Blog > How Credit Card Processing Works

How Credit Card Processing Works

At the start of 2021, only 13% of individuals paid with cash, leaving the rest of the payments to be completed electronically using a debit card, credit card, or online payment service like Apple Pay. To put it simply, the world is quickly moving toward fully digital transactions that rely on electronic means to pay for everyday products and services.

Since credit and debit cards are used as the main payment methods, it’s important to understand how processing these cards works to gain more knowledge as to how it can convert into profit for your business.

Credit card processing is a multi-step process that transmits customers’ credit card or debit card data into a dollar transaction from their financial institution to the merchant’s account. Credit card processing works by transmitting customers’ credit card and debit card data from their financial institution to the merchant’s account. From the moment your customer swipes or enters a credit card to when the merchant completes the transaction, credit card processing provides the software and services to make these payments possible.

It’s critical to understand how credit card processing works, so you can find the right processor for your company. This next section will thoroughly explain how this process works to give your business the necessary knowledge it needs to make more informed decisions moving forward.

A look into how credit card processing actually works

Credit card processing can seem like a simple process where the customer swipes or enters his or her credit card details and the merchant simply accepts it, but there are a lot more parties involved.

Here’s a more in-depth look into what accepting credit cards looks like:

- The customer provides his or her credit card information to the merchant.

- The credit card information is sent to the merchant’s payment processor for authorization.

- The payment processor then sends the request to the issuing bank to verify the cardholder’s credit or bank account is trustworthy and acceptable.

- The bank either approves or denies the request.

- The approval/denial is sent back to the payment processor, who sends it on to the merchant.

- The merchant will then either complete or cancel the sale based on whether the card was approved or not.

Despite all these steps taking place within a few seconds, there are still a lot of technical operations and various parties involved behind the scenes.

What parties are involved in credit card processing?

Since credit card processing is a complex, multi-step process, it’s important to understand each party’s involvement.

Below are the eight parties involved in credit card processing and how they work together:

- Cardholder: This is the individual or company purchasing a product or service with a credit card.

- Merchant: The merchant is the company selling products or services to its customers. The merchant accepts credit cards from customers by collecting their credit card information. The merchant then sends a payment authorization request to its acquiring bank.

- Acquiring bank: This is the account of the merchant where credit card payments are deposited into. When the bank receives the payment authorization request, it sends and shares the request response with the merchant.

- Payment processor: Payment processors provide the software that processes credit card and debit card transactions for the merchant. The payment processor can also install hardware, such as POS terminals, for in-person sales. The payment processor can be the merchant bank but many times it’s a third party.

- Independent sales organizations (ISOs): A third-party ISO will come in if merchant banks don’t process credit card payments.

- Membership service providers (MSPs): Similar to ISOs, MSPs take over the payment process from the merchant bank by managing daily transactions.

- Cardholder bank: The issuing bank is the credit cardholder’s bank. They provide credit to the cardholder, so the cardholder can purchase products or services.

- Credit card networks: Credit card networks are the major credit card brands like MasterCard, Visa, Discover, and American Express.

The three main steps of credit card processing

Now that you have a general idea of what credit card processing is and the major parties involved, it’s important to understand the three main steps involved in this process.

Credit card processing can be broken down into three key steps: authorization, authentication, and settlement.

Authorization

Authorization is the first phase of credit card processing which includes the following steps:

- The cardholder presents their credit card information to the merchant. This can be completed online, by manually entering the credit card into a POS terminal, or by submitting a credit card authorization form.

- The merchant requests payment authorization from the payment processing company.

- The payment processor sends this request to the credit card networks.

- The credit card networks send this request to the issuing bank.

- The issuing bank either approves or denies the request and sends that answer to the credit card networks.

- The credit card networks send an approval or denial to the payment processing company.

- The payment processor sends an approval or denial to the merchant.

- The merchant shares the approval or denial response with the cardholder.

- If approved, the merchant provides the products or services to the cardholder.

Authentication

After the transaction has been successfully authorized and completed, the authentication phase can take place. Authentication occurs when the issuing bank verifies the transaction is valid. This includes the following steps:

- The credit card networks request authorization from the issuing bank.

