How to Open a Merchant Account: 7 Easy to Follow Steps to Set up an Account

How to Open a Merchant Account: 7 Easy to Follow Steps to Set up an Account

EBizCharge is a 5-star merchant account rated by G2 users

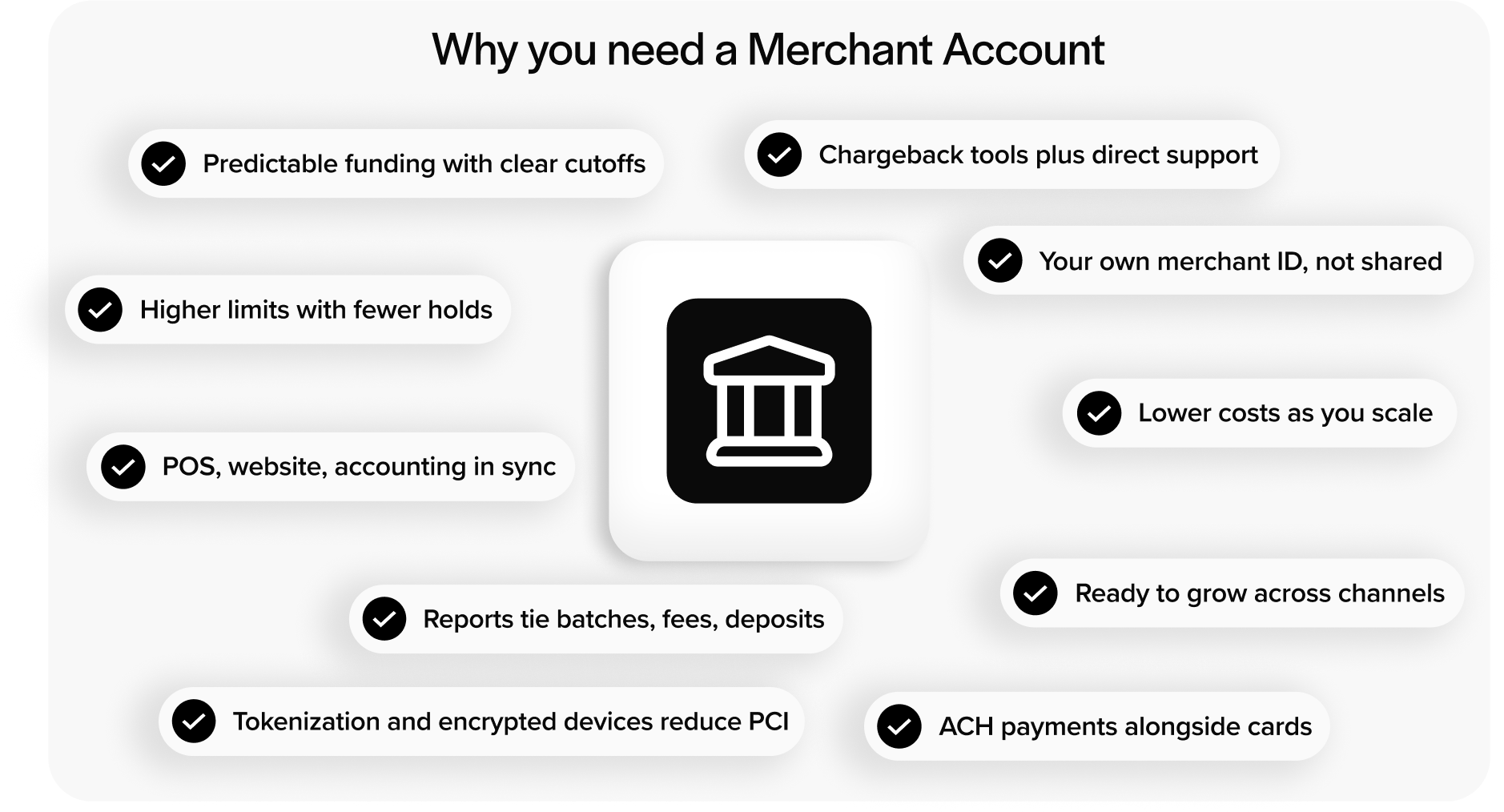

If you’re looking to start accepting credit card payments from your customers, then you’ll need to open a merchant account.

