Blog > How to Calculate Take Rates

How to Calculate Take Rates

Nowadays, online marketplaces have become a reigning platform for facilitating transactions since most consumers purchase via private sellers and third-party platforms for a more efficient experience.

To maintain a healthy cash flow, most marketplaces will charge fees for their services in the form of take rates. Whether you’re a consumer, seller, or an intermediary, it’s essential to understand how take rates work, as these fees can affect your buying and selling decisions.

Thankfully, this article will provide more clarity about these fees by explaining how to calculate take rates and answer important questions like what is a take rate?

What is a take rate?

A take rate is a financial metric representing the percentage of revenue or profit a platform, intermediary, or merchant service provider retains from the total value of a given transaction.

Simply put, a take rate is the earnings a business makes on a transaction for the services it provides.

Traditionally, take rates are leveraged by credit card companies by charging a fee to merchants for credit card processing. Today, take rates are everywhere, serving as a common form of revenue for popular businesses like Amazon, Airbnb, Uber, and Etsy.

Businesses should understand take rates since they indicate how effectively they monetize their services and transactions and can be used for strategic decision-making. Monitoring take rates also helps shareholders feel confident about their investment’s ability to generate consistent and reliable revenue.

3 components to consider before charging take rates

While take rates are a relatively simple concept, their strategic execution can be complex.

Businesses should consider several components when deciding how and when take rates should be used to generate revenue, such as:

- Platform sustainability: Take rates are essential for the financial sustainability of third-party platforms, as they cover operating costs, technology investments, etc.

- Pricing strategies: Businesses should evaluate competitors’ rates to understand industry averages to generate a reasonable pricing structure to attract more customers.

- Flexibility and adaptability: Flexibility and adjusting take rates to adapt to market dynamics, changes in user behavior, and competitive landscapes are critical to long-term success.

After applying these components to your decision-making process when incorporating take rates, your business must also learn how to calculate these rates.