- The issuing bank then confirms that the cardholder’s account is approved for the transaction with the merchant and validates the cardholder’s identification information (i.e. name, address, social security number).

- The issuing bank sends an approval or denial to the credit card networks and merchant bank.

- The issuing bank places a hold on the purchase amount for the cardholder’s account.

- The merchant’s POS terminal or software batches approved authorizations for processing.

- The merchant then sends a receipt to the customer for proof of sale.

Settlement

The settlement phase is when the merchant receives the funds from the cardholder. Settlement includes the following steps:

- The merchant’s POS system sends the batched payment authorizations to the payment processor.

- The payment processor sends the batch to the credit card association.

- The credit card networks forward this information to the issuing bank.

- The issuing bank charges the cardholder’s bank account for authorized payments.

- The issuing bank removes the interchange fees for the credit card networks and transfers the rest of the funds to the merchant’s bank.

- The merchant’s bank distributes the funds to the merchant account.

- The issuing bank notes the transaction to the cardholder’s account statement.

Knowing these three key steps is crucial to understand the ins and outs of the credit card processing process. The next section will discuss how to start accepting credit cards for your business.

How to accept credit card payments

If your business wants to accept credit cards, you’ll need to find a payment processing company that’s compatible with your company’s hardware and software.

Payment processing companies provide technology that seamlessly integrates into many different software applications to allow your business to accept credit card payments. Payment processors also allow businesses to accept payments directly from their websites or through their accounting software.

Credit card processing technologies

The type of technology your company requires to process credit cards will be determined by how you want to accept these payments from your customers — online or in person.

Regardless of which payment method your business chooses to accept, there are a few technologies that all credit card processing functions have in common:

- Payment gateway: The payment gateway is the software that links the physical POS payment terminal or online terminal to the credit card processing network.

- Payment processor: The payment processor is the technology that transmits the credit card data between the merchant, the issuing bank, and acquiring bank.

Accepting credit cards online offers a more straightforward approach since payment processing is directly built into the eCommerce platform. Whereas, in-person payments require the payment processing company to send you a POS terminal to physically process credit cards.

Whatever the method for accepting credit card payments, it’s important to thoroughly research the different payment processing companies out there and the services they offer to see which will be the best fit for your business.

Credit card processing fees

Credit card processing fees are often a big deciding factor for businesses when selecting a credit card processor.