While the process of setting up a merchant account may feel overwhelming at first, it’s essential to a great business. To get a merchant account, you’ll need to get a business license, open a business bank account, evaluate your payment needs, compare providers, complete an application, go through underwriting, and once approved, you can start processing credit card payments.

Here are the seven steps on how to get a merchant account.

How to open a merchant account

- Get a business license

- Open a business bank account

- Evaluate your needs

- Compare providers

- Complete an application

- Submit to underwriting

- Get approved and start processing

1. Get a business license

To open a merchant account, you’ll have to prove your business is legitimate. The very first step to setting up a merchant account is to get a valid business license.

What is a business license?

A business license is official permission from your city, county, or state to operate your business legally. It proves you meet local rules and often serves as documentation for things like bank accounts and merchant accounts.

Here is the part that confuses people: there is not one universal license. Many states do not issue a general statewide license. Most businesses get licensed at the city or county level, then add any industry permits their work requires.

If you are a small business owner or the finance lead wearing many hats, this step can feel vague at first. It gets simple once you know what to gather and where to apply.

Quick start checklist:

- Gather your entity paperwork, EIN, DBA if you use a trade name, owner ID, business address, and your NAICS code.

- Apply through your city or county website for a general business license or tax certificate.

- Check your state site for a seller’s permit or sales tax license if you sell taxable goods.

- Confirm any industry permits if you are in a regulated field like contracting, food and beverage, healthcare, childcare, alcohol, tobacco, or transportation.

- Save the issued license as a PDF and note the renewal date. Many licenses renew annually.

Payment Processors verify that your business is active and properly registered. A clean, current license speeds underwriting when paired with your EIN letter, bank letter or voided check, website or product description, expected processing volume, and refund policy.

2. Open a business bank account

Once you have a business license, you’ll need a business bank account. This bank account is where your merchant account provider will deposit your credit card sales and withdraw any fees. Most businesses prefer to open a business bank account with a local bank, as local banks tend to provide a level of convenience and customer service that can’t be matched by online accounts.

Which account to open

Start with a business checking account. Savings accounts rarely support the daily ACH deposits and withdrawals tied to card processing.

To get started, bring the following to the bank:

- EIN confirmation letter

- Business license

- Formation documents (Articles of Organization or Incorporation), or sole proprietor details

- DBA filing if you operate under a trade name

- Owner or officer ID and basic contact info

- Operating agreement or banking resolution if your bank asks for it

- Business address that matches your documents

This is the account your processor will use for deposits, fees, and any chargebacks, so make sure the name and numbers match your application exactly. Ask the bank for a voided check or bank letter, keep a small balance buffer, and choose a bank that fits your day-to-day needs, like ACH timing and online access. Save the account documents with your EIN and license to speed up underwriting and reconciliation later.

3. Evaluate your needs

Before you open a merchant account, think about your business needs. For example, you’ll need to decide which credit cards you want to process. Will you accept American Express, or just Mastercard and Visa? What about ACH or eChecks?

You’ll also need to consider how you want to accept credit card payments. Do you simply need an in-person solution for processing payments in your brick-and-mortar store? Or do you need a solution that supports mobile payments and online payments? How will your customers pay you—will you provide a customer payment portal where customers can pay off invoices?

Map out exactly what your business will need, including both the short-term and the long-term. If you’re planning on expanding in the next few years and anticipate additional payment needs in the future, be sure to include them in your planning.

4. Compare providers

Now that you have an idea of what your business needs, you can take that information and start assessing merchant account providers for the best fit. Line up a few providers and compare them side by side. Focus on what affects cost, risk, and day-to-day work.

PCI compliance and strong security

Merchants have a responsibility to protect their customers’ credit card information, and that responsibility can sometimes feel like a burden. But you can release some of that stress by choosing a PCI compliant merchant account provider that offers strong security features. Knowing your merchant account provider is actively protecting your customers’ vulnerable data will lift off some of the pressure and give you peace of mind.

