions and financial data. By integrating various systems, merchants can gain a deeper understanding of customer needs and preferences. This holistic approach supports the creation of personalized marketing strategies that enhance the user experience. Customer integrations also streamline operations by reducing manual data entry and improving operational efficiency, which is crucial for enterprise growth.

- Advanced reporting and analytics provide detailed insights into financial operations. Reporting tools analyze transaction volumes, payment methods, and customer trends, providing valuable insights that support strategic planning. Access to these features is crucial for enterprise merchants to make data-driven decisions.

- Fraud prevention and security tools are essential for protecting businesses against unauthorized transactions and data breaches. For enterprise merchants, implementing these tools is a top priority to safeguard customer data and maintain trust. Security features, such as encryption, tokenization, and real-time monitoring, help reduce the risk of fraudulent transactions, ensure that sensitive payment data is processed securely, and minimize potential financial losses.

These features contribute to numerous benefits for merchants looking to accept payments. Additionally, businesses can also leverage integrated payment solutions to deliver a more comprehensive payment experience.

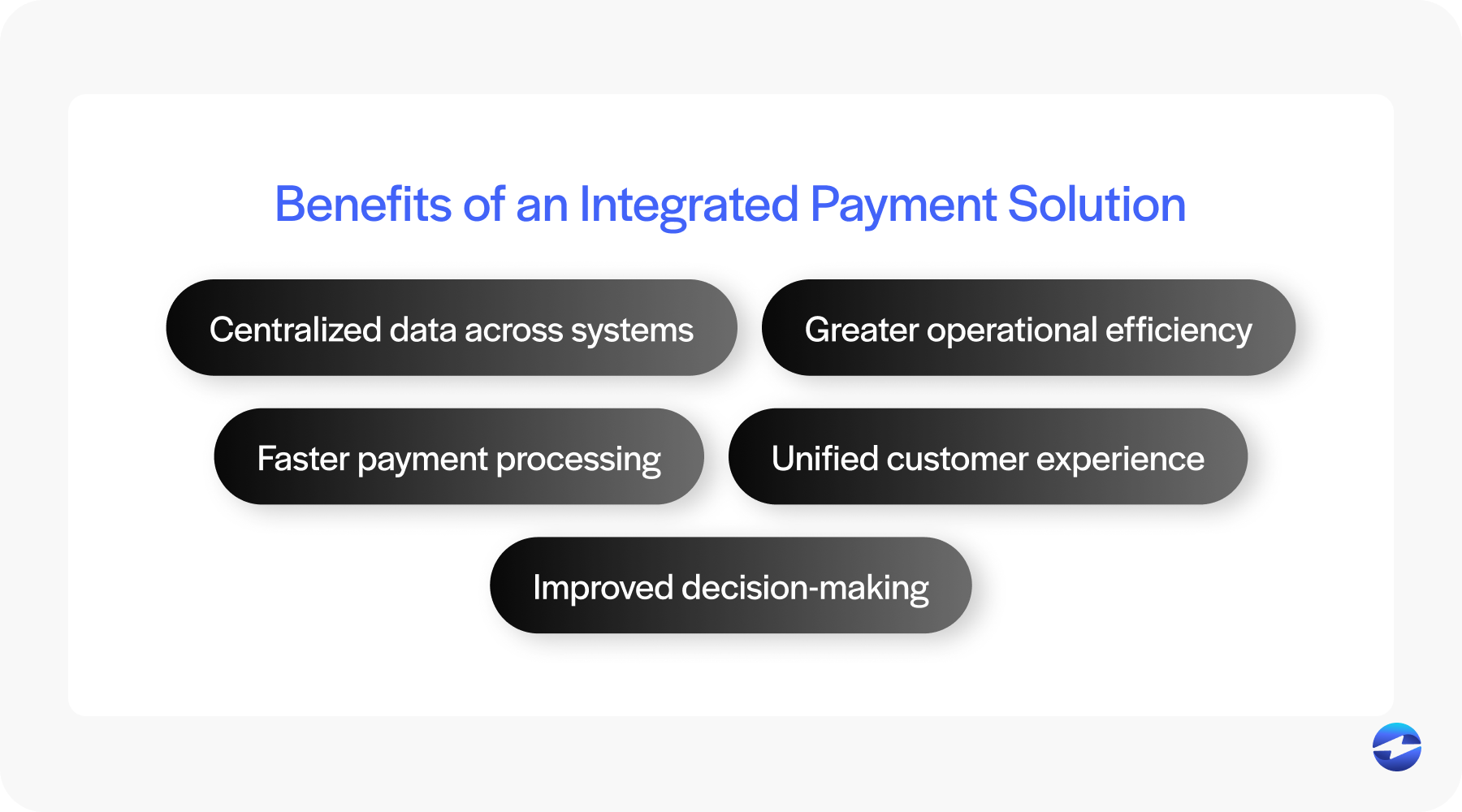

The benefits of an integrated payment solution

For enterprise businesses, managing payments isn’t just about accepting transactions – it’s about making the entire process smarter, faster, and more connected. That’s where integrated payment solutions come in.

Rather than juggling multiple disconnected tools, an integrated system brings everything together, creating a more streamlined approach to payment management. Whether you’re dealing with high transaction volumes or looking to improve day-to-day efficiency, the benefits of integration can make a noticeable difference.

Centralized data across systems

Centralized data across systems allows businesses to connect payment methods like credit cards, debit card transactions, and online payments in a single system. With a central hub, business owners can easily access and analyze transaction volumes. This eliminates the need to pull information from multiple sources, which often leads to errors. A centralized system improves efficiency and provides a comprehensive view of all transactions. This way, financial institutions and merchant services providers can ensure more secure payment processing. Having centralized data also prevents fraudulent transactions and ensures all payment options are covered in one place.

Greater operational efficiency