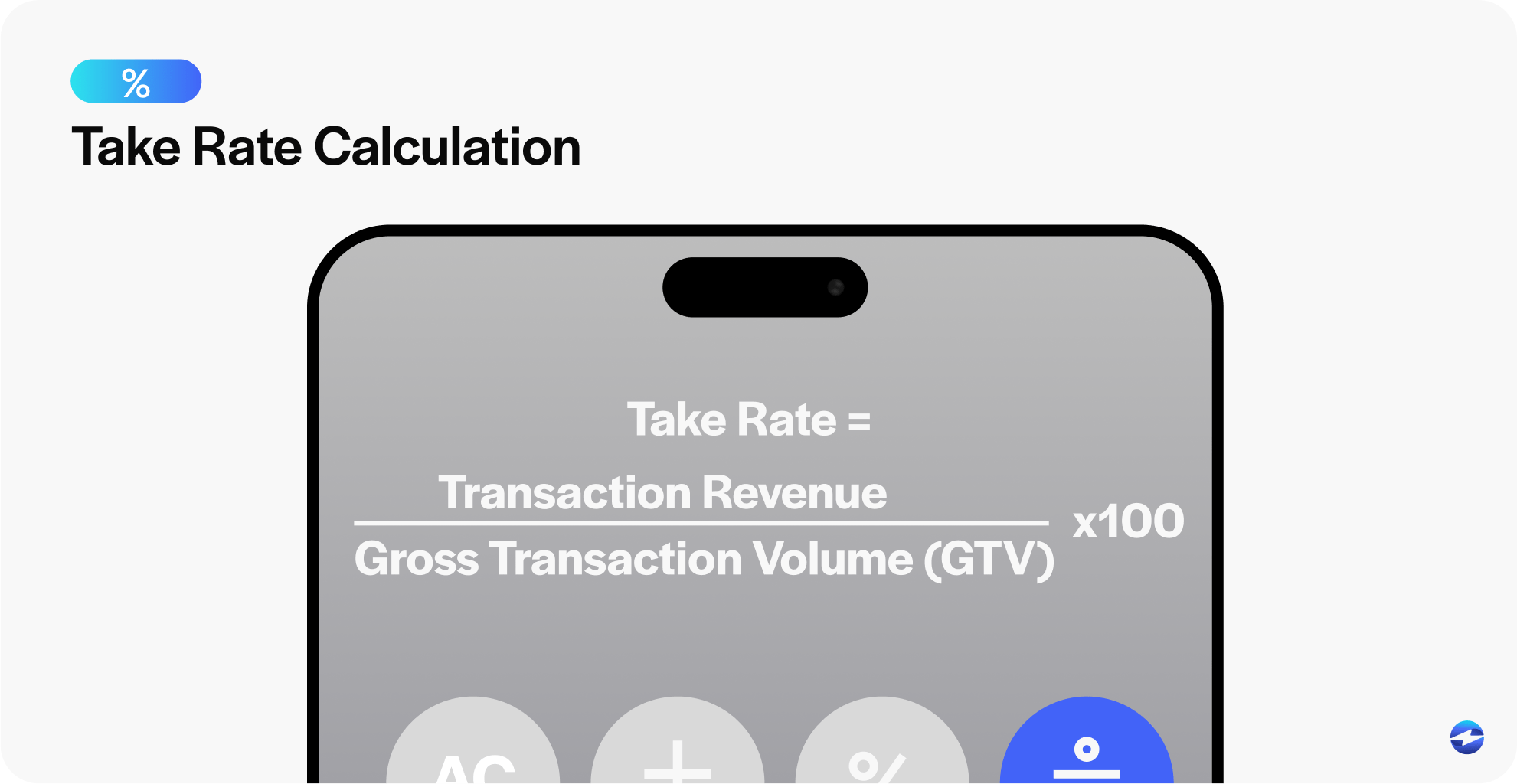

How to calculate a take rate

The take rate formula divides the revenue from the transaction by the gross transaction volume (GTV). This number is then multiplied by 100 to convert it to a percentage.

Take Rate = Transaction Revenue/Gross Transaction Volume (GTV)

For example, if an eCommerce platform charges a $10 fee on a $50 transaction, the take rate percentage will be 20%.

To better understand the take rate formula, here’s a quick real-world example…

Calculating take rates for Airbnb

The properties listed on Airbnb are hosted by private parties and listed on Airbnb’s 3rd-party website. When a traveler selects an Airbnb property, they pay the amount shown in the listing. To generate revenue, Airbnb requires the property owner to pay a small fee to Airbnb for using their platform to advertise the rental and attract high-quality renters.

Suppose a traveler books a stay for $100 per night, and Airbnb charges a 15% take rate. The take rate calculation would result in a $15 fee from the total booking value.

This fee is crucial as it covers operational costs, provides customer support, invests in platform improvements and advertising, and generates profits.

Since take rates can come in the form of fixed fees or variable service fees, it’s essential to know the difference between the two.

Fixed take rates vs. variable service fees

Companies have various options for determining how to apply take rates to their products and services. Some businesses may select a single standard rate for every one of their products, while others may employ variable service fees depending on several factors.

Simply put, fixed take rates provide a stable and predictable pricing model, and variable service fees are adjusted based on transaction values and volumes.

The consistency of fixed take rates can offer transparency in understanding the overall cost of a given transaction. Whereas variable service fees are viewed as more adaptable since they allow users to pay based on their consumption rates, the type of product, or the level of service they require.

Leveraging a one-size-fits-all take rate is challenging, especially for businesses with a wide range of products and services. Therefore, it may be necessary to charge different take rates depending on the specific transaction or type of customer.

5 factors to consider when calculating take rates

When establishing marketplace take rates for your products and services, several components should be considered before charging these fees.

Here are five factors to assess before calculating take rates:

- Transaction rate and size

- Average order value

- Discounts and incentives

- Product types

- Chargebacks

1. Transaction rate and size

Platforms with higher transaction frequency but lower individual transaction sizes may operate on lower take rates.