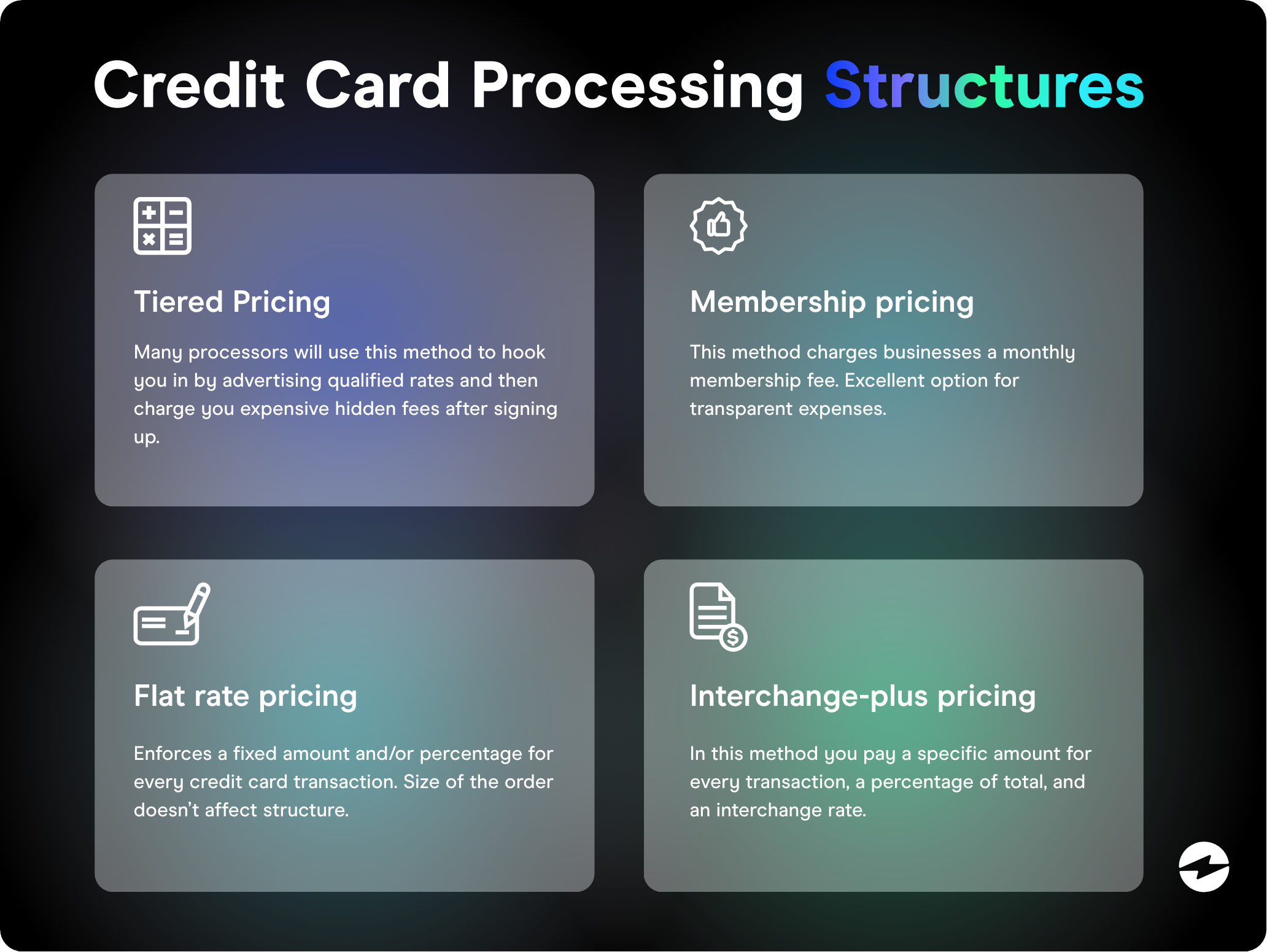

Since there are many ways credit card processing companies can charge your business, it’s important to understand the four main methods of credit card processing fees which include:

- Tiered pricing: Tiered pricing bases rates on different tiers: qualified, mid-qualified, and non-qualified. Many payment processors will use this method to hook you in by advertising qualified rates and then charge you expensive hidden fees after signing up.

- Membership pricing: This method charges businesses a monthly membership fee. On top of the membership fee, credit card processing companies will often charge a small transactional fee. This is an excellent option if your company wants payment processing expenses that are transparent.

- Flat rate pricing: The flat rate pricing structure enforces a fixed amount and/or percentage for every credit card transaction. The size of the order doesn’t affect the flat rate pricing structure. (Ex. A fixed-rate could be $0.40 + 2% of the transaction amount per transaction.)

- Interchange-plus pricing: With interchange-plus pricing, you’ll pay a specific amount for every transaction, a percentage of the total transaction, and an interchange rate that’s determined by the credit card processing company.

Merchants may be subject to other credit card processing charges which can include:

- Assessments: This expense goes directly to the credit card association. An assessment fee is usually seen as a percentage and varies depending on the credit card brand and pricing structure.

- Chargebacks: Chargebacks occur when customers dispute a transaction which leads to the charge being returned to their credit cards. Chargebacks are continuing to rise and are a financial strain for merchants because they come with a fee every time a customer disputes a transaction.

- Markups: Markups are fees that payment processing companies and merchant banks charge to generate revenue to cover credit card processing costs.

- Interchange fee: Interchange fees are the fees that the merchant’s bank and credit card processing company pay to the issuing bank.

Credit card processing simplified

Understanding the ins and outs of credit card processing may seem complex and tedious to learn but it’s beneficial for your company to be aware of the technical process, major parties involved, and processing fees.

Knowing how credit card processing works will not only help your business make more informed decisions as to how it wants to accept and process these payments but will also assist you in choosing the best credit card processor for your business.