Integrated payment solutions boost operational efficiency for enterprise merchants. When payment processors and gateways are combined, businesses save time and resources. Businesses no longer need separate systems for card payments or digital wallets. This means operations run smoother because there are fewer systems to manage. By reducing transaction fees and simplifying fee structures, companies can focus more on growth rather than administration. Enterprise payment processing solutions also streamline payment types, ensuring seamless transactions for both customers and staff. In turn, this efficiency leads to improved customer experiences and lowered business costs.

Faster payment processing

One of the standout benefits of integrated payment solutions is faster payment processing. With technological advancements, payment processors now handle transactions quickly and more accurately. This is vital when dealing with large transaction volumes in enterprise businesses. Quicker payment methods reduce wait times, especially in online payments.

Unified customer experience

A unified customer experience is essential for any business aiming for growth. Integrated payment solutions play an important role in achieving this. By using enterprise merchant services, businesses ensure customers enjoy consistent and smooth transaction experiences. Whether customers use mobile payments, electronic payments, or credit cards, the process feels similar. This consistency builds trust and loyalty among consumers. It also reduces confusion and frustration, which can occur when using different payment methods. By focusing on a unified payment experience, businesses can enhance customer satisfaction and retention.

Improved decision-making

Integrated payment solutions improve decision-making by providing business owners with comprehensive data. Merchants can make informed decisions about fee structures, payment options, and other financial aspects by analyzing centralized data. With clear insights into payment types and trends, businesses can strategize effectively for growth. This valuable information is essential when adjusting to market demands and consumer preferences. Business owners can spot potential issues, like fraudulent transactions, early, preventing larger problems.

With better data, faster processing, and fewer systems to manage, it becomes easier to focus on what really matters: running and growing your business. That said, not all payment solutions are created equal, so understanding how to choose the right one for your business is essential.

Choosing the right enterprise merchant services provider for your business

Choosing a merchant services provider isn’t just another box to check – it’s a decision that will shape how smoothly (or painfully) your business handles payments. Whether you’re in retail, SaaS, hospitality, or manufacturing, simple and efficient payment processing is essential. And if you’re managing an enterprise-level operation, you’re likely juggling multiple payment channels, large transaction volumes, and other pieces that don’t always fit neatly together.