Free in-house support

If something goes wrong with your credit card processing, it’s no joke—that’s your profit at stake. Look to open a merchant account with a provider that supports you with 24/7, in-house customer service free of charge.

Next-day funding

Some merchant account providers offer next-day funding options, so you get money in your account faster.

Transparent pricing models

Credit card processing fees are confusing, especially for merchants new to the scene. If your merchant account provider is unclear or anything less than completely transparent, it might be a sign to reconsider. Research credit card pricing models to see which model is right for your business, then choose a provider that offers your preferred method. Two of the most popular and cost-effective pricing models are flat rate and interchange plus.

Scalability

Keep the future in mind when opening a merchant account. Your business may be small or based in brick-and-mortar now, but if you have plans to expand or venture online, you’ll need a merchant account provider that can scale with your growing processing volume and changing needs.

No contracts

Ensure your merchant account provider doesn’t require a contract or choose one that offers month-to-month contracts. The last thing you want is to get locked into a long contract with a provider that turns out to be a bad fit.

No unnecessary fees

Finally, research any fees that will be included in your merchant account service. Some fees are unnecessary and only hurt the merchant. Ask for a detailed list of all included fees, and look out for customer service fees, batch fees, annual fees, and monthly minimum fees.

Questions to ask every provider

| Topic | What to ask for |

|---|---|

| Pricing breakdown | Interchange plus markup, per transaction fee, gateway fee, monthly fee, PCI and batch fees, AVS, retrieval and chargeback fees, early termination, and equipment costs. Ask for sample math using your average ticket, highest ticket, and monthly volume. |

| Funding and cash flow | Deposit timing, cutoff times, weekend and holiday rules, daily vs monthly fee deduction, next day funding, and how deposits appear on statements. |

| Limits and risk | Max ticket, monthly cap, reserve rules, review triggers, and path to raise limits. |

| Contracts and term | Month-to-month or term, cancellation policy, early termination fee, equipment lease terms, and token portability. |

| Support | 24/7 availability, in-house vs outsourced, response targets, named contact, escalation path. |

| Integrations and data | Native integrations, API and webhooks, automatic posting to ERP or accounting, export formats, and customer vault ownership. |

| Security and PCI | Encryption at capture, tokenization, PCI validation method, user roles and permissions, MFA or SSO, IP allowlists. |

| Chargebacks and fraud | Dispute alerts, representment help, evidence templates, AVS and CVV checks, 3-D Secure, risk rules, and blocklists. |

| Hardware and reliability | Device options and prices, warranty and replacement speed, offline mode, connectivity, Apple Pay, and Google Pay support. |

| ACH and eCheck | Per item and return fees, funding time, account verification tools, NACHA compliance, and ACH dispute handling. |

| Compliance extras | Surcharging or convenience fee support, required signage or settings, multi-currency or cross-border, stored credential flags. |

| Reporting and reconciliation | Deposit reports tied to batches, fee line items, statement labels, time zone settings, and exports. |

| Implementation | Onboarding timeline, who sets up users and devices, training, test plan, go-live checklist, and success criteria. |

| Total cost snapshot | One page total with all recurring and one-time fees based on your numbers. |

A single provider for credit card processing

Some merchants choose a merchant account provider that’s separate from their credit card processor. However, splitting these services between two different providers is a missed opportunity. It’s more efficient, convenient, and cost-effective for merchants to choose a merchant account provider that also offers credit card processing.

If your credit card processor also opens your merchant account, you’ll experience several benefits:

- You won’t have to open two separate accounts for credit card processing and ACH processing

- Reduces the number of people you have to deal with and gives you a single point of contact for all your credit card processing

- Underwriting typically happens in-house (and you only have to do it once)

- Access to additional services like chargeback management, payment gateway, integrated payment applications, and eCommerce integrations

For example, EBizCharge offers a QuickBooks payment gateway and BigCommerce payment gateway alongside merchant account services, so you get processing, integration, and support all from one provider.

5. Complete an application to open your merchant account

Once you’ve compared merchant account providers and made a choice, you’ll need to fill out an application. This application will require detailed information about your business, so be prepared with all necessary documentation.