For example, a business may have a lot of repeat customers, resulting in higher transaction rates. Therefore, this business may agree to accept lower take rates since they’ll generate significant revenue over time. Whereas platforms facilitating infrequent, higher-value transactions may charge higher take rates since return purchases are less likely.

2. Average order value

The average size of an order can influence the take rate, which is why understanding customer behavior and preferences is critical to optimizing this metric.

Businesses may be able to influence customers to place larger orders for smaller fees. This is similar to offering free shipping on orders of $100 or more. If there’s $70 worth of product in a shopping cart, the customer may be willing to buy another item to take advantage of free shipping.

3. Discounts and incentives

Some companies may offer discounts or incentives that affect the take rate, so it’s essential to consider these in your overall revenue strategy.

For example, in many industries, the more transactions or volume of transactions, the higher the discount they may receive. This encourages businesses to increase transaction volumes, benefiting the service provider and the client.

Additionally, in B2B relationships, partnerships may involve special incentives, including reduced transaction fees, priority support, or exclusive access to certain features or services.

4. Product types

For platforms facilitating transactions on behalf of third-party sellers, take rates can vary based on the nature of the products, such as their operational costs, risk factors, market competition, and other variables.

For example, digital goods may involve lower operational costs compared to physical goods that require shipping and handling. Companies like Amazon adjust their take rates based on product categories, recognizing that the value and market dynamics differ for electronic items compared to household products.

5. Chargebacks

Chargebacks can significantly reduce a merchant’s take rate as they often come with fees imposed by payment processors or banks that increase the overall cost of processing transactions for the service provider.

These fees can take many different forms, including the chargeback fees themselves or the operational costs associated with resolving chargebacks. High chargeback rates can also be a risk factor for payment processors and banks, resulting in increased scrutiny of the merchant’s account or even termination of services.

With many factors affecting take rates and how they’re imposed, different business models and industries will apply their own methods of implementing take rates.

How different industries affect take rates

Since take rates vary depending on the type of products and services businesses sell, it’s important to know how different industries will adjust these fees.

Here are five industries that offer unique take rates:

- eCommerce: eCommerce businesses often charge lower take rates ranging from 5% to 15% because this industry is very saturated, and companies want to remain competitive and attract a broad range of sellers.

- Ride-sharing and food delivery: Convenience-focused platforms like ride-sharing and food delivery often operate with higher take rates of 20% to 30%. The convenience and immediacy of these services tend to justify the higher percentage.

- Streaming services: While fixed subscription fees are standard in the streaming industry, additional “in-app” purchases or subscriptions can shift take rates between 15% to 30%. Flexible revenue models allow these platforms to diversify income streams.

- Financial services: Take rates often differ to reflect the complex financial services industry. Credit card processing fees can range from 1% to 3%, depending on transaction size, type, and volume. Other financial services like brokerage firms may charge a percentage take rate for users who purchase stock or other investments.

- Freelance and free agents: In the gig economy, freelancers and free agents operate with take rates of around 20% to accommodate the dynamic market and allow individuals to set rates that align with their skills and market demand. Some platforms offer adjustable rates based on experience, rewarding highly profitable sellers with larger profit margins.

Understanding how marketplace take rates vary across different industries allows businesses to benchmark their performance and strategize effectively.

Leveraging take rates to fit your business

Knowing the ins and outs of take rates is crucial for all parties involved in these transactions. For consumers, take rates can affect the overall cost of products or services and help them compare prices. For sellers, take rates can persuade them to sell on one platform instead of another. Most importantly, take rates need to be understood by 3rd-party platforms that rely on their revenue to survive.

Access to valuable insights regarding transaction dynamics, user behavior, and industry benchmarks can help you make more informed decisions. For businesses, tracking take rate trends within their industry will help them avoid unpleasant surprises or drawbacks.

With these insights in mind, businesses can leverage take rates to stay competitive and meet revenue goals by analyzing operational costs and considering factors like transaction process, customer support, and any additional services provided.