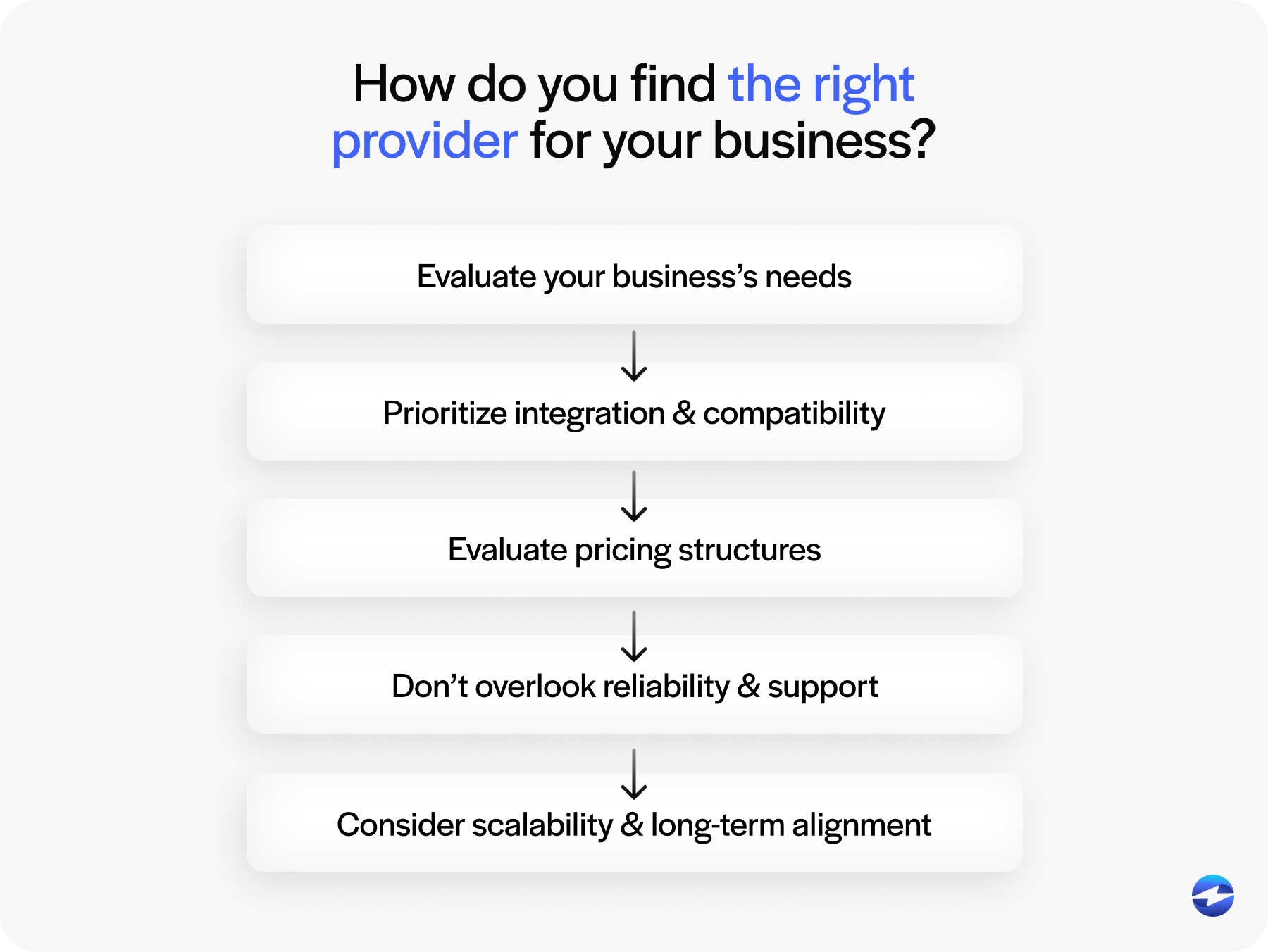

So, how do you find the right provider for your business?