Merchant account requirements

Most providers ask for the basics below. To smoothly apply for an account, gather the following before you start.

- Legal business name and DBA, business address, phone, and website

- Business start date and a short description of what you sell

- Tax ID and, if you know it, your NAICS or business category

- Bank account and routing numbers, plus a voided check or bank letter

- Authorized signer contact information and government ID

- Owner and control party details for identity checks: names, home addresses, dates of birth, Social Security numbers, and ownership percentages

- Business license and formation documents

- Processing profile: where you accept payments, average ticket, highest ticket, and estimated monthly volume

- If you sell online, live pages for pricing, refund policy, shipping or delivery timelines, and contact information

- If you have prior processing, recent statements

For higher volume or higher risk

You may be asked for recent business bank statements, basic financials, vendor invoices or contracts, and a short fulfillment plan for made-to-order or preorder items.

Depending on the amount of volume you expect to process, you’ll need to provide more or less information. For example, a small business that expects to process several thousand dollars a month may only need to provide a voided check and proof that they’re currently conducting legitimate business. In contrast, a larger business may need to provide bank statements going back several years.

6. Submit to underwriting

Taking on a merchant account is a risk for both the account provider and the acquiring bank. The provider will, therefore, underwrite and assess your business before accepting you. They’re looking for red flags like high-risk businesses or industries, warning signs of fraud, or businesses that haven’t been operating for very long. If your business is established and has proven good standing for at least a few months to a year, you should make it through the underwriting process without any problems. However, new businesses may struggle to make it past the underwriting stage, as account providers and banks are less likely to accept the risk of a new business.

7. Get your merchant account approved and start processing

Depending on the provider, opening a merchant account can take anywhere from one business day to about a week. Once your business is approved, you can start accepting credit card payments from your customers right away.

Approval is your green light. You will receive a welcome email with your merchant ID, gateway login, funding schedule, and limits. Read it, save it, and use it as your launch plan. Take the time to set up your merchant account by getting your settings connected, configured, and enabled. Make sure to run tests to confirm payments are processing as expected. Keep support info handy and write down fixes so your team can repeat them.

Frequently Asked Questions

How to set up a merchant account?

To set up a merchant account, start by obtaining a license, opening a business bank account, evaluating your needs, comparing service providers, applying, undergoing underwriting, getting approved, and initiating payment processing.

What do I need to open a merchant account?

When you apply for a merchant account there is a decent amount of information and documents you must provide.

- You need to provide detailed information about your business. This includes your legal business name, business structure (such as an LLC or corporation), and contact information like your business address.

- You will also need to submit important business registration documents such as a business license, articles of incorporation or organization, and your Tax Identification Numbers. This includes details like your Employer Identification Number (EIN), Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN).

- You will also need to provide banking details, such as your business bank account information and either a voided check or bank letter. If applicable, you may also need to provide details about your processing history, such as chargeback rates and transaction volume.

- If you plan to accept payments online, you will need to provide information about your website, including its URL and security measures.

Some payment processors or financial institutions may ask for a brief business description or plan. - You will also need to comply with industry regulations, such as PCI DSS, for handling cardholder data.

- Depending on the payment processor or financial institution, you may need to provide additional underwriting information such as financial statements or credit history.

It’s important to check the specific requirements of your chosen payment processor or financial institution to ensure a smooth application process.

How to get a merchant ID?

To receive a Merchant ID (Merchant Identification Number or MID), you need to open a merchant account with a payment processor or acquiring bank. Your MID will automatically be issued after being accepted for a merchant account. The Merchant ID is a unique identifier associated with your business within the payment processing system, and it allows transactions to be tracked and managed.

How to get a merchant account with bad credit?

In situations where businesses have a higher risk profile or bad credit, there are specialized companies that focus on offering merchant accounts. These high-risk merchant account providers tend to be more open to working with businesses that might face challenges securing approval from traditional banks.

What are the types of merchant accounts?

The main types of merchant accounts are retail, e-commerce, mobile, telephone, and mail-order. Each is tailored to suit specific business models.