Start by evaluating your business’s needs.

Before you even look at providers, take a moment to audit your current setup. What systems are you already using – enterprise resource management (ERP), eCommerce, customer relationship management (CRM)? Are you operating across multiple regions or just domestically? Do you need support for recurring billing, in-person payments, online checkouts, or all the above? Having a clear view of your ecosystem will help you filter out providers that aren’t equipped to support your scale or complexity.

From there, prioritize integration and compatibility.

For enterprise organizations, the ability to integrate cleanly with existing systems is essential. Whether it’s connecting to your ERP, syncing data to your accounting software, or supporting your development team with usable APIs, seamless integration should be a top priority. Ask specific questions – how do updates work? Is maintenance handled in-house or externally? Will custom development be required? These details can make a major difference in implementation time and long-term stability.

Next, evaluate pricing structures – not just the rates.

While it’s easy to compare providers’ processing fees alone, enterprise pricing often includes multiple layers. Interchange-plus, tiered pricing, blended models – each comes with trade-offs.

More importantly, be on the lookout for hidden fees, such as costs for PCI non-compliance, chargebacks, surcharges, or monthly minimums. Ask for real pricing scenarios based on your actual transaction volume and customer base. You want transparency and predictability, not surprises.

Don’t overlook reliability and support.

At the enterprise level, payment downtime or system issues can quickly become critical. Review the provider’s uptime record, understand their approach to incident response, and assess the quality of their customer support. Is support available 24/7? Are there dedicated account managers? How are escalations handled? These aren’t just service perks – they’re safeguards when things go wrong.

Finally, consider scalability and long-term alignment.

As your business grows or evolves, your payment needs may shift. A good merchant services provider should be able to support new currencies, expand into new markets, and adapt to emerging payment technologies. Look for a partner, not just a vendor – someone who can support your roadmap, not hold it back.

If you’re managing an enterprise operation, you’re already used to balancing short-term needs with long-term goals. Choosing a merchant services provider should be no different. Take the time to evaluate not only what works today, but what will continue to work as your business grows and your needs become more complex.

How EBizCharge supports high-volume merchants

For high-volume merchants, managing payments efficiently is crucial to keeping operations running smoothly and profitably. EBizCharge offers practical tools and features specifically designed to support businesses that process large volumes of transactions.

From reducing fees to improving security and integration, EBizCharge helps enterprise merchants handle their payment needs without unnecessary friction.

Here’s how EBizCharge supports high-volume merchants:

- Lower transaction fees: Competitive processing rates help keep costs down and increase your profit margins as transaction volume grows.

- Multiple payment options: Accepts a wide variety of payment types, including credit cards, debit cards, digital wallets, and contactless payments – giving your customers the flexibility they expect.

- Secure payment processing: Built-in security features help protect your business and customers from fraudulent transactions and data breaches.

- Seamless system integration: Easily connects with existing business systems, such as ERPs, CRMs, and accounting software, helping streamline operations and reduce manual data entry.

- Reporting and analytics: Offers clear, detailed insights into transaction data so you can track performance, identify trends, and make better business decisions.

- Support for mobile and electronic payments: Enables businesses to accept payments through mobile devices and online portals, meeting the expectations of today’s consumers.

EBizCharge is designed to make payment processing easier for enterprise-level businesses. Whether you’re scaling up or just looking to simplify your current systems, it provides the tools and flexibility needed to manage high transaction volumes with reliability and confidence.

EBizCharge: A top-rated solution for your enterprise business

Running an enterprise business comes with its own set of challenges – more transactions, more systems to manage, and greater expectations from customers. The right merchant services provider shouldn’t add complexity – it should simplify your operations and support your long-term growth. That’s where EBizCharge stands out.

As a top-rated and trusted payment solution, EBizCharge offers enterprise merchant services built to handle high volumes, integrate seamlessly with your existing systems, and provide the flexibility your business needs to scale. With transparent pricing, strong security features, and tools designed to streamline every step of the payment process, EBizCharge gives you the confidence to grow without worrying whether your payment infrastructure can keep up.